TFSA vs RRSP?

Picking The Right One Could Save You $100,000+ In Tax

Both TFSA and RRSP are great, but they’re also different. These tax-advantaged accounts each have their own pro’s and con’s.

If you only have a set amount to invest each month, it’s important to pick the “right” account.

The “right” account can change over time as your income and personal circumstances change.

Each account, TFSA vs RRSP, deals with taxes differently. Choosing the right account will help you save $100,000+ in tax over your lifetime. Who would say no to $100,000?!?

By choosing the right tax-advantaged account, you can actually save less each month and still achieve all your financial goals.

Deciding Between TFSA and RRSP:

TFSA and RRSP are both tax-advantaged accounts. They both help you delay and/or avoid tax but they work a bit differently.

There are many pro’s and con’s for each account. Many of these pro’s and con’s aren’t strictly financial considerations and will depend on your personal circumstances.

For example, RRSPs are protected from creditors and cannot be seized to pay a lawsuit or bankruptcy. This isn’t the case for a TFSA which can be seized by your creditors. Read more about the pro’s and con’s of the TFSA and the pro’s and con’s of the RRSP.

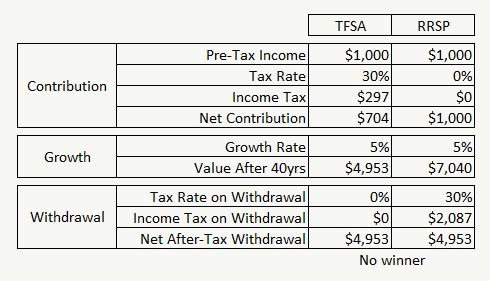

Typically though, the main factor when deciding between a TFSA and an RRSP is usually taxes. If your tax rate today is the same as in the future, then it doesn’t matter, both TFSA and RRSP will work the same.

However, deciding between a TFSA and RRSP becomes challenging when your tax rate today is different than your tax rate when you start making withdrawals (ie. retirement).

This is where a little tax planning can really pay off.

Income Tax Efficiency:

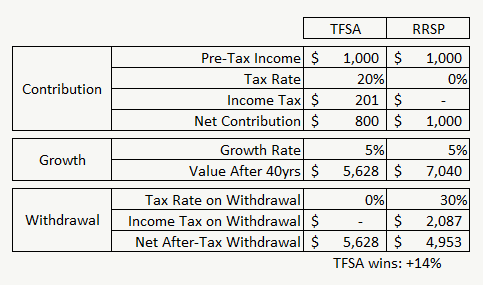

If you anticipate your income will be higher in retirement (probably the case for most young people starting out in the work force) then the TFSA has the advantage.

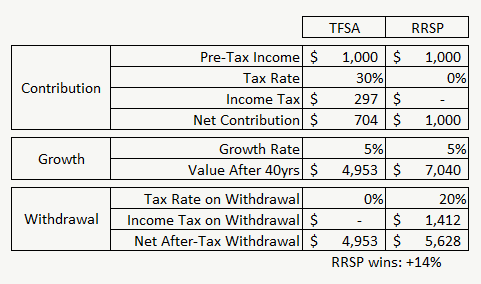

If you anticipate your income will decline in retirement (the case for most people who are established in their careers) then the RRSP has the advantage.

As you can see, the difference can be large. A 14% difference is a huge amount when we talk about retirement savings. If you’re saving $1,000,000 for retirement then we’re talking about a potential $140,000 difference!

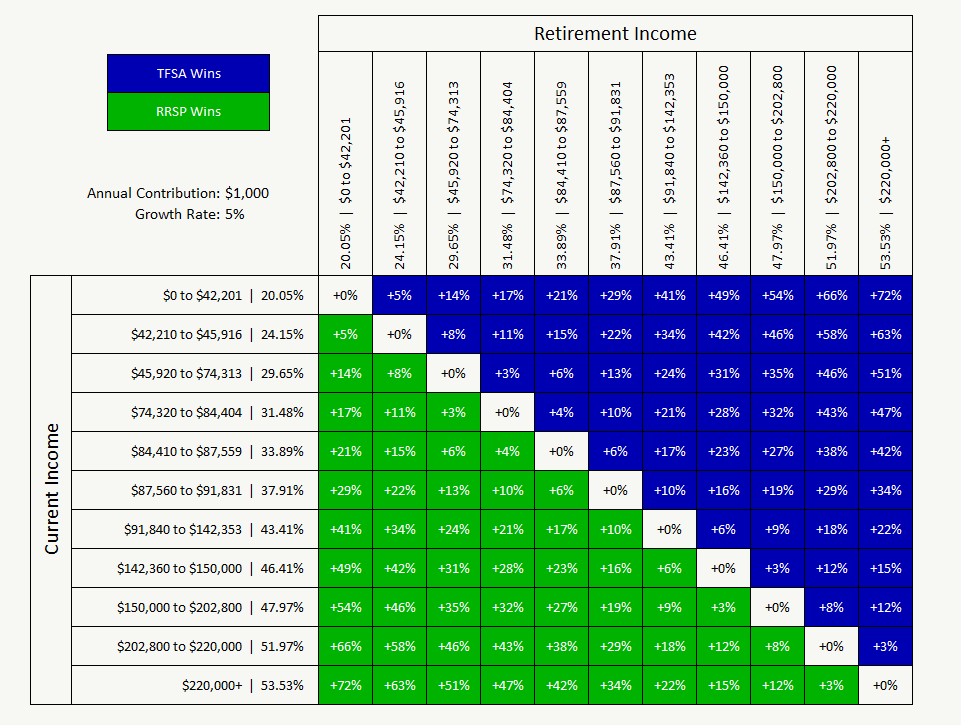

We can take the example above and create a TFSA vs RRSP matrix for all the income combinations. This gives us a map of where the TFSA is best vs where the RRSP is best.

It’s hard to predict the future. If you’re on the edge of a TFSA vs RRSP border, then you may want to start with the TFSA. Starting with the TFSA gives you the flexibility to change strategies in the future.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

BUT! Income tax efficiency is only half the story. The decision between RRSPs and TFSAs also needs to include income- tested government benefits. RRSP contributions boost your government benefits, TFSAs can’t do that.

Government Benefit Efficiency:

Claw backs on income-tested government benefits can add up quickly. This is especially true for low and moderate income families. Claw back rates can easily reach 20-40% for certain households.

The cool thing is that making RRSP contributions lowers your net income and boosts your government benefits.

In the eyes of the government, making a $1,000 contribution to your RRSP is the same as earning $1,000 less income. Your government benefits will increase in either scenario.

This can make RRSPs more attractive for low and moderate income families even when income tax rates are lower.

“Choosing the right account will help you save $100,000+ in tax over your lifetime.”

Combining Income Tax and Government Benefits:

To decide between TFSA and RRSP you need to look at your combined income tax rate and government benefit claw back rate. This is known as your marginal effective tax rate (METR).

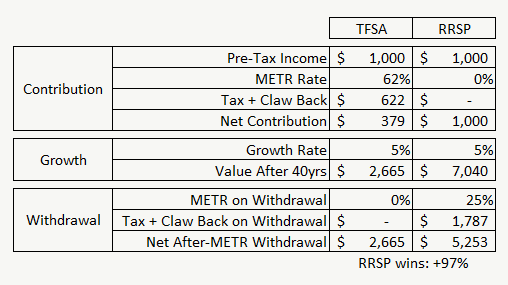

As an example, let me share the TFSA vs RRSP analysis for my situation: two adults and two kids. My wife is at home with the kids so let’s say our family income has dropped to $50,000/yr but we’re targeting $60,000/yr in retirement.

In this situation, RRSPs surprisingly provide a much larger benefit, 97% greater to be exact.

This is counter intuitive because our income is lower now than in retirement. This usually means TFSAs are a better choice, but due to the high level of government claw backs, an RRSP contribution will boost our government benefits and provide an income tax benefit. This combined effect makes an RRSP contribution a clear winner.

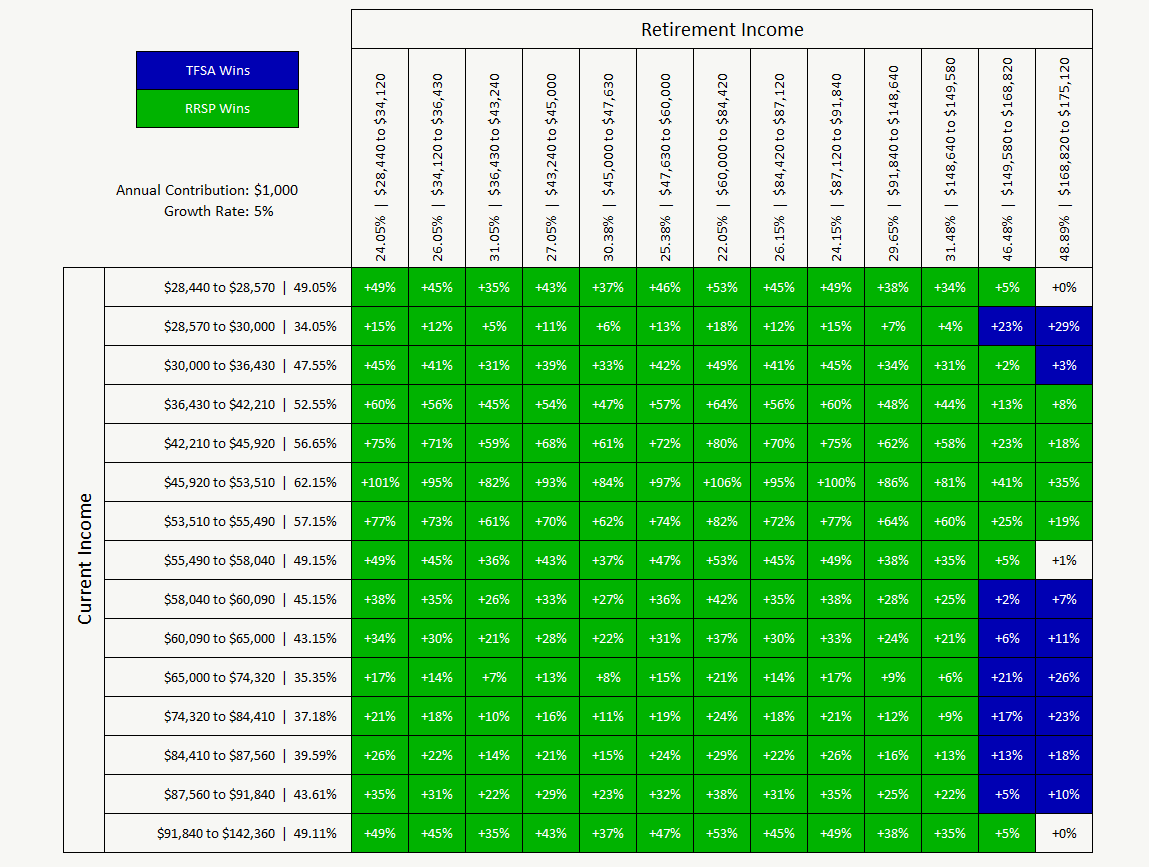

But what about other income scenarios? By recreating the same matrix we did above we can look at all income scenarios for my situation (to make it easier to read we’ve zoomed in on just a few combinations, here is the full matrix).

As you can see, nearly every scenario favors the RRSP. This is mostly due to the very high claw back rates on child benefits like the Canada Child Benefit and the Ontario Child Benefit. The combined Marginal Effective Tax Rate (METR) is lower in retirement for nearly every scenario.

TFSA or RRSP?

Deciding between a TFSA contribution or an RRSP contribution can be confusing. Making the wrong decision could cost you $1,000’s in taxes. Plus, it means you’ll need to work harder and save more to achieve the same financial goal.

Whether you’re receiving government benefits now, or anticipate receiving them in the future, making the right decision between TFSA or RRSP can help you reach your goals faster and with less effort.

This is where a good financial planner can help maximize your savings.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Super interesting read! Thanks for the helpful information.

What about clawbacks in retirement to OAS, GIS, CPP? A TFSA will reduce the taxable income in retirement thus reducing the clawbacks on government programs. There should be a shift for middle and lower income families planning for a retirement income >$75000 where the TFSA would be a more effective savings tool. I would be curious to see what you come up with.

Agree 100% Rob. Government benefits are an important consideration. Although there is a government benefit example for my situation in this post, this will vary greatly from person to person.

Here are two posts which touch on the importance of planning for government benefit clawbacks…

https://www.planeasy.ca/optimizing-your-government-benefits-both-now-and-in-retirement/

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

One small note, there is no clawback on CPP, only on OAS and GIS, so for most people with average retirement income they wont qualify for GIS and wont have income high enough to worry about OAS clawbacks.

I think that your math is a bit off there. In your chart it shows the marginal tax rate that you would be at withdrawing from your RRSP. But if someone pulls out the same amount as their income before retirement they’ll pay a lower average tax rate.

For example someone making $150,000 in Ontario has a marginal tax rate of 43.41%. So a contribution of $10,000 will lower their tax burden by $4,341.

However even if they withdraw $150,000 per year from their RRSP in retirement, assuming no other income, they won’t pay 43.41% tax on those withdrawals they’ll only pay 30.09% or $45,083 in tax.

In fact in this example to pay 43.41% income tax on your RRSP withdrawals you’d have to be pulling $380,000 from your RRSP yearly

Hi Kiegan, that’s an interesting observation, what you’ve highlighted is the difference between marginal tax rates and average tax rates. But in most cases, we want to look at marginal tax rates, not average tax rates when deciding between an incremental TFSA or RRSP contribution.

First, its important to highlight that the average tax rate is lower for two main reasons:

1. Non-refundable tax credits means we pay zero tax on the first $xx,xxx of income (tax credits like the basic exemption, age credit, pension income tax credit etc.) this lowers the average tax rate considerably

2. The withdrawal in your example crosses many tax brackets, the 20% tax bracket, the 30% tax bracket, and into the 40% tax bracket etc.

When it comes to retirement, we usually want to focus on marginal tax rates and not average tax rates because tax credits are often used up by other sources of retirement income already. After age 60-65 the income from CPP & OAS will typically use up non-refundable tax credits so any additional RRSP/RRIF withdrawal will be at a 20%+ marginal tax rate. This is also the case when there are employer sponsored retirement plans like defined benefit pensions, defined contribution pensions, deferred profit sharing plans, group-RRSPs etc. Or when there is money in a LIRA from an old employer retirement plan. The money in these accounts, when withdrawn in retirement, will typically use up any non-refundable tax credits. So, when making a decision between an incremental TFSA or RRSP contribution it’s typically better to look at marginal tax rates than average tax rates.

The other thing to consider is that a $150,000 RRSP withdrawal is not likely in retirement unless someone has a monster RRSP. Usually RRSP/RRIF withdrawals will be in the $20,000-$50,000 per year range. This puts the majority of those withdrawals in just one or two marginal tax brackets. Unlike in your example where the $150,000 withdrawal crossed multiple different tax brackets ranging from 20% up to 40%, in reality an RRSP withdrawal will hit just one tax bracket. This is actually ideal because we want to plan RRSP withdrawals over the entire retirement period to be in the lowest tax bracket if possible.

So, because non-refundable tax credits are typically already used up by other sources of retirement income, and because RRSP withdrawals usually don’t cross multiple tax brackets, its often best to look at marginal tax rates when planning an incremental TFSA vs RRSP contribution.

Now, as always in personal finance, it depends. So, you’re right that in a unique situation where there is no other source of retirement income it’s best to look at your average tax rate, but in reality this type of situation is rather rare or only happens for a few years between CPP/OAS begin.

Thanks for the comment!

Love the matrix views! I’m curious how this changes (if at all) is you have an RPP instead of an RRSP. My company has a DC RPP with matching so it’s beneficial to contribute to that for the matching so wondered how it compares tax wise. I know the RPP contributions come out of my RRSP contribution room so they’re definitely related.

Hi Jennifer, generally employee matching on Group-RRSP or DCPP contributions is so attractive that it doesn’t really matter what tax & benefit rates are, the 50% or 100% match is a great deal and you should take full advantage of it. There are also strategies to help draw down these accounts in retirement to minimize income tax and minimize government benefit clawbacks.

You’re right that RPP contributions will reduce the amount of new RRSP contribution room you earn each year, so one impact is that you have a bit less flexibility to manage income tax and government benefits, but again, much better to get the 50% or 100% employer matching that these accounts typically provide.