How RRSP Contributions Affect Your Government Benefits

RRSP contributions can be a great tool to help manage your income taxes before and after retirement. They can also be a great tool to help manage your government benefits in a similar way. RRSP contributions affect government benefits like the Canada Child Benefit (CCB), Ontario Child Benefit (OCB), Guaranteed Income Supplement (GIS), GST/HST Credit, Ontario Sales Tax Credit etc etc.

What many people may not realize is that most government benefits have a “claw back” rate that acts like a tax rate. If you earn more income the “clawback” rate will reduce your government benefits. But the opposite also happens, if you make an RRSP contribution and your income goes down, then this “clawback” rate will work in reverse and it will increase your government benefits!

There are a couple situations where RRSP contributions can have a BIG effect on government benefits. Let’s take a look at two real life examples.

One example is a senior who is receiving GIS benefits. We’re going to plan some strategic RRSP contributions to help them maximize their GIS benefits. This is counter-intuitive, we’re always told that TFSAs are best for low-income individuals, but in this case we can use RRSP contributions strategically to maximize GIS.

The second example is a young family with three children. They’re receiving the Canada Child Benefit and the Ontario Child Benefit and we’re going to plan some strategic RRSP contributions to help them maximize their family benefits.

RRSP Contributions For Seniors Receiving GIS

Making a strategic RRSP contribution is one of the most interesting planning opportunities for seniors who are receiving GIS. RRSP contributions can be used to “offset” other income from sources like CPP. This can help a low-income senior maximize GIS for a few years.

This strategy can be very impactful because GIS has a “clawback” of 50% to 75%. This means for every $1,000 in RRSP contributions we’ll be able to increase our GIS by $500 to $750. Not a bad return!

The challenge is that at some point we need to withdrawal all these RRSP contributions. This withdrawal has an impact, but the net effect of maximizing GIS is that we still come out further ahead.

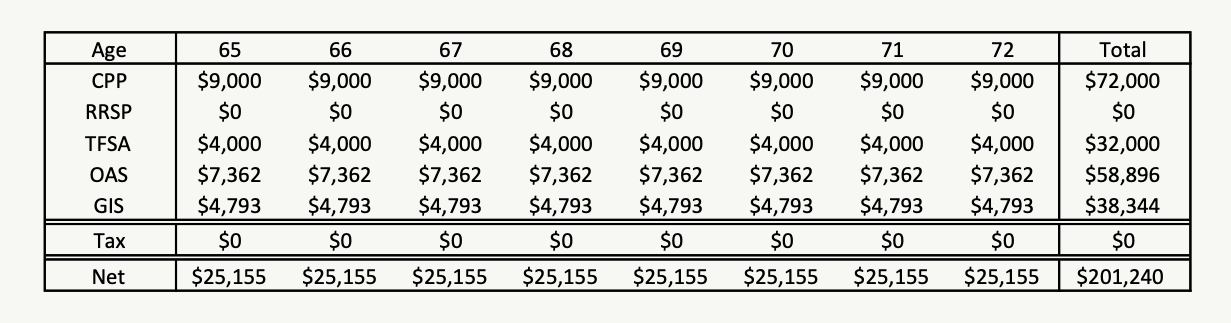

To illustrate this example let’s look at a scenario. We have a low-income senior who just turned 65 this year. She’s fully retired and has started CPP. She will receive $9,000 per year from CPP and the maximum $7,362 per year from OAS. The rest of her income comes from her $80,000 TFSA.

With $9,000 of CCP income she will see a reduction in her GIS benefits but she will still receive $4,793 per year in tax free benefits from GIS. OAS income does not impact GIS benefits, nor does income withdrawn from a TFSA.

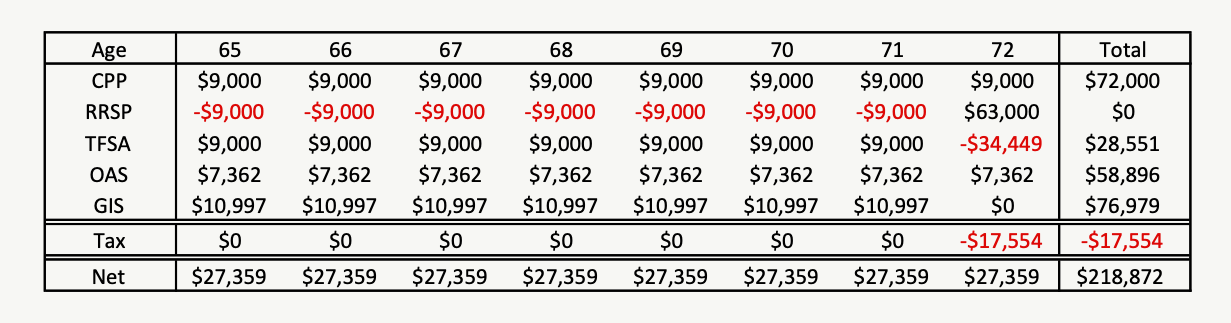

But, with a strategic RRSP contribution of $9,000 we can maximize her GIS. We can shift $9,000 from the TFSA into an RRSP and offset the CPP income. This reduces her income to zero and she will receive the maximum GIS benefit of $10,997, an increase of $6,204! That’s an average return of 68.9% on our $9,000 RRSP contribution! Wow!

But we do need to withdraw these funds eventually, so let’s see how this plays out over the course of 8-years until age 72 when we’re forced to start RRIF withdrawals…

GIS: No RRSP Contributions

Maximizing GIS: With RRSP Contributions

With some strategic RRSP contributions we’ve received an extra $38,635 in GIS benefits over 8-years and an extra $17,632 in net cash flow available for spending!

RRSP Contributions For Families Receiving CCB/OCB

Strategic RRSP contributions can also help families maximize their family benefits. Benefits like the Canada Child Benefit and the Ontario Child Benefit have high claw back rates, when combined with regular income tax rates the combination of income tax and benefit clawbacks can reach 50%, 60% or even 70%+.

Making RRSP contributions means that a family can get the most out of their savings. It does require some planning and foresight. We assume that our family will be able to withdraw these RRSP contributions in the future at much lower tax rates when the children are fully grown.

TFSAs can often be the saving vehicle of choice for low and moderate income families. They’re easy, flexible, and tax free. But a well timed RRSP contribution will help maximize their available savings.

To illustrate this let’s look at an example. We have a family with 3-children under 6. One partner stays at home with their children while the other partner earns approximately $60,000 per year. Cash flow is tight but they’re still able to save $5,000 per year after-tax. They’re deciding between a $5,000 TFSA contribution and a $5,000 RRSP contribution.

Before we look at the two contributions, lets understand their tax and benefits clawback rates…

- Marginal Income Tax Rate: 29.65%

- Canada Child Benefit Clawback Rate: 19.00%

- Ontario Child Benefit Clawback Rate: 8.00%

- Ontario Energy and Property Tax Credit Clawback Rate: 2.00%

- Ontario Sales Tax Credit Clawback Rate: 4.00%

Total Marginal Effective Tax Rate: 62.65%

The first option is to put the $5,000 in the TFSA. This is easy and makes these funds very accessible in the future. This would give us a $5,000 balance in the TFSA.

The second option is to put the $5,000 in the RRSP. This would create a $5,000 tax deduction which would help reduce income tax and government benefit clawbacks. Between the tax refund and increased benefits, the $5,000 RRSP contribution creates $3,131.50 in after-tax savings at 62.65% which could be placed in the TFSA ($5,000 x 62.65%). So with the RRSP option we end up with $5,000 in the RRSP plus $3,131.50 in the TFSA for a total of $8,131.50 in savings!

Obviously we’ll need to pay tax on these withdrawals in the future, but if withdrawn at a 20% tax rate (with some good pre-planning and income splitting in retirement) the net effect is that this family comes out much further ahead by making an RRSP contribution.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Using RRSP Contributions To Maximize Your Financial Plan

These are just two basic examples of how strategic RRSP contributions can help you maximize your financial plan. Understanding the impact that RRSP contributions can have on your plan will ensure that you’re reaching your goals in the easiest way possible.

RRSPs and spousal-RRSPs provide a number of financial planning opportunities to help make the most of your savings.

But… just like a well time RRSP contribution helped improve the financial situation in our two examples, a mistimed RRSP contribution can work against you.

Find out when and how much you should be contributing to an RRSP by working with an advice-only planner. We help our clients plan contributions and withdrawals from RRSPs, TFSAs, RESPs etc. We create a cash flow plan that ensures our clients are maximizing the planning opportunities over time. This can be worth $1,000’s!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

18 Comments

Trackbacks/Pingbacks

- March’s Top Three Reads | Personal Finance | Spring Planning - […] of thinking about why before we think about how. Superb information from Owen Winkelmolen about increasing government benefits with…

Which is better boosting CPP contributions or contributing to an RRSP? I am a small business owner .

Hi John, great question, this is one of those questions that seem simple but are actually quite complex. It will very much depend on your personal and business circumstances. Because of both the complexity and the size of the opportunity my recommendation would be to speak with an advice-only planner who specializes in business owners and understands government benefits. Most do a free initial Discovery call during which you can discuss different strategies and opportunities.

https://www.adviceonlyplanners.ca/

I get tax of 14,180 in BC for a single 65+ with the 2000 pension amount (income of 79,362)

When they withdraw the RRIF, they would still get 10,997 GIS at age 72, until June of the next year.

Not sure what the -34,449 is? All of the 9,000 from the TFSA goes into the RRSP so there is no cash flow from the TFSA.

Hi Mark, this is a simplified example and the tax rates will vary from province to province. The GIS benefit is paid starting in the month of July following the tax year. In this simplified example we showed the GIS benefit in the same year to make it easier to understand the cause and effect relationship between RRSP contribution and GIS benefit. In the example the black/positive values are withdrawals or benefit payments, this represents incoming cash flow, and the red/negative values are contributions, this represents outgoing cash flow. At age 72 there is a large withdrawal from the RRSP (black/positive) and although there is some income tax to be paid the rest of this cash needs to go somewhere so there is a net contribution to the TFSA (red/negative). Hope that helps!

Hi. It seems the government has eliminated all these loopholes as of the 2021 taxation year. You state that OAS income does not affect gis benefits. In your example, she would now have to contribute the 9000(CPP)+7362(OAS)=16,362 to get the maximum GIS amount, since both are considered as income. Is this correct???

Hi Dan, although OAS is included in line 23600 on the tax return, it is excluded from the GIS calculation. So although OAS is considered taxable income, it does not affect GIS benefits.

Can you provide a source for this? All other sources I see online indicate they calculate GIS based on net income which is line 23600. Line 23600 includes OAS.

Hi John, if you go to the Gov. of Canada website for OAS/GIS (link below) and look at the benefit tables you can see that it states that the annual benefit is based on “Yearly Income (excluding OAS Pension and GIS)”. If you also look through the legislation (Old Age Security Act) you’ll also see that income from the act is excluded from the GIS calculation (meaning both OAS and GIS are excluded). Hope that helps!

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments.html

What is the date on this story? Is the advice still valid?

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

Hi Mike, the concepts are still valid, but the exact numbers will change as tax and benefit rates change over time. It’s best to create a more detailed plan using your exact situation.

I’m a senior looking to utilize RRSP contribution room to get GIS. However I am still working. How is self employment Income factored into GIS calculation? $5K working income is exempt and 10K is clawed back at 50% but when is this done? Can I earn $35,000/yr employment income plus CPP and Interest income and offset it by $35K In RRSP contributions and get max GIS?

Hi Diane, without knowing more my guess is that this strategy is likely to backfire especially if you expect to receive GIS later in retirement as well. The reason is that when withdrawn, those RRSP contributions will then cause more GIS clawbacks in the future. Making strategic RRSP contributions to maximize GIS is very effective at smaller contributions levels, for example when equal to CPP income, but at contribution levels of $35,000+ it may have a different effect. I would highly recommend creating a more detailed financial plan before making any RRSP contributions or withdrawals.

Hello Owen. Thanks for this valuable site. I have created a 12,000 RRIF to take advantage of the annual 2000 Pension Income Credit. I currently qualify for some GIS and it seems to me that the 2000 annual RRIF reduces my access to GIS because the Pension Tax Credit come much later in the tax form on line 31400 and it not part of my Net Income calculation. Is this correct? Have I made a mistake setting up the 12000 RRIF?

Hi Jamie, yes, it may have been a mistake. The pension tax credit is great, but its only worth 15-25% where as those RRIF withdrawals will cause 50%+ GIS clawbacks, but this depends on the situation.

It’s possible to move a RRIF back into an RRSP if you are under the age of 72. So if you create a detailed retirement plan and determine that RRIF withdrawals are not the best decision right now then it is possible to reverse this mistake. If that’s the case then it could help avoid $6,000+ in GIS clawbacks.

Thank you Owen! I couldn’t seem to find a straight answer anywhere. I’ll be coming to you guys in the not too distant future for a complete audit.

Hello,

I do not think the calculations above regarding “RRSP Contributions For Seniors Receiving GIS” are right.

After 8 years in TOTAL column, under TFSA should be the amount remaining from 80,000; so in first table should be [80,000-32,000] and in second table should be [80,000-28,551]

The final result is $217,240 vs $241,770

Hi Claudiu, there may be some confusion, the tables are showing income only, not account balances. So the Total column is showing the total income, taxes, and net income over the period. Hope that helps!

That may be, but you have to take into consideration the initial TFSA money (80,000) and the final TFSA money.

The person applying this strategy , at 72 would have (compared with doing nothing):

+ 3,449 in TFSA

+38,635 in GIS

-17,554 in tax

——————————-

+24,530

So, the person applying this strategy will be better of with +24,081at the end of this “experiment”