4 Investment Planning ‘Must Haves’ For Every Investor

Do you have an investment plan? Do you know what an investment plan is? Did you know that an investment plan can save you $1,000’s and keep you sane during a downturn?

Why do you need an investment plan?

Having an investment plan is critical for every investor because we’re not always the rational, logical, disciplined investors we’d like to be. We’re emotional. We fear loss. We suffer from behavioural traps.

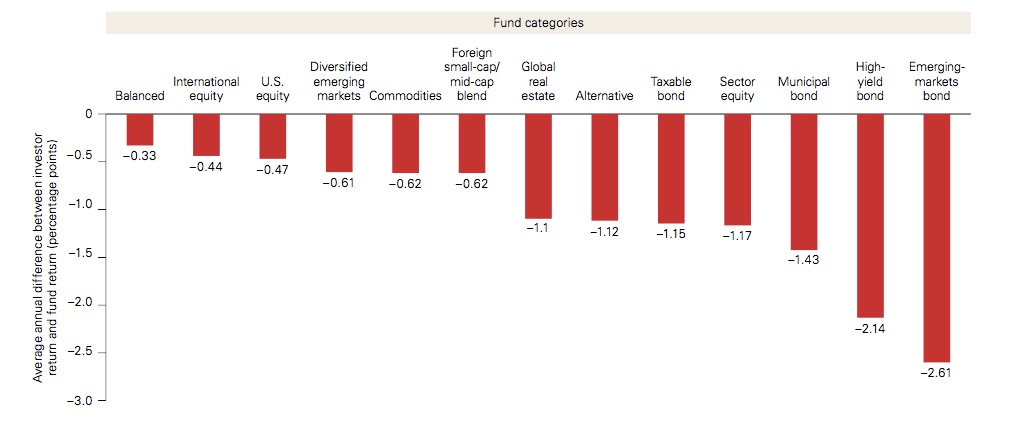

The performance of individual investors has been repeatedly shown to lag the index in which they invest. Morningstar does an analysis called ‘Investor Return’ whereby they measure cash inflows and outflows for different funds.

These cash inflows and outflows are essentially investors timing the market. Individual investors don’t behave rationally. They sell investments during a crisis, causing large outflows, and then when things get better they buy back in. Essentially buying high and selling low. This causes individual investor return to be lower than the fund in which they’re invested

How large is the gap between investor return and the fund return? Anywhere from -0.33% to -2.61% depending on the fund. Vanguard has summarized the gap by fund in this handy little graph.

So what can you do?

An individual investor can avoid many of these issues by creating an investment plan.

An investment plan will help reduce the lag between your return and the fund return. Over time this can help you save $1,000’s. This will help you reach your financial goals faster. But most importantly, having an investment plan will help keep you sane during a downturn.

There are 4 key components to any investment plan.

1. Goals

Any investment plan needs to start with a financial goal. Different goals require different investments. Each goal should have its own investment plan. Even the most basic financial goal needs two key components.

Amount – How much do you need to save?

Timing – When do you need it?

Every financial goal needs its own investment plan. Asset allocation, tax strategy, risk profiles, liquidity requirements are different for each goal. In general goals can be broken down by time, short-, medium- and long-term goals.

Short-Term Goals (1-5 years): Buying A Home, Emergency Fund

Investment Profile: Low Risk, Low Return, Maintain Principle

These goals are short term, they require safe and liquid investments. Think a high interest savings account or guaranteed bank deposit. Although the rate of return is lower, this investment strategy ensures that the principle remains intact.

Medium-Term Goals (5-15 years): Children’s Education, New Car Purchase, Vacation Home Purchase

Investment Profile: Medium Risk, Medium Return But Also Potentual For Small Loss of Principle

These goals are medium term and due to their time frame they can be a candidate for a more balanced investment profile. Think about a mix of stocks, bonds and guaranteed bank deposits. The exact mix will depend on your risk tolerance. The return on a balanced portfolio will be higher but there is also more risk of the principle decreasing in the short term.

Long-Term Goals (15+ years): Retirement

Investment Profile: Higher Risk, Higher Return But Also Potential For Large Loss of Principle

These goals are long term. Because of their long-term nature, it is possible to take on more risk. Additional risk means additional returns, this can help you achieve your goals faster or with less savings.

This additional risk also means that you can see your principle decline significantly in the short- and medium-term.

Over the long-term though, an investor can receive a higher return from a portfolio of stocks and bonds. With a higher stock allocation the risk will increase but so will the investment return. The exact mix will depend on your risk tolerance which we’ll cover in the next section

2. Balance

Having the right balance of investments is important. You need to define your asset allocation based on your investment goal and your personal risk tolerance. Once you set this in your investment plan it shouldn’t change.

Leaning too far towards stocks will increase your returns but also your risk. For a risk averse investor this can cause unnecessary anxiety. On the flip side, leaning too far towards bonds/bank deposits will reduce risk but also reduce returns. Lower returns may lead you to miss your financial goals over the long-term.

Finding the right balance between risk and return is important for the individual investor. You don’t want to take on more risk than necessary.

Online investor risk profiles can help you decide your risk tolerance.

3. Cost

Cost can be a major drag on your portfolio. Any good investment plan will outline the various costs and how they impact your ability to achieve your financial goals.

There are three components to cost.

- Annual investment fees on the funds you use, also referred to as MER or Management Expense Ratio.

- Trading costs when buying/selling these funds.

- Tax efficiency of your investments, also referred to as asset location.

Investors need to have an investment plan that outlines the cost of their investments. A good investment plan will seek to reduce investment costs both now and in the future.

Investing with low cost ETFs is a great way to reduce MER. Using discount brokerage services that allow for free ETF purchases will reduce your trading costs. Ensuring you utilize tax advantaged accounts will help increase your tax efficiency.

Don’t underestimate the impact of costs. A low-cost three fund ETF portfolio can have a MER of 0.15% vs 1.5%+ for mutual funds. Using a discount broker can reduce your trading cost from $5-20 per purchase to zero. These two changes can help your investments grown by an additional $189,682 over 40 years.

“Don’t underestimate the impact of cost. Cost can be a major drag on your portfolio.”

“Having an investment plan is critical for every investor because we’re not always the rational, logical, disciplined investors we’d like to be.”

4. Discipline

The final and possibly most important component of any investment plan is discipline. A good investment plan will include clear guidelines for reviewing and rebalancing your portfolio.

Pre-set guidelines will help you avoid the emotional and irrational behaviour many individual investors face during difficult times.

Rebalancing of your investment portfolio should occur on a predetermine schedule and include two “rules.”

Rule one: rebalance your investments quarterly using new funds/dividends only. This will help reduce trading costs from selling/buying.

Rule two: only when the allocation drifts by more than 5% from the original goal should selling/buying be used to rebalance. This should be done once annually and at the same time each year.

Vanguard did a study that found these two rules will help reduce the number buy/sell rebalances from 1,068 to just 36.

In addition to rebalancing there should also be a review of your portfolio returns vs expectations. Adjustments should be made to increase savings if returns are lagging the initial assumptions.

If you’re in a well diversified portfolio there should be no need to change your investment structure (hopefully you’re using a simple three fund portfolio that covers domestic equities, international equities and bonds which means you wont miss out on any growth regardless of where it happens in the world).

Just know that past returns are no guarantee of future performance. Things can change, economies can stall, inflation can spike, and interest rates can deviate from historical averages. These might require you to save more each month to make up the difference.

Review your investment performance regularly and increase your savings rate if your return starts to fall below your expectations for a long period of time.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments