Feel better about your money.

From budgeting to investing, PlanEasy helps make financial planning easy.

Tell us your goals, your income, your expenses, and we’ll help build a custom financial plan for you.

Feel better about your money.

From budgeting to investing, PlanEasy helps make financial planning easy.

Tell us your goals, your income, your expenses, and we’ll help build a custom financial plan for you.

[mc4wp_form id=”26269″]

How It Works

PlanEasy helps make financial planning easy. We handle all the tough calculations and integrate applicable government programs to create a personalized financial plan for you. To get started, all you need to do is answer some simple questions.

How It Works

PlanEasy helps make financial planning easy. We handle all the tough calculations and integrate applicable government programs to create a personalized financial plan for you. To get started, all you need to do is answer some simple questions.

Put your money to work

Plan for monthly expenses and minimum debt payments. Make sure you have enough money to pay your bills each month.

Expect the unexpected

Plan for infrequent expenses and emergency bills. Set aside a little bit each month for gifts, car repairs, home repairs etc. Create an emergency fund. Let us help you choose the right size.

Don't leave money on the table

Maximize employer matching on retirement accounts and other programs. Reduce taxes both now and in the future.

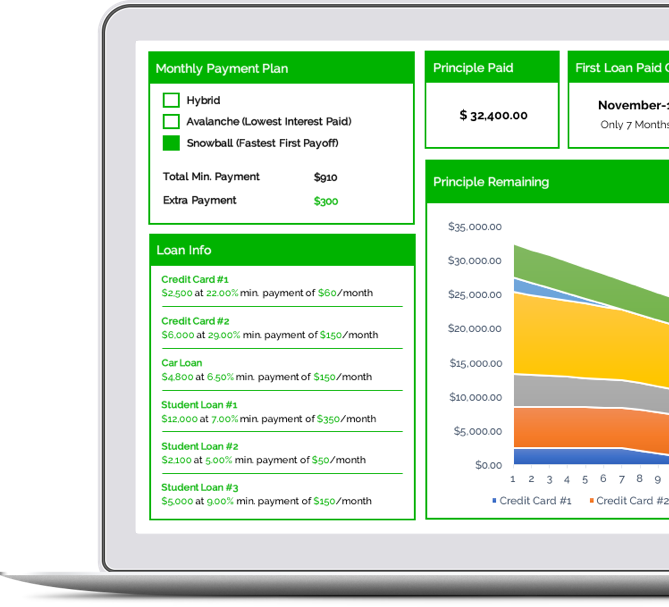

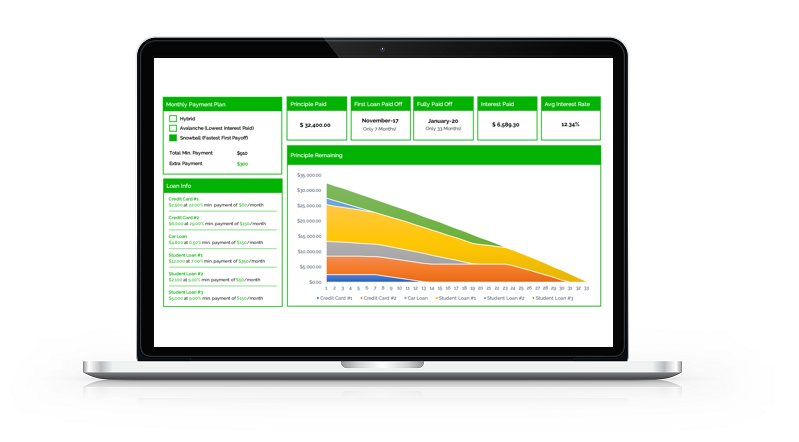

Pay down debt and evaluate assets

List your debts and assets. Create a debt pay off plan by choosing one of the options recommended by our AI Engine. Find out exactly how long it will take to pay off your debt.

Set and review financial goals

Set financial goals like down payment for a house, wedding, children’s education, bigger house, vacation house, new car. PlanEasy will prompt you for additional information.

Investment planning and risk management

Create an investment plan to help hit your financial goals but still reduce your risk during downturns. Reduce your risk with insurance when applicable.

Why PlanEasy?

It makes financial planning easy.

A financial plan is a list of your financial goals, both now and in the future, with a map of the best way to get there. Life rarely follows a straight path. You need help to navigate the financial twists and turns. A financial plan will help you put your hard-earned money to work in the best way possible. PlanEasy helps make financial planning easy.

Why PlanEasy?

It makes financial planning easy.

A financial plan is a list of your financial goals, both now and in the future, with a map of the best way to get there. Life rarely follows a straight path. You need help to navigate the financial twists and turns. A financial plan will help you put your hard-earned money to work in the best way possible. PlanEasy helps make financial planning easy.

The Value of Advice

Net worth is up to 2.0x greater with financial advice, even when controlling for age and income.1

That’s an extra $53,000 to $214,000 depending on income level.

(Figures are for those under the age of 45)

The Value of Advice

Net worth is up to 2.0x greater with financial advice, even when controlling for age and income.1

That’s an extra $53,000 to $214,000 depending on income level.

(Figures are for those under the age of 45)

Income below $35k/year

- Net Worth With No Advice: $65k

- Net Worth With Financial Advice: $118k

Income $35-70k/year

- Net Worth With No Advice: $92k

- Net Worth With Financial Advice: $186k

Income above $70k/year

- Net Worth With No Advice: $258k

- Net Worth With Financial Advice: $472k

Income below $35k/year

- Net Worth With No Advice: $65k

- Net Worth With Financial Advice: $118k

Income $35-70k/year

- Net Worth With No Advice: $92k

- Net Worth With Financial Advice: $186k

Income above $70k/year

- Net Worth With No Advice: $258k

- Net Worth With Financial Advice: $472k