“Should I Delay OAS?” Four “Soft” Factors To Consider

“Should I delay OAS”?

This a common question that gets asked during a financial plan. Along with CPP payments, OAS payments will increase the longer you delay them. This creates a big incentive to delay both OAS and CPP.

Delaying OAS until 70 can lead to monthly OAS payments that are 36% higher than at age 65. This can make delaying OAS, as well as CPP, very appealing to soon-to-be retirees.

That being said, even though receiving the maximum OAS benefit sounds appealing as a retiree, the decision to delay OAS needs to include many factors, some of them are “soft” factors that have nothing to do with the financial breakeven.

OAS benefits are significant for retirees. A retiree with over 40-years in Canada between age 18 and 65 can expect to receive over $7,000 per year in OAS benefits. A couple can receive over $14,000. This makes OAS benefits an important component of any retirement plan.

But OAS benefits have one unique factor that makes the decision to take OAS at 65, or delaying OAS until 70, much more difficult, and that is the clawback. Officially called the OAS recovery tax, this clawback is 15% of every dollar earned above a certain threshold. Above this threshold, the OAS recovery tax takes $0.15 from every $1 of income until OAS is gone.

When we consider the impact of this recovery tax it may make delaying OAS very appealing in certain situations. In this post we’ll look at some of the soft factors to consider when deciding whether or not to delay OAS.

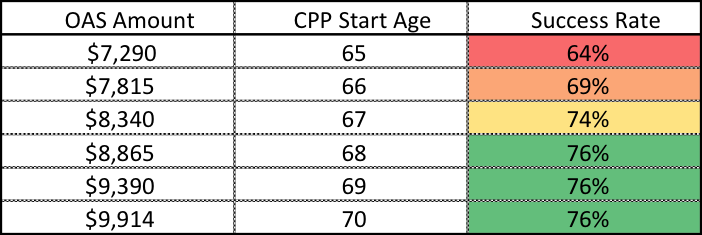

Improved Success Rate When Delaying OAS

When we look at a retirement plan we measure the “success rate” by looking at how our plan would do over historical periods of stock returns, bond returns, and inflation rates. This gives us a good sense of how actual returns, which can vary drastically from year to year, affect our retirement plan. We consider a historical period a success if our investment assets reach the end of the plan with a balance above $0 (even if it’s just $1).

When we delay OAS we end up drawing down investment assets to close the income gap in retirement. Delaying OAS essentially means we’re “trading” risky investment assets for a higher government pension in the future, a government pension that is inflation adjusted. This can help decrease the risk in a retirement plan.

A larger inflation adjusted pension means that our retirement plan is impacted less by fluctuations in the stock market, bond market, and inflation rates. This can improve the success rate of our retirement plan and can make the decision to delay OAS more appealing.

Using the example we set up in the previous post, we can see how the success rate improves slightly when we delay OAS. Is this enough reason to delay OAS? That will depend from person to person.

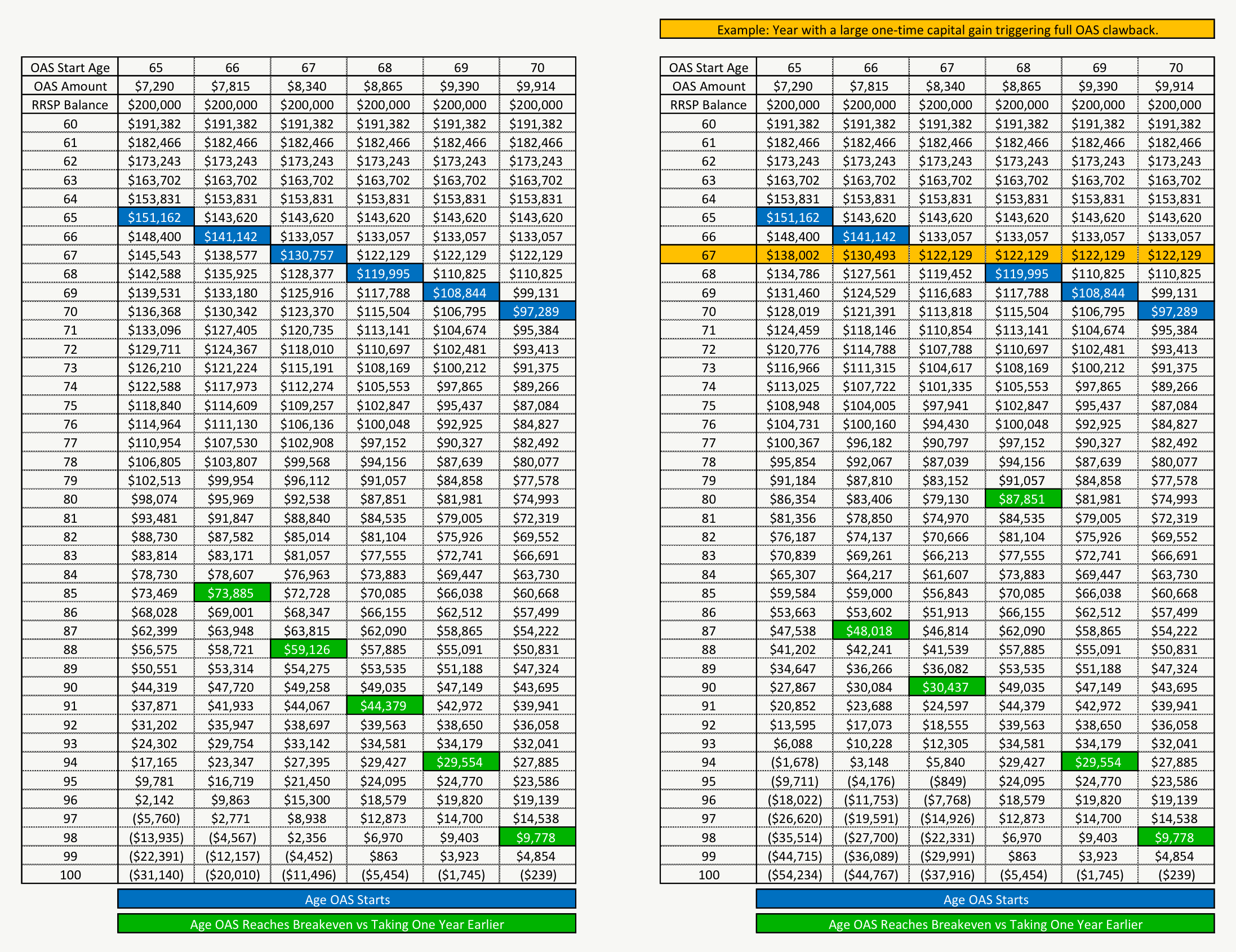

Expecting A Large Capital Gain? Consider Delaying OAS

One possible reason for delaying OAS is if you expect a large capital gain between age 65 and 70. Any retiree who has a large capital gain may end up triggering clawbacks on their OAS benefits.

If you’re in this situation, starting OAS at age 65 only to have it clawed back after triggering capital gains may not be the best decision.

This one-time clawback, triggered by a large capital gain, can affect the breakeven analysis and can make delaying OAS more attractive. This one-time capital gain could be triggered by the sale of a rental property, the sale of a vacation property, or perhaps the sale of non-registered investment assets.

Using our example from the previous post, we can look at how the breakeven changes if there is a large capital gain just a few years after age 65.

In this example below we assume there will be a large capital gain at age 67, essentially clawing back all OAS benefits. In this situation, the decision to delay OAS to at least age 68 is more attractive because the breakeven moves forward when including the impact of the clawback.

High Income Retirees May Wish To Delay OAS

One other reason to delay OAS is if you expect a higher income in retirement. There is no reason to start OAS if you expect to trigger the clawback anyway.

In fact, because of the way the OAS clawback works, delaying OAS means there is more OAS benefit to clawback if you choose to delay and this means OAS benefits could still be available at higher incomes.

Let’s look at two examples using today’s clawback thresholds (Get updated clawback thresholds here)

Taking OAS At Age 65:

Avg Annual Benefit in 2019: $7,253.46

Clawback Rate: 15% of taxable income

OAS Clawback Threshold Where Clawback Starts: $77,580

OAS Clawback Threshold Where OAS Is Entirely Clawed Back: $125,937

Taking OAS At Age 70:

Avg Annual Benefit in 2019: $9,864.83

Clawback Rate: 15% of taxable income

OAS Clawback Threshold Where Clawback Starts: $77,580

OAS Clawback Threshold Where OAS Is Entirely Clawed Back: $143,346

Lots Of Non-Reg Canadian Dividends? Watch Out For Gross Ups

Any investor who has a large amount of non-registered Canadian dividends will need to watch out for gross ups. Even though it may appear that income is below the threshold, the gross up on non-registered Canadian dividends can put an investor above the OAS clawback threshold.

Gross ups on Canadian dividends increase the actual cash dividend received by 38% (for eligible dividends). This phantom income is included in line 236 on your tax return and is considered when calculating OAS clawbacks.

Situations like this it may provide an incentive to delay OAS until the non-registered accounts are drawn down and/or a different asset location strategy is chosen to avoid the effect gross ups in the non-registered account.

Should You Delay OAS?

The decision to delay OAS is a very personal one. There are many situations where delaying OAS is not the best choice but there are also many situations where delaying OAS makes a lot of sense. The decision to delay OAS will depend on your personal circumstances.

Outside of the pure breakeven analysis for delaying OAS there are also many “soft” factors to consider. Although we’ve covered a few of these soft factors in this post there are potentially more considerations that may affect your decision. It’s best to speak with an unbiased advice-only financial planner to determine how OAS fits into your overall plan.

Making the right decision around OAS can mean thousands in additional payments over the course of your retirement!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments