“Welcome to the PlanEasy blog! We make personal finance easy.

Thanks for visiting.”

– Owen

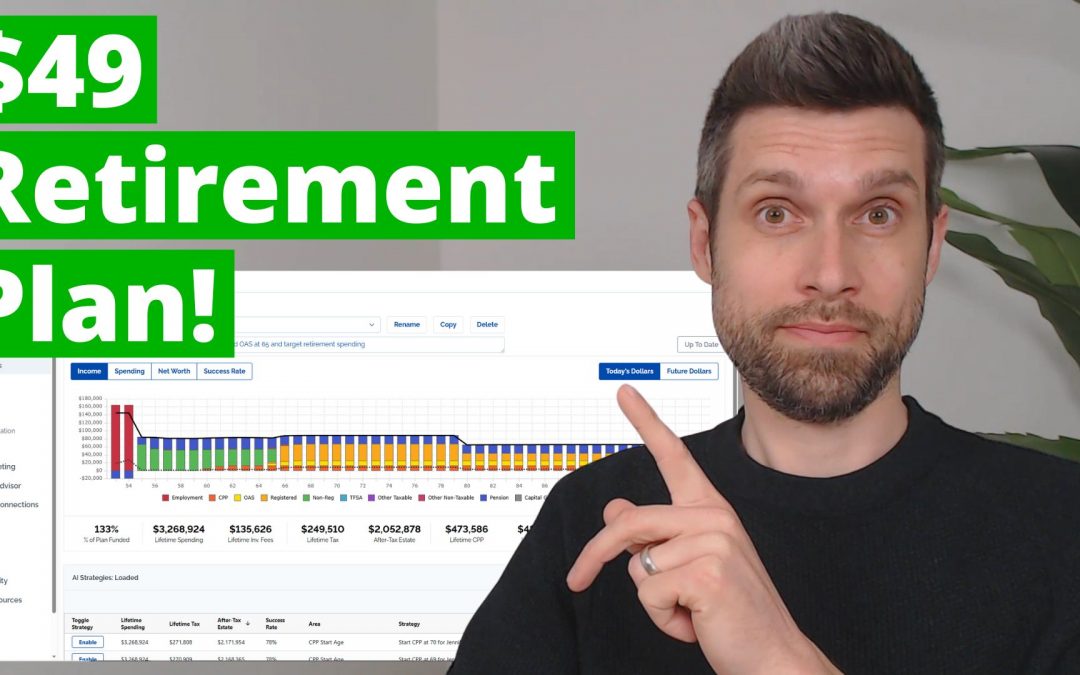

Introducing the $49 Retirement Plan

We’re excited to introduce the $49 Retirement Plan. This is an exciting new way to create a retirement plan in Canada!

With PlanEasy our goal from the very beginning was to make retirement planning easy, accessible, and inexpensive.

With this new $49 Retirement Plan from our sister company Adviice we are getting extremely close to that goal.

What is Included in the $49 Retirement Plan?

When you sign up for the $49 Retirement Plan, you’re getting more than just the software platform, you’re getting access to a full retirement planning ecosystem built to provide you with clarity, confidence, and control over your financial future.

You’re getting access to…

– Retirement Planning Platform

– AI Strategies

– Community Support Forum

– Educational Webinars (2x per Month)

– Optional 1:1 Platform Training

Canada Child Benefit Increase! What Will Your Monthly CCB Be?

The Canada Child Benefit is one of the most generous government benefits in Canada and it just increased! Unlike many government benefits, the Canada Child Benefit is available to low, moderate, and also some high income families.

The amount you receive from the Canada Child Benefit (CCB) depends on a few factors, one is the taxable net income for the family (line 23600 on your tax return), another is the number of children in the family, and the final factor is the age of each child.

The Canada Child Benefit is an “income tested” government benefit. The higher your taxable net income is, the lower your Canada Child Benefit will be. For some high income families, at a certain level of income the Canada Child Benefit will be reduced to $0. Anyone with income above that income level will not receive any benefit. The tricky thing is that this income level is different depending on the number of children and their ages.

The Canada Child Benefit also changes every year. New benefits start in July and are based on prior years tax return (the first payment of the updated benefit is July 20th).

The Canada Child Benefit also increases with inflation. The new 2025 Canada Child Benefit has increased by 2.7% versus 2024.

So how much Canada Child Benefit can you expect in July? We’ve got a table below that shows the Canada Child Benefit based on family taxable net income (line 23600) in $10,000 increments, so you can figure out generally how much you can expect in July.

The CPP Max Will Be HUGE In The Future

Did you know that the Canada Pension Plan (CPP) is getting bigger? Every year since 2019 CPP has been expanding and it will continue to expand for the next 40+ years until 2065. By the end, CPP will be HUGE!

CPP is an important retirement benefit. The old “base” CPP aimed to replace 25% of pre-retirement employment income. The new “expanded” CPP will increase this amount to 33.33% and will cover a larger amount of pre-retirement of income. The result is that CPP will be over 50% larger in the future.

If we follow the rule of thumb* that suggests that we need 70% of pre-retirement income in retirement, then for the average Canadian the new expanded CPP could provide nearly half of retirement income in the future. When combined with OAS this means that over half of retirement income could be covered by CPP and OAS combined.

And if we consider that the maximum annual CPP payment could be over $7,000 per year higher in the future (and over $14,000 per year for a couple), that could mean the average Canadian needs to save hundreds of thousands less for retirement.

In this post we’ll look at the current maximum CPP payment, the maximum CPP contribution, the current contribution rate, and how these will change in the future as CPP expands. We’ll also look at how the current “base” CPP will grow by over 50% in the future…

Owen Winkelmolen

Advice-only financial planner, CFP, and founder of PlanEasy.ca

“Welcome to the PlanEasy blog! We make personal finance easy.

Thanks for visiting.”

– Owen

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

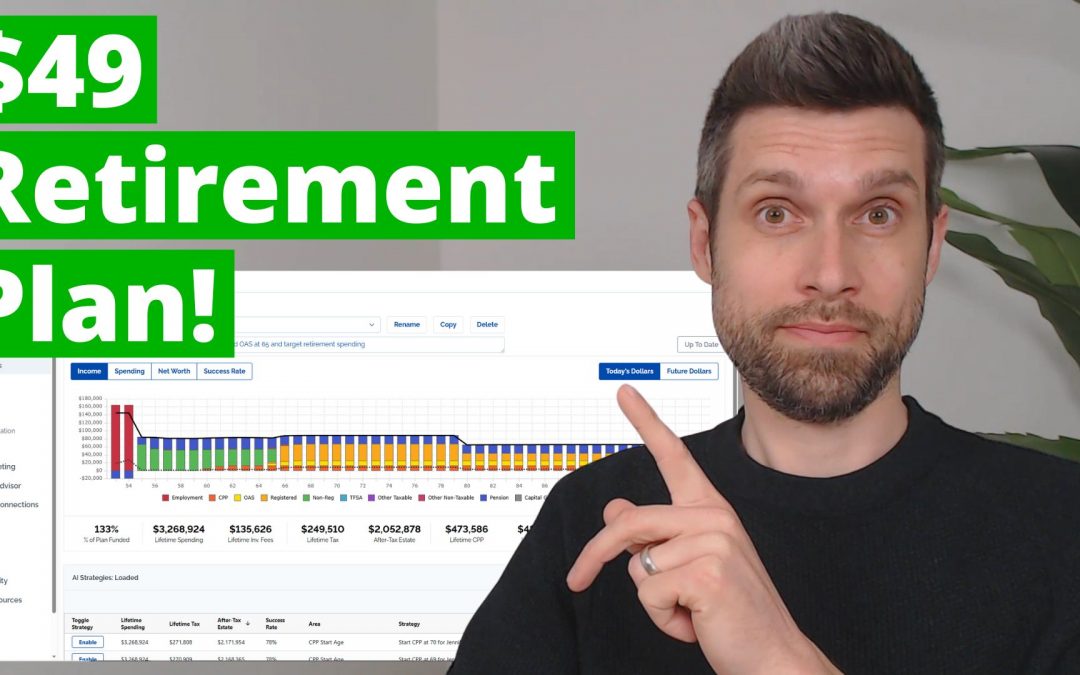

Introducing the $49 Retirement Plan

We’re excited to introduce the $49 Retirement Plan. This is an exciting new way to create a retirement plan in Canada!

With PlanEasy our goal from the very beginning was to make retirement planning easy, accessible, and inexpensive.

With this new $49 Retirement Plan from our sister company Adviice we are getting extremely close to that goal.

What is Included in the $49 Retirement Plan?

When you sign up for the $49 Retirement Plan, you’re getting more than just the software platform, you’re getting access to a full retirement planning ecosystem built to provide you with clarity, confidence, and control over your financial future.

You’re getting access to…

– Retirement Planning Platform

– AI Strategies

– Community Support Forum

– Educational Webinars (2x per Month)

– Optional 1:1 Platform Training

Canada Child Benefit Increase! What Will Your Monthly CCB Be?

The Canada Child Benefit is one of the most generous government benefits in Canada and it just increased! Unlike many government benefits, the Canada Child Benefit is available to low, moderate, and also some high income families.

The amount you receive from the Canada Child Benefit (CCB) depends on a few factors, one is the taxable net income for the family (line 23600 on your tax return), another is the number of children in the family, and the final factor is the age of each child.

The Canada Child Benefit is an “income tested” government benefit. The higher your taxable net income is, the lower your Canada Child Benefit will be. For some high income families, at a certain level of income the Canada Child Benefit will be reduced to $0. Anyone with income above that income level will not receive any benefit. The tricky thing is that this income level is different depending on the number of children and their ages.

The Canada Child Benefit also changes every year. New benefits start in July and are based on prior years tax return (the first payment of the updated benefit is July 20th).

The Canada Child Benefit also increases with inflation. The new 2025 Canada Child Benefit has increased by 2.7% versus 2024.

So how much Canada Child Benefit can you expect in July? We’ve got a table below that shows the Canada Child Benefit based on family taxable net income (line 23600) in $10,000 increments, so you can figure out generally how much you can expect in July.

The CPP Max Will Be HUGE In The Future

Did you know that the Canada Pension Plan (CPP) is getting bigger? Every year since 2019 CPP has been expanding and it will continue to expand for the next 40+ years until 2065. By the end, CPP will be HUGE!

CPP is an important retirement benefit. The old “base” CPP aimed to replace 25% of pre-retirement employment income. The new “expanded” CPP will increase this amount to 33.33% and will cover a larger amount of pre-retirement of income. The result is that CPP will be over 50% larger in the future.

If we follow the rule of thumb* that suggests that we need 70% of pre-retirement income in retirement, then for the average Canadian the new expanded CPP could provide nearly half of retirement income in the future. When combined with OAS this means that over half of retirement income could be covered by CPP and OAS combined.

And if we consider that the maximum annual CPP payment could be over $7,000 per year higher in the future (and over $14,000 per year for a couple), that could mean the average Canadian needs to save hundreds of thousands less for retirement.

In this post we’ll look at the current maximum CPP payment, the maximum CPP contribution, the current contribution rate, and how these will change in the future as CPP expands. We’ll also look at how the current “base” CPP will grow by over 50% in the future…

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...