Retirement Planning for Young People

Even though it’s a long way off, many young people think about retirement planning.

Twenty-five percent of young people list retirement as one of their top two financial concerns. Top two! They’re more concerned with retirement than debt, expenses, unexpected emergencies or losing their job.

When young people think about retirement their biggest concern is “running out of money.”

To be honest, I’m not surprised.

Saving for retirement is something we’ve been told to worry about again, and again, and again.

The good news is that starting early makes a HUGE difference. Starting early is basically retirement savings on “easy mode.”

The best way to ease your retirement concerns is to make a plan and start saving today (even if it’s just a small amount).

In this post we’ll go over a ‘quick and dirty’ way to create a retirement plan. This “retirement plan” is perfect for a young person. It isn’t a replacement for a full financial plan, but it’s a good way to put yourself on the right path and start saving.

Step 1: Think About Your Target Retirement Spending

The first thing you need to do is think about how much you want to spend in retirement. If you know how much you want to spend then you can figure out how much you need to save.

According to the most recent Statistics Canada survey the average income for an “elderly family” was $64,800.

This can be a good place to start… but you’re probably not average.

To get a better estimate you can take your current spending and multiple by 70-80%. This is roughly what you need in retirement to maintain your current lifestyle.

If you want to get more specific, you need to think about a few things…

Do you want a luxurious, modest or basic retirement? Not sure? Maybe do all three scenarios to see the difference.

Increasing your retirement spending by $10,000 per year means you need to save roughly an extra $2,070 per year for 40 years (more if your time period is shorter). Do you really need to save/spend that much? Is saving an extra $2,000 today worth spending an extra $10,000 in the future? Maybe it is. Maybe it isn’t.

To get even more accurate you need to create a retirement budget.

The best way to do this is to think about how much you spend today and go from there. Add in things like travel/vacations/sports/hobbies and subtract things like mortgage (hopefully!), work related expenses, and child related expenses.

Step 2: Decide When to Retire

Decide when you want to retire. According to Statistics Canada the average retirement age last year was 63.6.

Normally when people think about retirement they consider the age of 65. This is when most government benefits become available without any reductions.

Creating a retirement plan now gives you options. One option is early retirement. With advanced planning you could retire at 55, 45, 35 or even earlier.

For this exercise we’ll use the normal retirement age of 65.

Step 3: Include Defined Benefit Pensions

If you have a defined benefit pension, then all or part of your retirement spending might be covered by your pension.

It’s important to understand how much you can expect from your workplace pension plan. Usually you can find an estimate on your annual/quarterly pension statement. Otherwise call your pension provider.

Step 4: Don’t Forget Government Retirement Benefits

Government retirement benefits can add up quickly.

CPP is available as early as 60 but full benefits start at age 65. The average is $8,221/yr and max is $13,370/yr.

OAS is available at age 65. The max is $6,942/yr.

Government benefits alone can provide up to $20,312 per year for an individual or $40,624 for a couple (more if you choose to delay CPP and OAS until the age of 70)

Step 5: What Is Your Retirement Income Shortfall

For most people government retirement benefits and work place pensions aren’t enough to cover retirement spending.

This next part can get really complex. The timing of pension benefits, CPP and OAS may not coincide with your target retirement date. If this is the case then you need to manage your retirement cash flow a bit closer. In this case it’s best to speak with a financial planner or use a financial planning platform like PlanEasy.

However, if all your dates coincide (say age 65) then you can take your target spending, subtract CPP, OAS, and pension benefits to get your retirement spending shortfall.

So, as an example, say my wife and I need $60,000 per year in today’s dollars, we would subtract, $16,442 for average CPP benefits, and subtract $13,884 for OAS. We don’t have work pensions. What we’re left with is a retirement income shortfall of $29,674 per year ($65,000 – $16,442 – $13,884 = $29,674).

“Starting early is basically retirement savings on ‘easy mode’ “

Step 6: How Much You Need To Retire

Now that we know how much your retirement income shortfall is we can calculate how much money you need to have at retirement to generate that income. We’ll use a rough guideline like the 4% rule to estimate how much money you need to retire. The 4% rule ensures that your principle continues to grow with inflation. This is a good strategy for long retirements.

Take your annual income shortfall and divide by 4% (or multiple by 25, either one works). This is roughly how much you need to retire.

Using our example, my wife and I would need $741,850 at retirement ($29,674 / 4% = $741,850).

“Saving for retirement is something we’ve been told to worry about again, and again, and again.

The good news is that starting early makes a HUGE difference. Starting early is basically retirement savings on ‘easy mode’ ”

Step 7: How Much To Save Each Year For Retirement?

Now that we know how much you need to retire the question is, how much do you have to save?

We need to break down your big retirement goal into smaller chunks.

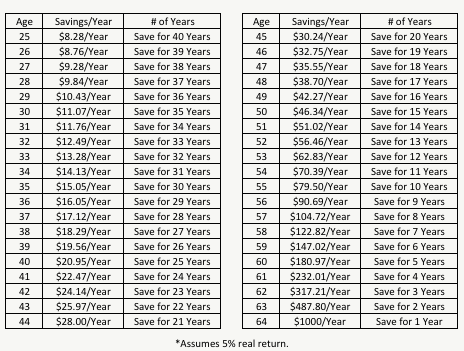

The table below shows you how much you need to save each year to get $1,000 at age 65. If you need to save $500,000 then take the annual amount and multiple by 500.

For example, a 25 year old needs to save $8.28 per year from age 25 to 65 to get $1,000 at retirement. So they would need to save $4,140 per year to get $500,000 at retirement ($8.28 x 500 = $4,140).

A 35 year old needs to save $15.05 per year from age 35 to 65 to get $1,000 at retirement. So they would need to save $7,525 per year to get $500,000 at retirement ($15.05 x 500 = $7,525).

A 45 year old needs to save $30.24 per year from age 45 to 65 to get $1,000 at retirement. So they would need to save $15,120 per year to get $500,000 at retirement ($30.24 x 500 = $15,120).

As you can see, the amount increases quickly the closer you get to retirement. For every 10 years you wait between age 25, 35, and 45 the amount you need to save each year doubles. This is why starting early is retirement savings on “easy mode.”

Using our example, my wife and I need to save $742,000 for retirement at age 65 (rounded to the nearest $1,000). Using the table above we would need to save $6,144 per year from the age of 25 to 65 to reach that goal ($8.28 x 724 = $6,144). Thats a little more than $100 per week. Not easy to do but definitely achievable with some small lifestyle changes.

Thankfully we’ve been doing this plus a bit more. As a result we’re targeting an earlier retirement at age 55. This is another benefit of starting your retirement plan early.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments