Did You Give Your Investment Advisor A 10% Raise? How Generous!

Did you give your investment advisor a 10% raise last year? How generous of you!

With many investment advisors and portfolio managers compensated based on assets under management (AUM), an increase in portfolio value translates directly into an increase in compensation.

Despite the tumultuous year, investment returns pulled off an incredible recovery and ended the year much higher. Bonds, Canadian equities, US equities, Global equities, all higher than the year before. If you were holding VGRO or XGRO (two all-in-one ETFs with an 80/20 allocation) your portfolio would have grown 10.89% or 11.42% respectively.

With investment returns of 10%+ year over year that also means investment advisors are being paid more in 2021 than in 2020. How much more? Well, if their investment returns matched the market then their fees would also increase 10%+ in 2021.

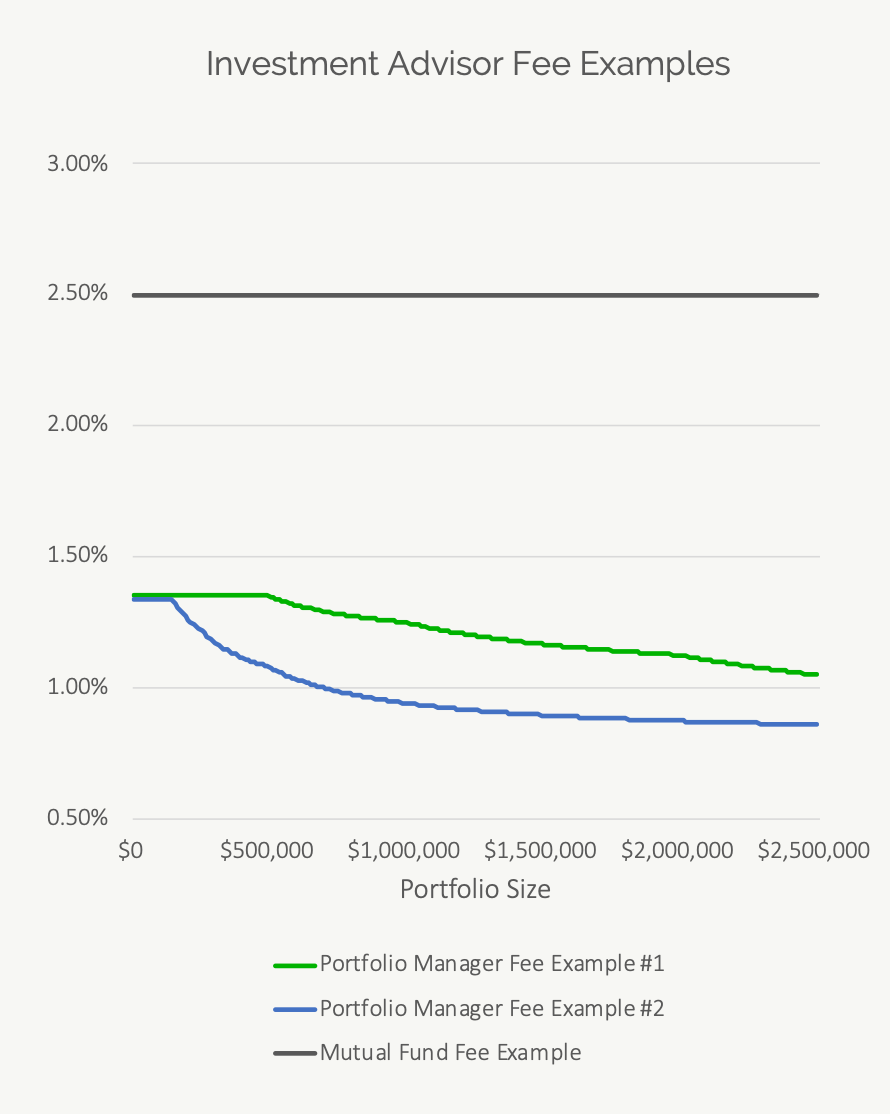

Although there are many forms of compensation, many investment advisors and portfolio managers make a percentage of the portfolios that they manage. This could be 1.5% to 2.5%+ for smaller portfolios, 1.0% to 1.5% for portfolios of $1M to $2.5M, and under 1% for large portfolios of $2.5M+.

If portfolio values are 10% higher year over year, then these investment advisors and portfolio managers just received a 10% raise!

Investment Returns And Investment Fees

A salary increase of 10% year over year is quite exceptional, and probably not the norm, but what if you could get an average 5.5% raise every year? That would sound pretty great wouldn’t it?

For many investment advisors this is how their compensation is structured. As a portfolio increases in size, their compensation increases as well.

Because portfolio values increase year over year thanks to the magic of compound interest, portfolio values will get exponentially larger over time and so will an advisor’s compensation.

With an 80/20 portfolio it’s not unreasonable to expect a 5.5% return over the long-term. That means an investment advisor will see their compensation grow by 5.5% per year as the investments they manage grow.

Fees That Scale

Many investment advisors and portfolio managers understand this dynamic and have fees that scale with portfolio size.

The fee for the next $xxx,xxx dollars they manage will be less and less as the portfolio grows. This makes sense because the cost of managing $200k isn’t double the cost of managing $100k. Similarly, the cost of managing $2M isn’t double the cost of managing $1M.

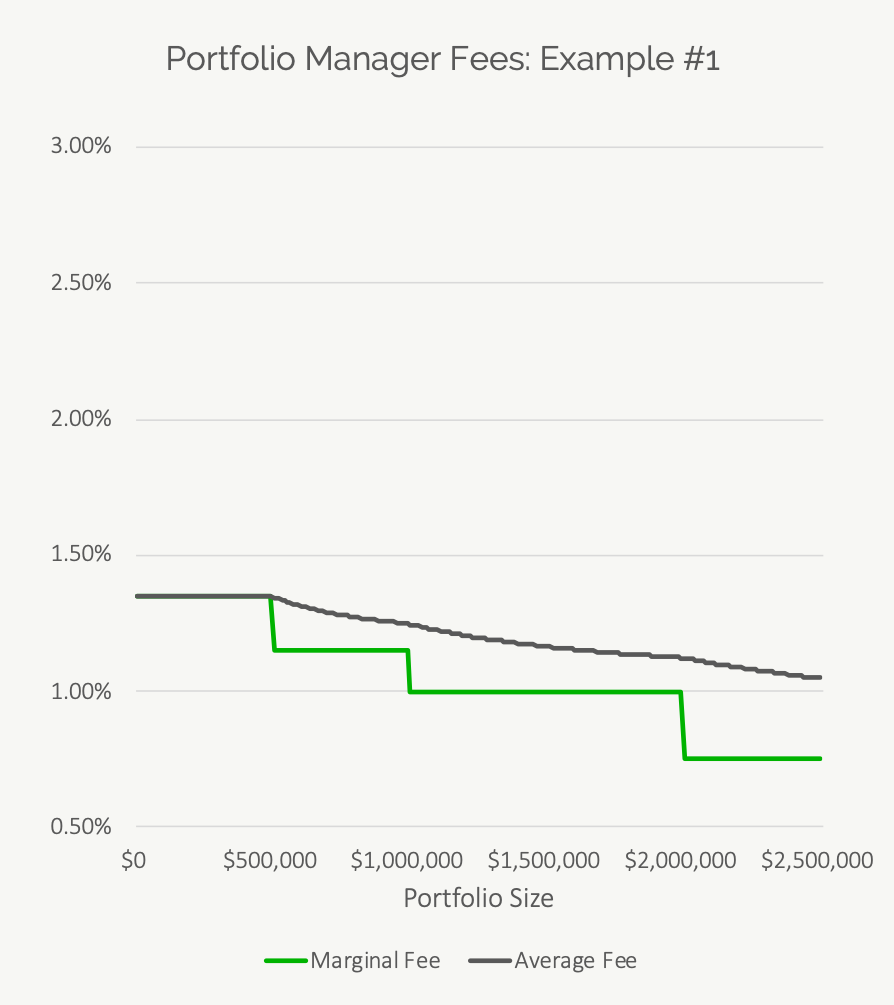

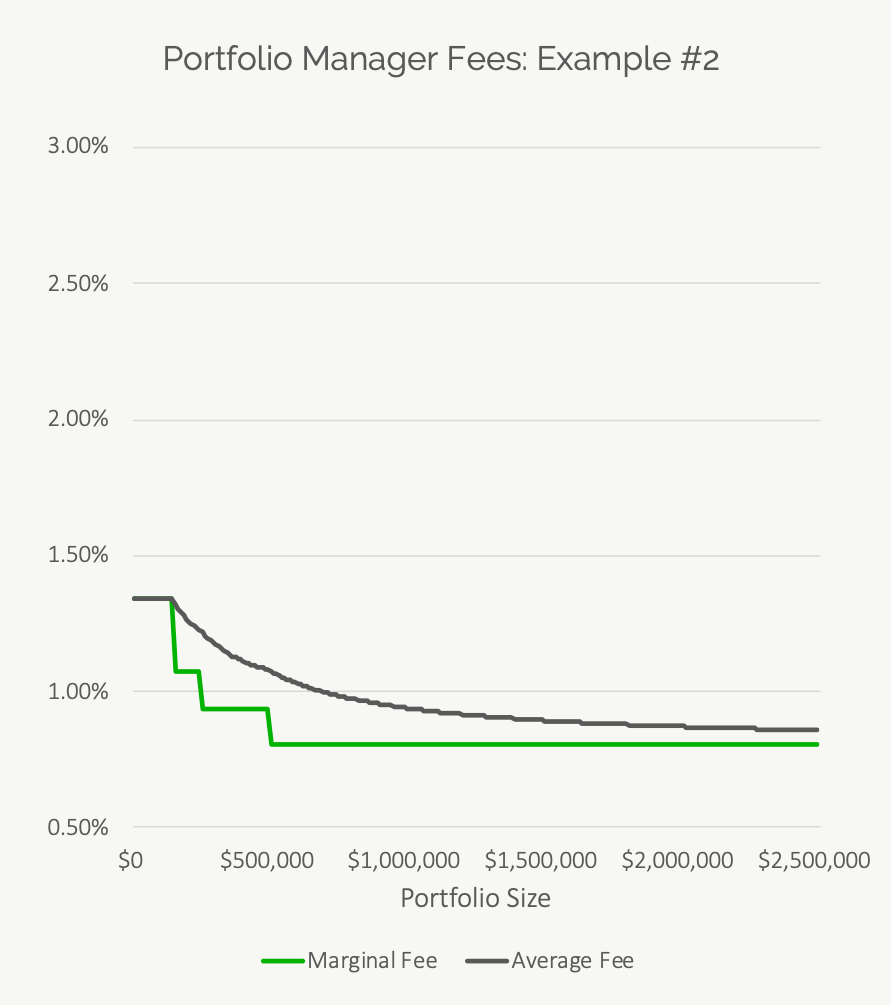

Here are two specific examples of how portfolio managers have fees can scale with the size of the portfolio they manage. There is the marginal fee, the fee for the next $1 of investment value, and then the average fee, the fee on the total portfolio. As the portfolio gets large and larger the marginal fee decreases and this brings down the average fee for the whole portfolio.

Fees That Don’t Scale

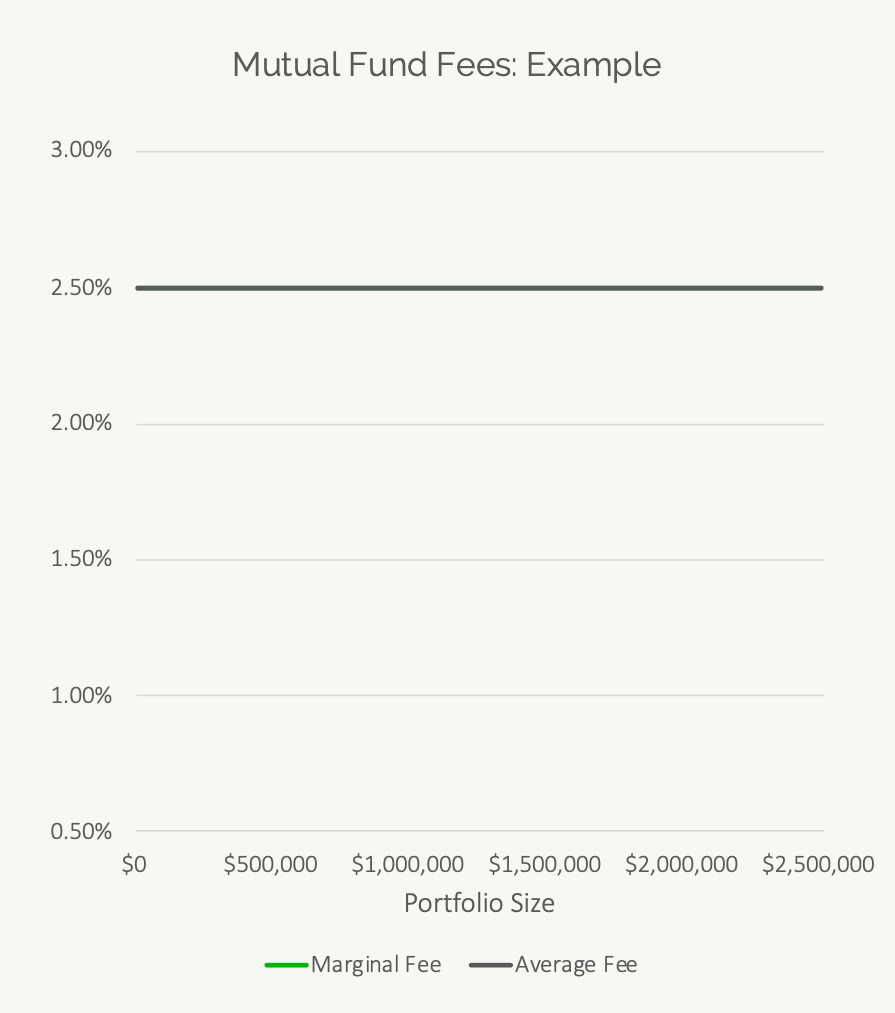

Some fees however do not scale with portfolio size. Many mutual funds have a set fee that does not scale with the size of the portfolio. This means that a typical mutual fund portfolio could have the same 2.5% fee with $500,000 in assets as it did with $50,000 in assets.

This affects many, many people… especially those people who started their investment portfolio at a young age and have seen it grow over time with new contributions and investment growth.

Over the last 10-years we’ve seen investment values grow rapidly. Investment contributions made 10+ years ago could have doubled or tripled in value by now. A portfolio that was $50,000 with $1,250 in annual fees could now be $500,000 with $12,500 in annual fees or even $1,000,000 with $25,000 in annual fees. With these types of mutual fund portfolios, the fees don’t decline as the portfolio grows.

If paying $25,000 per year in investment fees seems ridiculous… then I’d have to agree.

Investment Advisor Fees

Depending on the fee structure, some investment fees do not scale with portfolio size. While these fees may have seemed reasonable when the portfolio was small, they deserve a second look as portfolio size increases.

As the portfolio grows the level of support and advice may no longer match the annual fees being paid. For portfolios of $500,000, $750,000 or $1,000,000+ there are often lower cost investment options that provide the same or better advice at a much lower cost.

Don’t get caught paying 2.5% fees on a large portfolio. You’re likely overpaying for the same or less advice.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I have found this article to be very informative and packed with useful information.

My brother and I recently negotiated a lower management fee charged on our investments as we grouped all the family members under “one household”… which in turn resulted in a savings on the fee charged.

* Thank you for providing great content.*

Thanks for your comment Al! That’s great that you were able to negotiate a lower fee, many people don’t realize this is even possible.