How To Pay Off The Mortgage Early

One of the largest purchases we’ll ever make is when we buy a home. It’s an exciting time but also very stressful. Along with this large purchase comes an equally large mortgage. This new debt will typically take between 25 and 30 years to pay off, but many people choose to pay off their mortgage earlier.

Paying off the mortgage early is an important financial goal. It’s a goal that typically (and hopefully) is achievable before retirement.

Paying off the mortgage early is a great medium-term goal, something achievable within 10-20 years (or even earlier if you’re really aggressive). This makes it a very interesting financial goal to include in your financial plan. Unlike investing, paying off debt is very predictable, so it can be very motivating to see steady progress against your mortgage each year.

Getting rid of your mortgage is a great feeling! It’s incredibly satisfying to see those mortgage payments disappear forever. It’s also nice to know that you have the security of owning your home outright.

Paying off the mortgage early also removes a large burden from your monthly cash flow. This creates a lot of flexibility to make lifestyle changes, switch careers, take more time off work, or even retire early.

There are different ways to pay off a mortgage early. Which method you choose will depend on your personal and financial goals. The important thing is to make a plan.

Making a mortgage payoff plan can be exciting. It’s amazing to see how those future payments can quickly reduce your mortgage. Making a plan is easy and we’ll show you a couple of examples using our free debt payoff tool. It’s always important to balance paying off the mortgage early against other financial goals, like saving for retirement. So make sure your goal to pay off the mortgage early is part of your overall financial plan.

Two Options: Increasing Monthly Payments vs Larger Lump-Sum Payments

There are essentially two ways to pay down a mortgage early. One way is to increase monthly payments. The extra amount above your original mortgage payment will go directly towards the mortgage principal. The second way is to make lump-sum payments. These are larger and less frequent payments where you can choose both the timing of the payment and amount of the payment. The entire lump-sum payment goes toward mortgage principal.

Which one you choose will be partially influenced by your mortgage itself. Each lender has different rules for these types of payments.

Generally, an increased monthly payment is permanent and decreases your financial flexibility in the future. This however may be a positive for individuals who could benefit from this extra accountability.

Lump-sum payments are more flexible. The maximum annual amount of lump-sum payments is usually capped at a percentage of the original mortgage balance. Typically, this percentage is between 10% and 20% of the original mortgage balance. There also may be a limit on the number of lump-sum payments per year. The nice thing about lump-sum payments is that you maintain your flexibility to reduce or stop payments in the future (for example if you experienced a job loss).

When we paid off our mortgage early we chose to use lump-sum payments to pay down our mortgage principal. We were capped at 20% of our original principal each year but could make as many lump-sum payments as we wanted each year, 1, 2, 5, 15… whatever.

So, as an example, with a mortgage of $500,000 the total of all the lump-sum payments that could be made would be capped at $100,000 per year.

Personally, we liked the extra flexibility that lump-sum payments afforded us. We chose to make 3 lump-sum payments each year, once every 4-months. The added benefit of this strategy was that in between lump-sum payments we essentially had an increased emergency fund. By placing money in a high interest savings account between payments we did lose a small amount to the interest rate differential but over 4-months this amount was quite small.

Which option you choose will depend on your personal circumstances and the options available with your current mortgage.

A Third Option: Extra Large Lump-Sum At Renewal

Another option available is to make an extra-large lump-sum payment at the time you renew your mortgage. If you choose this option you aren’t constrained by the annual lump-sum cap. You can make a 20%+ lump-sum payment at renewal or even pay off your mortgage entirely without penalty.

If you happen to have a mortgage with a low lump-sum cap of 10% per year this is another option to consider. You could save any extra cashflow in a high-interest savings account until your next mortgage renewal, at which point you could apply the entire amount against your mortgage with no limit.

Making A Mortgage Payoff Plan

Paying off the mortgage is a fantastic goal. It’s a great medium-term financial goal. It’s hopefully a goal that will take less time than other large financial goals like saving for retirement. It’s also very satisfying to see your progress as your mortgage principal drops on a regular basis. This shortened time frame and increased feedback makes paying off the mortgage early extremely motivating as a financial goal because that positive feedback is very addictive.

Making a plan is the only way to turn your goal into concrete action.

Using a debt payoff calculator like the one we have available in the resources section is an easy way to make a mortgage payoff goal into a plan or if you’re using the PlanEasy platform to create your financial plan you can integrate your mortgage payoff goal by adding specific lump-sum payments against your mortgage.

Whether you choose to make higher monthly payments, or lump-sum payments, or both, you can use the debt payoff calculator to figure out exactly what it takes to reach your goal (best of all, by using the platform you can revisit and make changes frequently and also see how it affects your overall financial plan).

When we paid off our mortgage early we found that making a plan provided a lot of extra motivation.

This extra motivation was one of the big benefits of our mortgage payoff goal, a benefit that we didn’t expect at the beginning. We made a number of lifestyle changes in an effort to reach our goal faster. We paid off our mortgage a number years ago but these lifestyle changes are still providing $1,000’s per year in financial benefit. These are also changes that we feel we wouldn’t have made if we were just investing instead.

Let’s look at two mortgage pay off plans as an example. We’ll look at one where we use larger monthly payments and a second where we use lump-sum payments.

We’ll assume a mortgage of $377,600, which is the average home price minus a 20% down payment. And we’ll assume a fixed mortgage rate of 3.39%. Lastly, we’ll assume we start off slow and increase extra payments each year as we get raises and/or make lifestyle changes to achieve our goal.

Let’s look at the original amortization, a scenario with higher monthly payments, and a scenario with lump-sum payments.

Original Amortization

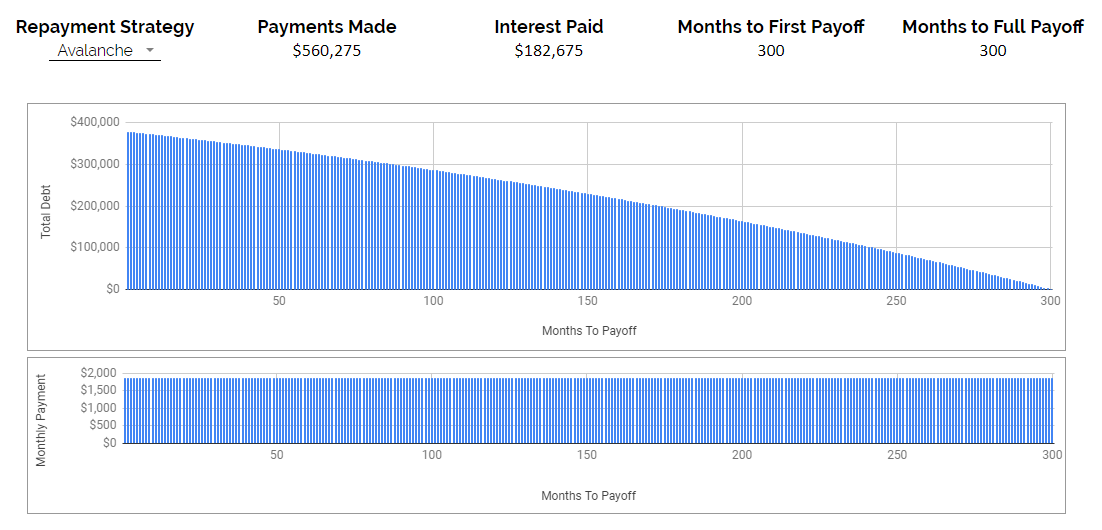

The original amortization is 25-years. Over that time there will be over $560,000 in payments made, this includes principal payments and interest combined. Over those 25-years there will be $182,675 in interest payments.

Take a look at the Google Sheet for more details.

Mortgage Payoff Plan With Higher Monthly Payments

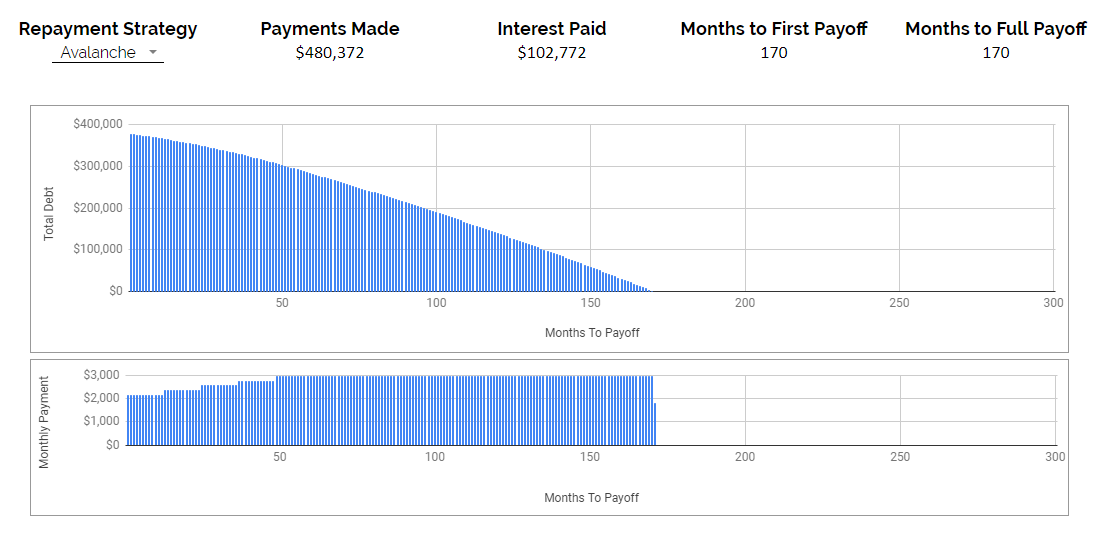

In this scenario we cut the mortgage down by over 10-years! The original amortization is 25-years is cut to just over 14-years thanks to the extra monthly payments. We start with extra monthly payments of $300 per moth and they ramp up by $200 per month until they plateau at and extra $1,100 per month by year-4. This takes the original monthly payment of around $1,900 to just under $3,000 per month.

This reduced the total interest paid to $102,772!

Take a look at the Google Sheet for more details.

Mortgage Payoff Plan With Lum-Sum Payments

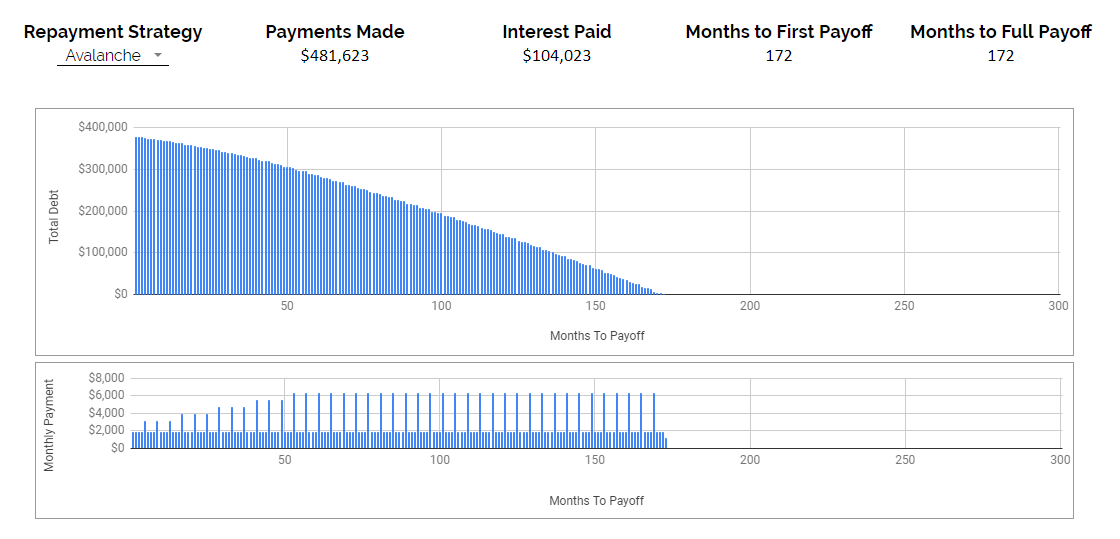

In this scenario we also cut the mortgage down by over 10-years but we do it through lump-sum payments. Instead of monthly payments we start with extra lump-sum payments of $1,200 every 4-months they ramp up to $4,400 every 4-months by year four. This has almost the same effect with total interest paid of just $104,023!

Take a look at the Google Sheet for more details.

Warning! Paying Off The Mortgage Early Versus Other Financial Goals

Paying off the mortgage early is a fantastic medium-term financial goal but it shouldn’t come at the expense of other financial goals like saving for retirement, reducing taxes, or increasing government benefits. Being too focused on one particular goal can sometimes mean that you’re making decisions without seeing the bigger picture and this could lead to missed opportunities.

For example, when deciding to pay off the mortgage early its always important to first understand if investing inside a TFSA or RRSP is a better choice. The tax advantage of investing inside a TFSA or RRSP can be huge. Choosing the right one can help save $100,000 in lower taxes or increased government benefits.

It’s also important to understand the value of balancing various financial goals. Focusing too much on paying down the mortgage early may not leave much room for regular investing, but investing on a regular basis is an important habit to develop, and regular dollar cost averaging can provide benefits when there are fluctuations in the stock market.

Before deciding to pay off the mortgage early make sure you understand how this goal fits into your overall financial plan. It’s great to see your mortgage decline quickly, but not if it means your other financial goals become harder to achieve.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments