‘All-In-One’ ETFs May Be The Best Way To Grow Your Money

The average investment portfolio in Canada consists of high-fee mutual funds but over the last few years we’ve seen the introduction of multiple new ways to invest. These new ways to invest are typically low-cost, highly diversified, and easy to manage. They’re a welcome change to the typical high-fee mutual fund portfolio that many Canadians use to invest.

The average mutual fund portfolio in Canada has investment fees of around 2.5% per year. On a $100,000 portfolio that’s $2,500 per year in fees. On a $500,000 portfolio that’s $12,500 per year in fees. And on a $1,000,000 portfolio that’s $25,000 per year in fees! That’s quite the drag on investment returns.

These are astronomical figures, especially when investors aren’t receiving the level of planning and advice that should be expected with these types of fees.

These fees are also not very easy to find, they’re typically hidden on the statement, or they’re split between advisor fees and investment management fees, so it’s very difficult to see how much you’re actually being charged. When looking at the typical investment statement it’s very hard for the average mutual fund investor to see that they’re paying such high fees each year.

One of the reasons these high-fee portfolios are so prevalent is because until recently, the main alternative to a high cost mutual fund portfolio was to do it yourself (DIY). This required setting up a self-directed brokerage account and it also meant buying and selling individual securities or perhaps ETFs. This can be very daunting for a long-time mutual fund investor.

But recently things have started to change. In the last 3-5 years we’ve seen multiple new ways to invest. These new ways to invest are easy, convenient, highly diversified, and low-cost. They’re typically built on an “index investing” philosophy. They’re not trying to “beat the market” but instead match the market return and dramatically lower fees. These new ways to invest include robo-advisors and the new “all-in-one” ETF.

Investing of course isn’t all about fees. There are many things to consider when creating an investment portfolio. But in my opinion the “all-in-one” ETF provides an amazing balance of all these factors and they may be the best way to grow your money.

Let’s take a look at some of the factors you should consider when creating an investment portfolio and, in my opinion, why the “all-in-one” ETF provides the best overall balance for the typical investor.

Disclaimer: This post should not be considered investment advice. Please do you own due diligence before selecting an investment portfolio. Personal Note: Having started with individual ETFs many years ago I do not personally own any “all-in-one” ETFs, but if I was creating an investment portfolio from scratch today I would seriously consider the “all-in-one” ETF as my investment option.

Investment Fees

Investment fees have gotten a lot of focus recently and rightfully so. The average investor in Canada is still paying some very high fees on their investment portfolio. These high fees mean that the average investor rarely outperforms the index and in the worst case sees over 1/3rd of their return being lost to investment advisors and fund managers.

The focus on fees has resulted in a movement toward low-cost index investing. The theory is that it’s nearly impossible to “beat the market” so it’s better to focus on matching market returns and controlling fees instead. Vanguard is famous for spearheading this change from high-fee active investing to low-cost passive index investing.

But fees are only one part of the overall investment decision. Now that there are multiple low-cost investment options like robo-advisors, low-cost mutual funds, “all-in-one” ETFs and individual ETFs, there are often other factors that need to be considered before making an investment decision.

So, although fees are an important consideration they are not the only consideration. An “all-in-one” ETF isn’t the lowest-fee option available. It’s more expensive than your typical 3 or 4 fund ETF portfolio. But when considering the other factors, it might be the best way to grow your money and it’s about 1/10th the cost of the typical mutual fund portfolio.

Asset Allocation

Asset allocation is an important consideration for every investor. Asset allocation will influence how much risk an investor has in their portfolio and what long-term return they may expect.

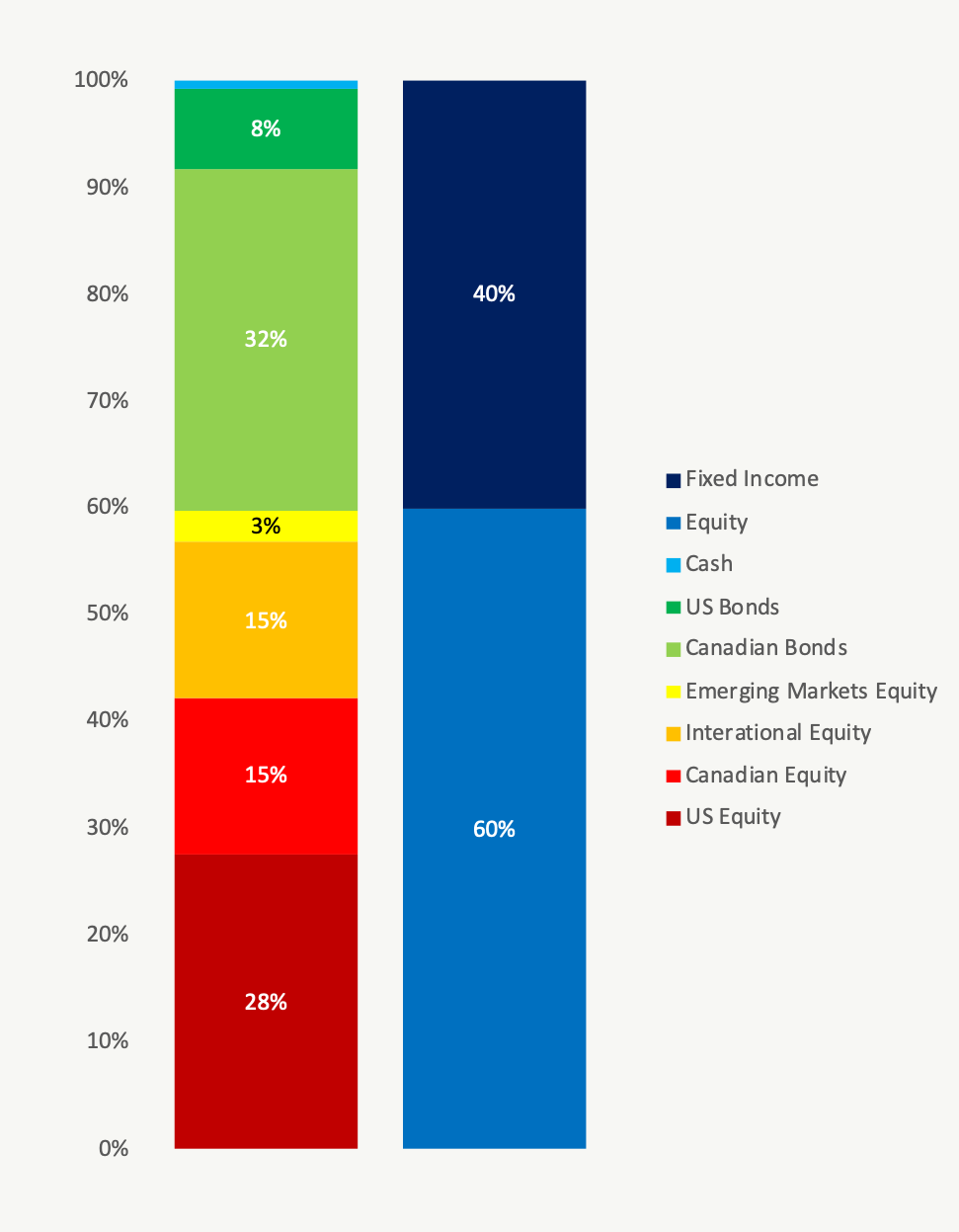

The typical asset allocation is a mix of stocks and bonds. For example, the 60/40 asset allocation is 60% equities and 40% fixed income. This high level asset allocation is typically based on an investors risk profile and their financial goals/timeline. Before deciding on a high level asset allocation like 60/40, or 80/20, or 100/0, it’s important to take a risk assessment to determine your risk profile.

This asset allocation can become more detailed when we include geographical allocation. We may want to allocate some of the 60% equity portion to Canadian, US and Global investments. Each allocation would have its own risk and return.

An “all-in-one” ETF has a very specific asset allocation. This is set by the fund provider. There is usually a higher level target allocation, like 60/40, or 80/20, or 100/0, but also a more specific allocation between geographies or types of investments.

There are multiple “all-in-one” ETF providers and while they all may have a 60/40 option, the specific asset allocation inside the ETF may differ slightly from one provider to the other, so check to see which “all-in-one” ETF better suits your needs.

The benefit of the “all-in-one” ETF is that it’s very easy to choose a high-level asset allocation like 60/40 and have the ETF maintain that target asset allocation through regular rebalancing.

Example “All-In-One” Asset Allocation

60/40 Portfolio

Automatic Rebalancing

One of the most challenging things about maintaining an investment portfolio is rebalancing. Over time different types of investments will perform differently and rebalancing is necessary to get the actual asset allocation back on target.

If 60/40 is the target asset allocation then over time it might be necessary to sell some bonds and buy stocks if stocks have dropped in value, or it might be necessary to sell some stocks and buy bonds if stocks have increased in value.

The rebalancing itself isn’t necessarily the challenge, but managing our own investor behavior can be. Often an investor can be their own worst enemy, allowing their asset allocation to drift off target by not rebalancing regularly. This drift can either increase risk (by having too much in equities) or decrease return (by having too much in bonds/cash).

You may believe that this behavior is rare but it’s actually extremely common. It takes a lot of discipline and planning to stick to a target asset allocation.

During difficult times this becomes more common. Investors sometimes try to time the market, reduce risk, take money off the table, build up a cash reserve etc etc.

This behavior leads to a gap between actual asset allocation and target asset allocation. It leads to cash piling up in savings accounts and investment accounts. It also leads to decreased long-term returns. At precisely the moment when investments are “cheap” some undisciplined investors shift to cash or other safe investments.

This market timing can be extremely detrimental. There have been some great studies that show long-term returns can be 0.3% to 2.61% lower due to investors trying to time the market. This lower return actually increases the risk of running out of money in the future. So even though an investor believes they’re decreasing risk by shifting into cash, the fact is that they’re potentially doing the exact opposite by decreasing their long-term returns.

Because “all-in-one” ETFs automatically rebalance, they help investors avoid this market timing issue, they help avoid bad investor behaviour. By using an investment option with automatic rebalancing the investor is always close to their target asset allocation. For a highly disciplined investor this may not make much difference, but for the average investor this can potentially increase returns by avoiding the urge to “time the market”.

Diversification

Diversification is an important way to reduce risk. The idea behind diversification is that the value of many assets don’t move in a similar way. They may even move in an opposite way. By owning a diverse group of investments this can help balance the impact of certain changes in the market.

The best example I’ve seen is to think of two companies, one a coffee bean grower and the other a coffee shop. When coffee bean prices rise this helps the coffee bean grower, allowing them to earn more income for the same harvest. But it hurts the coffee shop, causing its input costs to increase and margins to shrink. If you owned shares in the coffee bean grower your investment would rise, if you owned shares in the coffee shop your investment would fall. But if you owned shares in both the coffee grower and the coffee shop your investment would be stable. The diversification from owning both companies means your investment portfolio isn’t impacted by the price of coffee beans. This is the benefit of diversification.

Index investing provides a high degree of diversification. Index investments try to recreate the return of an entire index. This index could be made up of dozens, hundreds or even thousands of different investments. This provides a high degree of diversification.

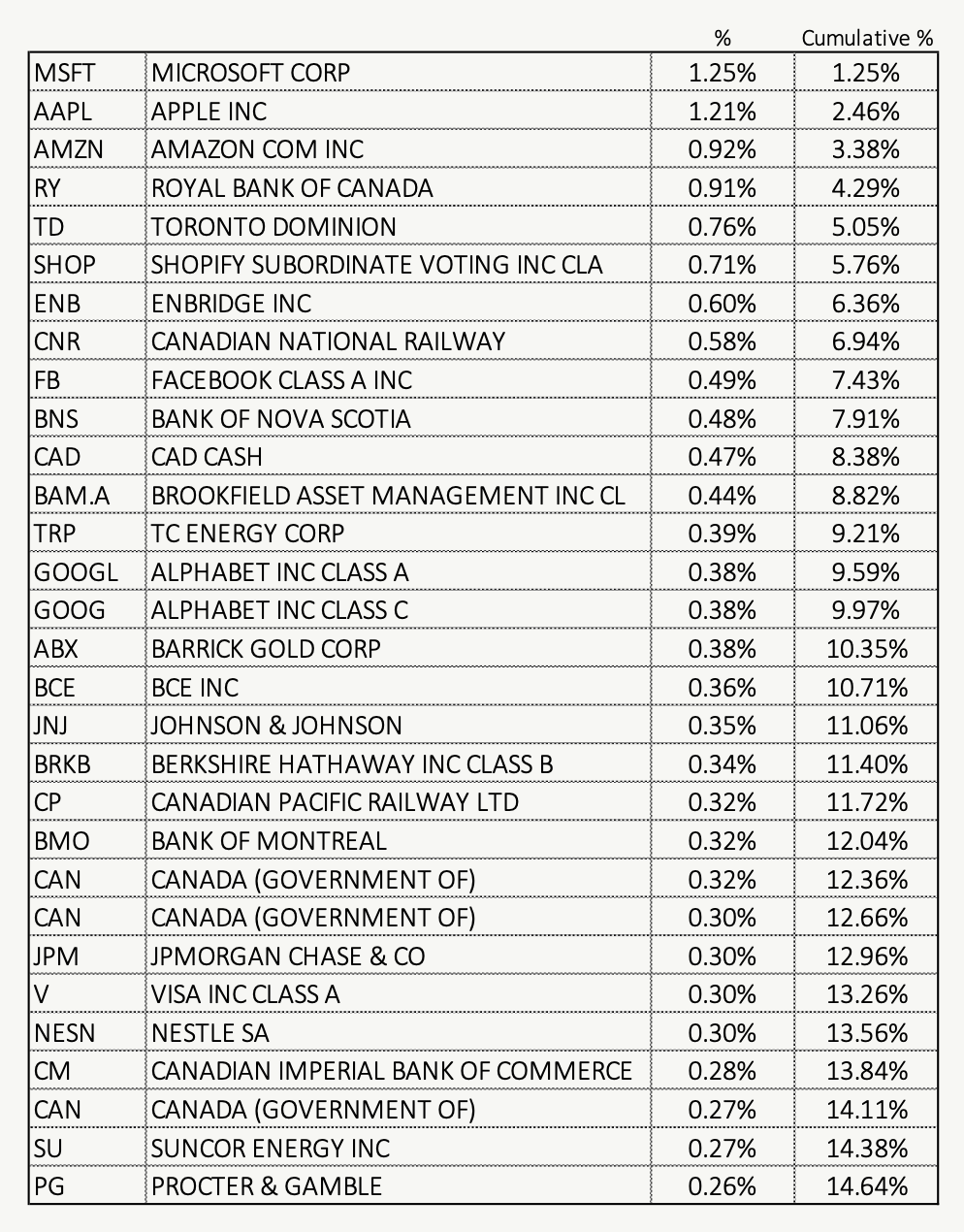

The “all-in-one” ETF provides an extremely high level of diversification. It typically contains multiple index investments across geographies, sectors, and investment types. This makes it a very inexpensive way to get investment exposure to thousands of investments in one shot. For example, the top 30 holdings from “all-in-one” ETF we’ve used as an example represents 14.64% of total assets (shown below). Those 30 holdings are only a small piece of the over 17,000 holdings within this particular ETF.

Example “All-In-One” Diversification

60/40 Portfolio – Top 30 of 17,605 Holdings

Investment Management

One of the last factors to consider is investment management. This is the day-to-day management of contributions, rebalancing, withdrawals etc. It also includes the annual tax implications of the investment portfolio.

Different investment options are easier to manage than others. One of the big draws behind a high-fee mutual fund portfolio is that it is extremely easy to manage. The investor typically has an investment advisor to help with paperwork, setting up automatic contributions, or setting up systematic withdrawals. This is very attractive and is one of the reasons lower-cost alternatives haven’t grown as quickly.

But with the advent of the robo-advisor this has become easier. The robo-advisor does a lot of the same paperwork, automatic contributions and systematic withdrawals. This makes it easy to manage an investment portfolio while also lowering fees (Note: One downside of the robo-advisor is apparent when investing with a non-registered account. The robo-advisor holds many investments and makes many changes throughout the year. In a non-registered account this can mean many, many tax slips that need to be managed during tax time. Of course, this isn’t a concern for investors using tax advantaged accounts like the RRSP or TFSA).

The “all-in-one” ETF isn’t quite as easy to manage as a robo-advisor. First, to purchase “all-in-one” ETFs the investor requires a self-directed brokerage account. This means completing paperwork and account setup. Second, once the account is set up its still necessary to fund the account and purchase the ETF. ETFs are purchased on the stock exchange. This means the investor needs to make trades during market hours (ie. 9:30am to 4pm). Third, ETF purchases (for the most part) cannot be automated. The investor needs to log in and make purchases on a regular basis. This extra work means the “all-in-one” ETF is not the easiest investment to get set up or manage.

With some “all-in-one” ETF there are options to decrease this workload. It’s possible with some ETFs to set up regular purchases through the fund provider.

For the most part, the “all-in-one” ETF isn’t the easiest to get set up or manage day-to-day, but once set up it becomes much simpler to maintain over time (especially once the investor becomes more comfortable with a self-directed brokerage account).

The Best Way To Grow Your Money

While not perfect, the “all-in-one” ETF provides a very attractive balance of all the different factors to consider when creating an investment portfolio.

It isn’t the lowest fee option available, but it’s pretty darn close.

It’s easy to choose a target asset allocation.

It’s easy to maintain that target asset allocation thanks to the automatic rebalancing (plus it helps investors avoid potential behavioural pitfalls)

It’s highly diversified, an important factor to reduce risk.

It isn’t the easiest to set up and maintain but becomes much simpler over time.

Considering all these factors together the “all-in-one” ETF may be the best way to grow your money. It provides the option to “set it and forget it” for the individual investor. It’s low-fee and can grow annually without the drag of high investment fees.

Disclaimer: This post should not be considered investment advice. Please do you own due diligence before selecting an investment portfolio. Personal Note: Having started with individual ETFs many years ago I do not personally own any “all-in-one” ETFs, but if I was creating an investment portfolio from scratch today I would seriously consider the “all-in-one” ETF as my investment option.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments