Will We Die With Millions?

The 4% Rule is a common personal finance rule. It suggests that a retiree can spend 4% of their initial retirement portfolio each year, adjusted for inflation, and have a reasonably high chance of success.

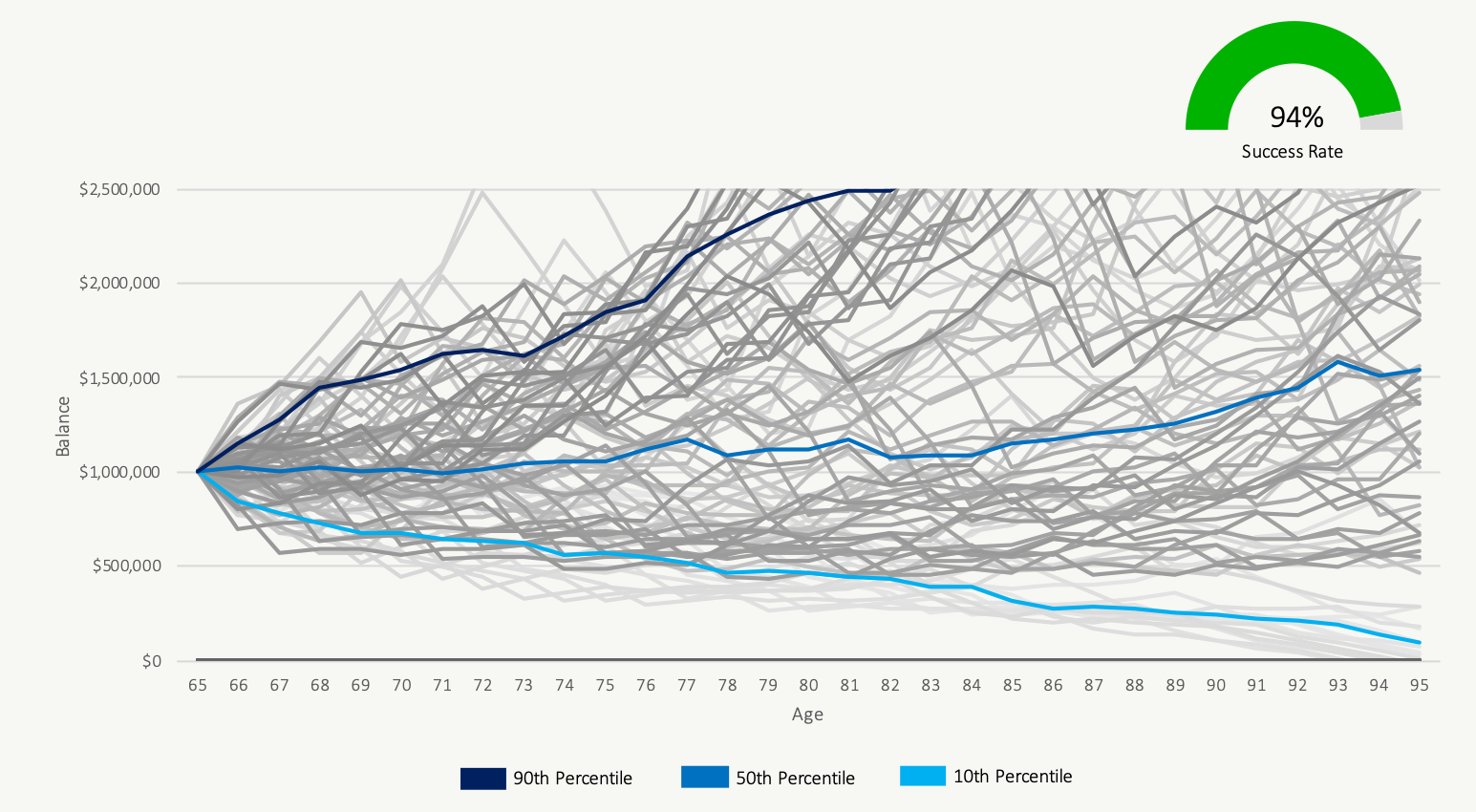

When talking about the 4% Rule, a retirement period is considered a “success” when the retiree doesn’t run out of money by the end of retirement. Any investment balance above $0 is considered as success, even if that’s just $1.

By using this safe withdrawal rate, the success rate of a retirement plan could be as high 90%-95%+. This means that during 5%-10% of historical periods a retiree could run out of money if faced with the same sequence of returns in the future.

But… this also means that during 90%-95% of historical periods a retiree will end up with money left over, sometimes a lot of money.

This is the unspoken downside of the 4% Rule. By aiming for a high success rate of 90%-95% we’re often building plans for the very worst-case scenarios. By using the 4% Rule we’re planning for a very poor sequence of returns in early retirement, we’re planning for below average returns for 5, 10, 15+ year periods, or we’re planning for high inflation that is significantly above the average.

But what happens if we get average returns, average inflation, and steady growth year over year… well… we could die with millions in the bank.

No one wants to be “the richest person in the graveyard”, so what can be done about the fact that 90%-95% of the time the 4% Rule will leave us with lots and lots of money in late retirement?

There are a couple options to consider but first, let’s look at the typical “success rate” analysis that we do in a retirement plan and what “success” actually means.

Retirement Success Rate

The 4% Rule is considered a success if there is at least $1 left at the end of the retirement projection. The analysis uses historical periods of stock returns, bond returns, and inflation rates to simulate different “paths” that a retirement plan could take.

Most retirement calculators use a simple average rate of return. This creates a pretty graph, with a nice straight line, but it doesn’t reflect reality. In reality a retiree will face periods of low or negative investment returns that can greatly affect the success of their retirement plan. This is known as sequence of returns risk. Even though the average return is the same, the sequence of those returns matters a lot.

Example: Retirement at age 65 with $1,000,000 in financial assets and $40,000 annual withdrawals (plus CPP/OAS of $30,000 per year for a total retirement income of $70,000 per year)

By using the 4% Rule we have a high success rate over 30-years but our retirement plan can take many different “paths” depending on the actual sequence of investment returns we might face in the future. In this example we only have a few historical periods that end in failure, but we also have many, many historical periods that end with millions.

This gets worse over longer retirement periods. Sometimes we’re planning for long retirement periods of 40+ years which requires a safe withdrawal rate (SWR) that is below the typical 4% Rule. This reduced SWR reflects the longer retirement period. This is typical for many retirees who retire in their 50’s or early 60’s. There is a reasonably high chance of making it to your early 90’s so we need to plan for a long and healthy retirement. Unless there are known health factors, we would expect a 25% chance of living to early 90’s and a 10% of chance of living to late 90’s. With a long retirement period and a lower withdrawal rate this increases the odds of dying with millions.

So, what are the options? How do we avoid being the “richest person in the graveyard”?

Option 1: Variable Spending

One of the best practices when building a retirement plan is to plan for the worst but hope for the best. We want to ensure that the “core” part of the retirement plan is successful in 90%-95% of historical periods. This provides a certain level of peace of mind that “core” spending is achievable in retirement regardless of what the future holds*.

What “core” spending means will vary from person to person. Core spending could include no discretionary spending, or it could include a certain level of discretionary spending on hobbies, vacations etc.

On top of “core” spending we also want to test how successful the plan is with additional “variable” or “discretionary” spending. This is spending that can change from year-to-year and could be stopped entirely if faced with a really poor series of investment returns (ie. the great depression). It could be things like extra vacation spending which can easily be reduced/changed from year-to-year.

With this additional spending the success rate of a retirement plan might drop to 50%-60%. This means the extra spending can be supported in 50%-60% of historical periods but in 40%-50% of historical periods it may need to be reduced or eliminated entirely.

If investment returns are average or above average then this extra spending is safe, but if investment returns turn negative or are below average for a period of time then this extra spending is at risk.

By allowing part of retirement spending to be variable and based on actual investment returns there is a lower chance of dying with millions in the bank (although it still could happen in 50%-60% of historical periods).

Option 2: Plan For Estate Goals

The second option is of course to plan ahead for specific estate goals. With a high chance of dying will a large investment portfolio we want to ensure that the estate is as tax efficient as possible and can be passed on without a large impact from taxes.

There are a few options that can be used to achieve this but one we almost always use is to slowly transfer of assets to the TFSA each year. Because the TFSA accumulates contribution room, even in retirement, we want to take advantage of this tax advantaged space to decrease taxes on any future estate.

This involves slowly drawing extra from the RRSP/RRIF/LIF and transferring those assets to the TFSA. This will trigger some extra income tax each year, but it will slowly transfer these assets into the TFSA where they can continue to grow tax free.

Because the RRSP/RRIF/LIF is entirely taxable in the year of death it is beneficial to move as much as possible into the TFSA as contribution room becomes available. Ideally all of the investment assets end up inside the TFSA in the future and they can be passed on without any tax.

When combined with principal residence exemption on a retiree’s home, the slow transfer of investment assets to the TFSA can mean that the majority of estate assets can be passed on tax free.

Option 3: More Aggressive Spending Plus The Assumed Sale Of Real Estate Assets

The last option is unique to home owners. The last option is to spend even more aggressively in retirement but plan for a downsize in the future. This downsize wouldn’t need to happen if investment returns are above average, but in most cases would require the sale of real estate assets late in retirement to support spending.

The downsize could be into a smaller home, or it could into a rental apartment. In either case the goal is to free up capital from home equity to fund any remaining retirement years.

This is a more aggressive plan and isn’t often a goal for retirees. Many retirees would prefer to stay in their home as long as possible (us included!). Their goal is to use their home equity for unexpected expenses late in retirement, like long-term care or a health emergency.

But for retirees who want to make the absolute most of their assets, this more aggressive option allows home equity to be freed up late in retirement. This can allow for a higher level of spending throughout retirement but also reduces the flexibility within the plan. It also reduces the size of any potential estate.

Will We Die With Millions?

Personally, our plan is a hybrid of option 1 and option 2. Like many future retirees we want to stay in our home as long as possible and won’t be planning to sell at any point. We will however plan to include a variable component in our retirement spending. This extra spending would be for travel and would be on top of our “core” travel budget. This variable spending will increase/decrease from year-to-year based on actual investment returns.

Based on our plan, this would be approximately $10,000 per year in variable spending but it depends highly on the mix of assets and sources of income in retirement.

We also plan to pass on assets in our estate. If everything goes well, we would hope to pass on our principal residence tax free as well as two reasonably large TFSAs tax free as well.

Although we don’t want to be “the richest people in the graveyard”, we’re comfortable with the potential of leaving a large sum of money in our estate if that means we can enjoy a long and stress-free retirement.

*We have no idea what the future holds, so we use historical investment returns to “test” a retirement plan. Of course “past returns are not an indication of future success” so there is a risk that we see future investment returns that are outside of historical results/volatility.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments