Stress Free Retirement Planning

Start by downloading a free sample retirement plan.

Get certainty.

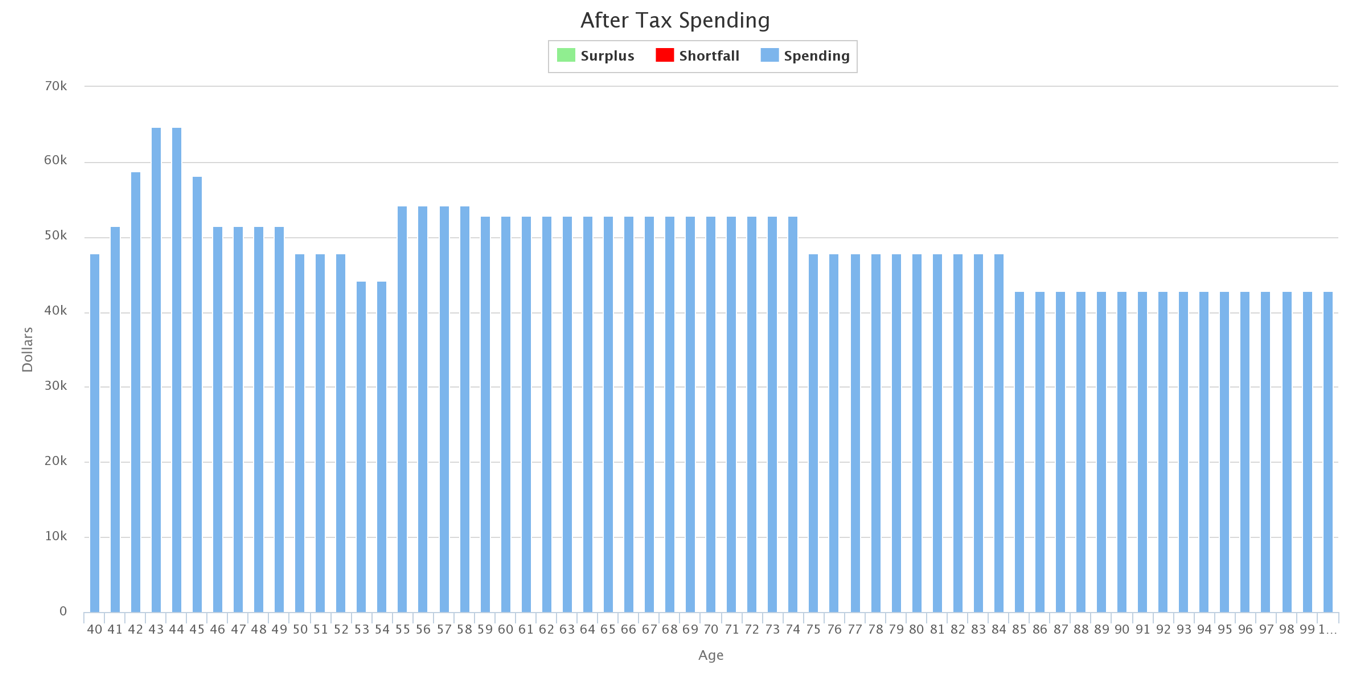

Retirement spending.

How much do you want to spend in retirement? Will you be able to cover those unexpected expenses? Have you included infrequent expenses, the ones that only happen every few years? Will you be able to keep your lifestyle in retirement?

We help you double check your retirement spending and anticipate changes.

Get certainty.

Retirement spending.

How much do you want to spend in retirement? Will you be able to cover those unexpected expenses? Have you included infrequent expenses, the ones that only happen every few years? Will you be able to keep your lifestyle in retirement?

We help you double check your retirement spending and anticipate changes.

Get detail.

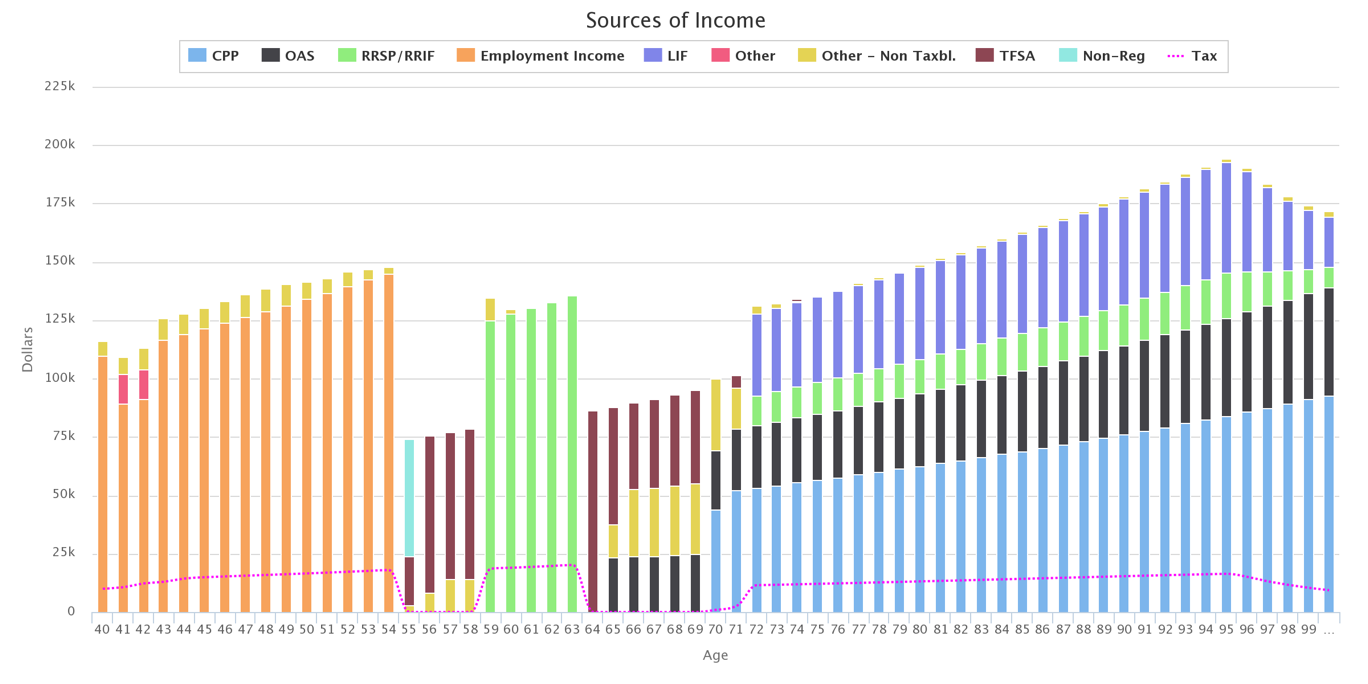

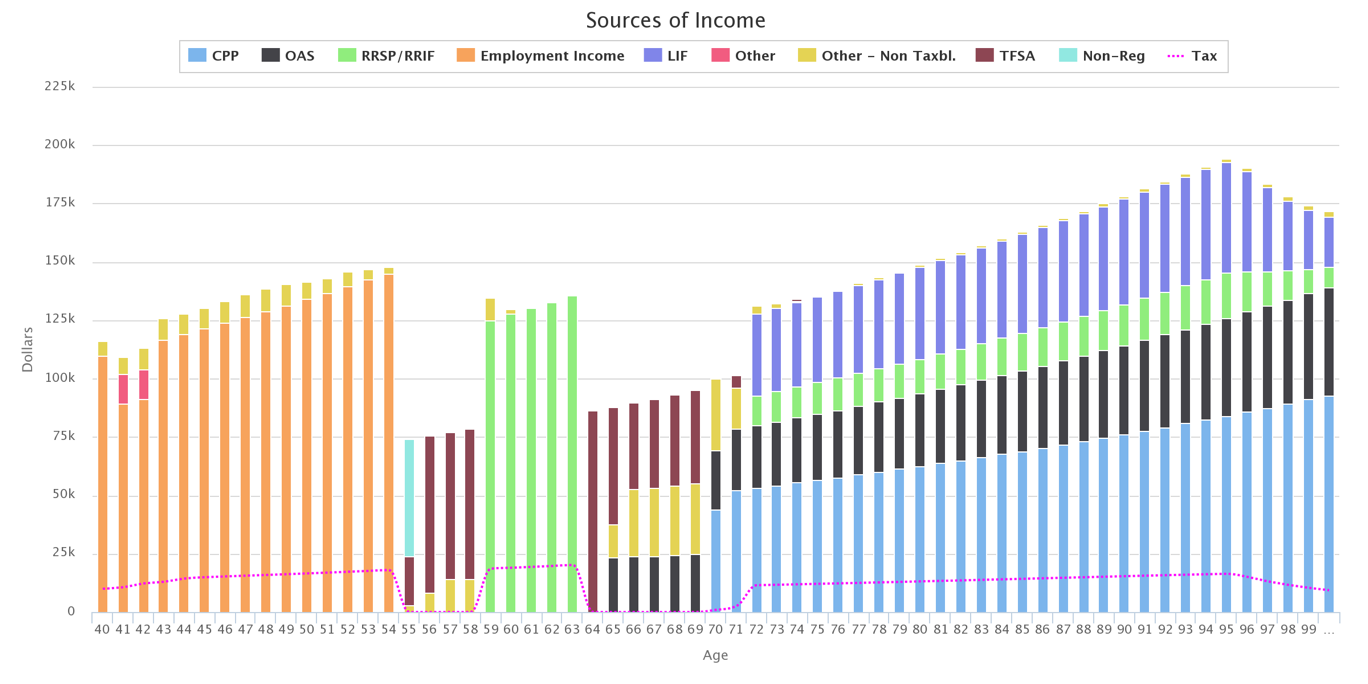

Retirement income planning.

What can you expect from government benefits like CPP and OAS? Are you eligible for any other benefits? Will your savings and investments generate enough income each year to support your expenses?

There are 7-10+ common retirement income sources, each with their own tax rates and claw back rules. We find the best way to turn your assets into income. We plan which accounts to draw from, when to draw from them, and how much to draw. We calculate income taxes and government benefits to ensure you’re meeting your spending goals.

Get detail.

Retirement income planning.

What can you expect from government benefits like CPP and OAS? Are you eligible for any other benefits? Will your savings and investments generate enough income each year to support your expenses?

There are 7-10+ common retirement income sources, each with their own tax rates and claw back rules. We find the best way to turn your assets into income. We plan which accounts to draw from, when to draw from them, and how much to draw. We calculate income taxes and government benefits to ensure you’re meeting your spending goals.

Get optimized.

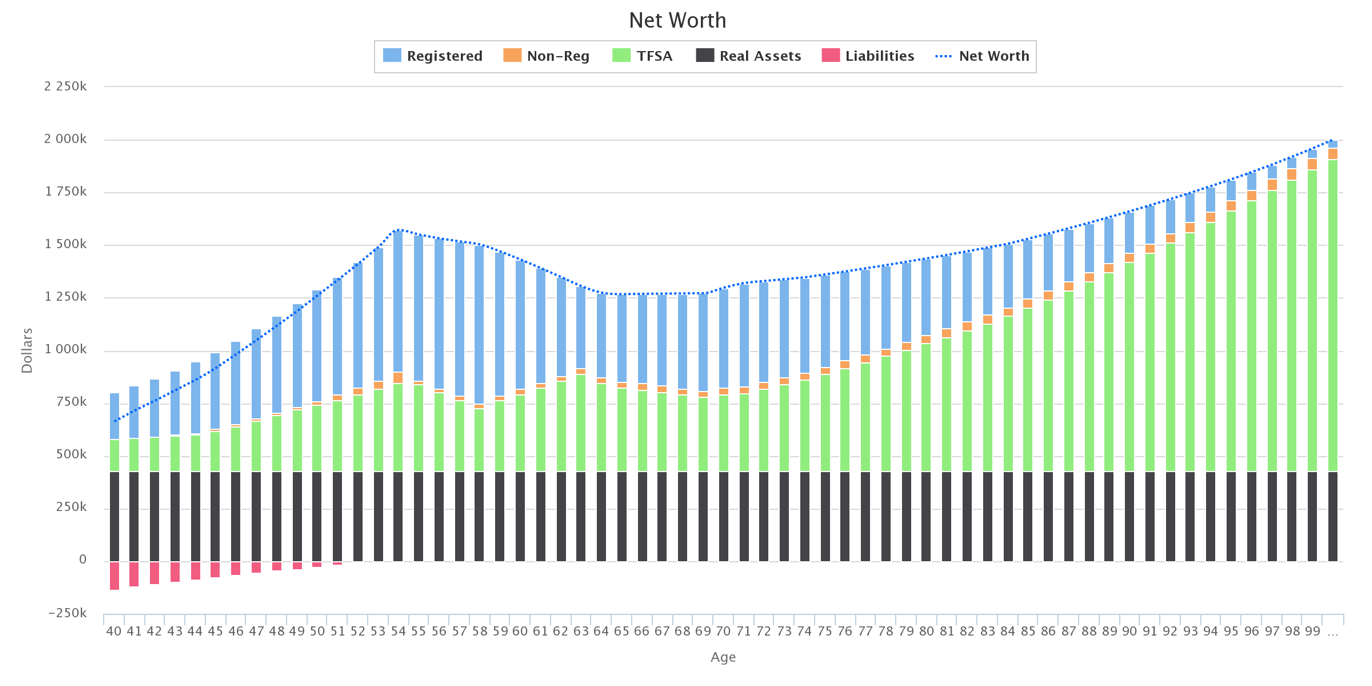

Grow your net worth.

Are you paying too much in investment fees? Have you optimized your investments for taxes and government claw backs? Are you using tax-advantaged accounts to their maximum? Will you be able to reach your short and long-term goals without making changes?

We take your savings and investments and project them into the future. We’ll show you how your assets will grow in the future and tell you if you’re on track to reach your goals.

Get optimized.

Grow your net worth.

Are you paying too much in investment fees? Have you optimized your investments for taxes and government claw backs? Are you using tax-advantaged accounts to their maximum? Will you be able to reach your short and long-term goals without making changes?

We take your savings and investments and project them into the future. We’ll show you how your assets will grow in the future and tell you if you’re on track to reach your goals.

Get security.

Peace of mind.

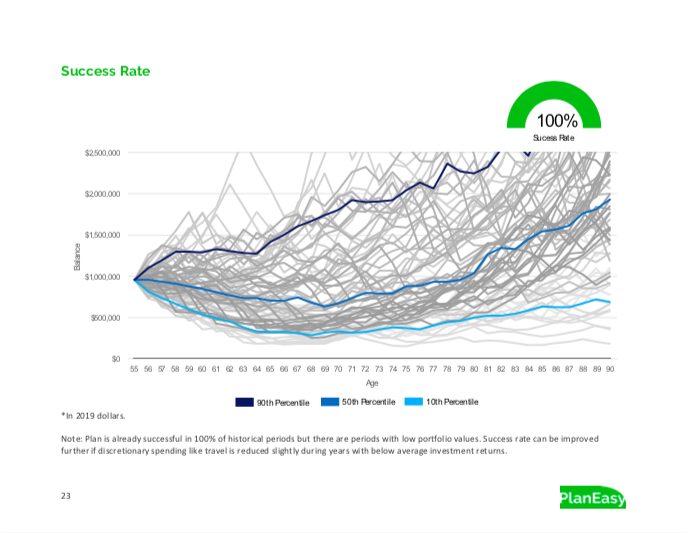

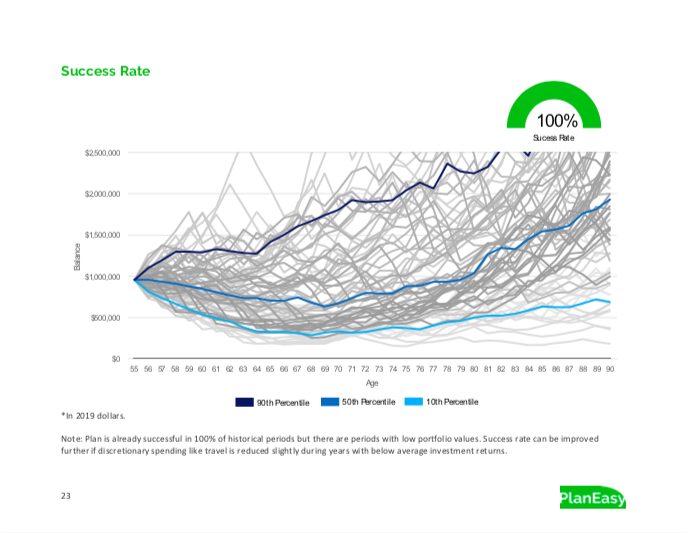

Will your savings last as long as you will? What happens during bad investment years? How much can you safely withdrawal from your investments each year?

We run your plan through dozens of historical scenarios to ensure you will never run out of money. Get the peace of mind of knowing that your money will last, even in the worst case scenario.

Get security.

Peace of mind.

Will your savings last as long as you will? What happens during bad investment years? How much can you safely withdrawal from your investments each year?

We run your plan through dozens of historical scenarios to ensure you will never run out of money. Get the peace of mind of knowing that your money will last, even in the worst case scenario.

Testimonials

Unbiased retirement planning.

“I highly recommend PlanEasy! Owen guided me through building an attainable budget.”

Ania G.

Client

“Owen is doing consistently great work, and right now – as you file your taxes for last year – is the perfect time think about decreasing your taxes and increasing your benefits”

Sandi M.

Financial Planner

Custom Retirement Plan

$1,000 One-Time

Feel secure with your financial future. Get a comprehensive retirement plan customized to your values and goals. We plan every aspect of your finances and create a detailed year-by-year plan from today until age 100.

Custom Retirement Plan

$1,000 One-Time

Feel secure with your financial future. Get a comprehensive retirement plan customized to your values and goals. We plan every aspect of your finances and create a detailed year-by-year plan from today until age 100.

Start By Downloading The Sample Plan

Most people have never worked with a fee-for-service financial planner or have seen a custom retirement plan. Download the sample plan to see if a custom retirement plan is right for you.

No commissions. No sales goals. Just advice.

PlanEasy Inc. 201 King St. London Ont N6A 1C9 phone: 1-226-374-8501 email: info@planeasy.ca Copyright © 2017-2019 PlanEasy Inc.