Getting Our TFSAs To One Million

TFSAs are an amazing tax sheltered account that every Canadian has access to regardless of income. Unlike RRSP contribution room, which is based on employment income, we all get the same amount of TFSA contribution room every year.

The TFSA is a perfect way to save for retirement. In fact, for many young people they are better off starting with their TFSA rather than their RRSP, especially when they’re starting out at a lower income.

At lower income levels the TFSA can provide many advantages versus the RRSP. Namely that future withdrawals aren’t taxed and won’t count towards government benefit claw backs.

There are other benefits to the TFSA too, like if you have a habit of spending your tax refund. If that’s the case then maybe a TFSA contribution is a better idea.

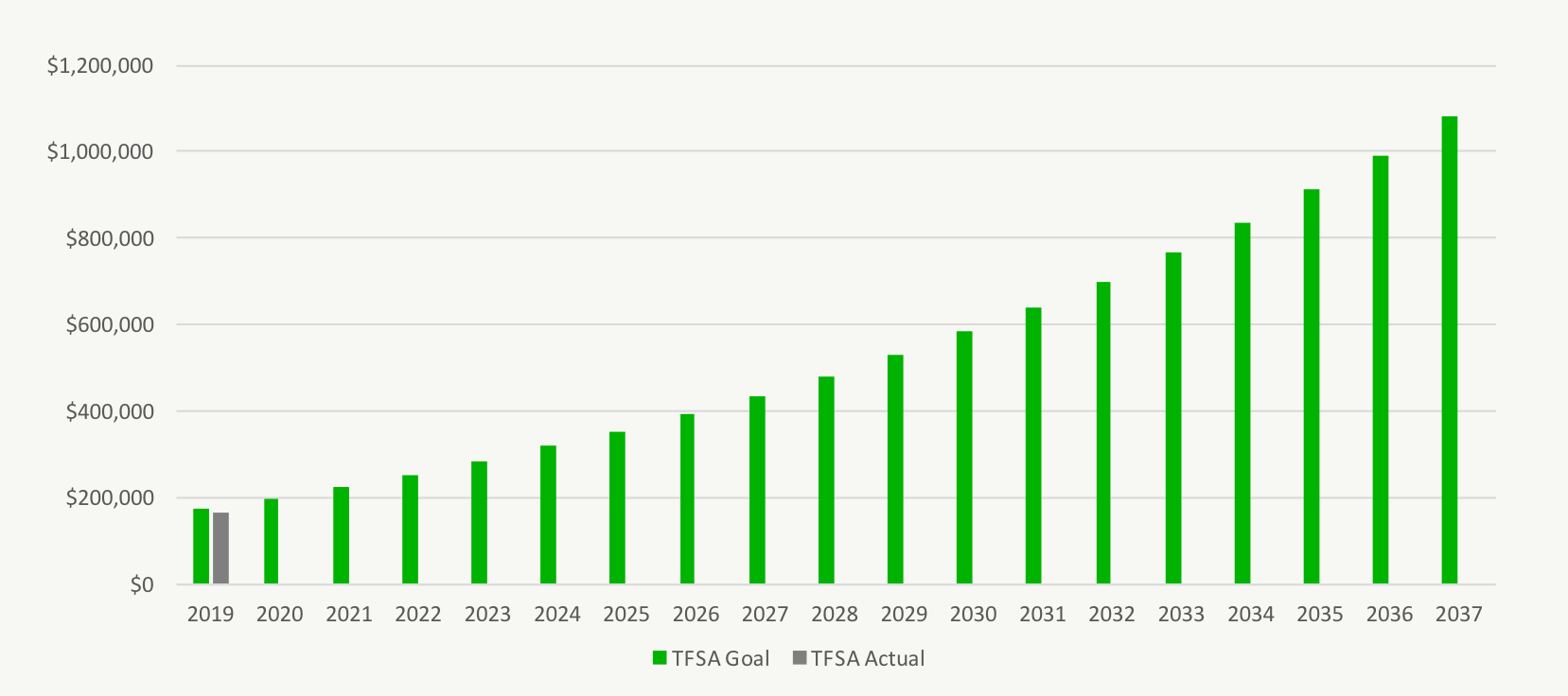

My wife and I have a BIG goal for our TFSAs. Our goal is to grow our combined TFSAs to $1 million by the time we reach early retirement at age 55. This is an ambitious goal, one that we may not meet, but it’s fun to have a BIG financial goal like this. We find it motivating to have BIG financial goals and it gives us something to work toward.

Two years ago I provided an update on our progress to our one million TFSA goal and I think it’s time to do it again. Not just for the accountability but also because it’s good to share how amazing the TFSA is for these kinds of goals.

Our One Million TFSA Goal

Our goal is to build our combined TFSAs to one million by the time we reach age 55. Our TFSAs make up an important part of our financial plan. They provide a lot of flexibility to draw tax free income in retirement.

Our TFSAs won’t make up our all our income in retirement, but it will be an important tool to help us keep our income in the lower tax brackets. This will help us take advantage of basic tax credits to draw from our registered investments in a systematic way.

Most retirement plans can benefit from this type of draw down strategy. Depending on when you retire, what tax credits you’re eligible for, the province you live in, and where your assets are located (RRSP, LIRA, TFSA, non-reg etc) you will likely want to mix your investment withdrawals to minimize your lifetime tax bill.

The mixture of withdrawals may also change over time. Once we hit age 65 there are additional tax credits and income splitting opportunities that may help us lower our overall tax rate even more. We may plan more registered withdrawals after age 65 just to take advantage of these tax changes.

Our TFSAs will be an important component of our retirement income so we want to be close to our $1,000,000 goal by age 55.

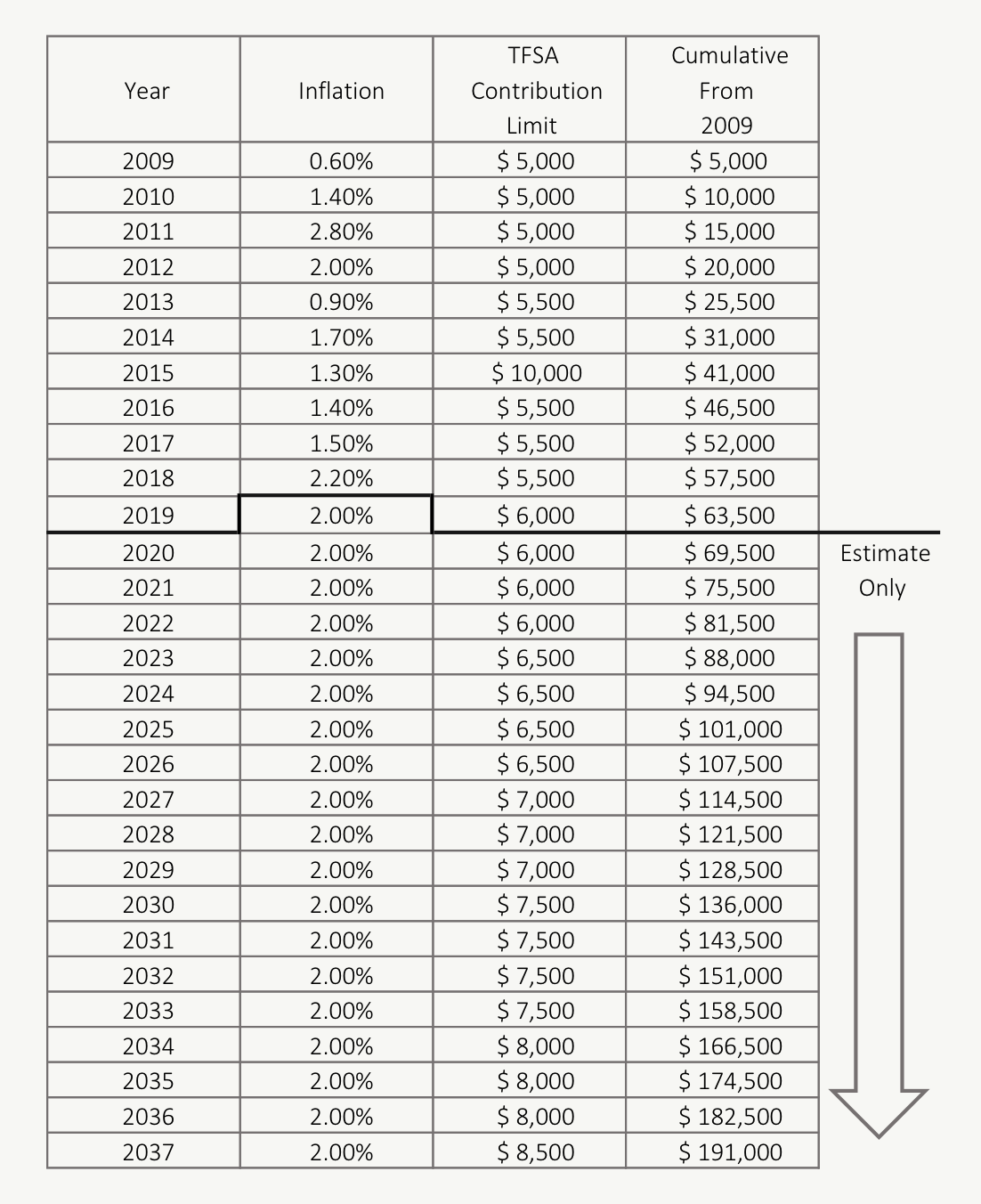

Past TFSA Contribution Room and Future Estimate

TFSA contributions are limited by your annual contribution room. Every person over the age of 18 receives new TFSA contribution room each year. If you were over the age of 18 in 2009 (when the TFSA was born) then by 2019 you should have $63,500 in TFSA contribution room in total. This may be affected by contributions and/or withdrawals if you’re been using your TFSA since then.

If you weren’t 18 in 2009 then you need to calculate your TFSA contribution room based on the annual amount since you turned 18.

Another way to verify your TFSA contribution room is to log into your myCRA account and check your TFSA contribution room according to the CRA. Be warned though, this number typically gets updated just once per year and could be out of date. It’s always good to double check their calculation with your own records.

Each year we receive new TFSA contribution room. The new TFSA contribution room that we receive each year increases slowly with inflation in $500 increments. In the table below we’ve made an estimate of what future TFSA contribution could look like if we experience an average 2% annual inflation in the future.

Our plan is to maximize our TFSA contribution room every year going forward. We save up in advance and make the full TFSA contribution at the beginning of the year.

Our Current Progress

Back in 2017 our goal was to have $172,439 in combined TFSA assets by the end of this year. We’re currently sitting at $164,013.

When we made the initial goal, we used a simple 7% rate of return. This estimated rate of return is slightly optimistic based on a diversified portfolio. Using the current guidelines from the Financial Planning Standards Council we should expect a slightly lower rate of return in the future.

Still, because this is a BIG goal we’ve chosen to keep the same 7% rate of return for the projections below.

Will we make it to our goal? Only time will tell.

But if we end up with “just” $800,000 or $900,000 in our TFSAs at age 55 we’re definitely not going to complain.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments