Tax Deferral Is Not Necessarily An Advantage

At this time of year, the interest in deferring tax is high. It’s easy to see the appeal of deferring tax, but is all tax deferral an advantage? Does paying tax now or paying tax later really matter? As we’ll see below, no, in some cases tax deferral is not an advantage.

Tax deferral can seem like a large advantage. If you can avoid paying $10,000 in tax today, and defer that tax to later, sometimes 10, 20, 30+ years later, then that money can continue to grow and earn income. This would seem like a large advantage would it?

For the average Canadian there are two main ways to defer tax…

1. Use an RRSP

2. Earn capital gains

In this blog post we’ll explore the first type of tax deferral, using an RRSP, and we’ll see that the tax deferral itself doesn’t necessarily provide an advantage.

First: Tax Deferral vs Tax Arbitrage

Before discussing the tax deferral it’s important to highlight the difference between tax deferral and tax arbitrage. This is important because often when the benefit of tax deferral is discussed its actually tax arbitrage that provides the benefit, not the deferral itself.

Tax deferral is when tax is delayed to some point in the future, usually by delaying the recognition of income.

Tax arbitrage is when income is shifted from a high tax rate to a low tax rate, thereby reducing total tax paid.

Tax rate arbitrage can take many forms. For international corporations, tax rate arbitrage may involve shifting income from a high tax jurisdiction to a low tax jurisdiction through some creative accounting or corporate structure.

But for the average Canadian, tax rate arbitrage usually means shifting income from a high tax rate year (perhaps when fully employed) to a low tax rate year (perhaps in retirement). This is the most common form of tax rate arbitrage.

Tax rate arbitrage provides a benefit because tax is paid at a lower rate in the future.

As we’ll see below, tax deferral itself doesn’t necessarily provide an advantage. As long as investments grow tax free, paying tax now or paying tax later doesn’t matter when the tax rates are the same.

Tax Deferral: TFSA vs RRSP

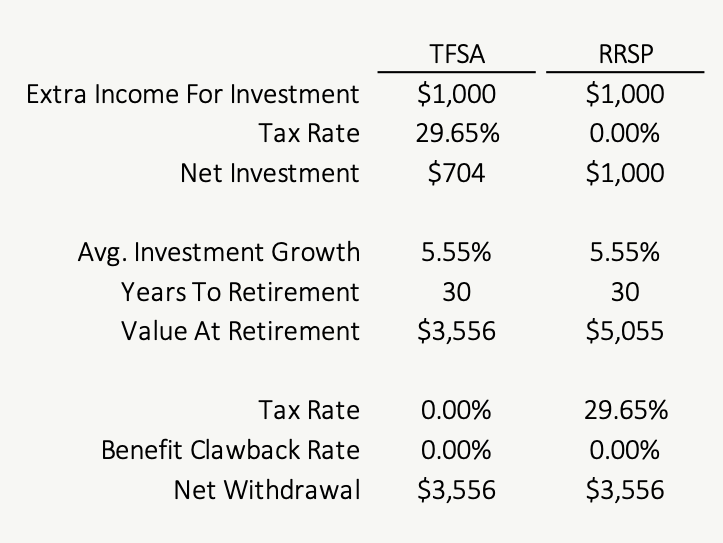

One of the simplest ways to show that tax deferral doesn’t necessarily provide an advantage is when comparing a contribution to a TFSA vs a contribution to an RRSP.

With a TFSA, the contribution is made with after tax dollars (paying tax now) and withdrawals are made tax fee (no tax in the future).

With an RRSP, the contribution is made with pre-tax dollars (no tax now) and tax is paid upon withdrawal (tax deferred and paid in the future).

The two accounts work oppositely, TFSA pays tax now, RRSP defers tax to the future.

What’s interesting is that when the tax rate today and the tax rate in the future is the same (when there is no tax rate arbitrage) this tax deferral provides no advantage. The tax deferral itself doesn’t matter as long as investments can grow tax free inside either account.

(Tax isn’t the only thing to consider, see the other disadvantages/ advantages of the RRSP and the disadvantages/ advantages of the TFSA)

Tax Arbitrage: TFSA vs RRSP

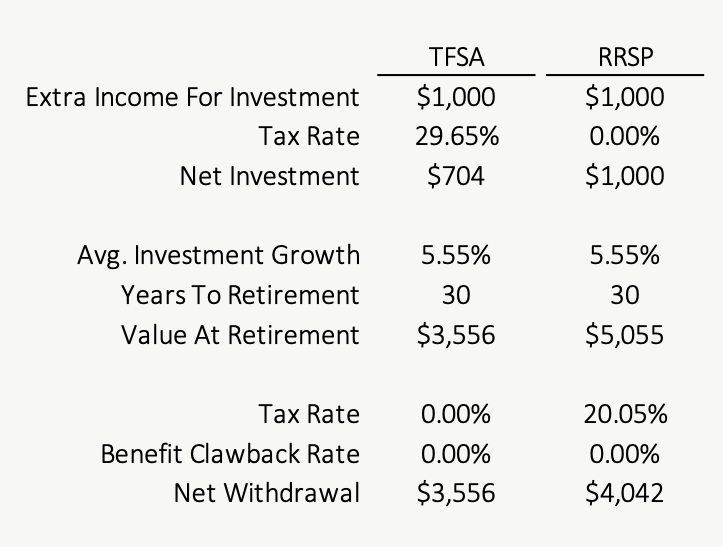

Tax deferral doesn’t necessarily provide an advantage, but when combined with tax rate arbitrage this deferral can provide an advantage, but it can also provide a disadvantage too.

When the tax rate in the future is lower, deferring tax can be attractive because it allows tax to be paid in a lower tax year. In this case the tax rate in the future is nearly 10% lower and this tax rate arbitrage, going from a 29.65% tax rate to a 20.05% tax rate, provides a significant benefit.

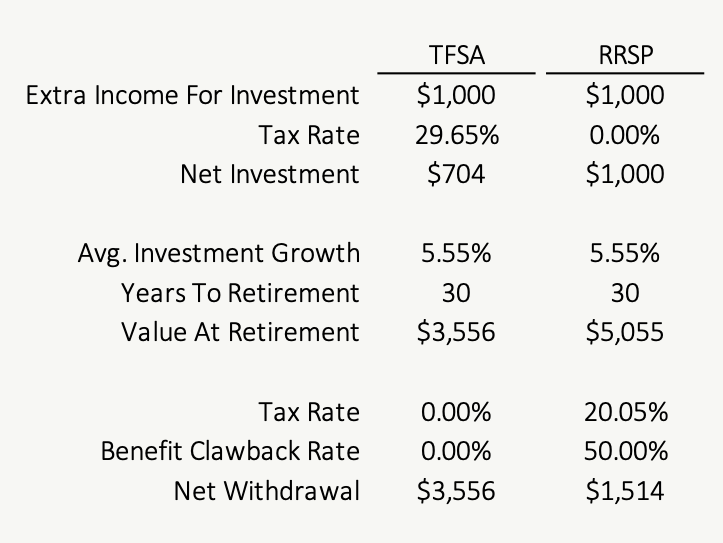

But when the tax rate in the future is higher, deferring tax can have a large downside. This is especially the case when government benefits like GIS are available in the future. Nearly 1 in 3 Canadians over the age of 65 are eligible for GIS and GIS comes with a “clawback” rate of 50% to 75%. This increases the marginal effective tax rate from 20.05% in the future to 70.05% (or even higher when other government benefits are included!)

In this case the marginal effective tax rate in the future is over 40% higher and this tax rate arbitrage, going from a 29.65% tax rate to a 70.05% tax rate, provides a significant downside.

(Learn more about marginal effective tax rates and the impact that government benefit clawbacks can have on financial planning decisions)

Tax Deferral vs Tax Arbitrage

When deciding to make an RRSP contribution to defer tax, it’s important to realize that the tax deferral itself doesn’t provide an advantage when a TFSA contribution is also an option.

When comparing a TFSA vs an RRSP there is no benefit from deferring tax and the benefit of tax rate arbitrage can be positive or negative.

Don’t get fooled by the idea of “deferring tax”, because it’s not necessarily an advantage of using an RRSP vs a TFSA. Deferring tax could even be a downside when marginal effective tax rates are higher in the future.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments