Where Are You In The Financial Planning Life Cycle?

Where are you in the financial planning life cycle?

Are you a student? Are you single? In a relationship? Do you have a young family? Maybe a growing family? Perhaps you’re entering retirement, or maybe you’re starting to consider your legacy for the next generation.

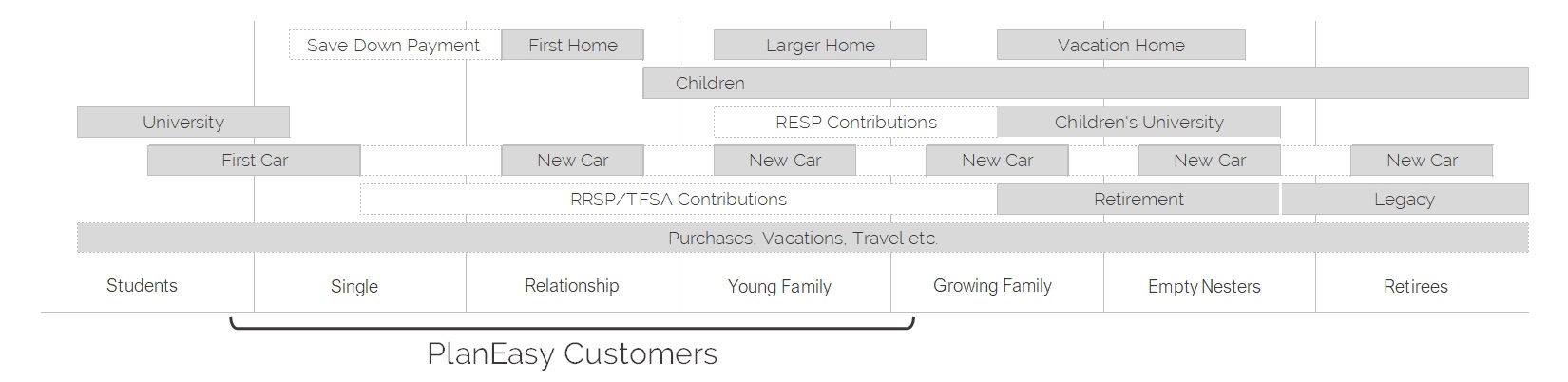

The financial planning life cycle is a quick way to visualize the different financial needs a person will experience throughout their life.

Depending on where you are in the financial planning life cycle your financial needs will change. The financial needs of a university student are vastly different from a new retiree. It’s also possible to be in multiple stages of the financial planning life cycle at one time. This creates its own challenges because financial needs will have to be prioritized.

Knowing where you are in the financial planning life cycle can help you understand your current and future financial needs.

The Financial Planning Life Cycle

(more details below)

Why does it matter?

Knowing where are you are in the financial planning life cycle will help you anticipate your future financial needs. It will ensure you’re setting yourself up well for the future.

Thinking even a few years ahead will help you prepare for those new challenges. It could be something short term like buying a new home, or something long term like planning for retirement. Anticipating those challenges will help you prepare for them.

In addition to preparing for the future, knowing where you are in the financial planning life cycle will also help you avoid skipping important things today.

The power of compounding works best over a long period of time. Skipping things like saving for retirement, saving for a child’s education or saving for a down payment make it more difficult to achieve these goals in the future.

To fully leverage the power of compounding it helps to start as early as possible, even if its a small amount. Making a few small sacrifices can help you get ahead of the curve. Someone who starts saving in their early 20’s can save 4x less and still end up with the same amount at retirement.

Check out the graph below to see just how important saving in your early 20’s can be.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

You can be in multiple stages at once.

Each stage of the financial planning life cycle isn’t separate. It’s possible to be in multiple stages at once. Going back for a master’s degree while also having young children puts you into two different financial planning stages each with their own unique problems and concerns.

Being in two financial planning stages are once will create some extra work. Knowing the unique challenges of each stage will help you prepare for this additional complexity.

The financial planning life cycle isn’t linear.

Although presented in a linear way a person can jump from one stage to another or skip some stages entirely.

A person could go from being single, to being in a relationship and then back to being single again. This creates its own unique financial challenges. Perhaps it means re-saving for another down payment. Or maybe restarting TFSA/RRSP contributions.

A person may choose to go back to school later in life, putting them right back into the student stage.

Each stage has its own unique challenges and it’s possible to come back to the same challenge more than once.

“Knowing where are you are in the financial planning life-cycle will help you anticipate your future financial needs.”

“Knowing where you are in the financial planning life cycle will help you ensure you’re not skipping anything important today.”

The financial planning life cycle

There are various financial milestones for each stage in the financial planning life cycle. These can vary from person to person depending on their own unique situation. The financial planning life cycle can act as a guide for the typical financial milestones a person will encounter.

The list below is not exhaustive but represents some of the typical financial milestones during each stage.

Student:

- University/College

- First Car

- Credit Card

- Student Debt

- Budgeting

Single:

- First Job

- Down Payment

- Student Debt

- Large Purchases (ie. Bed/Couch)

- Travel

Relationship:

- New Car

- Wedding

- First Home/Mortgage

- Investment Planning

- Retirement Savings

Young Family:

- Larger home

- Children

- Life Insurance

- Wills

- RESP Contributions

- Investment Planning

- Retirement Savings

- Maternity/Paternity Leave

Growing Family:

- Vacation Home

- Children

- RESP Contributions

- Renovations

- Investment Planning

- Retirement Savings

Empty Nesters:

- Vacation Home

- Renovations

- Down Sizing

- Retirement

- Travel

Mature Adults:

- Retirement

- Estate planning

- Wills

- Long Term Care

- Travel

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

While the chart is clean and easy to follow, don’t you think it oversimplifies things? With each passing year I am involved in the personal finance community I recognize more and more how unique each financial situation. Even looking at a sample of 20 people of the same age they would all likely have a significantly different financial planning life cycle. With that being said, I realize you have to start somewhere and make assumptions if you are going to have any sort of frame-of-reference.

It’s a starting point. Everyone is certainly unique in their financial planning needs but most people will hit many of these milestones in their lifetime. Sometimes it’s helpful to start from a common framework and then customize to an individuals needs.

Agree with DC. My wife and I are about to buy our first home, our youngest daughter just moved out, and I am planning to quit my job early in four years time 😉

That’s awesome!

The different financial planning milestones definitely don’t need to come in the exact order listed above. This just represents the “typical” financial planning life cycle. It’s a starting point from which you can customize for a persons unique needs.