Attention Financial Voyeurs!

See Our 2018 Family Budget

I’m not sure what it is, but I love reading about other peoples’ personal finances.

Maybe it’s because talking about our personal finances is somewhat taboo.

Or maybe it’s because I’m a personal finance geek and I love to see how other people organize their financial life.

Whatever the reason, I love learning about another person’s finances.

Because I know there are other personal finance “voyeurs” our there I thought it would be fun to share a bit myself. In this blog post I’m going to give you a glimpse at my own personal finances and share my family’s budget for 2018.

Three times a year my wife and I sit down and review our financial plan. We go over our investments, our asset allocation, our income and our expenses. We make small changes and tweaks to ensure we stay on track with our overall financial plan. Having a solid budget is an important tool for achieving your financial goals.

So, without further delay, here is my family budget for 2018.

Our 2018 Family Budget

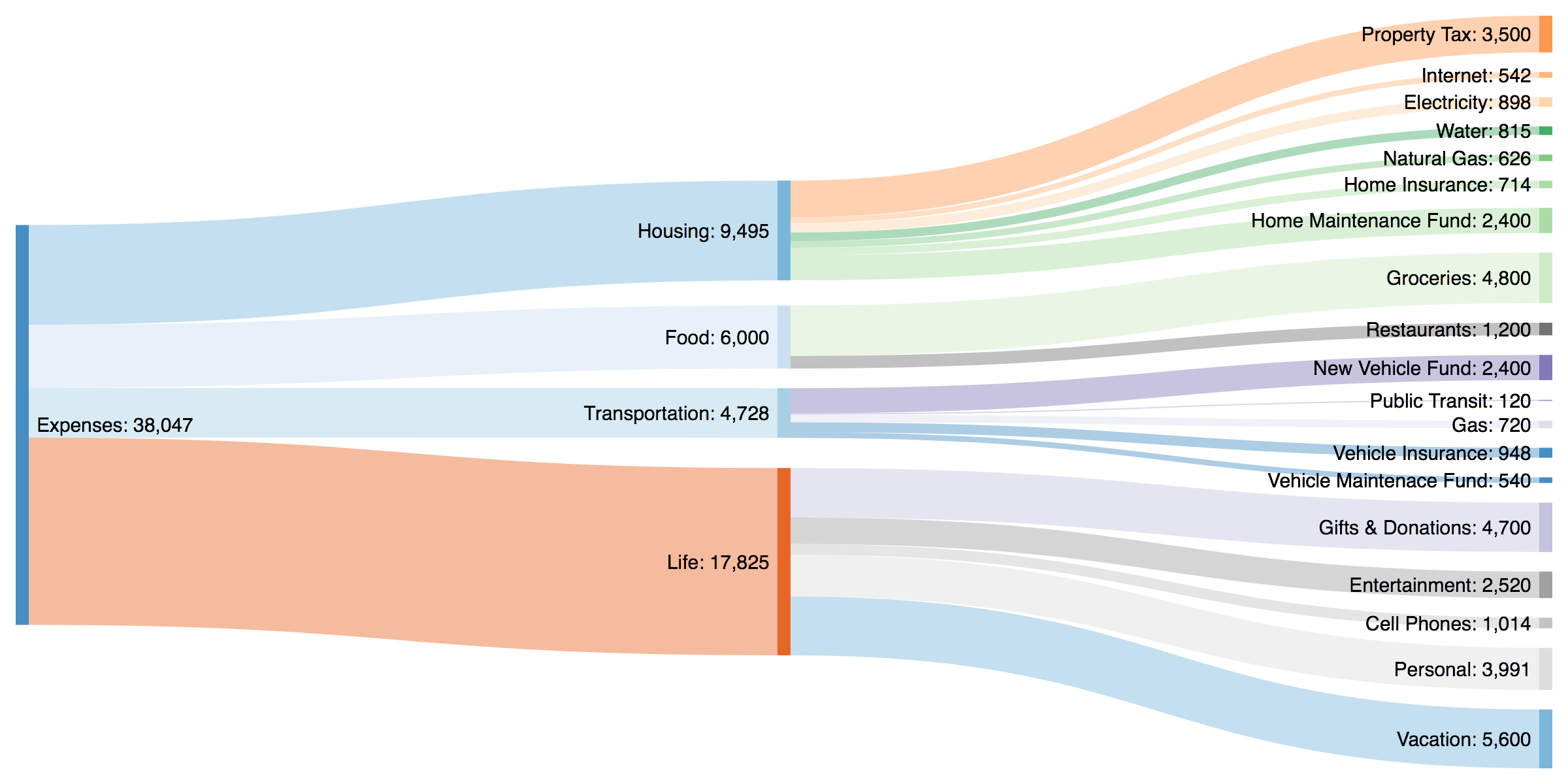

Our Family Budget For 2018:

Right off the bat you’ll notice our family spending is quite low for the average family of four. At $38,000 per year we’re well below the average household spending of $62,000 per year.

For the most part we try to reduce our spending on the big three categories, housing, transportation and food. Our goal is to save money in these three big categories so that we don’t have to worry so much about the rest of our budget.

Housing:

When it comes to housing we don’t have a typical family budget. One noticeable absence is our lack of mortgage. This is due to our previous financial goal to pay off our mortgage early.

If you add in a typical mortgage our spending would be about $12,780 higher. This makes a big difference in our housing expenses (having no mortgage also saves us about $6 per month on our home insurance, a small bonus!)

On top of this we also choose to live in a smaller home. Our house is only 1,000 square feet for the four of us. It’s small but efficient. We chose to live small for many reasons, but one big reason is that it saves us another $6,000 to $12,000 per year in extra mortgage and maintenance costs. It also helps us keep our utility bills very low.

We set aside $2,400/year for home maintenance each year. This money goes into a “house fund” which is just a separate savings account. When we need to make repairs, we take some money out of the fund. To keep things simple, we don’t budget for individual home repairs, we just budget for a flat $200 per month.

Join our online community!

Community members get (free!) access to our budgeting spreadsheet.

Transportation:

When it comes to transportation we choose to save money by having just one car. Having just one car saves us A LOT of money each year.

To make this happen we bike and walk whenever possible. If it’s not possible to bike or walk we’ll use public transit.

To be frank, having just one car can occasionally be a real inconvenience, but it helps us save about $5,000 per year, so we’re willing to make that trade off.

You’ll also notice that, like in our housing expenses, we set aside $480/year for car maintenance. This money goes into a “vehicle maintenance fund”. When we need to do some car maintenance we take money out of the fund.

Again, to keep things simple, we don’t budget for individual expenses like oil changes, air filters, replacing tires etc etc, we just budget a flat $40 per month which is based on how much we drive each year.

Although we don’t have a car lease or a financing payment in our budget, we do set aside a bit of money each month for purchasing a new car in the future (new to us anyway, the last car we bought was used and we’ll probably do it again).

To help us buy our next car in cash we set aside a total of $2,400 per year. Eventually we’ll trade in our current car and get a newer one. We estimate every 7 years or so for an upgrade.

“We try to reduce our spending in three big categories… housing, transportation and food.”

Life:

On average we spend $400 per month on food for a family of four. This excludes eating out which we consider in our restaurant budget, this is an extra $100 per month. When you add restaurants our total food budget is closer to $500 per month or $6,000 per year.

This is a bit under the average spending which makes sense because we’re diligent about not wasting food and we make a menu for the week and try to stick to it. Food waste costs the average family $1,608 per year! We also try to eat vegetarian a few nights per week and we make most meals at home.

One big addition to our budget in 2018 is a family vacation. Normally we go on 3-4 camping trips each year which we budget $600 for, but this year we’re looking to take a bigger family vacation. We’ve budgeted $5,000 for this trip.

Our Budget:

Having a budget is an important personal finance tool. It’s the best way to control your spending. But budgeting isn’t easy. It takes time to get good at budgeting.

Having a budget is also just one piece of a good financial plan. (Let us know if you need some help creating a budget or some help creating an full financial plan. We can help you focus your financial plan to achieve your goals)

For a long time our plan has been to decrease our cash outflow. This is something we’ve been working on for years.

Our overall budget is $38,048 per year but if we were to add in a typical mortgage payment our budget would be closer to $50,828. Add in a second car and we’d be closer to $55,828 which is pretty close to the typical household spending. Our diligent budgeting lets us save over $20,000 per year vs the typical household.

Having a good budget makes it easy to manage your spending and cash flow. Don’t delay! Start budgeting today!

I had to add that cheesy rhyme 😉

“I’m not sure what it is, but I love to read about other peoples’ personal finances.”

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hey Owen,

What’s the sizable donation for?

PS are you familiar with the FIRE community in London? I think you’d like it! They do a monthly meet up and have an FB group as well

Hi Dominika, that amount would cover both regular donations and gifts. For gifts it would include things like birthdays and holidays.

I think I’ve come across the London FIRE group in the past but haven’t attended an event yet. Would you mind sharing a link or some more info? I’d like to check it out.

Thanks!

Here you go 🙂 https://www.facebook.com/groups/LDNonFIRE/about/

Thank you! I just joined.