When To Take Old Age Security? Should You Delay OAS To Get The Maximum OAS Benefit?

When is the best time to take Old Age Security (OAS)? Should you delay OAS to get the maximum benefit? Or should you take OAS as early as possible?

Old Age Security is a government retirement benefit paid to seniors over the age of 65. Unlike Canada Pension Plan, Old Age Security payments come from government revenue. It has nothing to do with contributions. It has everything to do with how long you’ve been in Canada. And unlike CPP, it can be “clawed back”.

It can also be substantial. Old Age Security is worth over $7,000 per person per year if you receive the maximum benefit. For a couple that’s over $14,000 per year in retirement income. This increases with inflation every 3-months.

And like CPP, OAS payments increase the longer you delay it. The earliest OAS can start is at age 65, but for every month you delay OAS payments the benefit increases by 0.6%. If you choose to delay for a full year your OAS benefits would be 7.2% higher. If you choose to delay the full 5-years to age 70 your OAS benefits would be 36% higher!

Delaying OAS may seem appealing, but should YOU delay OAS to get the maximum OAS benefit in retirement?

Perhaps not, but it depends on your situation.

How OAS Works…

OAS benefits are based on one factor, the number of years you were a resident or citizen of Canada between age 18 and age 65. There are 47 years between age 18 and age 65 and to get the maximum OAS benefit an individual needs 40-years in Canada.

There is also a minimum number of years. For those who currently reside in Canada the minimum is 10-years since the age of 18. For those who currently reside outside of Canada the minimum is 20-years since the age of 18. However, there are social security agreements between Canada and other countries that could help you qualify for OAS or a similar pension from another country.

OAS is paid out of government revenues. Unlike Canada Pension Plan (CPP) it has nothing to do with contributions and/or income levels during your working years.

Old age security also has a clawback if your income exceeds a certain threshold in retirement. The OAS clawback threshold is currently $81,761 in individual taxable net income.

What Happens When You Delay OAS?

Similar to the Canada Pension Plan, there is a small benefit from delaying OAS. This benefit is 0.6% per month you delay OAS benefits.

Delaying OAS by one year would increase your OAS benefits by 7.2% for the rest of your life. Delaying old age security until age 70 would increase your OAS benefits by 36%.

The maximum OAS benefit is 136% of the benefit received at age 65. The current maximum OAS benefit at age 65 is $7,289.52 per year. This increases to a maximum OAS benefit of $9,913.74 if you choose to delay until age 70.

These OAS amounts are indexed to inflation and increase on a quarterly basis. Here are the latest OAS benefit amounts.

Should You Delay OAS To Get The Maximum Benefit?

Should you delay OAS? That depends on your specific circumstances. It can certainly seem advantageous to delay OAS to receive the maximum benefit each year. Delaying OAS can provide a lifelong inflation adjusted pension but it comes at a cost.

Delaying OAS typically means drawing down investment assets as you wait for OAS to begin. There is an opportunity cost to drawing down investment assets because we lose out on the investment growth on an annual basis. Below we’ve created an example breakeven analysis to compare the benefit of increased OAS payments versus the opportunity cost of drawing down investments faster between age 65 and 70.

The other factor to consider is that OAS has a recovery tax, often called a clawback. This clawback means that starting OAS may not be advantageous if you expect income to be above the OAS clawback threshold between age 65 and age 70. This could happen if you’re still earning employment income, business income or expect large sales of capital assets like a cottage, vacation property, or rental property. If you expect income to be above the OAS clawback threshold then there may be a good reason to delay.

Detailed OAS Breakeven Analysis Including Opportunity Costs

Let’s look at at detailed OAS breakeven analysis where we include our investment portfolio. In this analysis, we’re going to assume that we’re retiring at age 60 and we already have some form of retirement income like LIRA/LIF withdrawals, a defined benefit pensions, or other RRSP/TFSA assets. The decision we’re trying to make is how to create that LAST $15,000 of retirement income.

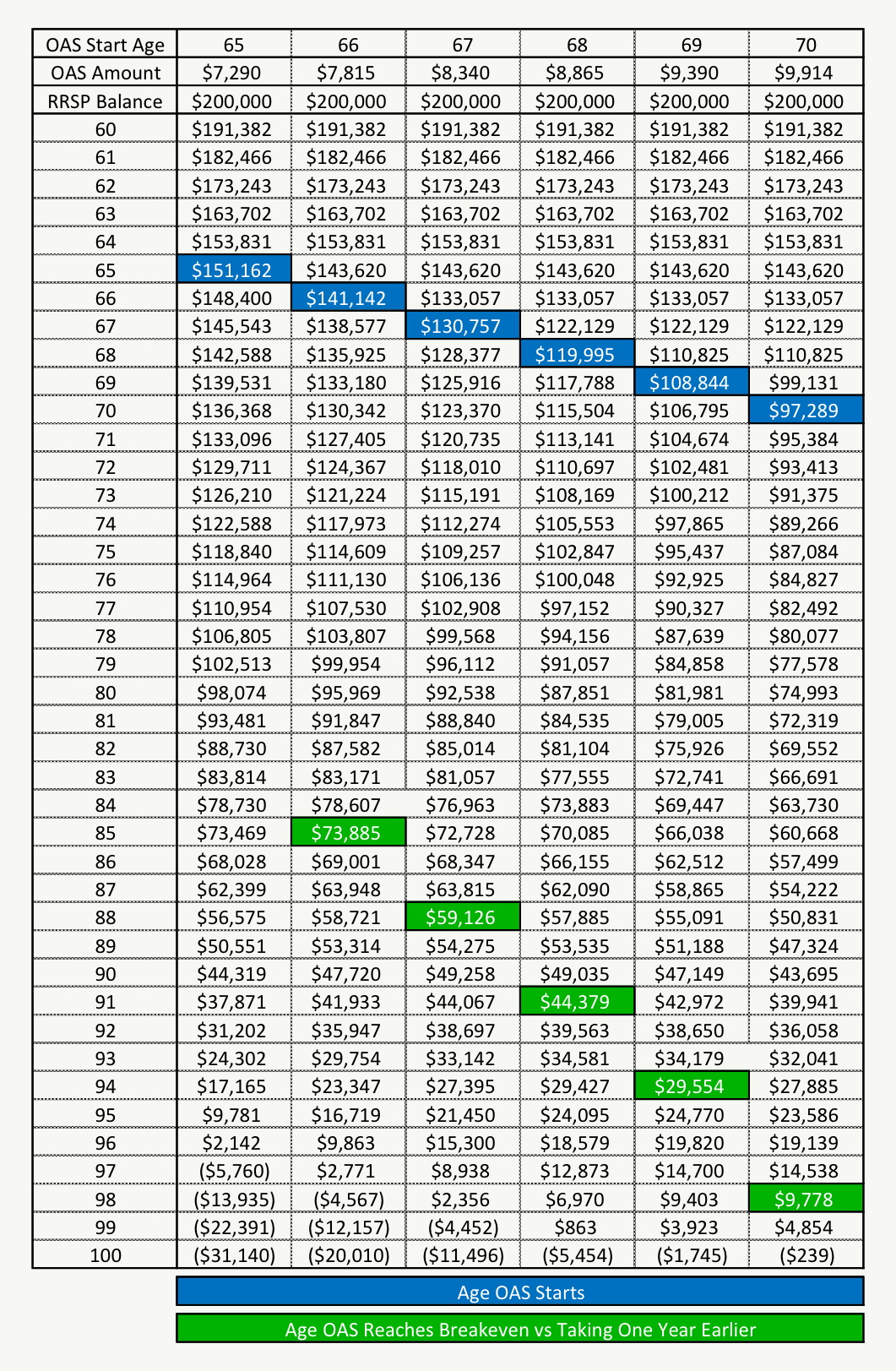

We’re going to assume $200,000 of RRSP assets. We’re going to assume the current full OAS of $7,290/year. We’re also going to assume a 60/40 asset allocation. These factors are important and will impact the breakeven point. To do this breakeven for your personal situation please seek the help of an unbiased advice-only financial planner.

Because we’re drawing from either RRSP or OAS to create that LAST $15,000 of income the tax impact is the same. Both OAS and RRSP withdrawals are taxed at the marginal tax rate. As a result, we’ll look at pre-tax numbers.

The question is, should we start OAS early and make a combination of OAS and RRSP withdrawals to create $15,000/year? Or should we delay OAS and make larger RRSP withdrawals for 5-10 years?

Let’s take a look at the numbers below…

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

CPP Breakeven Age 65 vs Age 70

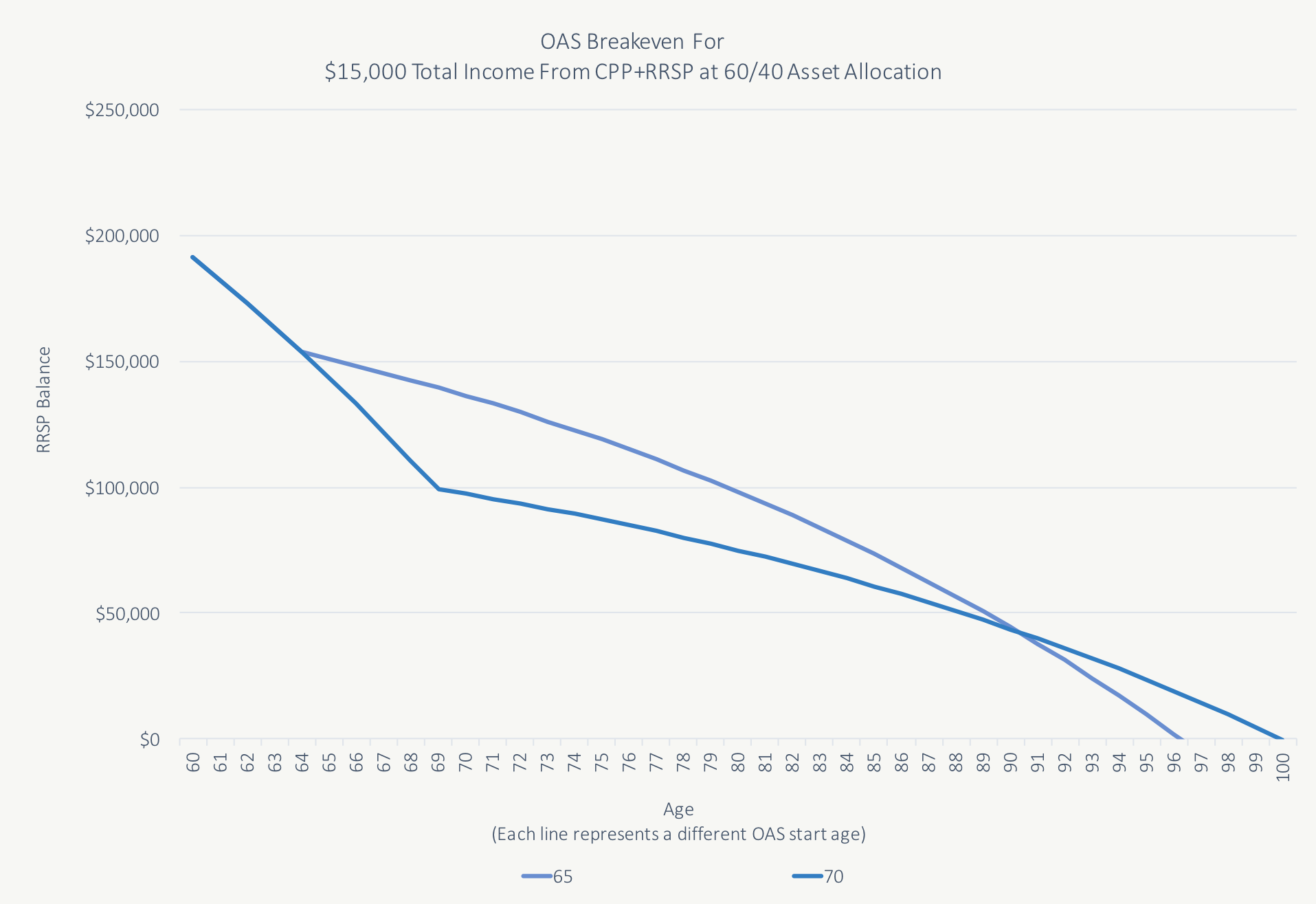

Using the scenario above we can create a breakeven chart for taking OAS at age 65 vs taking OAS at age 70. The line represents the RRSP balance in the future.

Between age 60, when we retire, and age 65, which is the earliest we can start OAS, the RRSP line declines at the same rate because we’re drawing $15,000 per year from the RRSP portfolio between age 60 and age 65 in either case.

But notice in the chart below how delaying OAS until age 70 causes the RRSP balance to continue to decline rapidly from age 65 to age 70? This is because when we choose to delay OAS to age 70 we’re still drawing the full $15,000 from the RRSP for an extra 5-years. Only at age 70, when OAS begins, does the line stop dropping so quickly.

The breakeven point is where the two lines cross at age 91.

Both scenarios provide $15,000 in pre-tax income. Taking OAS at age 65 means the RRSP balance decreases at a slower rate in the early years. Taking OAS at age 70 means the RRSP still declines quickly between age 65 and age 70 but declines less rapidly after OAS begins at age 70.

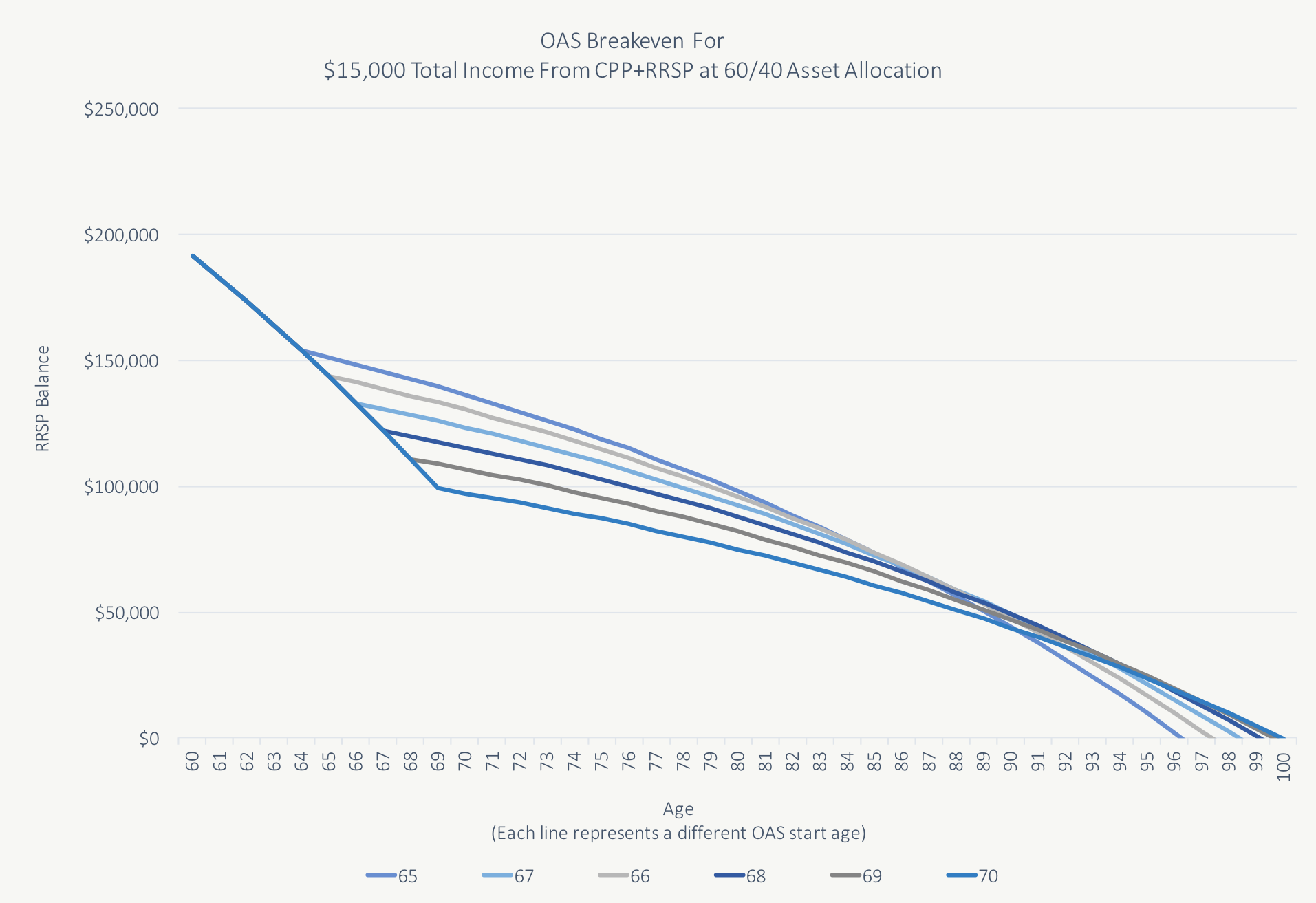

OAS Breakeven For All Ages Between 65 and 70

We can replicate this analysis for all ages between 65 and 70. The chart itself is hard to read, but in the table below you can get a much clearer sense of the financial trade-off between taking OAS early or delaying.

With the lengthy period until breakeven it doesn’t make as much sense to delay OAS as it does with CPP. This is mainly due to the fact that you gain only 0.6% for each month you delay OAS but you gain 0.7% for each month you delay CPP. That 0.1% may seem small, but over the course of a 30-40 year retirement those slightly higher payments can make a big difference in the breakeven.

That being said, there are certain factors that can make delaying OAS very attractive, the primary factor being the OAS recovery tax (aka OAS clawback threshold). Depending on your situation it can be advantageous to delay OAS if you expect that you may trigger this clawback between age 65 and age 70.

Disclaimer: As always, please seek the advice of an unbiased financial planner when making these complex retirement decisions. The analysis we’ve presented here is dependent on a number of different factors. If your situation is slightly different the analysis may lead to a different conclusion. This post is for educational purposes only.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

If you start receiving the OAS before you have been resident in Canada for 40 years will the OAS increase annually in relation to the total number of years you have been resident divided by 40.

i.e. if start receiving when having been in Canada for say 20 years presumably would receive half the maximum OAS payment.

After a further year would you then receive 21/40 times the maximum OAS payment and so on.

Or when you start receiving the OAS does it remain at that value other than increases for inflation and any increases set by the government.

I am unclear about what we should be receiving from the OAS and would more than appreciate your advice.

I hope this comes within your requirements for comments as it is in fact a question.

Hi Ian, great question! Once you start OAS benefits the calculation is set, and it will no longer increase with additional years living in Canada, but it will increase with inflation adjustments going forward. This is certainly a consideration for those who have immigrated to Canada and do not have the full 40-years to qualify for full OAS. Delaying OAS can result in increased benefits from the actuarial adjustment of +0.6% per month PLUS the 1/40th increase with each additional year in Canada (+2.5% per year). BUT this decision isn’t easy because GIS is tied to OAS and GIS has a top-up that will bring OAS to 100% even with less than 40-years in Canada. More details on GIS here…

https://www.planeasy.ca/what-is-the-guaranteed-income-supplement/

Hi Ian. Can you delay OAS a second time? I initially delayed for 9 months because I was still working. I was to start collecting January 1st but then started a part time job. I received a clawback letter that indicated the clawback was more than I would even have gotten. I am aware I can submit a form to estimate my coming years income but I think I would be better off at this time to delay until this job is finished? So can I just resubmit the forms to delay again?