Canada Child Benefit Increase!

What Will Your Monthly CCB Be?

Updated for 2025.

The Canada Child Benefit is one of the most generous government benefits in Canada and it just increased! Unlike many government benefits, the Canada Child Benefit is available to low, moderate, and also some high income families.

The amount you receive from the Canada Child Benefit (CCB) depends on a few factors, one is the taxable net income for the family (line 23600 on your tax return), another is the number of children in the family, and the final factor is the age of each child.

The Canada Child Benefit is an “income tested” government benefit. The higher your taxable net income is, the lower your Canada Child Benefit will be. For some high income families, at a certain level of income the Canada Child Benefit will be reduced to $0. Anyone with income above that income level will not receive any benefit. The tricky thing is that this income level is different depending on the number of children and their ages.

The Canada Child Benefit also changes every year. New benefits start in July and are based on prior years tax return (the first payment of the updated benefit is July 20th).

The Canada Child Benefit also increases with inflation. The new 2025 Canada Child Benefit has increased by 2.7% versus 2024.

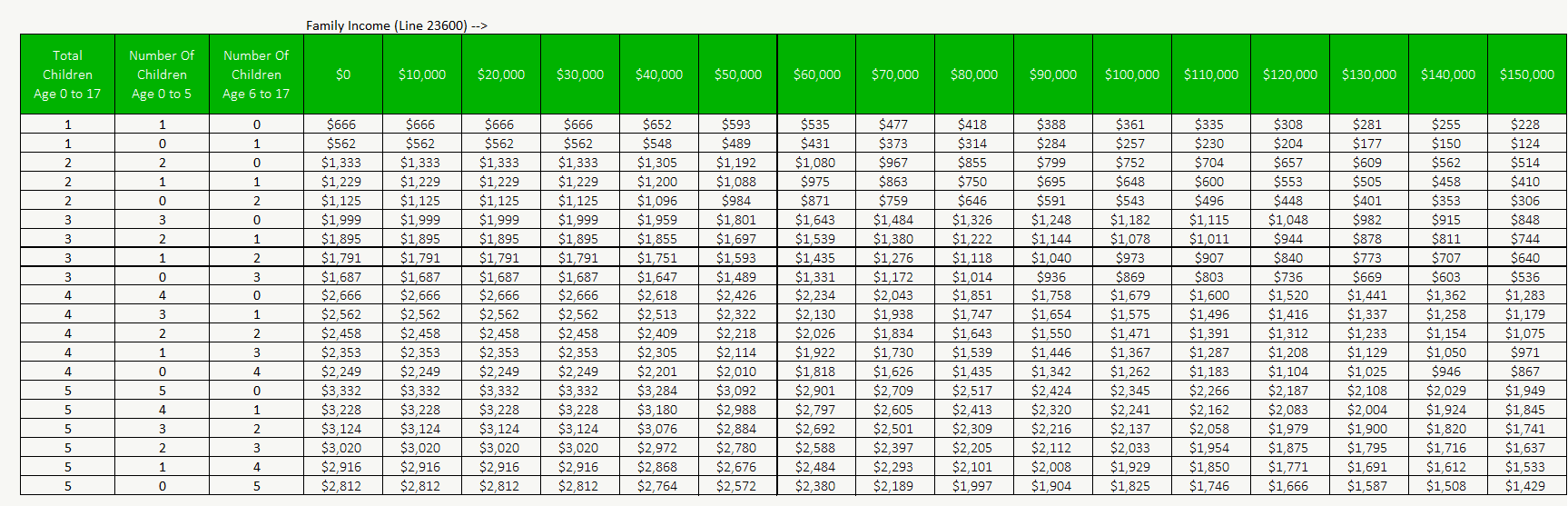

So how much Canada Child Benefit can you expect in July? We’ve got a table below that shows the Canada Child Benefit based on family taxable net income (line 23600) in $10,000 increments, so you can figure out generally how much you can expect in July.

What Are The New CCB Amounts?

The Canada Child Benefit starts at a maximum amount depending on the number of children and the children’s ages. This amount then gets reduced based on the family’s income level.

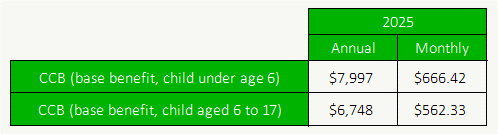

The new CCB amounts are in the table below. These amounts are the maximum a family would receive for each child if they had taxable net income below $37,487 in 2024.

In 2025 the maximum Canada Child Benefit for children age 0-5 is $7,997 per year or $666.42 per month and for children age 6-17 the maximum amount is $6,748 per year or $562.33 per month. This then gets reduced by the “clawbacks” explained below.

How Does CCB Work?

The Canada Child Benefit is an “income tested” government benefit. This means the benefit is reduced as income increases, but how does this work exactly?

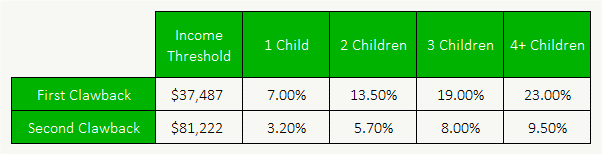

As a family’s taxable net income increases the Canada Child Benefit gets “clawed back” at a certain rate. This rate depends on the family’s income level. Below a certain income level there is no clawback but as income increases that clawback rate changes. The table below shows the different clawback rates.

But what does this clawback mean? The clawback reduces the Canada Child Benefit as income increases. Here are two examples…

Example 1: For a family with two children over 6-years old the maximum annual benefit they would receive is $13,496. If they earned $90,000 in 2024 then they would receive $7,091 from CCB from July 2025 to June 2026. They start with the maximum but then this gets reduced based on their income. The first reduction is at a rate of 13.5% for income between $37,487 and $81,222 ($81,222 – $36,502 = $43,735 x 13.5% = $5,904 clawback). The second reduction is at a rate of 5.7% for income between $81,222 and $90,000 ($90,000 – $81,222 = $8,778 x 5.7% = $500 clawback).

Example 2: For a family with three children under 6-years old the maximum annual benefit they would receive is $23,991. If they earned $90,000 in 2024 then they would receive $14,979 from CCB from July 2025 to June 2026. They start with the maximum but then this gets reduced based on their income. The first reduction is at a rate of 19.0% for income between $37,487 and $81,222 ($81,222 – $37,487 = $43,735 x 19.0% = $8,310 clawback). The second reduction is at a rate of 8.0% for income between $81,222 and $90,000 ($90,000 – $81,222 = $8,778 x 8.0% = $702 clawback).

Want more info on how the Canada Child Benefit works? Check out this post.

What Are The Canada Child Benefit Payment Dates In 2024?

The Canada Child Benefit gets paid on a monthly basis, around the 20th of each month. The payment dates will vary slightly depending on weekends and holidays but this is when you can expect to receive your Canada Child Benefit payment in 2025…

- January 20, 2025

- February 20, 2025

- March 20, 2025

- April 17, 2025

- May 20, 2025

- June 20, 2025

- July 18, 2025

- August 20, 2025

- September 19, 2025

- October 20, 2025

- November 20, 2025

- December 12, 2025

How Much CCB Could You Expect?

We can expand the math above and look at all sorts of different family scenarios. To help you estimate how much CCB you can expect in 2025 we’ve created the table below. This table is based on line 23600 of your tax return. For a couple you will need to add both you and your partner’s line 23600 to figure out your total family income.

This table shows the monthly benefit you could expect after the CCB increase… (click here for an even larger table up to $400,000 in family income).

How To Increase Your CCB Next Year

Want to increase your Canada Child Benefit next year? One great way to increase the Canada Child Benefit is through RRSP contributions. For families an RRSP contribution can be more attractive than a TFSA contribution because an RRSP contribution will decrease taxable net income.

An RRSP contribution is considered a tax deduction, it reduces line 23600 on your tax return. Someone who earned $80,000 but made a $10,000 RRSP contribution will have a taxable net income of $70,000. This increases their CCB the following year.

Although it might be attractive to make an RRSP contribution to boost your CCB this isn’t always the best decision. RRSP contributions can be detrimental to low income retirees who expect to receive Guaranteed Income Supplement (GIS) in the future. But! With a bit of careful planning you can still contribute to an RRSP as long as there is a plan to draw down the RRSP before age 65 when GIS begins.

This is also where the help of a good financial planner can pay for itself. If you’re already saving money then a bit of careful tax and benefit planning can lead to lower income tax and higher government benefits. Learn how to optimize your government benefits both now and in retirement.

See this blog post for more details on how you can maximize your Canada Child Benefit and see a case study showing how one family increased their CCB by $55,000 and gained over $100,000+ in additional net worth just by maximizing their Canada Child Benefit!

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Canada Child Benefit Is Increasing

For many families the Canada Child Benefit is an important government benefit that helps with the cost of raising children. It’s one of the most generous government benefits in Canada but it also comes with some steep “clawback” rates. Understand how these clawback rates work and being smart about how you save can help increase you benefit.

Each year the Canada Child Benefit will increase by inflation. This means that every year families can expect to receive a slightly higher amount as long as they earn the same level of income.

Although the CRA calculates the new CCB amount automatically each July, it can be nice to know in advance how much you could expect to receive, especially when you’ve experienced a large change in income.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen, Thank you so much for providing a timely info with useful examples and good tips to increase the benefit, I will share with others too.

I was just wondering, is this increase a dramatic one compared to previous years? Thank you again!

Hi June, no problem! The increase in 2021 is less than 2020 when it increased by 1.9%, so not dramatic no, but in 2021 the unique part about CCB is the $300 quarterly payment for children under 6yo (although at the time I’m making this comment this proposal has not yet passed).

Thank you Owen for a quick response!

Still very grateful for this generosity by the government.

(Living in Toronto where day care costs over $1500/child monthly, I also hope the budget 2021 proposals will become in effect.)

Why not go for all kids ages under 18? As get older they get more expensive, all kids should be treated equally..

Hi Amy, the CCB does continue until age 18, but at a slightly lower annual amount. The amount drops once a child turns age 6. Presumably this is when the government expects childcare expenses to decline. But for a real explanation you may need to write to your MP.

I have a son that’s 17 I am in am in a low income bracket what will I receive for my benefit

Hi Lois, you’ll need to know the total taxable income for your household, line 23600 on your tax return (or notice of assessment). You can use this total taxable income in combination with the table above to estimate your CCB for 2021 starting in July (look at the second row in the table for 1-child between age 6 and 17 inclusive). For example, if your taxable income was $30,000 in 2020 then you would receive the maximum amount of $480 per month. Because your son is 17 you will only receive a monthly CCB payment until he turns 18.

Hi i never got my july 300$ yet when will it come in my bank

Hi Daisy, the Canada Child Benefit payments usually come around the 20th of every month. The July 20th payment will reflect the new income from the previous year and could be different than the June payment.

I have not received my refund the last 2 years. This clawback is nonsense you say CTB is increasing but if it’s increasing why deduct the payments in the long run????? It will just put families further in poverty?? Everything is so expensive as it is hard to make ends meet right now. Rent is thru the roof, food is outrageous, everything is out of control!!!! Homeless everywhere and our government wants to start taking money away????

This is not the time to do it!!

Here’s a thought open up more home owners programs that don’t depend on down payment at first, or rentals that allow pets, instead of having so many empty homes or buildings that could be fixed up and rented out like rooming homes get these homelss off the streets.

Hi CF, I feel your frustration. Its very difficult at the moment. The only (small) positive is that next year the Canada Child Benefit will increase with inflation, so families should see a good “bump” in their benefits, albeit slightly delayed.

Hi Owen, I have an year old son and CCB decreased in july. It did not increase for my child.Also, I am getting the same ammount in August. Which means my ccb has decreased from now for an year. Why is that?

Hi Anam, the Canada Child Benefit is what they call an “income tested government benefit”. This means it can vary as income goes up or down. If your CCB when down, then I suspect it’s because your taxable income in 2021 was higher than in 2020. This would cause your CCB to decrease in July 2022.

It depends on the situation, but sometimes making RRSP contributions can be attractive because it creates a tax refund plus it helps lower taxable income and increase Canada Child Benefit. This could be something to consider in 2022.

Hi Owen. Great article. Really helpful. However, do you know how this formula is calculated if you are separated? Im looking at the table, and it is about 2x almost exactly from what I actually do recieve? Could this be because my x-spouse has a higher income? Thanks! Justin.

Fantastic question Justin. You are correct, the rules for parents who are separated/divorced are slightly different and it depends on custody. It sounds like you have shared custody, in which case the maximum Canada Child Benefit is exactly 50% and the “clawback” on that 50% is calculated based on your net income. It actually doesn’t matter what your ex’s net income is because the CRA calculates your CCB separately.

I was wondering if I get any extra for a 11 and a 14 year old?

Hi Shannon, there is no extra benefit that is specifically related to their ages, but depending on your income level you could get more/less based on your income from the previous year. Sometimes it can make sense to contribute to an RRSP to help reduce income tax AND increase your government benefits. Making an RRSP contribution lowers your taxable income (line 23600 on your tax return) which will help boost Canada Child Benefit starting the following July.

Hi Owen! It seems the CRA never received our tax return for 2020 (though we completed it and paid our amount owing before the deadline of April 30, 2021). Can we get the Canada Child Benefit retroactively (we submitted both our 2020 and 2021 tax return today)? If so, do you have a table (like the one above) but for 2020? I know the benefit amounts increased in 2021. Thank you in advance!

Hi Meg, you bet we have the tables from previous years, these are just estimates in $10,000 increments, but they’ll help you validate that the CRA calculated your back payments correctly…

2022: https://www.planeasy.ca/wp-content/uploads/2021/05/Monthly-CCB-Benefit-2022-Up-to-350000-Income.png

2021: https://www.planeasy.ca/wp-content/uploads/2020/06/Monthly-CCB-Benefit-2021-Up-to-350000-Income-copy.png

2020: https://www.planeasy.ca/wp-content/uploads/2020/06/Monthly-CCB-Benefit-2020-Up-to-350000-Income.png

Do we know yet if we will be getting the $300 for 2022-2023 ? I don’t think I got one this year as of yet

Hi Goldie, good question! The CCB young child supplement was unfortunately just for 2021. There has been no announcement for 2022.

Hi Owen,

Thank you for this very informative post. I started working in Jan of 2022 and we are still getting paid the CCB based on my husband’s income until now. My this year’s taxes still wont reflect that I have started working. It will only reflect in my taxes that I file in March 2023. I am guessing we will keep getting the CCB until then. My question is will the CRA ask me to repay them as I file my taxes next year? I am dreading it because although the amount doesn’t seem huge per month, but when you multiply it by 15 months, it definitely shakes everything up.

Hi Rach, the Canada Child Benefit “lags” a bit, it only changes in July based on the previous tax year. So even though your income has increased as of January 2022 you wont see the effect on your CCB until July 2023, a full 18-months later. You won’t have to pay anything back, this is just how CCB works.

In this case the “lag” helps you because you have the extra income from employment and a higher CCB benefit. But on the opposite side, if someone lost their job at the beginning of the year then the “lag” hurts because although their income has dropped, their CCB would only increase in July the following year, as much as 18-months later.

If you’re not already, consider using the extra CCB to maximize your RESP and/or make catch up contributions to the RESP.

This is such great advice! Thank you so much Owen, very helpful!

Hi owen just wondering if any updates when we get the new funds for child tax

Hi Penny, as long as you filed your income tax return on time, the new Canada Child Benefit payments are typically sent out July 20th.

Yeah $21 per month additional is not helping much in this inflation. Just got $21 extra in child benefit today

Thanks for the comment SJ. With such a small increase I suspect there were probably other factors like a child who when from age 0-5 to age 6-17 (which has a lower benefit) or there may have been an increase in income last year.