Should You Consider Paying Off The Mortgage Early or Investing Instead?

Paying off the mortgage early can be a fantastic financial goal. In the last post, we looked at the different ways to pay off a mortgage early, how to make a mortgage payoff plan, and talked a little bit about the benefit of paying off the mortgage early.

In this post, we’re going to look at some considerations when deciding to pay off the mortgage early vs investing. This is a common dilemma for many people in Canada. Where should they put extra cash? Against the mortgage? Or in non-registered investments?

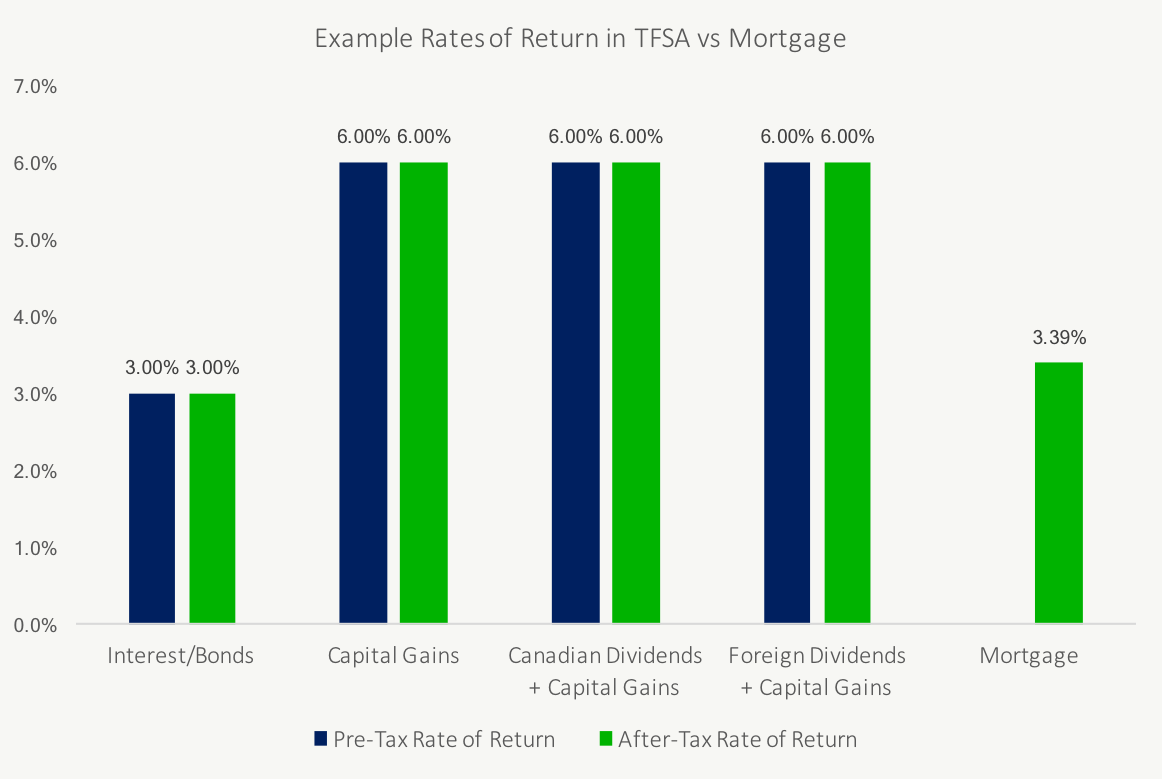

Generally, it’s better to invest inside an TFSA or RRSP before choosing to pay off the mortgage early. There is no annual tax impact when investing inside either of these two accounts. Investments can grow tax free. This can make it more attractive to invest inside an tax advantaged account before paying off the mortgage early. But not always…

RRSPs can be counterproductive at certain income levels and in certain situations. Investing inside an RRSP for someone expecting a very low income in retirement might not be the best use of those extra funds. They may experience large GIS claw backs on RRSP withdrawals in retirement. In those cases, it may make sense to pay off the mortgage early before maximizing RRSP contribution room.

As always, when making a financial decision, like paying off the mortgage early vs investing, it’s important to look at the whole financial picture and not just one aspect. If you’re struggling with this decision then it might be helpful to get a custom financial plan from an advice-only planner.

Deciding to pay off the mortgage or invest isn’t just about taxes and investment returns… there are also a bunch of soft benefits to consider. These aren’t pure financial benefits but they can still be “worth” a lot depending on how much you value them. Make sure you consider the financial benefit of paying off the mortgage early but also the soft benefits as well.

To decide between paying off the mortgage or investing we absolutely need to look at the after-tax rates of return. We’re going to assume that we’ve maximized our RRSP and TFSA contribution room already and are deciding between paying off the mortgage or investing in a non-registered investment account.

After Tax Rate of Return

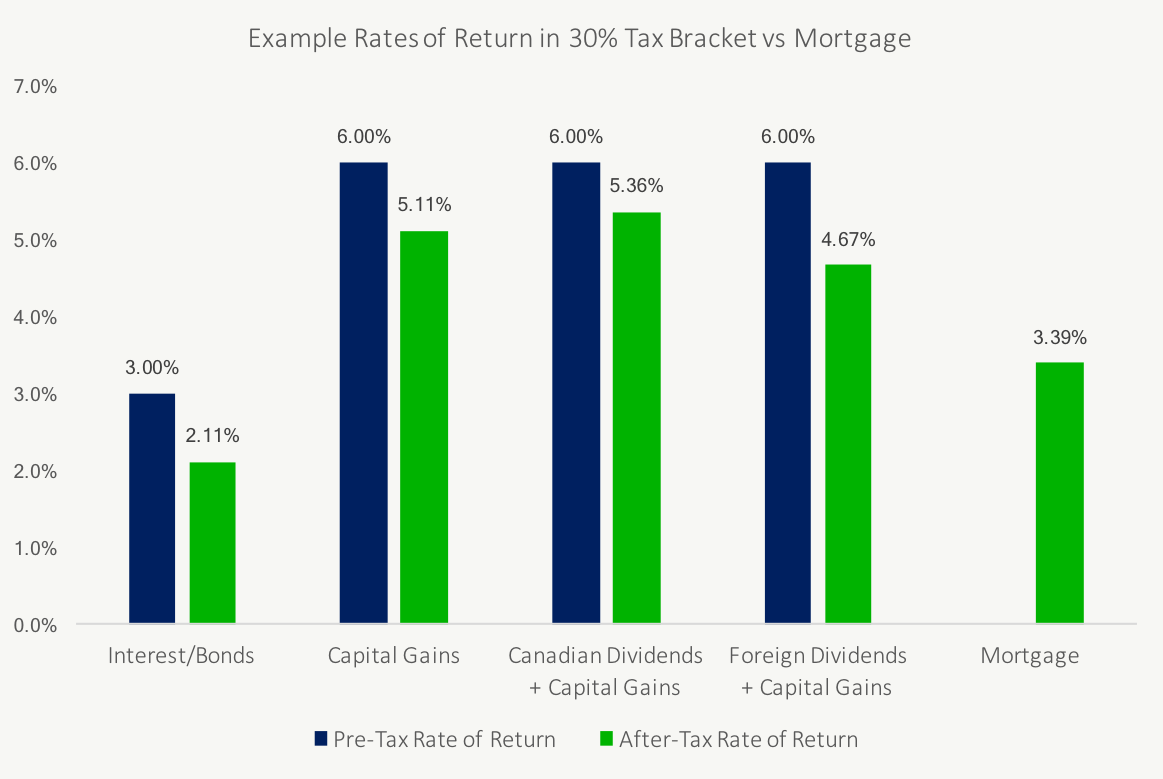

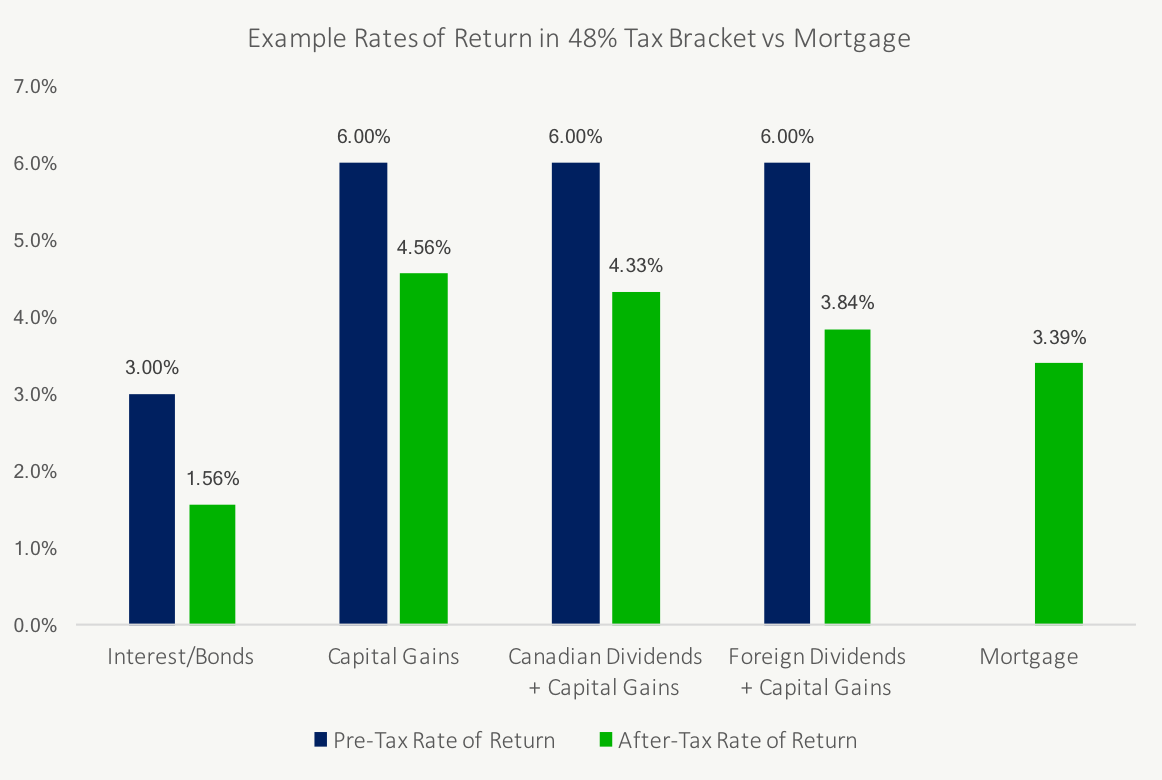

Not all income is created equal. Some types of investment income get special tax treatment from the Canada Revenue Agency while other types get taxed at your full marginal tax rate. Depending on the type of investments you hold in your non-registered account you may experience different after-tax rates of return even when the pre-tax return is exactly the same!

Not only does the type of investment income matter, but also your marginal tax bracket. Your marginal tax rate is the tax you pay on the next $1 of income you earn. If you’re in a high marginal tax bracket your after-tax rate of return will be different than someone in a lower marginal tax bracket. This is important when making the decision to pay off the mortgage or invest.

Because we pay off the mortgage using after-tax dollars we always want to compare after-tax investment returns with our mortgage rate. This gives us a good “apples to apples” comparison for paying off the mortgage vs investing.

Let’s look at the after-tax rate of return for various investments vs paying off the mortgage. We’ll look at three situations. One with a marginal tax rate of about 30%, another with a marginal tax rate of about 50%, and a third scenario with a marginal tax rate of 0% (which is essentially what happens in a TFSA).

Disclaimer: As always, it’s important to review your situation with a unbiased advice-only financial planner. The examples below are for educational purposes only. Your tax rates will differ depending on the province you live in, the type of investment income you earn, and which marginal tax bracket you’re in.

Notice how the gap between the different after-tax rates of return and the mortgage rate shrinks with the higher tax rates? This is just one example of why paying off the mortgage vs investing is a very unique decision from person to person.

In this last chart we can see the benefit a tax advantaged account can provide. The pre-tax and after-tax rates of return are exactly the same. More importantly, the gap between these rates of return and the mortgage rate is much larger than in our previous examples.

Risk Adjusted Rate of Return

The other factor we need to consider when looking at rate of return is the risk-adjustment. Investing in the stock market typically provides a higher investment return because there are higher risks. The increase in return is called the “risk premium”. It’s the amount you’re compensated for taking on extra risk.

Stocks have a risk premium over bonds, and bonds have a risk premium over GICs.

When we look at paying off the mortgage vs investing, it’s important to weigh this risk premium in the calculation.

Paying off the mortgage early has zero risk. It’s essentially the equivalent to a guaranteed rate of return on a very safe investment.

Investing in the stock market will typically provide a higher rate of return, but is that extra rate of return enough to compensate you for the extra risk? Sometimes it’s not.

When you look at the after-tax rate of return it’s important to adjust for risk. Everyone perceives risk differently so this is more subjective and will vary from person to person. There are ways to calculate the historical risk premium but it comes down to the person because each of us perceives risk differently and has a different tolerance for risk.

Personally, I’m fairly risk averse, I’ve experienced some large drops in investments over the years. From those experiences, I know that I prefer less volatility, even if that means slightly lower returns in the long-run.

It’s important to understand your own risk tolerance. Take an online risk profile questionnaire and look back at your own experiences to determine your personal risk tolerance. Then look at the rate of return and decide if the extra return is worth the risk.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Reduced Cash Flow Needs & Greater Peace of Mind

Looking at “the math” is only part of the equation. When deciding to pay off the mortgage or invest there are a bunch of soft considerations as well.

Some of the soft benefits of paying off the mortgage early include…

1. Reduced cash flow needs

One of the biggest benefits of paying off the mortgage early is that it can greatly reduce your outgoing cash flow. Housing typically makes up 35% of a family’s budget and a mortgage is a big portion of that. Removing the mortgage means a family can experience a reduction in income and still make ends meet.

2. Increased flexibility

Along with reduced cash flow, paying off the mortgage provides a lot of flexibility. Less outgoing cash flow means that you can make lifestyle changes, reduce your time at work, switch careers, or even start a business without worrying about that monthly mortgage payment. It also means it’s easier to qualify for new debt in the future because your debt to income ratio is lower.

3. Reduced risk

Paying off the mortgage is a risk-free return and when used in conjunction with long-term investing inside your TFSA & RRSP it can help reduce your total risk. Paying off the mortgage should always be part of a holistic financial plan. If paying off the mortgage is the only thing you’re doing then you’re “putting all your eggs in one basket” and not actually reducing risk.

4. Greater peace of mind

Being debt free is a great feeling. There is an incredible peace of mind that comes from knowing that you own your home outright. It’s comforting to know that you have no outstanding debts or obligations. This peace of mind can be very valuable and in our case, we found it extremely motivating and it became a big part of our mortgage payoff plan.

Pay Off The Mortgage or Invest?

What should you do, pay off the mortgage or invest? It’s not a simple decision and should be part of a holistic financial plan. For many people, paying off the mortgage is an important financial goal, but should it be the first financial goal? As we’ve seen, it depends on your situation and personal circumstances.

Planning to pay off the mortgage should be a part of every homeowner’s financial plan, there’s no question, but it’s important to determine where it fits. Making the right choice based on your personal circumstances can have a very positive financial impact and leave you feeling better about your financial future.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments