Taking CPP Early Or Late? How Long Until Breakeven?

Explore Your CPP Breakeven

With An Advice-Only Financial Plan

Should you take CPP early or late? Are you considering taking CPP early? Are you wondering if you should delay? Should you take it early at age 60? Should you wait until regular retirement age at 65? Should you delay until age 70, the last date possible?

When to start taking CPP is just one of the many difficult decisions soon-to-be retirees face as they approach their retirement date.

It’s a big decision, and like many financial decisions there are many aspects to consider when deciding when to take CPP.

When a soon-to-be retiree is deciding to take CPP early or late there are both financial considerations as well as non-financial considerations to weigh.

Taking CPP late can provide a financial benefit if you plan to live past a certain age. This is a number and it’s easier to evaluate but it’s based on longevity, which is a big unknown.

Taking CPP late also has non-financial considerations. There are “soft benefits” to delaying CPP. Depending on how much you value these soft benefits they can be worth quite a bit as well.

Even when two people have the exact same financial situation, they may choose different times to start CPP simply due to these longevity questions and soft benefits.

When deciding to take CPP or delay its first important to get basic understanding of how CPP works and how CPP payments change each year as you delay.

How CPP Works…

CPP payments are based on a number of different factors. These factors mean that most people do not qualify for the maximum CPP benefit at age 65. To get the maximum CPP you need at least 39+ years of maximum contributions between age 18 and 65. Due to schooling, breaks in employment, early retirement etc, many people never reach the maximum.

Your CPP amount at age 65 is based on your contributions. You can get something called your “Statement of Contributions” from the CRA that clearly outlines your contributions since the age of 18. This can be used to get a very good estimate of how much you could expect from CPP.

What Happens When You Delay CPP Or Take CPP Early?

Using the Statement of Contributions we can calculate how much you’ll receive at age 65 , but then we need to increase/decrease that amount based on when you actually decide to take CPP.

For each year you take CPP early you need to decrease your CPP by 7.2%. If you take CPP 5-years early, your CPP payments at age 60 will be 36% below what you would have received at age 65.

On the flip side, for each year you delay CPP after age 65 you need to increase your CPP by 8.4%. If you take CPP 5-years late, your CPP at age 70 will be 42% above what you would have received at age 65.

The difference between CPP payments at age 60 and CPP payments at age 70 is an extra 122%! Taking CPP early at age 60 will give you 64% of the amount you’d receive at 65 but taking CPP later at age 70 will give you 142% of the amount you’d receive at age 65.

You get more than double the CPP payment by waiting 10-years. That’s a pretty big incentive to wait. The downside of waiting however is that you don’t receive any CPP payments for those 10-years, whereas someone who takes CPP early will have already gotten a large amount in payments.

Someone who takes CPP early gets a lower payment each month, but those early payments really add up over 10-years. Someone who takes CPP later gets a higher payment, but it takes a few years for those higher payments to catch up.

So even though the payment, is higher it still takes a bit of time for those higher payments to offset the benefit of getting payments early, this timeframe is called the breakeven point, and it can be one factor to consider when deciding to take CPP early or delay.

Related Posts:

- Taking CPP Early or Late? The Soft Benefits

- Canadian Pension Plan (CPP) is Expanding! And That’s Going to Make Retirement Easier

- Don’t Get Surprised by OAS and CPP Survivor Benefits

Simple CPP Break-Even Analysis

There are lots of simple CPP breakevens that can be found online. There is this one from RetireHappy.ca which we’ve replicated below. The analysis looks at how long it would take the higher payment you get at age 65 to make up for the fact that taking CPP earlier creates a lot of advanced income.

It suggests that if you choose to take CPP at age 65 vs age 60 it would take 106.7 months to reach break-even. If you choose to delay until age 65 then by the time you reach age 73.9 you’re now benefiting financially from the increased monthly payments.

This analysis is simple… but it’s too simple… This simple breakeven analysis doesn’t take into account the opportunity cost of drawing down investment assets early when we choose to delay CPP.

Taking CPP Later Means Drawing Down Investment Assets

The reality is that for most retirees the decision to take CPP early or late also means deciding to start drawing on investment assets earlier or later.

Realistically we need that CPP income. Most of us are not rich enough to consider CPP an “extra”. When we decide to delay CPP we need to make up that income through higher withdrawals from our investment assets. This has an impact. There is an opportunity cost because higher investment withdrawals mean lower investment returns in the future.

To get a clear sense of CPP breakeven we need to take into account the faster drawdown on these investment assets as we wait for CPP to start.

Detailed CPP Breakeven Analysis Including Opportunity Cost

Let’s look at at more detailed CPP breakeven analysis where we include our investment portfolio. In this analysis we’re going to assume that we already have some form of retirement income like LIRA/LIF withdrawals, a defined benefit pensions, or other RRSP/TFSA assets. The decision we’re trying to make is how to create that LAST $15,000 of retirement income.

We’re going to assume $200,000 of RRSP assets. We’re going to assume the average CPP of $8,687/year. We’re also going to assume a 60/40 asset allocation. These factor are important and will impact the breakeven point. To do this breakeven for your personal situation please seek the help of an advice-only financial planner.

Because we’re drawing from either RRSP or CPP to create that LAST $15,000 of income the tax impact is the same. Both CPP and RRSP withdrawals are taxed at the marginal tax rate. As a result we’ll look at pre-tax numbers.

The question is, should we start CPP early and make a combination of CPP and RRSP withdrawals to create $15,000/year? Or should we delay CPP and make larger RRSP withdrawals for 5-10 years?

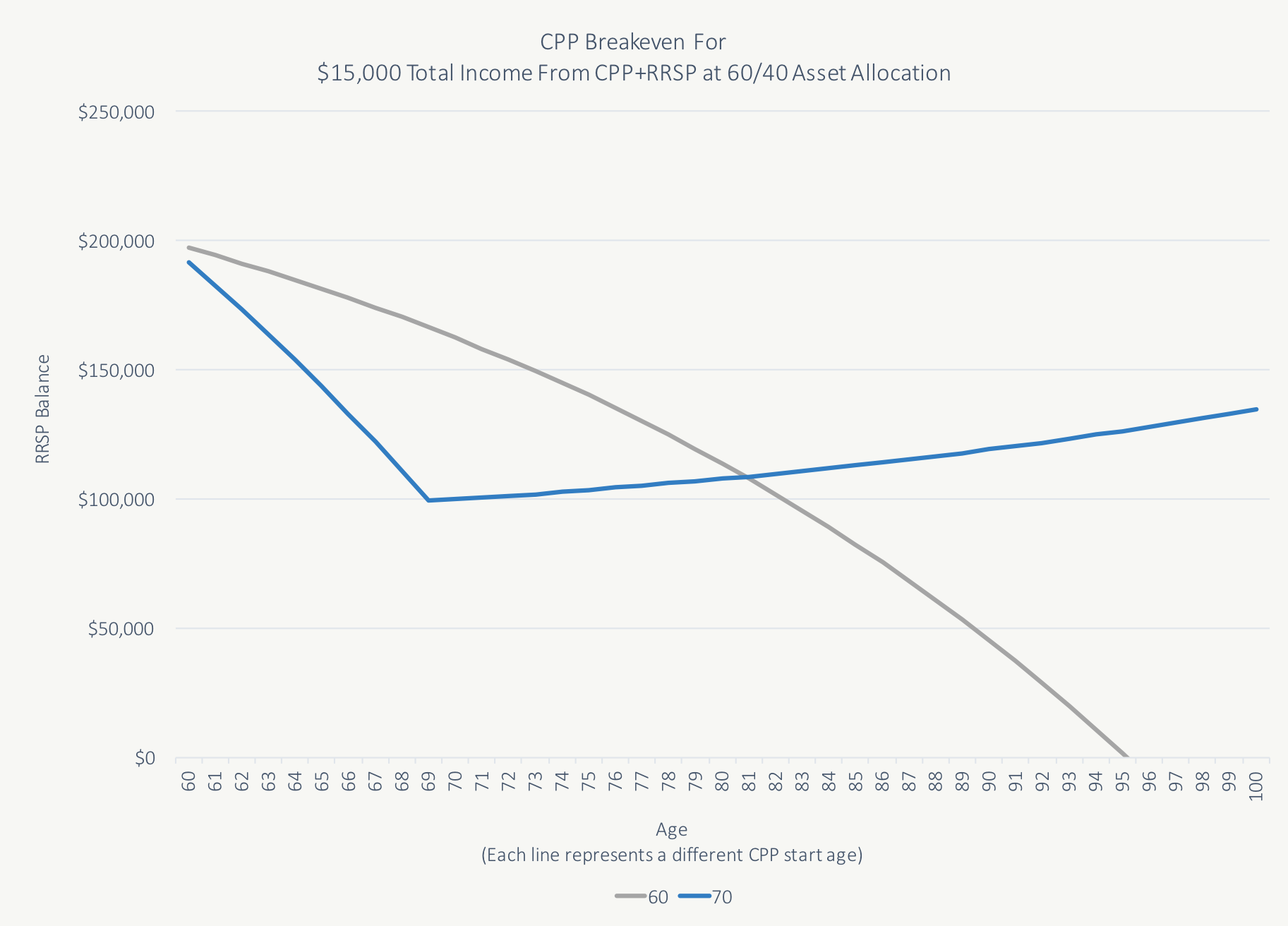

CPP Breakeven Age 60 vs Age 70

Using the scenario above we can create a breakeven chart for taking CPP at age 60 vs taking CPP at age 70. The line represents the RRSP balance in the future.

Notice in the chart below how delaying CPP until age 70 causes the RRSP balance to decline rapidly from age 60 to age 70?

Also notice how after CPP begins at age 70 the higher CPP payments means that RRSP withdrawals are much smaller, and as a result the RRSP actually starts to grow?

The breakeven point is where the two lines cross at age 81.

Both scenarios provide $15,000 in pre-tax income. Taking CPP at age 60 means the RRSP balances decreases at a slower rate in the early years. Taking CPP at age 70 means the RRSP actually grows after age 70 but one downside is that the RRSP balance declines rapidly between age 60 and age 70.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

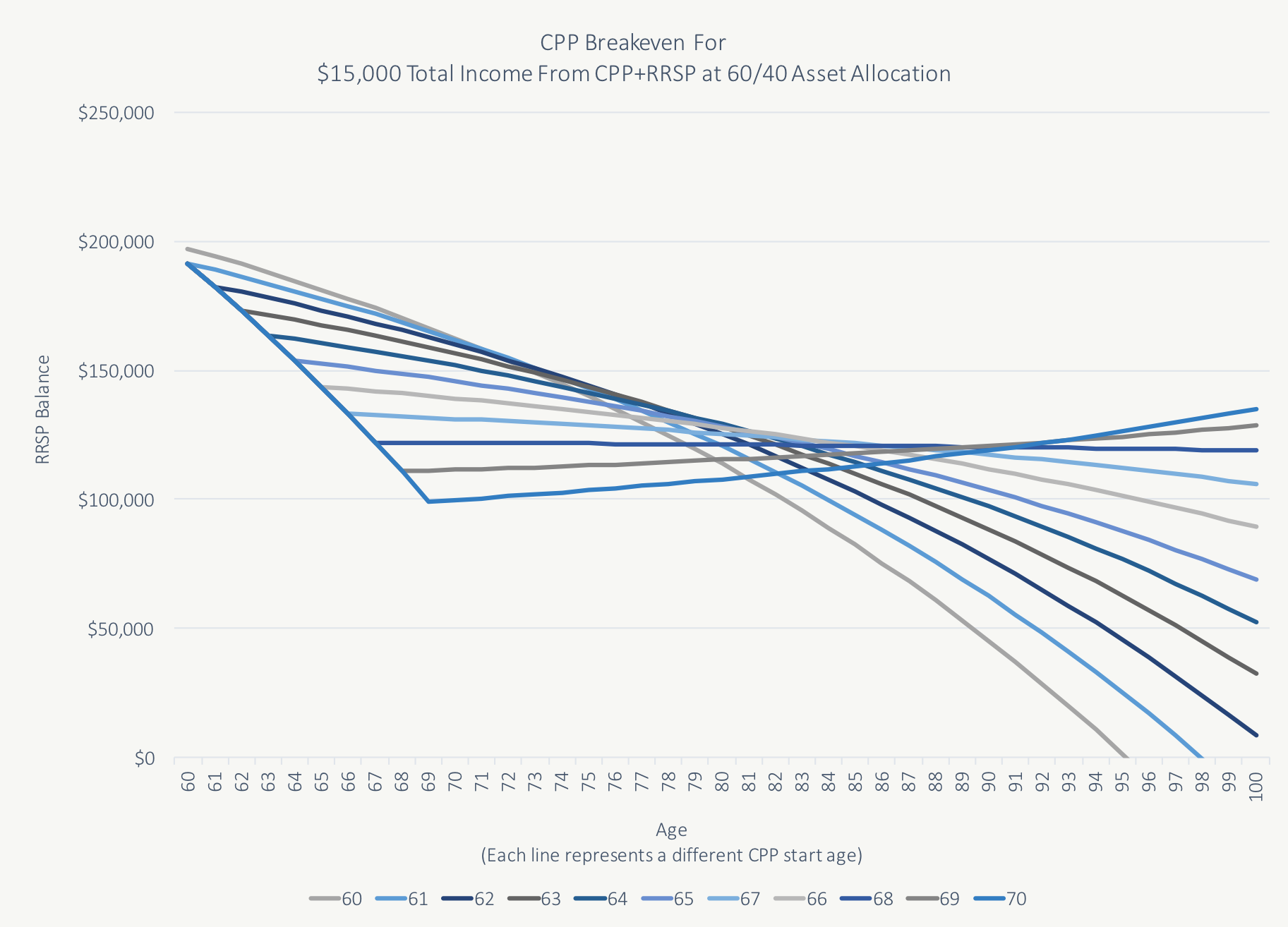

CPP Breakeven For All Ages Between 60 and 70

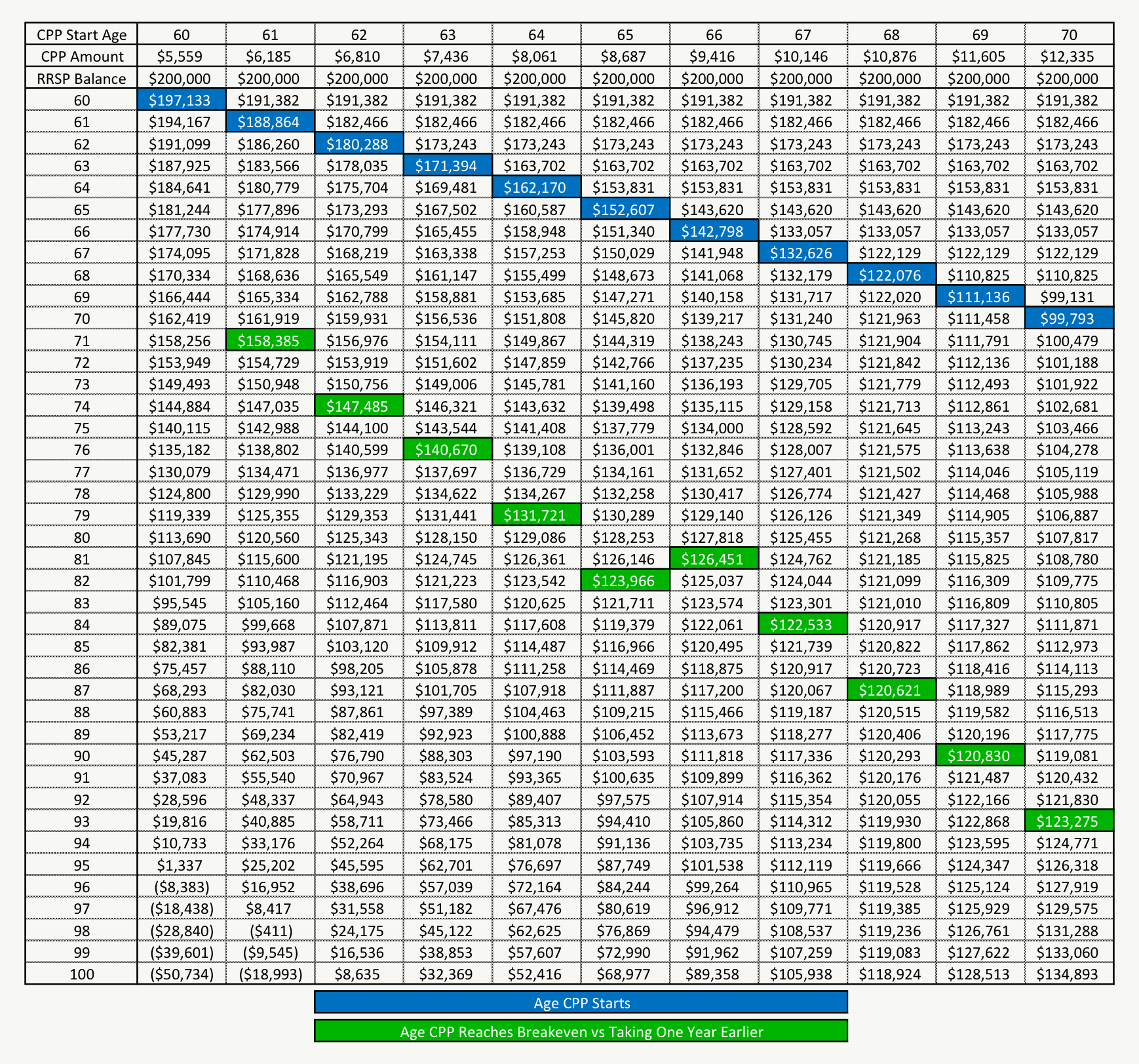

We can replicate this analysis for all ages between 60 and 70. The chart itself is hard to read, but in the table below you can get a much clearer sense of the financial trade-off between taking CPP early or delaying.

One particularly interesting insight into the “take CPP early or late” question is that it is rarely optimal to take CPP at age 65. Notice how in this scenario it’s better to either take CPP at age 64 or age 66 but not age 65. This is because delaying to age 66 means a monthly payment that is higher by 8.4%. The higher payments mean that it reaches breakeven BEFORE taking CPP at age 65.

The only exception would be if you expect a shortened longevity. Breakeven still takes 14 years so if you expect a shortened longevity then consider taking CPP earlier.

Disclaimer: As always, please seek the advice of an unbiased financial planner when making these complex retirement decisions. The analysis we’ve presented here is dependent on a number of different factors. If your situation is slightly different the analysis may lead to a different conclusion. This post is for educational purposes only.

In the next post we’ll look more closely at the “soft-factors” when deciding to delay CPP or take CPP early.

Table For CPP Breakeven Scenario

(Same data as chart above but in table format)

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

14 Comments

Trackbacks/Pingbacks

- They have $1.2 million and no pensions, can they retire? - My Own Advisor - […] CPP can sometimes be an advantage for retirees. Delaying CPP has several benefits but also a few risks. One…

While I understand the desire to calculate the breakeven numbers, I believe that they are really irrelevant to a proper retirement plan. Whether we take benefits early or late, it should be almost the same result actuarially speaking. The age that really matters is the age to which you or your spouse might possibly live to. If your plan works for this, the most expensive scenario, then you are good to go. Without knowing the unknowable (the age we will die), we should plan for the longest retirement we can imagine.

Enjoy your blog!

Planning for a long-retirement is a good default assumption! I would rather assume I live into my 90’s and plan accordingly.

I’m no actuary but you might be interested in the idea of “adverse selection” Garth. The idea is that the actuary has less information than the individual and this could give an advantage to the individual. Someone with a shorter life expectancy (perhaps a heavy smoker) may choose to take CPP early, while someone with a healthy lifestyle may choose to take CPP later. Of course, they probably have estimates for this behaviour!

Something to consider anyway! Thanks for the comment Garth!

You talk about delaying CPP and portfolio management, but you don’t actually discuss what rates of return are in use in your illustrations, making them totally useless for planning purposes. If you’re assuming a 10% rate of return or a 4% rate of return people need to know that.

That is a very astute observation Tim! The rate of return assumed in the calculations above was 5.62% nominal return and 3.45% real return. Having a higher or lower rate of return will certainly impact the breakeven calculations

When I mapped out my future retirement income, I discovered that if I commence CPP at age 65 or later, the increased CPP payouts push me into a higher tax bracket than I need to be in. Sure, I can reinvest the surplus [higher taxed] income, but the extra tax is lost. I also see a reduction in the federal and provincial Age Amount credits. These two ‘penalties’ push out my breakeven point further. Also, due to many dropout years, my CPP does not increase much between age 63 and 65.

Clearly, determining the optimum age to commence CPP is a much more complex matter than the simple breakeven point analysis often discussed on blogs etc. It was good to see your analysis Owen. It confirmed that what I’m seeing in my data is not out of whack with reality.

You’re absolutely right Bob, the decision to start CPP early or delay is very unique from one person to the next. In the analysis we assume the same tax bracket, which makes sense for most people, but when you’re on the edge of a higher tax bracket, for example going from 20% to 30% in Ontario, or perhaps crossing into 15% OAS clawback territory, then the breakeven analysis can change significantly.

Plus, sometimes its all about the “soft” benefits of delaying CPP, like the inflation protection, the reduced investment risk, or the longevity protection, there is no “one size fits all” answer when it comes to delaying CPP.

https://www.planeasy.ca/taking-cpp-early-or-late-the-soft-benefits/

Hi Owen,

Really appreciate this article. My mom is trying to decide when to take CPP. I saw you answered the rate of return question. I was also wondering if you included an adjustment for OAS in your calculations? I’ll be creating my own chart for her specific scenario, just curious.

Thanks!

Hi Dave, this post was specific to CPP breakeven analysis. OAS has different “actuarial adjustments” when delaying OAS past age 65. Here is a blog post with the OAS breakeven analysis…

https://www.planeasy.ca/when-to-take-old-age-security-should-you-delay-oas-to-get-the-maximum-oas-benefit/

In general, because the adjustment for delaying CPP to age 70 is +42% and the adjustment for delaying OAS to age 70 is only +36%, the priority should be to delay CPP first, and then carefully consider if delaying OAS makes sense. Although it may not seem like much, that 8% difference in adjustment has a large impact on the breakeven analysis, this makes delaying OAS past age 65 less attractive unless in specific circumstances.

This model could be more complete if it includes the factor on G.I.S. and its claw back pending on amount of income level receives from CPP, future dividends or withdrawal from RRIF. An annual income of $15,000 is not sufficient alone to survive on today’s basic living standard, therefore a base amount is needed to add in the calculation to assume a basic living standard. It is the overall after tax income that counts and not just the CPP alone.

Hi Bill, you’re absolutely right, for someone receiving GIS delaying CPP is much less attractive. About 1 in 3 retirees receive GIS. For anyone receiving GIS benefits, starting CPP as soon as possible at age 60 is an important consideration. In the example above, $15,000/year was an arbitrary number to show the interaction of CPP start date vs RRSP withdrawals. Check out these blog posts for more information about how retirement planning changes when GIS is involved…

https://www.planeasy.ca/what-is-the-guaranteed-income-supplement/

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

https://www.planeasy.ca/case-study-low-income-retirement-plan/

Would it not be more beneficial to delay OAS rather than CPP if you are no longer making CPP contributions since delayed OAS won’t be affected by drop off years of no contributions like CPP would be? And since I have a defined benefit pension that is not indexed to inflation, I want to delay either CPP or OAS for the inflation hedge.

Hi Dave,

It entirely depends on the situation but one key piece of information is that the actuarial adjustment for delaying OAS is lower than when delaying CPP, this leads to a longer period until “breakeven”. Delaying OAS from age 65 to age 70 provides an adjustment of +36% but delaying CPP from age 65 to age 70 provides an adjustment of +42%.

Here is an example of the breakeven for delaying OAS…

https://www.planeasy.ca/when-to-take-old-age-security-should-you-delay-oas-to-get-the-maximum-oas-benefit/

Another important factor is that delaying CPP from age 65-70 will not add more zero earning years to the calculation. There is a special drop out for the years between age 65 and 70 when delaying CPP.

All I read on when to start CPP or OAS is based on early retirement at age 60 but what if you work till you are 70 and then retire. using the same 200,000 RRSP is there an optimal age to begin CPP or OAS not withstanding the clawback?

Hi Norman, unfortunately it all depends on your specific situation and there is no simple answer. With CPP you earn a post retirement benefit if you start CPP early but continue working and contributing to CPP. So this must be factored into the breakeven. With CPP you can also opt to stop contributions after age 65 IF you’ve started CPP benefits already, so this also needs to be factored into the breakeven. Everyone’s situation is slightly different and what might work for you may not work for a friend, or what works for your friend may not work for you, it all depends.