What Is The Guaranteed Income Supplement?

The Guaranteed Income Supplement is a government benefit program focused on low-income retirees. It is based on income and is available to low-income Old Age Security (OAS) recipients. It is a non-taxable benefit meant to protect seniors from low levels of retirement income.

The GIS benefit provides income support to over 2.1 million retirees. It provides support to nearly 1 in 3 seniors in Canada. In a given year the Guaranteed Income Supplement will provide over $13 billion in benefits!

GIS is one of the most generous benefits in Canada and because of this it also comes with some extremely high “clawback” rates. GIS benefits get reduced as household income increases. This reduction is called a “clawback” rate because it “claws back” benefits from higher income households. At a certain income level, depending on the household situation, all benefits will be clawed back.

This “clawback” rate is important because it can reach 50% to 75%. This makes low-income retirement planning an important consideration. Not all income triggers the GIS clawback so it’s important to understand where retirement income is coming from and how GIS will be affected. With the average GIS recipient only receiving 54% of the maximum these clawbacks have a big impact.

In this post we’ll review what the Guaranteed Income Supplement is, how it works, how much you could receive, and how the GIS “clawback” works. We’ll also cover some common types of retirement income and how they can affect GIS benefits.

What Is The Guaranteed Income Supplement?

The Guaranteed Income Supplement (GIS) is a government benefits program focused on low-income retirees. It is one of the most generous government benefits in Canada. It’s meant to protect seniors (those over age 65) from extremely low levels of income in retirement and, with other government programs, helps to creates a “floor” for retirement income.

Guaranteed Income Supplement (GIS) is only available to Old Age Security (OAS) recipients. This means that it cannot start until age 65 and it cannot start unless the individual has a certain number of years in Canada to meet the minimum OAS criteria (10+ before age 65).

GIS payments start the month after you turn 65, provided that you’ve filed taxes on time.

Who Can Receive The Guaranteed Income Supplement?

Eligibility for the Guaranteed Income Supplement is mainly based on three things.

- One is the household structure, married/common-law couple versus an individual.

- The second is who is receiving OAS, are there two OAS recipients or just one?

- The third is income level, beyond a certain income level the household will stop receiving GIS any benefits (this is due to the GIS “clawback”, more on that below)

There are also a couple of other important criteria that may impact someone’s ability to receive the Guaranteed Income Supplement. One very important criteria is that they must be eligible for OAS benefits. GIS is only available when receiving OAS, so for anyone with less than 10-years in Canada they will not be eligible for OAS and therefore also not eligible for GIS. You also have to live in Canada to receive GIS benefits.

How Much Could You Receive?

The Guaranteed Income Supplement gets reduced as household income increases so how much gets received will depend on other sources of retirement income. The higher the household income, the lower the GIS benefit. A certain point the GIS benefit disappears entirely. If your income is below this threshold then you should receive at least some GIS benefit, but the exact amount will depend on your exact income and the “clawbacks” you face (more on GIS “clawbacks” below).

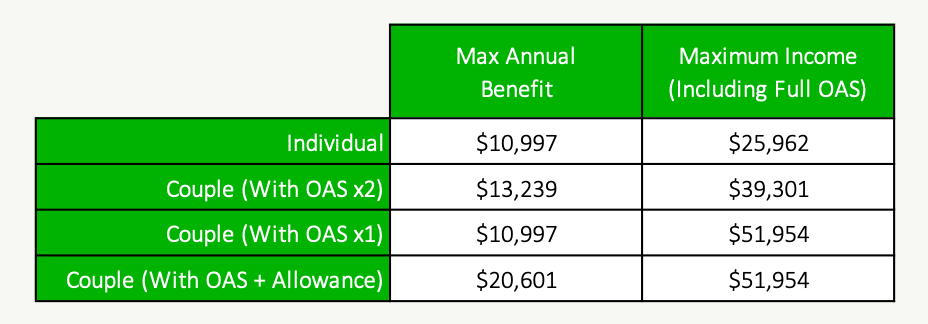

Maximum Benefit and Income Thresholds For GIS

(As of July 2020)

How Does The Guaranteed Income Supplement Work?

The Guaranteed Income Supplement is meant to support lower-income retirees with retirement spending. It helps provide a “floor” for retirement income and helps keep seniors out of extreme poverty.

To do this, GIS provides a very generous benefit that gets reduced as income increases. A household with a higher income, everything else being equal, will receive less GIS benefit.

To reduce GIS as a retiree’s income increases there is a GIS “clawback”. This clawback acts like a tax rate. The more income a retiree earns, the more the clawback reduces their GIS and the lower their GIS benefit will be. Once a household goes beyond a certain income level they will not receive any GIS benefit because it’s been entirely “clawed back”.

This clawback helps ensure that only those who need GIS will receive it. But it does sometimes work against retirees who may not fully appreciate the rules and how different types of income affect GIS. The average GIS recipient is only receiving 54% of the maximum GIS, the rest is being clawed back based on income.

GIS payments are based on the income reported on the tax return (specifically line 23600). The tax return is used to calculate GIS payments. The GIS payments change in July based on the previous tax year. This creates a lag.

For example, if additional income is earned in January 2020 (perhaps from some employment income) this is counted in the 2020 tax year and won’t affect GIS until the following July 2021. This can create up to an 18-month lag between income going up and GIS benefits going down. This is important to plan for otherwise a retiree could be in for an unpleasant surprise the following July when their GIS decreases.

What Is The Guaranteed Income Supplement Clawback? How Does It Work?

The basic premise behind the GIS “clawback” is simple, it reduces GIS benefits for every dollar of income the household receives. The base clawback for GIS is 50% of each additional dollar of income. But… the clawback rate will unfortunately differ depending on the household situation and the income level. There are income levels where the clawback rate jumps to 75%+ of each additional dollar of income.

How does this work?

For example, let’s say a retiree is earning $10,000 per year from CPP and decides to take $1,200 from their RRSP. This RRSP withdrawal is considered taxable income for the year. The extra $1,200 of RRSP income will reduce GIS by 50% or $600/year. This decrease starts the following July, so the monthly payments will remain the same until July of the following year when they’ll be reduced by $50/month (the $600 reduction spread over 12-months).

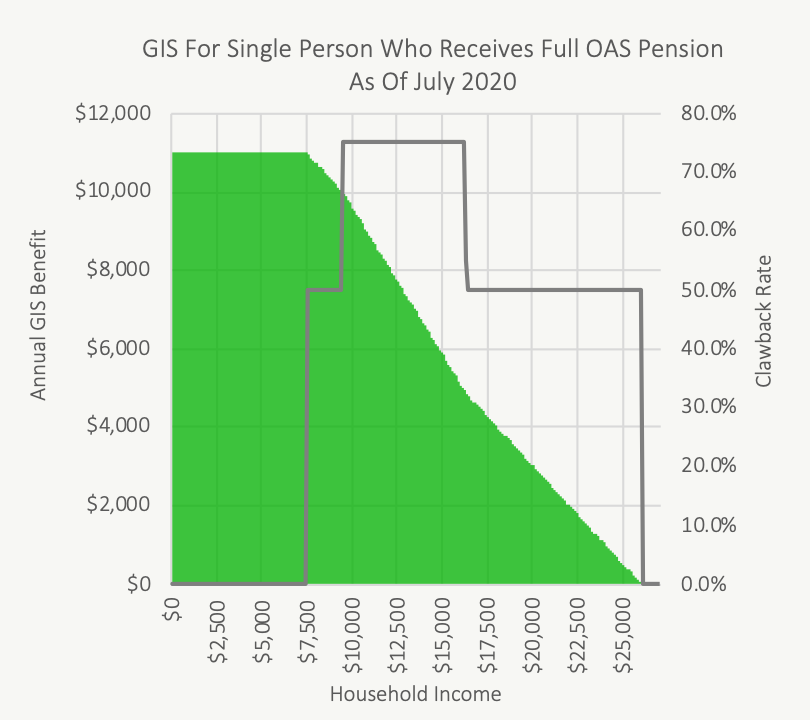

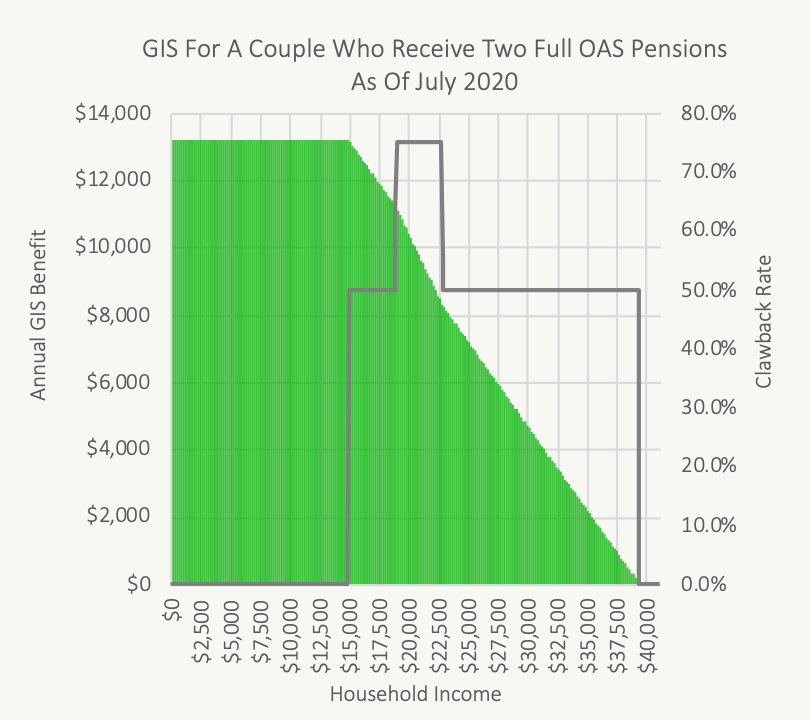

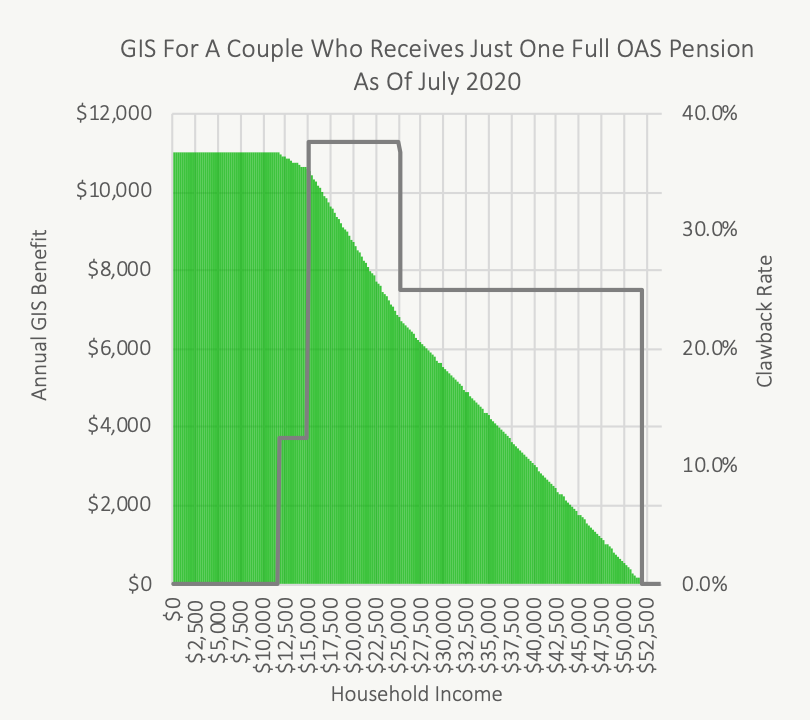

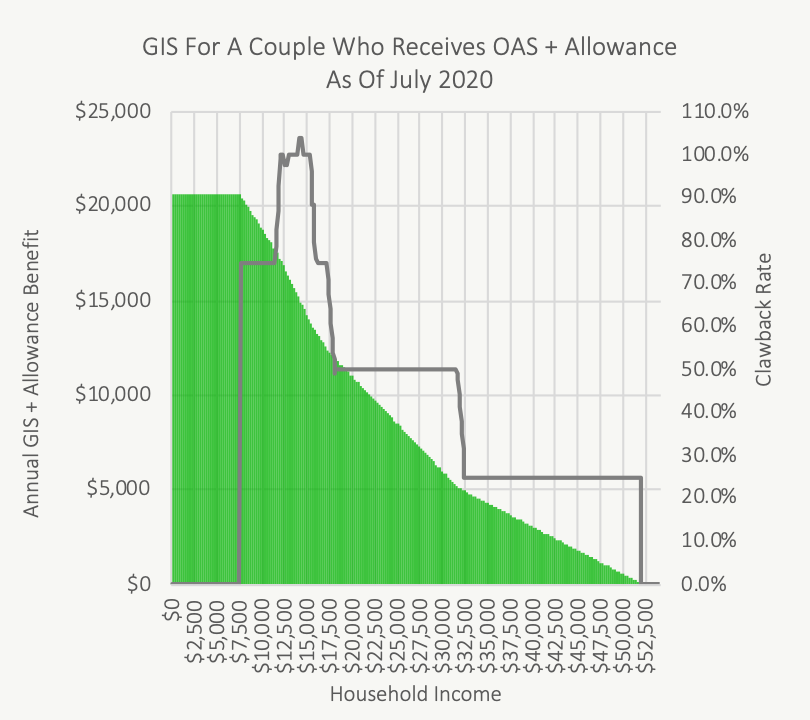

The GIS clawback reduces GIS as income increases until at a certain income level, above this income level a retiree will not receive any GIS benefit. This income level changes depending on the household situation. Here are 4 charts that show both the GIS clawback rate and the expected GIS amount for the 4 common household situations.

One important thing to note is that certain types of income are either fully excluded from the GIS calculation or are partially excluded. In the next five sections we cover the common types of retirement income and how they affect GIS.

How OAS Affects The Guaranteed Income Supplement

OAS benefits are excluded from GIS clawback calculations. So, although OAS is a taxable benefit, and is included as income on a tax return, it is excluded from GIS clawback calculations.

Plus, if OAS is below the maximum there is a special GIS top up that brings OAS to 100%. This can make GIS even more valuable for anyone who has less than 40-years in Canada and therefore does not qualify for full OAS.

How CPP Affects The Guaranteed Income Supplement

Unfortunately, income from the Canada Pension Plan (CPP) causes GIS clawbacks. Receiving the maximum CPP can incur a lot of GIS clawbacks. It can also make delaying CPP to age 70 very unattractive for low-income retirees.

For a low-income retiree who expects to receive GIS benefits in the future it can make sense to start CPP benefits as early as possible at age 60, even if still working. This decreases the monthly CPP benefit so less gets clawed back in the future and the extra CPP income from age 60 to 65 can be saved in a TFSA.

How Pension Income Affects The Guaranteed Income Supplement

Like CPP income, pension income also causes GIS clawbacks. For a low-income retiree a small pension can be clawed back at a rate of 50% to 75%.

In some cases, it can make sense for a low-income retiree to take the commuted value of a pension rather than receive a lifetime pension benefit (which would just get clawed back at a rate of 50% to 75% anyway). This is a unique decision and should be done with the help of a certified financial planner. It would require using unlocking rules to gain access to the commuted value and shift it into a TFSA where it can grow tax free. This only works with pensions of a certain size but it’s an important consideration when clawback rates for GIS are so steep.

How RRSP Withdrawals Affects The Guaranteed Income Supplement

Similar to CCP and pension income, withdrawals from a registered account like an RRSP, RRIF or LIF will all cause GIS clawbacks. This can make something like annual RRIF withdrawals very detrimental to a low-income retiree.

Strategically we would like to “meltdown” any registered assets before age 65 to avoid this clawback on RRSP/RRIF/LIF income.

Ideally, we could place these assets into a TFSA prior to GIS starting at age 65 but sometimes that’s not possible and we need to plan a large withdrawal in the future. This large withdrawal should ideally happen on or before age 72 when mandatory RRIF/LIF withdrawals begin.

How Employment Income Affects The Guaranteed Income Supplement

Guaranteed Income Supplement now has a special provision for employment income. This was new for 2019 tax year and beyond.

Old rules made it difficult for retirees to earn part-time employment income without triggering hefty GIS clawbacks. New rules allow the first $5,000 of employment income per person to avoid all GIS clawbacks, plus the next $10,000 of employment income, going from $5,000 to $15,000, will only incur half the typical GIS clawback. Rather than a 50% to 75% clawback this would reduce the clawback to a more manageable 25% to 37.5% depending on the situation and other income sources.

This makes it possible for a low-income retiree to augment their retirement income with some part-time work and not lose a large percentage to GIS clawbacks.

Low-Income Retirement Planning

The Guaranteed Income Supplement is a valuable benefit for low-income retirees. But the high clawback rate makes low-income retirement planning very important! Even a small change in RRSP withdrawals or employment income can cause large changes to GIS benefits.

Sometimes these changes to GIS benefits cannot be avoided, but many times we can be strategic about how a retiree draws down retirement assets. With some careful planning we can avoid $10,000’s in GIS clawbacks.

Because 1 in 3 retirees receive GIS this is an important consideration for many retirees. The hefty clawbacks on GIS benefits mean that a bit of planning can potentially increase retirement income and security.

The best time to plan for a low-income retirement is during your late 50’s and early 60’s. This provides enough time to plan retirement income and make changes if necessary. There are strategic decisions that can be made before age 60 that will help maximize GIS over a retiree’s lifetime. A few smart decisions before retirement can help make a low-income retirement more secure.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen, thank you for this detailed article.

It got me think, if I transferred assets from RRSP to TFSA before turning 65 (to avoid clawbacks), what’s the tax implications for this? Maybe we have to carefully plan to start transferring over a few years instead of doing it all in one year, to avoid heavy taxation?

Thank you again!

Hi June! Absolutely, strategically drawing down an RRSP before OAS/GIS begin at age 65 can be a great strategy but it all depends on the details. The size of the RRSP, the current level of income, future level of income from pensions/CPP, if there is TFSA room to hold the net RRSP withdrawals etc. etc. These are all factors when creating a low-income retirement plan.

But because GIS clawback rates range from 50% to 75% there is a large incentive to draw down the RRSP before OAS/GIS begin.

Thank you for your prompt response Owen. I’m a little overwhelmed by how many considerations there are. As I still have > 30 years until retirement, if the program continues, I should have a large TFSA room by age 65, and it may be possible to transfer a large portion of RRSP. I will keep that and other factors you mentioned in mind. Thank you so much for this information!

Hi,

The Government of Canada has a set of tables that show the GIS clawback, but the info in those tables seems to be different that what you have here. For example, for a single person that received OAS, it shows the clawback rate at 50% from the first few dollars of income, vs your chart showing the clawback starting at 0%, then increasing to 25%, then 50%. Any comments on why they are different, or what impacts you are including that this table is not? Your article mentions the new rules on the first $5,000 and next $10,000 of income, so I’m assuming the difference is somehow tied to that, but if so, I don’t understand why the government tables wouldn’t include that effect as well.

The tables I’m referring to are here:

https://www.canada.ca/content/dam/canada/employment-social-development/migration/documents/assets/portfolio/docs/en/cpp/oas/sv-oas-jul-sept-2021.pdf

Thanks

Hi Sean, this is a fantastic question, the reason for the difference is that in the Gov. of Canada tables they exclude OAS income (which although taxable, does not cause GIS clawbacks). You’ll notice in the pdf that it says “Yearly Income (excluding OAS Pension and GIS)”. In the charts and table we assume a full OAS benefit because that’s what most people will experience in retirement and we shift the start of the clawbacks to ignore this OAS income. Hope that helps!

Hi Owen,

Thanks for the quick response. Yes, this does help.

For the charts, is it correct that the “Household Income” is assumed to be made up of some components of OAS Pension, CPP, other pension Income and RRSP withdrawals, but NOT employment income, as that would be clawed back at a lower rate than what the charts are showing?

Thanks for the helpful content in your posts as well.

That’s correct, the charts do not include any employment income, which would receive special treatment for the first $5,000 and also the next $10,000 ($5,000 to $15,000 of employment income). The charts also do not include different types of non-registered income like dividends and capital gains. Dividends are great for income tax, but it’s the grossed up dividend that gets included in taxable income line 236000, so for GIS recipients Canadian eligible dividends can cause more “clawbacks” than might be expected.

Unfortunately, every situation is very unique depending on the mix of retirement income, the charts above are more illustrative of the different peaks/valleys when considering GIS clawbacks.

I needed money in 2020 to help pay my bills, not to go on some kind of spending spree. I withdrew $15000 – $3000 (tax withheld) = $12000 net from my RRSP. My accountant did my taxes this year for last year T1 return. I was shocked to find last month the the CRA cut my GIS entirely.

Up until June of this year, I was receiving 1,214.16 (OAS) and in July, the CRA cut it by almost 50% down to 626.49 (OAS), while CPP remained at $355 per month. My RRSP is with a full service fee based broker. I wish someone there had advised me what the tax repercussions would be, I would have made a smaller withdrawal.

I’m 68 years old and I relied on that $589.65 extra per month that was put into my bank account via direct deposit. Full service brokers – isn’t that what full service means?

Thanks.

That is very frustrating Ron! Unfortunately, investment advisors can lack the tools/knowledge to optimize government benefits like GIS.

What is even more frustrating for me is that you could have used that opportunity to withdraw even more from your RRSP and place it inside your TFSA. You had already triggered a full reduction in GIS by withdrawing $15,000, so there was an opportunity to draw even more in 2020 and avoid GIS clawbacks in the future. Its frustrating that your advisor missed that.

This is the type of strategic planning we do with clients. If you’re interested in talking, complete the Discovery form by clicking Start Planning in the menu and you’ll be prompted to book a free Discovery call. We can’t undo the past but at the very least we can discuss your situation and see if there are any opportunities to maximize your benefits in the future.

Owen

I was receiving GIS of approx. $250 a month, on top of my OAS, during 2020. Based on the rules, this was obviously based on a couple of prior years income. However, during 2020 I worked and received approx. $22,000 in employment income as I took on some part-time work. This has unfortunately made me ineligible for GIS as of July, 2021.

I understand all this, but my question is about “claw-back”. It appears that they have not only clawed back all my GIS for the next 12 months but also some of the GIS they paid during 2020 as well. Instead of the standard $625 or so in OAS for the next 12 months they are only paying me $440. Meaning that they have clawed back approx. $185 of my current OAS for the coming year.

Does this seem right. Is this correct? I’m sure other seniors would be interested in this situation.

Hi Andrew, I’m sorry to hear that. There is now an exemption on the first $5,000 of employment income and a partial exemption of 50% on the next $10,000 of employment income (from $5,000 to $15,000). Without seeing all the details, based on receiving $250/month previously, it does seem like your GIS would be entirely clawed back with $22,000 in employment income.

Regarding OAS, I suspect that you were eligible for the OAS “top-up” that is tied to GIS. For those who are not eligible for the maximum OAS benefit because they did not have 40+ years in Canada between age 18 and 65 the OAS “top-up” will bring their OAS to the maximum amount if they’re also eligible for GIS. Based on the values you shared it seems like you only qualify for 70% of the maximum OAS benefit based on about 28-years in Canada between 18 and 65? This could be why your OAS was reduced.

One possible option to explore, there is a special option to have your current year’s GIS be based on this year’s income rather than previous years income. If you experienced a large drop in income because you no longer are employed part-time then this could be an option. You would need to call Service Canada to make a special request. Please come back and leave a comment if this works for you. I’d love to know if you qualify for this.

Thanks Owen.

I had already maxed out my TFSA earlier (2020) in the year, so there was no room. I have done the same at the beginning of this year too, as I have since it’s inception. There’s nothing that I can do now. I have called the CRA twice, on (speakerphone) hold for at least 2 hours both times. The last guy could not or would not answer my questions. The phone went dead, not sure if he just hung up on me or it was disconnected. I suspect the former.

I thought that I was more financially literate.

Owen

I appreciate that you did not know all my details but I have been in Canada for all of my 68 years and therefore do not believe it was the reason you suggested.

I have in fact contacted service Canada for the second reason you mentioned. As any employment income is totally gone for 2021 I am trying to get them to use my estimated 2021 income to calculate GIS. I don’t hold out a lot of hope but we’ll see what happens.

I have still to find out why they are reducing my actual OAS payment for the future but when I get their “letter in 10-15 days” as they say in the decision, I will hopefully have the answer and write a comment here explaining.

Hi Andrew, that’s interesting, the other common reason OAS is reduced is if income is above the OAS clawback threshold ($79,845 in 2021). Come back and leave a comment when you get to the bottom of it. Good luck with Service Canada!

In table 3, the clawback ranges from 25% to about 38%. ie: from 10k to 20k income GIS reduces by 35% but between 20k and 30k only 25%

Hi Mark, that’s correct, but unlike the GIS Tables on the government website the charts above assume a full OAS benefit. OAS benefits don’t cause any clawbacks for GIS, they are ignored, so this effectively shifts the clawback ranges in the government tables by the amount of OAS received. That’s why the government tables and the charts above might look different, but in the end the effect is the same, it’s just being shown differently.

The reduced clawback of 25-38% in Table 3 is with FULL OAS for one person Normally, as in Table 1,2 clawback is 50cents/$1 of income but in Table 3 it is much less. I think this is because the spouse is NOT receiving OAS. Maybe this is what you meant by “full OAS”?

Hi Mark, what I mean is that in the GIS Tables on the government website the income shown is the “Combined Yearly Income of couple (excluding OAS Pension and GIS)”. However, in the charts above, we include full OAS, this shifts the range of the clawbacks by the OAS amount. So, for example, in the GIS Table 3 the clawbacks start when income exceeds $4,100 for the year excluding OAS, but in the chart, when we add OAS benefits, this means the clawback actually starts when taxable income is around $11,500 including OAS.

Hi Owen,

Do you have any knowledge of the Alberta Local Authorities Pension Plan (LAPP)?

Hi Debbie, yes we’ve done a few financial plans that include the LAPP pension, did your question relate to the Guaranteed Income Supplement?

What strategies could a couple aged 66 use to collapse a 500k RRSP before age 72 with 150k TFSA room? They are receiving only OAS and CPP of about 15k combined

Hi Johnh, there is no easy answer here, it will entirely depend on your situation, the CPP and OAS income you already receive, the other types of retirement income you receive, any part-time employment income you earn, if you have RRSP contribution room available etc. etc.

My suggestion would be to click Start Planning in the menu and book a call with one of our financial planners. We can do a free Discovery Call together and see what opportunities there might be based on your particular situation.

For some additional reading, check out this post which has a great example of how to maximize GIS benefits using strategic RRSP contributions…

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

My hubby and I receive GIS as we don’t get full OAS (50%). Without this OAS our basic income is $21000 but we get OAS/GIS of $710 each. He will get first RRIF payment soon, aged 72 which increases our total income for 2021 by 8000. I suppose this will end our GIS + top up of our OAS but assume old payments will continue till July 2022 calculation and then change to probably zero. Will they clawback these overpayments and how?? I will also claim my CPP in 2022 at 70 which, with the new RRIF payment, will move us out of GIS claim bracket when we do taxes at end of 2022. So if we don’t get GIS, our OAS will also revert back to the 50% level ?

Hi Mary, you’re receiving an extra GIS benefit because you do not qualify for the full OAS benefit, this extra GIS tops up your OAS benefit to 100% but is clawed back at a rate of 50% for each dollar of taxable income. With an $8,000 RRIF withdrawal in 2021 that will reduce this GIS benefit by $4,000 the following year (July 2022 to June 2023). It will depend on the specific amounts of your OAS vs GIS payments, but it seems you may still receive a bit of GIS next year, but it will be greatly reduced.

When you start CPP at age 70 this will again impact your GIS benefit. Depending on how much CPP you’re eligible for that may result in all of your GIS being clawed back and you’ll be left with your 50% OAS benefit and both CPP benefits.

There are options however.

There are strategies like strategic RRSP contributions that could help you qualify for GIS for at least a few more years (assuming you and your husband have contribution room available).

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

There are also drawdown options. For example a fast drawdown of the RRIFs, depending on their size, could help you re-qualify for GIS in a few years.

A bit of planning could help you qualify for thousands in additional benefits. If you’re interested, click Start Planning in the menu and we can have a free Discovery Call to see if there are any opportunities that would justify a more detailed plan.

Hi Owen, my husband and I have a total CPP income $22000 (2021) plus he has another $3300 in pension income. Together we received $4600 in GIS this year, but that got almost entirely cut once I turned 65 this October and began collecting OAS. I would like to take out $20000 from my RRSP by end of 2021. When we file our taxes for 2021,will we be asked to repay the $4600 in GIS?

Hi Anna, it sounds like you were receiving the combined GIS + Allowance benefit up until October when you turned 65 and Allowance ended. This combined benefit is very generous and it will be more difficult to qualify for GIS without Allowance. Making a large RRSP contribution will likely cause your GIS to be entirely clawed back starting July 2022 (the GIS benefit starting in July is based on last years tax return). That being said, there are some options to consider. For example, making strategic RRSP contributions could help you qualify for up to $13,000 per year in GIS benefits between now and age 72. Here is a blog post with an example…

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

This type of planning is very complex, so I would highly recommend setting up a call with one of our advice-only financial planners. In total you could likely qualify for over $80,000 in additional benefits, so it makes sense to get a more detailed plan.

https://app.planeasy.ca/start-discovery

I am confused about clawing back of GIS/Allowance that is already paid out. My husband currently receives full OAS and some GIS, I receive CPP and the Allowance. We have no other retirement income. I will turn 65 in April at which time we will both receive OAS and the GIS along with our CPP. We have an RRSP investment of $49,000 that matures in March. We want to convert to a RIF and redeem the full amount to keep income taxes to a minimum by taking advantage of our low income, $16K in medical expenses and my husband’s disability tax credit. We do not need the RIF income to live, but rather, to pay off a small HELOC debt. Am I correct in assuming the following: Service Canada will stop paying us GIS in July of 2023 (because of our increased income in 2022), but will reinstate it in July 2024 when our income for 2023 goes back to just CPP? Or will we be expected to pay back any of the GIS paid in 2022?

Sorry…I omitted the fact my husband receives CPP as well.

Hi Laura, based on the information you shared, yes, your taxable income in 2022 will go up due to the large RRIF withdrawal which will impact the GIS benefits you receive from July 2023 to June 2024. The loss of GIS may also impact your ability to qualify for additional benefits like seniors dental care programs, discounted internet and phone service, and depending on your province, discounted electricity costs.

Thank you Owen for your timely response. I have someone preparing a preliminary 2022 tax return so we can see what the total tax bill will be if the full amount is withdrawn at once. It’s a question of what approach leaves us with the most money in our pocket while trying to mitigate income taxes and the loss of the GIS/benefits. The answer would be easier if we only had the one $50K RIF…we would take out the minimum RIF withdrawals over several years that would allow us to maintain some GIS/benefits and would keep income tax very low. However, we have two other RRSP investments, each worth $50K, one maturing 2023 and the other in 2026. It is not a large portfolio, but is still complicated enough that we are unsure what to do. Again, thank you for your response. I think I misunderstood a previous thread and thought that we might be asked to return GIS already paid, but I now understand that is not the case.

Hi Laura, given that you have an additional $100,000 in RRSPs that changes the strategy quite a bit. It may be more advantageous to make all these withdrawals in one year. You would be close/over the OAS clawback threshold, which is another concern, but it would mean you only lose GIS benefits for 1 year and you would avoid losing GIS benefits for 3 years. I would encourage you to complete the Discovery questions by clicking “Start Planning” in the top menu and booking a free Discovery Call with one of our advice-only financial planners. The cost of a custom financial plan is going to be small compared to the potential loss of GIS benefits over 3 years. We’ll be able to help create a drawdown plan that minimizes your GIS clawbacks.

the GIS calculation charts and your comments keep mentioning “income” minus OAS and GIS. Throughout the comments, there is little distinction between “net income” and “taxable income”. It seems that a t5007 for the hypothetical value of the subsidized bus pass for BC seniors on GIS becomes part of NET income, and is later subtracted on line 25000 to create TAXABLE income. So it seems like that bus pass subsidy ($579) , while not taxable, causes a 50% ($289) clawback of GIS. The pass is not worth to me the $289 PLUS the $45 fee to get it. But the BC benefits website says that the t5007 does NOT affect your GIS. Seems untrue.

Hi Ryan, your comment brings up an interesting nuance to GIS planning and that is that line 23600 (net income for tax purposes) is the basis of most income tested government benefit calculations but there are other adjustments that occur. For GIS, both OAS and GIS are excluded from the calculation. So although these amounts end up in line 23600, they will not impact the GIS benefit calculation. It seems that the BC bus pass subsidy is similar. You may want to reach out to the CRA about the calculation, but from the BC Gov. website it appears that the subsidy, although part of line 236000, does NOT actually impact GIS benefits. This leads me to believe that the CRA is making an adjustment for this benefit. Here is a bit more info… Section 7 speaks to the impact on GIS/SAFER…

https://www2.gov.bc.ca/assets/gov/british-columbians-our-governments/policies-for-government/bc-employment-assistance-policy-procedure-manual/additional-resources/t5007-info.pdf

Hi Owen

I have enjoyed your articles on OAS and GIS.

My wife and I qualify for maximum OAS and GIS . We liquidated our RRSP’s before getting OAS and GIS.

We also started CPP at 60 . We have maxed our contributions to our TSFA’s. We have a chunk of money to do something with sitting in cash.

Over the years we bought old houses and fixed them up, lived in them for a few years and sold them and no taxes.

I am in my 70/s now and still capable of taking on another old house but really do not want to Where is the most effective

place to put our cash to work with least effect on the GIS. I have been looking at GIC’s, bonds, and blue chip canadian dividend stocks, but even the blue chips are taking a bit of a beating in the market right now.

What do you think?

Hi Bill, it sounds like you’ve made some very good decisions regarding your government benefits! I’m impressed!

Your question is a great one.

One thing to keep in mind is that versus other investors, your risk/reward trade off is different, extra risk may only provide half the reward due to the 50%+ GIS clawbacks.

In terms of the type of investment return, capital gains will be the most attractive thanks to the 50% inclusion rate, so everything else being equal, an investment that provides more capital gains will be more attractive. Canadian dividends, while they enjoy a nice income tax advantage, are less attractive for GIS recipients due to the 38% “gross up” on dividend income. Watch out for bond funds valued at a premium to their face value, these funds will provide regular income that is fully taxable and incur full GIS clawbacks but will eventually provide a capital loss that is only worth half due to the 50% inclusion rate (and then only if there are other gains to offset).

The other consideration is the amount you have available to invest, if you’ll be able to add it to your TFSAs over the next few years then the temporary GIS clawbacks are less of a concern in my opinion.

Another option to consider, especially after age 70, is a prescribed annuity. After age 70 the potential income from a new annuity tends to increase with age. The income from a prescribed annuity can be very efficient for GIS as the taxable income is spread over the life of the annuity.

Thanks for the great article. Is there a situation where a low income retiree might annuitize their RRSP? Could that open the possibility of some access to the GIS after 71?

Hi James, quick answer is no, an annuity purchased with assets inside an RRSP will trigger taxable income throughout the rest of retirement and cause an enormous amount of GIS clawbacks. Depending on the specifics of the plan, what I would look at with a client is making a large RRSP/RRIF withdrawal and then using the after-tax proceeds to purchase a prescribed annuity. A prescribed annuity is a special type of annuity that essentially spreads the tax burden over the life of the annuity which helps to lower taxable income in early retirement and helps maximize GIS.

This type of strategy is complex, it involves careful planning and a lot of tax being paid up front, but can have a significant benefit over time. I would highly recommend working with one of our advice-only financial planners before implementing a strategy like this… https://www.planeasy.ca/services/

This blog is an amazing resource….thank you.

One follow up question: I have set things up to have good access to the GIS until I turn 72 with pretty good access until I am 75 and my wife is 72–about 9 years away. At that point we will no longer qualify but we should be able to draw down our RRSPs with very little tax burden. If I were to choose to cash in all of our RRSP at once it looks like I would have to pay about 50% in taxes or about $135000 in taxes and $8000 in lost OAS. I figure it would take many years to recoup my losses and break even from my increased GIS access . My question is, what are the chances that the GC will alter the rules for qualifying for GIS? I live in Quebec and programs such as ‘property tax relief’ are based on the combined criteria of income plus net worth—where the max allowable savings for a household is only $50,000 ( Aggregate TFSA’s + savings accounts). I guess I’m asking a kind of ‘bird in the hand’ question.

Hi James, you’re right to consider drawing down the RRSP quickly after age 72, this can be a great strategy when the RRSP isn’t very large, but in my experience this strategy is very situational. It depends on the exact size of the RRSP, if there is any TFSA contribution room available, and how close a household is to the GIS cutoff already. It sounds like you have a sizable RRSP so I would recommend carefully considering the pros and cons before making any withdrawals.

For some this is a great strategy, for others it can easily backfire.

Now, regarding the Government of Canada changing the rules for GIS qualification to include a “means” test or to include TFSA income, this is always possible and the pressure to do so will only increase as TFSAs get larger. Its impossible to say what a future government would do so I would recommend re-evaluating at age 72 before making any large RRSP withdrawals.

Thanks for this….your response is very helpful. It sounds like I need a more detailed analysis of our situation and in the not too distant future I will be reaching out to a member of your team for a deeper dive into our specifics.

Again, I am very impressed by your presentation and analysis of this subject. I currently have a financial planner in our local small town and he has, on a few occasions, frustrated me in the fact that he doesn’t seem to know the nitty gritty details of the GIS and nor is he interested in this area of ‘low income retiree strategy’–this only to say the I am ‘shopping hungry’.

Bye for now,

James Quinn

I was informed in the Spring that I qualified for GIS (2022) When can I expect to receive a cheque? thank you.

Hi Bertha, this is a specific question for Service Canada. You may need to call Service Canada to enquire about your GIS payments.

The $5000 exemption, do I use the exemption to reduce my income in calculating for GIS qualification?

or is the GIS exemption only used if you qualify for GIS for claw back purposes?

Hi Olivia, its one and the same, the $5,000 exemption on employment income reduces the income used to calculate/qualify for GIS. GIS clawbacks start on the first $1 of taxable income so the exemption helps reduce the clawback. It can even help someone qualify for GIS by bringing their income below the cut off threshold. Hope that helps!

For a couple both 65+ with partial OAS of approx 23 years residence would they be better off to convert their 250k RRSP to a TFSA over 3-5 years or keep part/all to maximize their LARGER GIS income thresholds. Assume CPP of 600 and 300/mo.

How many extra years would they need to live to pay off the tax from accelerating their RRSP meltdown?