The CPP Max Will Be HUGE In The Future

Updated for 2023.

Did you know that the Canada Pension Plan (CPP) is getting bigger? Every year since 2019 CPP has been expanding and it will continue to expand for the next 40+ years until 2065. By the end, CPP will be HUGE!

CPP is an important retirement benefit. The old “base” CPP aimed to replace 25% of pre-retirement employment income. The new “expanded” CPP will increase this amount to 33.33% and will cover a larger amount of pre-retirement of income. The result is that CPP will be over 50% larger in the future.

If we follow the rule of thumb* that suggests that we need 70% of pre-retirement income in retirement, then for the average Canadian the new expanded CPP could provide nearly half of retirement income in the future. When combined with OAS this means that over half of retirement income could be covered by CPP and OAS combined.

And if we consider that the maximum annual CPP payment could be over $7,000 per year higher in the future (and over $14,000 per year for a couple), that could mean the average Canadian needs to save hundreds of thousands less for retirement.

*Rules of thumb aren’t great for retirement planning, find out why here.

In this post we’ll look at the current maximum CPP payment, the maximum CPP contribution, the current contribution rate, and how these will change in the future as CPP expands. We’ll also look at how the current “base” CPP will grow by over 50% in the future…

Current CPP Max In 2023

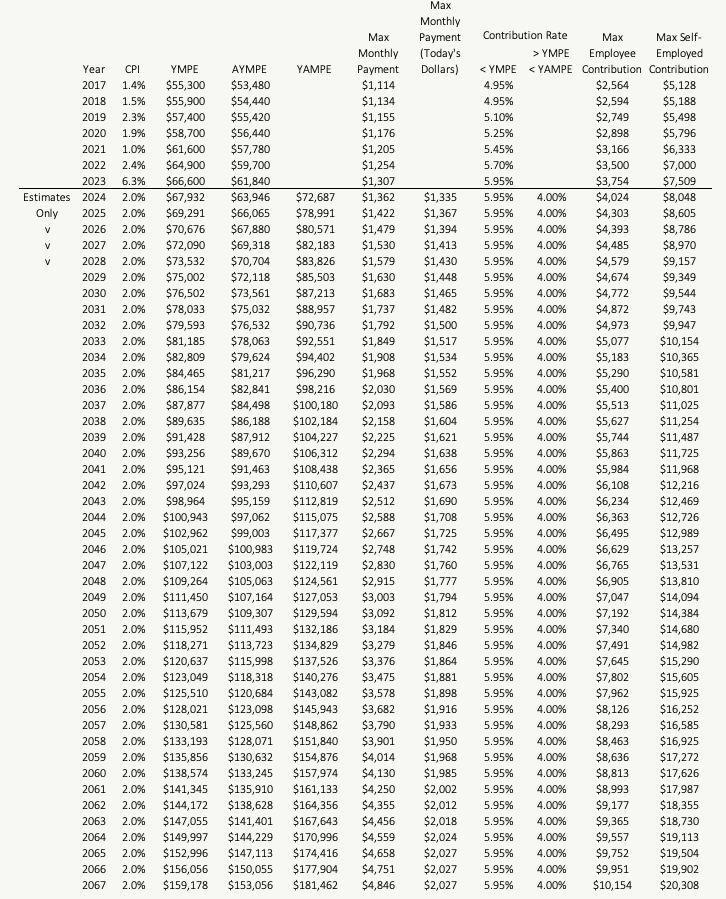

The maximum CPP payment in 2023 is $1,306.57 per month or $15,679 per year. This includes the maximum base CPP payment of $1,288.33 per month plus a maximum enhanced CPP payment of $18.24 per month. This maximum amount is payable at age 65 but most people will never reach this maximum.

To receive the maximum CPP payment requires making 39-years of maximum contributions between age 18 and 65, so this is a difficult threshold to achieve.

The current CPP contribution rate is 5.95% in 2023, this has increased from 4.95% in 2018. In 2023, the CPP contribution is maximized when employment earnings for the year are $66,600 or above. The first $3,500 of employment earnings is called the basic exemption and does not require CPP contributions. This gives us the maximum CPP contribution in 2023 of $3,500 for an employee (($66,600 – $3,500) x 5.95% = $3,754).

These contribution rates and maximum CPP contributions are doubled for self-employed, who need to make both the employee and employer contributions.

Watch The Video!

How CPP Max Payment Is Calculated

The goal of CPP is to replace 25% of employment earnings up to the max. Each year a credit is earned (or a fraction of a credit). The credit is basically a percentage of the Year’s Maximum Pensionable Earnings (YMPE).

Earning more than $66,600 in 2023 would result in a contribution of $3,754 to CPP and would earn one full credit.

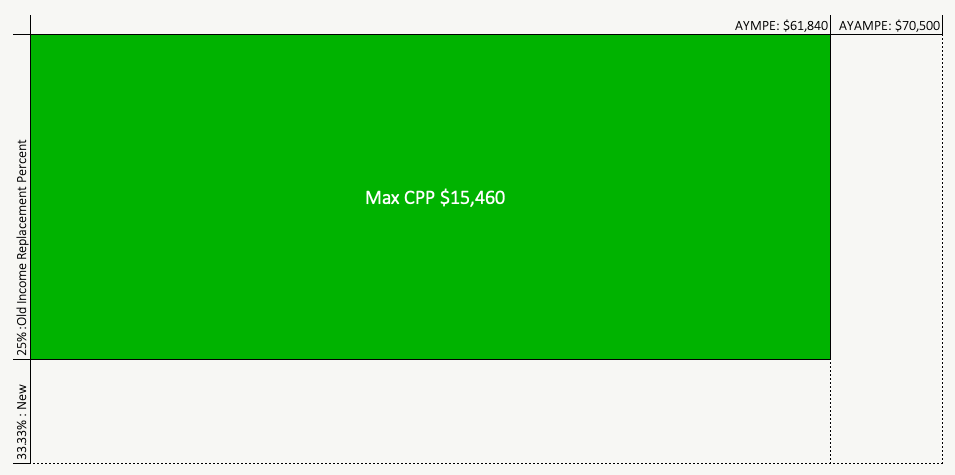

After earning 39 credits you are now eligible for the max CPP payment. The max CPP payment is 25% of the Average Year’s Maximum Pensionable Earnings (AYMPE). This is the average of the YMPE for the last 5-years.

In 2023 the AYMPE is $61,840 and 25% of this is $15,460. This is the maximum base CPP payment in 2023.

The Max CPP Payment Is Expanding In Two Different Ways

The calculation above is for the “base” CPP but CPP is expanding in two different ways. For those in the middle of their careers, or just entering the work force, the CPP enhancement will be a significant factor in future retirement plans.

The CPP enhancement started in 2019 and will slowly roll out until 2025. There are two parts to the CPP enhancement, more on that below.

Because you earn credits each year, and it takes a certain number of credits to get the maximum CPP benefit, the CPP expansion will not be complete until 2065, 40-years after the roll out is complete. So only those who were born in 2000 and later will experience the full benefit of the CPP enhancement (One interesting thing to note, the enhanced portions of the CPP benefit require 40-years of contributions to reach the max instead of 39-years for the basic CPP).

There are two ways that CPP is being expanded…

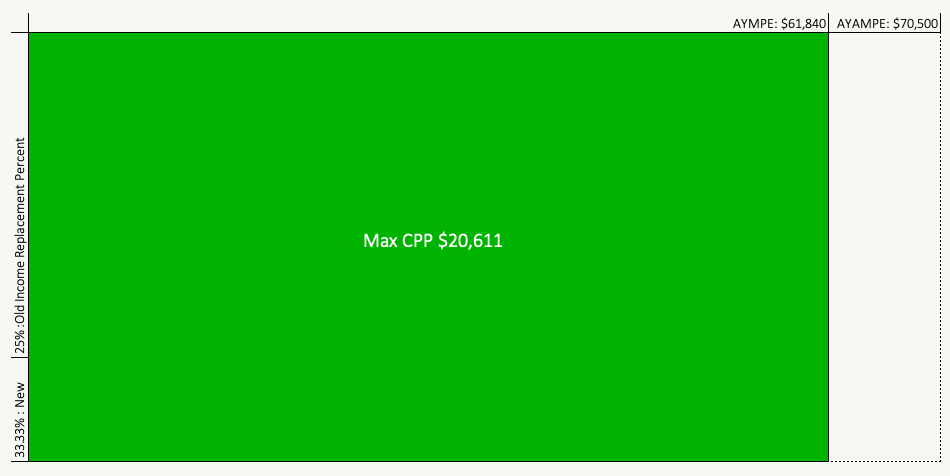

The first way the CPP max payment is expanding is through an increase in the replacement percent. The CPP income replacement percentage is increasing from 25% to 33.33%, an addition of 8.33%. This income replacement percentage aims to replace pre-retirement income up to the YMPE (Year’s Maximum Pensionable Earnings).

This is being funded through an increase in the contribution rate. The rate has increased from 4.95% in 2018 to 5.95% in 2023. This happened slowly over 5-years. This increases the future maximum from $15,460 in today’s dollars to $20,611 in today’s dollars. This has already started with an extra $18.24 per month or $219 per year available in 2023.

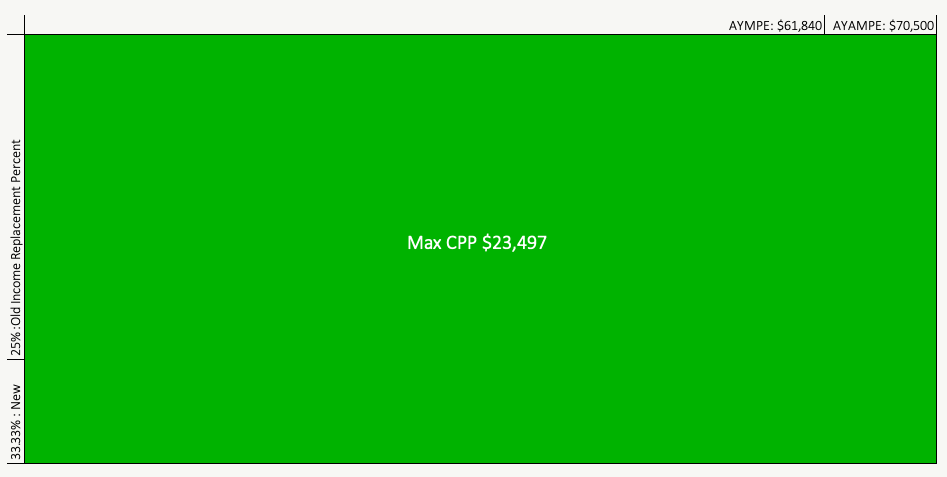

The second way the CPP max payment is expanding is through an increase in the income threshold that qualifies for CPP contributions (and benefits). In the past, income above the YMPE would not require CPP contributions but now there is a new second threshold. This new threshold starts rolling out in 2024 and will be complete in 2025.

The new Year’s Additional Maximum Pensionable Earnings (YAMPE) will be 14% higher than the old Year’s Maximum Pensionable Earnings (YMPE).

For example, if it was applied to 2023 this would mean CPP contributions are now also made on employment income between $66,600 and $75,900 per year. Once rolled out in 2024/2025 this expansion will help higher income earners get more out of CPP in the future.

It’s interesting to note that the contribution rate on these additional pensionable earnings is lower at only 4% (versus 5.95% on income below the YMPE)

The CPP Max Will Be HUGE In The Future

With the two CPP expansions fully rolled out, the max CPP payment will be huge in the future. In 2023 the maximum base CPP payment is $15,460 per year. After 2025, and after 40-years of contributions, the maximum will increase to $23,497 in today’s dollars (for those born after 2000 and experienced the full effect of the CPP expansion).

For couples, this could be double. For two high income earners, both contributing the maximum to CPP each year, their total CPP could be as high as $46,994 at age 65 in today’s dollars (if they were both born after 2000 and experienced the full effect of the CPP expansion).

This gets even larger if they both choose to delay CPP to age 70. The actuarial adjustment of +42% when delaying CPP to age 70 would increase max CPP payments from $46,994 for a couple at age 65 to $66,731 for a couple at age 70. That’s huge!

With CPP expansion slowly rolling out, the amount of retirement income coming from CPP in the future will be much larger in the future. This creates a much higher level of stable retirement income for future retirees. This is retirement income that does not fluctuate with investment returns and is indexed to inflation each year.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Estimates For Future CPP Max

Remember, it takes 40-years of maximum contributions to reach the new maximum CPP payment, so only those entering the workforce now will experience the full benefit. We can extend the calculations above into the future and get a sense of how the CPP enhancement will roll out.

Also remember that the income threshold is expanding too, so even if you were maximizing CPP in the past you may not be able to maximize CPP in the future when the income threshold increases by 14%. In today’s dollars, a couple would need to earn a combined income $151,800 per year or more to maximize both of their CPP benefits. This higher income threshold will be harder to achieve going forward and will make it more difficult to reach the maximum in the future.

Disclaimer: These are estimates only and only for educational purposes. The actual CPP calculation is very nuanced and can be greatly affected by actual contributions, wage growth, inflation rates etc. Most people will not receive maximum CPP. Please speak with an advice-only financial planner about your situation and how that may impact your future CPP benefit.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

How does this impact those of us in our late 40’s who are experienced a hybrid of the two systems? If we have 10-12 left before retirement, will there be any benefit from these latter years of increased co tri thinks and higher thresholds.

How are our last “credits” considered in the calculation?

Very interesting post Owen. Not enough info out there on this important retirement income topic.

Hi Bob, good question, as the CPP enhancement rolls out any future contributions will earn credits towards the new expanded benefit. It takes 40 “credits” to experience the full expansion but after 2025 every year that a max CPP contribution is made will earn 1 full credit. As a rough approximation, with 10-years of contributions after 2025 that will provide 10/40 or 25% of the full CPP enhancement (it will actually be a bit higher because there are partial credits being earned between 2019 and 2025).

If one is both self-employed and employed by another business, it is only at tax time that the employee over contribution can be reconciled. It occurred to me though that the employer side overpayment cannot be reconciled. Am I correct? This seems like a flaw, but it wouldn’t surprise me if it was by design.

That’s a great observation Colin, you are correct, the employee’s CPP payments are reconciled when filing the annual tax return, they won’t pay more than the CPP maximum for a year. But you are also correct that employer’s CPP payments are never reconciled, this essentially results in an overpayment to CPP. This can happen when a employee works part-time on the side, owns their own side business that is not incorporated, or switches jobs throughout the year etc. etc.

I’m sure there are many reasons why the employer side of CPP is never reconciled, but one reason might be that it would be difficult to split the employer’s over payment between 2/3/4+ employers, who gets the refund and in what proportion? Also, for privacy/legal reasons, an employee may not want their employer knowing they are employed on the side, but if that employer gets a refund on CPP overpayment that would be a very good indication that their employee has a side gig.

Owen, I have another 7 years for my retirement. So, how will my CPP payment calculated? I am contributing the 1st phase of the enhancement and I will contribute the 2nd phase till 2027 and then planning for retirement. So my CPP payment will be 33.33% for my whole 30 years (out of 39 years) contribution or 25% for 25 years and then 33.33% for 5 years? Can you explain the payment who contributed partially for some years only?

Hi Dan, good question, it would be closer to the latter. Its not quite so simple, but you can think of each year of CPP contributions as a “credit”, with a certain number of “credits” you’ll get maximum CPP. Assuming you’ve contributed the maximum to CPP each year*, you would have 25 “credits” at the lower benefit level and 5 “credits” at the higher benefit level**.

*This assumes a maximum contribution each year, if you’ve earned less than the YMPE in the past then you’ll get a “partial credit” for that year

**This also ignores the fact that the higher benefit is being phased in, so even some of those years wont be at the full 33.33% benefit level

CPP is quite complex, so the best thing is to get an estimate done based on your actual CPP Statement of Contributions. We do it as part of our financial plans but you can get a one-off estimate done by a pension consultant.

Good day,

I have a question in regards to CPP. I will be retiring from Federal government at 55 years old and 35 years of service. In reading the above information provided I wonder if I should wait at 65 or 70 to get my CPP. Also I believe if I’m a survivor I only get the max CPP amount if my spouse dies, which would be nil as I’m already at the max. I wonder if my husband dies and I differ the CPP to later if I get 60% of his CPP until I get mine.

Thank you.

Hi Lyne, those are some big questions you’re asking 🙂 The answer will depend on your particular situation. Deferring CPP can be a great decision in certain financial situations, but there are pros and cons to consider. Similarly, you are correct that the survivor benefit for CPP is capped at the maximum amount for an individual. Depending on your situation one particular strategy may be better than the other.

Here is a bit more info on CPP breakeven and the pros and cons to consider…

https://www.planeasy.ca/taking-cpp-early-or-late-how-long-until-breakeven/

https://www.planeasy.ca/taking-cpp-early-or-late-the-soft-benefits/

And some more info about CPP survivor benefits…

https://www.planeasy.ca/dont-get-surprised-by-oas-and-cpp-survivor-benefits/

Seems odd but they don’t allow you to opt out of CPP contributions 65-70 unless you are collecting CPP benefits. Why is this?

You’re 100% right John, it does seem odd. I’m not aware of any specific reason for why you cannot opt out of CPP contributions after age 65 without first starting CPP benefits. Perhaps a question for the government?

HI fOLKS:

I have recently retired as a CA after 35+ years. I was laid off from my job due to downsizing so right now i am on EI till the end of the year. I decided to hold off on CPP for now since I did not need the money and it was going to adversely affect my EI. I also knew that the longer you hold off on signing up for CPP the better, but I just recently thought about the fact that in 2022 I will only have EI as income and i did not pay into CPP – how will this affect my calculation for CPP – I understand it is based on the last 5 years , of which I have maxed for approx 30 years. I am wondering if I should apply in 2022 and not 2023 or does it matter?

Great question Marc, when to start CPP is very situational, it depends on your specific circumstances. In general, to get max CPP requires between 35 and 39 years of full contributions (depending on if you start CPP at 60 vs 65+). Every year matters, not just the last 5. Depending on the circumstances, delaying CPP may actually drag down your benefit due to the extra zero earning years. Delaying CPP can be very attractive but the breakeven point is in your 80’s. You can also use CPP strategically during a downturn to avoid selling investments at depressed values. See these blog posts for more info, or book a call with us an we can help build a full retirement plan and calculate CPP for you. https://www.planeasy.ca/services/

https://www.planeasy.ca/6-reasons-to-start-cpp-at-age-60/

https://www.planeasy.ca/taking-cpp-early-or-late-how-long-until-breakeven/

https://www.planeasy.ca/strategically-using-cpp-to-reduce-risk-in-retirement/

I was just wondering why no one ever mentions that CPP is well funded on a cash basis but is actually unfunded to the tune of 850B (yes that is with a B)(on an actuarial basis which is the correct way to look at it).

I know the govt will never let this go bankrupt so it is safe but the shortfall has to come from somewhere.

Hi Ken! Thanks for the comment. I would be interested in reading more about the $850 billion shortfall you mentioned. That’s not something I’ve come across.

I find myself in a position at 62 that i have more than 39 years of Maximum contribution, and is there any value in getting more than 39 years at the maximum contribution rate. I am likely going to work for two additional years just because of employment obligations.

Hi William, short answer is no, if you have 39 years at the maximum contribution rate then you will receive the maximum from CPP.

Long answer, there is a slight benefit from two additional years of contributions but its very small. Future contributions to CPP will also include the CPP enhancement benefit which increases CPP benefits above the old basic CPP. By contributing for the next two years you wont get more from the basic CPP but you’ll get a slight bit more from the enhanced CPP.

More details here…

https://www.planeasy.ca/the-cpp-max-will-be-huge-in-the-future/

Unfortunately you cannot avoid CPP contributions as a T4 employee unless you’re over the age of 65 and have started CPP, only then can you ask for CPP contributions to stop.

So I’m 31, and I’ve maxed out cpp since 18, does all that count for naught in the new credit system starting in 2025? Also what is the extra benefits that we will get with the secondary level of cpp? (which I’m guessing is not optional) theoretically, if I retire at 70, would that not come pretty close to full qualifications for the system?

Hi Jake, your CPP contributions from age 18 to now will still count towards the old CPP calculation and then any new contributions will count towards to new enhanced CPP calculation. When you retire you will get a hybrid of the old CPP benefit calculation and the new CPP benefit calculation.

The new “Year’s Additional Maximum Pensionable Earnings (YAMPE)” will allow higher income earners to get more out of CPP in the future based on additional employee and employer contributions on that extra income.

Hello Owen, we are planning on retirement in Feb 2023. How do we best decide on when to take our CPP. My spouse is 61 years old and has always been the primary financial provider in our relationship. We have been told that this year the CPI has never been so high and that we should begin to take CPP in December as it is predicted that CPP increase will be considerable higher as CPI has been high this year. So the advice is that if we begin in December we will see a higher payment going forward then if we began our CPP in Feb. when he retires and we start to draw on our RRSP’s. Is this good advice? We are so confused as we always thought the later we wait to take CPP the better? Thanks so much

Hi Doreen, what you’re referring to is a unique situation in 2022 due to the high inflation and low wage growth in the last year. Fred Vettese wrote an article in the Globe and Mail that outlines the details. For those planning to start CPP in early/mid 2023 it is better to start in Nov/Dec 2022 to get the benefit of the large increase in CPP due to inflation in January 1, 2023.

https://www.theglobeandmail.com/investing/personal-finance/retirement/article-thanks-to-a-rare-event-deferring-cpp-until-age-70-may-no-longer-always/

Hi, how do you calculate the maximum CPP monthly amounts? you wrote: “In 2023 the AYMPE is $61,840 and 25% of this is $15,460. This is the maximum base CPP payment in 2023.” $15,460 monthly is $1,288.33 but your table shows $1,307.

Hi Jeff, now that we’ve entered the CPP expansion phase the calculation is considerably more complex and would require a full blog post on its own. The $1,288.33 you mention is the “base” CPP benefit. In addition to the base benefit there are two CPP enhancement benefits, the first additional and the second additional. The first additional benefit just finished rolling out in 2023 and the second additional will only start rolling out in 2024. This means there are a number of partial enhancement years that need to be factored in. This is how we go from a max base CPP benefit of $1,288 to $1,307.

Hi Owen,

What are your thoughts about whether it makes sense for an incorporated professional to receive a salary (therefore, paying both employer and employee portions of the CPP) versus a dividend? Ignoring the other considerations such as RRSP room generated by a salary but not a dividend, etc., do you think the CPP would still be a good “investment” in this case?

Thank you.

Hi Diane, that’s an interesting question and there are many factors to consider. You want to speak with an advice-only financial planner who specializes in planning for incorporated business owners. There are lots things to consider and CPP is only one of them. For example, taking salary will create RRSP contribution room and any money inside an RRSP is protected from creditors, which could be an important advantage for a business owner. Lots of other factors to consider as well.

So, it is only a 25 to 33% increase for those that meet or exceed the YAMPE. Those <= YMPE will still get 25%?

Hi Mark, its an increase from 25% to 33% for everyone, there was an expansion in the contribution rate from 4.95% to 5.95%. The increase in YAMPE is separate and is to cover a higher salary range. The combination will make CPP benefits up to 50% higher than the original base CPP.

Thanks. Would it be possible to show a separate table of future benefits at the lower YMPE limits?

The change in the max monthly payment is increasing by ~3% not 2%

Hi Mark, yes, you are correct, the new YMPE just came out and the table needs to be updated for the 2024 max CPP. The note at the top of the post will be updated to “Updated for 2024” when the changes are made.

Thanks, I’m referring to all the years 2024 thru 2067 for the “max monthly payment” projections. They are increasing by an avg of ~3% but your CPI in the table is 2%

Ah, I understand your question now. The max monthly payment is increasing faster than inflation because each year it gets “averaged up” by one additional year of enhanced CPP. This process continues until 2065 when the full CPP enhancement will be in place (it takes 40-years of contributions to get max enhanced CPP and the phased rollout is complete in 2025). You’ll see in the table that the increase from 2066 to 2067 is 2.0%

Where do you find the details to calculate the enhanced CPP benefit? The only source I have ever found is at:

https://retirehappy.ca/enhanced-cpp/

I assume you did this with your spreadsheet above. I’d be interested how you created the formula to include what you call ““averaged up” by one additional year of enhanced CPP”

Thanks

Hi Mark, unfortunately I had to spend quite a bit of time parsing through the actual legislation to confirm the calculation, it was not easy. The calculation is quite complex and has many exceptions and nuances. It includes both the base CPP benefit calculation (already complex) plus the enhanced CPP benefit calculation is actually split into “first additional” and “second additional” (even more complex).

NP. I’ve read some of that legislation. You are a ‘genius’ to figure it out!