Our $1 Million Goal

How We’re Using Our TFSA For Retirement

Goals are important. Financial goals are especially important.

Having a goal gives you something to focus on, it gives you direction. Goals provide motivation, they get you moving.

We’ve had big financial goals in the past. Years ago my wife and I set a goal to pay off our mortgage early. That was our first BIG financial goal. Once we achieved that goal we were hooked.

We find financial goals to be very motivating. They give us a reason to stick to our budget. They give us a reason to control our spending and look for new ways to save. They help us avoid purchases that don’t align with our goals (especially impulse purchases).

We currently have one HUGE financial goal. Our goal is to have $1 MILLION in our TFSAs by the time we turn 55.

Why $1 Million?

So why $1,000,000? First of all it’s a nice round number. We could go with a goal like $923,671 but there is something nice about $1M.

Second, it’s big. No doubt about it, trying to save $1M is a big goal, huge even.

It’s challenging. This goal isn’t easily achieved. To reach this goal we need to manage our spending/savings each year. It will be challenging but not too challenging. It will give us motivation to find new ways to save or keep our spending in check.

It’s awesome. Imagine having a cool $1M in your savings account. That’s pretty cool. Seven figures! Plus you’re a millionaire! (Are you a millionaire if your assets are combined with your partner?!? Semantics maybe? At the very least we’ll be a millionaire household).

Why Use Our TFSA For Retirement?

TFSAs can be a great way to save for retirement. Don’t let the name fool you, you can use your TFSA for way more than just a regular savings account. You can hold all sorts of investments inside your TFSA. This makes it a great way to save for retirement.

Benefits of a Tax-Free Savings Account:

- Investments grow tax-free

- No tax on withdrawal

- Withdrawals don’t impact government benefits like OAS and GIS (A big plus! Government claw back rates can be brutal at lower incomes)

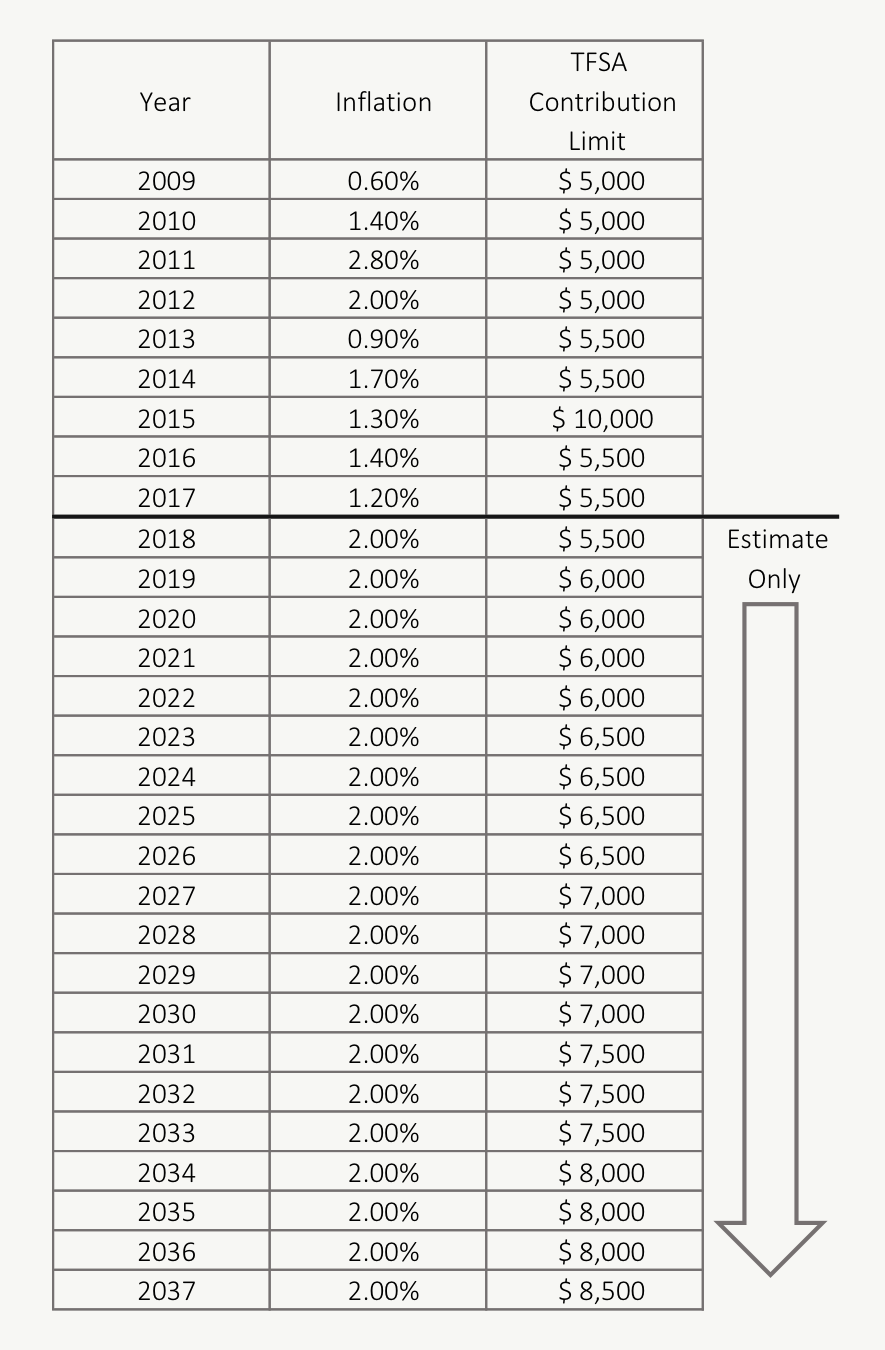

TFSA Contribution Limits by Year:

- Each year there is a maximum you can contribute to a TFSA. The current limit is $5,500 (This is old, get an update here)

- TFSA contribution limit increases and it’s based on annual inflation.

- TFSA contribution limit will only increase by increments of $500. So it may remain at the same level for a few years.

- If we assume a 2% inflation in the future this is what the TFSA contribution limit looks like for each year

- Our $1M goal assumes we contribute the maximum amount each year.

Related Posts:

- 8 Ways TFSAs Could Change the Future

- Are You Saving Too Much for Retirement?

- Retirement Planning for Young People

TFSA Rate of Return:

- TFSA interest rates are low when you use it as a savings account BUT TFSAs can be used for way more than just a simple savings account

- Investing in a basic ETF portfolio inside your TFSA is easy and you can increase your rate of return dramatically

- For our $1M goal we assume a 7% rate of return (5% after inflation). This is based on a mix of stock ETFs and bond ETFs

“Starting early is basically retirement savings on ‘easy mode’ “

Our $1M Goal:

Our goal is to have $1M in our TFSA for retirement. Like any good goal it needs to be SMART. So here are the details behind our $1M goal;

- Specific: The overall goal is $1M. This is split between our two TFSAs

- Measurable: To track our progress we’ll sign into our online broker. We’ll sit down every 4 months to review and rebalance our portfolio

- Achievable: To reach our $1M goal we need to maximize our TFSA each year. Not easy. But we think it’s achievable. We also need a 7% return on our portfolio. This is a reasonable assumption for long-term investment returns

- Relevant: Saving money for retirement is extremely relevant to us. This is a major piece of our retirement plan and we’re hoping it will let us retire early

- Time-Bound: We want to achieve our goal by age fifty-five, thirty years from now

How We Track Our Progress…

To keep ourselves on track we break down our goal into chunks. For our $1M TFSA goal we broke it down into annual contributions.

We started by breaking our goal down into years but you can break down your goal into quarters, months or even bi-weekly or weekly. This is what it looks like.

We try make our TFSA contribution on Jan 1st. This means saving during the year so that we have $5,500 available on Jan 1st.

On a weekly basis, we need to save a little over $100 per week for each TFSA.

To make sure we have enough savings at the end of the year we set a monthly budget and monitor our spending. If we overspend one month (which happens) we try to decrease our spending the next month. By monitoring our spending/savings monthly we can ensure we’ll reach our goal by the end of the year.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments