Case Study: Low-Income Retirement Plan

Greta

The Situation

Greta (age 59) is planning for retirement in a few years at age 65. She’s accumulated a small nest egg in RRSPs and TFSAs. Her income is modest, and she expects to qualify for Guaranteed Income Supplement (GIS) in the future but calculating Guaranteed Income Supplement (GIS) feels very complex. She wants help to make sure she’s not making any mistakes that may cost her later.

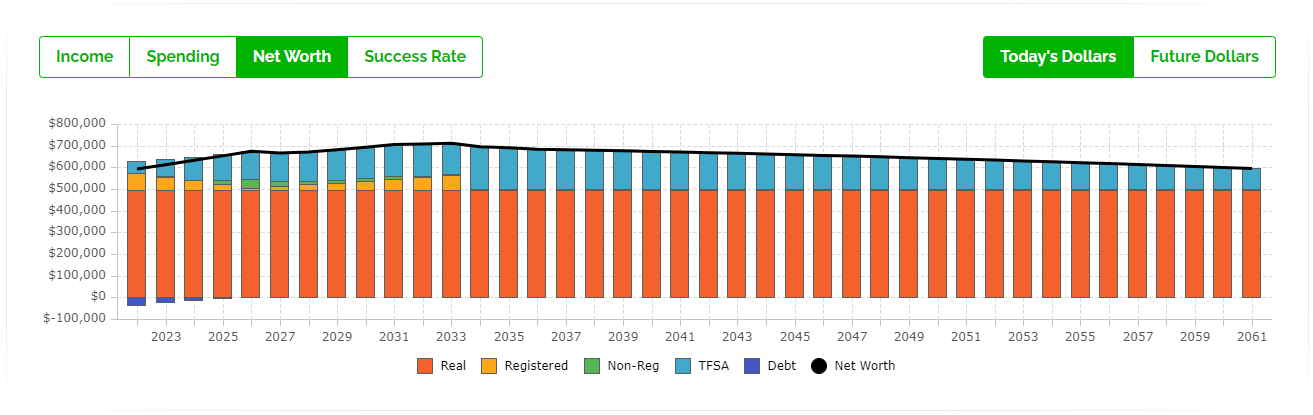

Her assets include an RRSP worth $89,442, a TFSA worth $33,110, and a home worth $485,000 with a small mortgage remaining.

She wants to make the most of her savings but is unsure what to do. The rules for government benefit programs are confusing. Eligibility for Guaranteed Income Supplement (GIS) is based on certain types of income and not others. She’s worried about doing the wrong thing and ending up with less benefits and higher taxes in retirement.

Greta owns a home in a small town in Ontario. She bought her home 15+ years ago for under $150,000 but now it’s worth quite a bit more. She could tap into home equity but would like to avoid that option if possible. Her cost of living is low, which should help in retirement, but she still has a small mortgage of $43,000 remaining which worries her.

She can start CPP in a few months at age 60 but will continue working until age 65. Her original plan was to delay CPP until age 65 but she read that this might not be a great idea due to the extra GIS clawbacks that would be triggered after age 65.

With all these rules Greta wants to know what she should do to have a comfortable retirement. She would like some help to navigate the confusing government benefit and income tax rules.

The Goal

With a detailed low-income retirement plan Greta can make sure she’s maximizing government benefits like the Guaranteed Income Supplement (GIS) and avoid unnecessary benefit clawbacks and income tax payments. This will mean $10,000’s in additional benefits over the course of her plan.

The Approach

Self-Directed Financial Plan plus one 60-Minute Session each year.

Greta used the PlanEasy platform to create her own financial plan and then refined it with an advice-only financial planner during a separate 60-minute session. With the help of the PlanEasy platform, Greta created her financial plan by…

- Reviewing current income and expenses and created a cash flow plan for retirement

- Mapping out her mortgage repayment year-by-year

- Restructured her current investment contributions to reduce income tax and benefit clawbacks in the future

- Estimated CPP and OAS benefits based on past contributions

- Analyzed the cost/benefit of when to start CPP benefits

- Planned RRSP contributions and withdrawals to maximize GIS benefits

- Structuring year-by-year withdrawal from RRSPs and TFSAs to minimize GIS clawbacks

- Testing the chance of running out of money in the future

The Plan

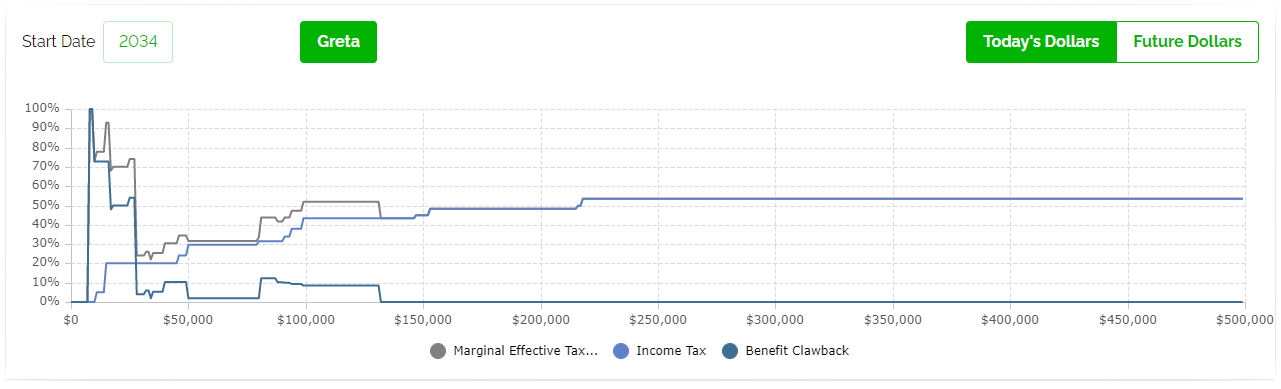

With her modest savings Greta is expected to receive Guaranteed Income Supplement (GIS) on top of CPP and OAS in retirement. This low-income retirement benefit will help her maintain a minimum level of income in retirement. GIS benefits are generous but comes with steep clawback rates of 50% to 75%. For every dollar of taxable income, her GIS benefit will be reduced by 50% to 75%. With nearly 1 in 3 retirees receiving GIS benefits she’s not alone in being worried about these clawbacks. The combination of GIS clawbacks and clawbacks on other government benefits will push Greta’s marginal effective tax rate to 50% to 100% on certain types of income. This means that without careful planning, for every $100 Greta has in taxable income at least $50 will be lost in taxes and benefit clawbacks.

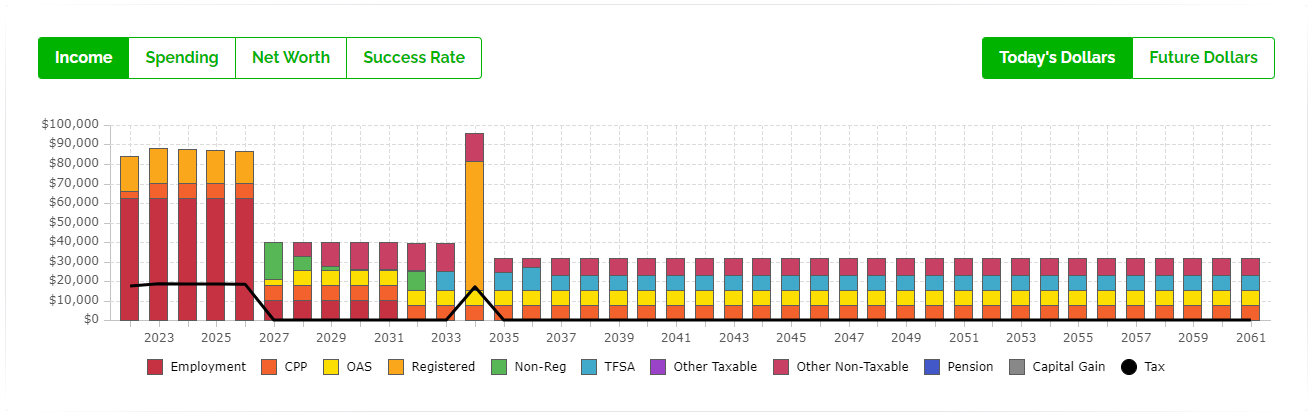

The PlanEasy platform automatically calculated Greta’s estimated CPP and OAS benefit based on past contributions and time living in Canada. Even through Greta could get up to $3,000 more per year by delaying CPP until age 65 this extra CPP income will just trigger extra GIS clawbacks of 50% in the future. This makes it more attractive for Greta to start CPP now at age 60 even though she’s still working. The extra income can be used to maximize her TFSA each year. She’ll get $7,472 per year starting at age 60.

Adding more money to RRSPs will only cause more GIS clawbacks in the future, so Greta will shift all future savings & investment contributions towards her TFSA. In fact, to minimize the impact of GIS clawbacks it’s a smart decision for Greta to draw down her RRSP now before age 64. We planned strategic RRSP withdrawals over the next few years. This causes extra income tax now at a 31% tax rate but decreases GIS clawbacks at a 50%-75% rate in the future. The RRSP withdrawals will be added to Greta’s TFSA. When Greta turns 65, we plan for her to reverse this strategy, she can add to her RRSP to maximize GIS benefits. This means from age 65 to 72 she’ll receive the maximum GIS worth over $11,000 per year. This type of low-income planning is unfortunately very complex, and Greta felt much better after refining her year-by-year plan with an advice-only financial planner.

After having the 60-minute session with an advice-only financial planner there are two additional strategies that Greta added to her plan. The first strategy is that employment income below $5,000 per year incurs no GIS clawbacks and employment income between $5,000 and $15,000 per year only incurs half the normal GIS clawbacks. To take advantage of this opportunity Greta plans to work part-time earning $10,000 per year from age 65-70. This $50,000 in employment income will go a long way to improving her plan. The second strategy is that Greta must withdraw her RRSP all at once when it’s converted to a RRIF at age 72. If left alone the RRIF will cause small minimum withdrawals each year which will incur GIS clawbacks at 50%-75%. To avoid these clawbacks, it’s advantageous to make one large RRIF withdrawal and place the entire amount in her TFSA. This will mean losing GIS benefits for 12-months, but it is better than a long and drawn out RRIF drawdown. This means that by age 73 all of Greta’s financial assets are in the TFSA being withdrawn tax free and this income has no impact on her GIS benefits.

Next Steps

With some early planning Greta is in a good position for retirement. Her home is nearly paid off and with some smart decisions leading up to retirement she’ll be able to spend nearly $32,000 per year without needing to worry about running out of money in the future.

She was smart to create a low-income retirement plan now, especially before government benefits like CPP, OAS, and GIS began. This has given her time to re-arrange her personal finances to minimize income tax and maximize government benefits like GIS in retirement.

Due to the complexity of this type of low-income retirement planning Greta will check in once per year with her advice-only financial planner to adjust the plan and keep herself on track. She will keep her plan up to date on the PlanEasy platform and then book a call with an advice-only financial planner each year to make small changes and updates.

Want to see Greta’s plan in more detail? Click the link below to see her “PlanEasy Public Dashboard” that includes all her income and spending information, detailed projections, and success rate.