Taking CPP Early Or Late? The Soft Benefits

In the last blog post we looked at the financial considerations when deciding to take CPP early or late. But personal finance is never just about the money. Half of personal finance is personal. The “best” path varies from person to person even when the numbers are exactly the same. When it comes to taking CPP early or late these personal considerations can make a big difference.

There are many “soft benefits” to taking CPP early or late. These benefits can make taking CPP early look more favorable… or it can make taking CPP later look more favorable… it just depends on how much YOU value each benefit.

Before deciding to take CPP early or late it’s important to understand what your goals are for retirement. Not just financial goals but personal goals. What do you want to do in retirement? What does your retirement look like? This may inform some of your decisions around these “soft benefits”

It can also help to have a financial plan and see how taking CPP early or late helps you achieve your financial goals. Everyone is different, and the decision to take CPP wont be the same for everyone.

Less Risk

There are many different types of risk in a financial plan. One very common type of risk is “market risk”.

This is the risk that stock market returns may not meet our expectations in the plan. This is very real risk for anyone who needs to save a large % of their retirement income. Reducing market risk can be a big benefit for retirees!

Another, less highlighted risk, is called “inflation rate risk”. This is the risk posed by above average inflation rates.

Imagine if we went through a period of inflation like the 1970’s. That would pose a risk for someone’s retirement plan as investment returns struggle to keep up with inflation and personal expenses rise rapidly year over year.

The last risk that is reduced by delaying CPP is “longevity risk”. This is basically the risk of living a long and health life.

By drawing down investments early, and waiting to start CPP, you can expect to receive a larger monthly benefit in the future. As long as CPP is well funded (which it currently is) these higher CPP payments will help reduce the longevity risk in your financial plan because these payments will continue for the rest of your life.

In most cases, all three of these risks are reduced by delaying CPP and drawing down investment assets instead. This can create a big incentive to delay CPP rather than take it early.

By taking CPP later and drawing down investment assets instead we end up with less money invested so we reduce market risk, we essentially transfer some of this risk to the Canada Pension Plan. We also reduce inflation rate risk because CPP is automatically indexed to inflation unlike investments. We also receive higher monthly CPP payments that will remain with us for as long as we live.

That being said, CPP isn’t necessarily set in stone, and changes in legislation could impact CPP in the future, this is sometimes referred to as “policy risk”.

By delaying CPP and drawing down investments we can decrease some types of risk, but we need to be aware that we might be increasing other types of risk at the same time. Overall, I believe many would agree that the overall risk has decreased by delaying CPP and this can make it a very attractive option for soon-to-be retirees.

Improved Success Rate

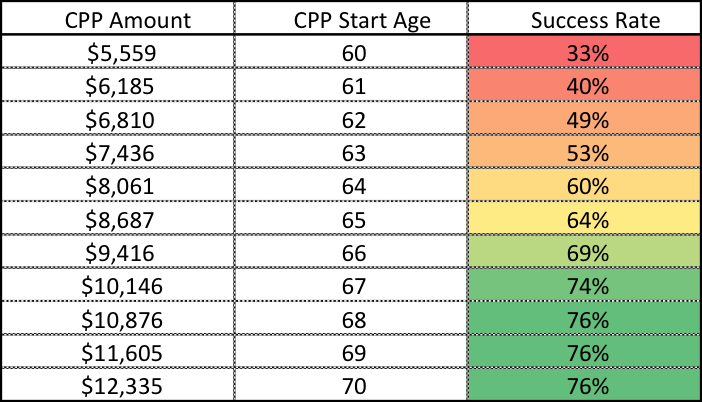

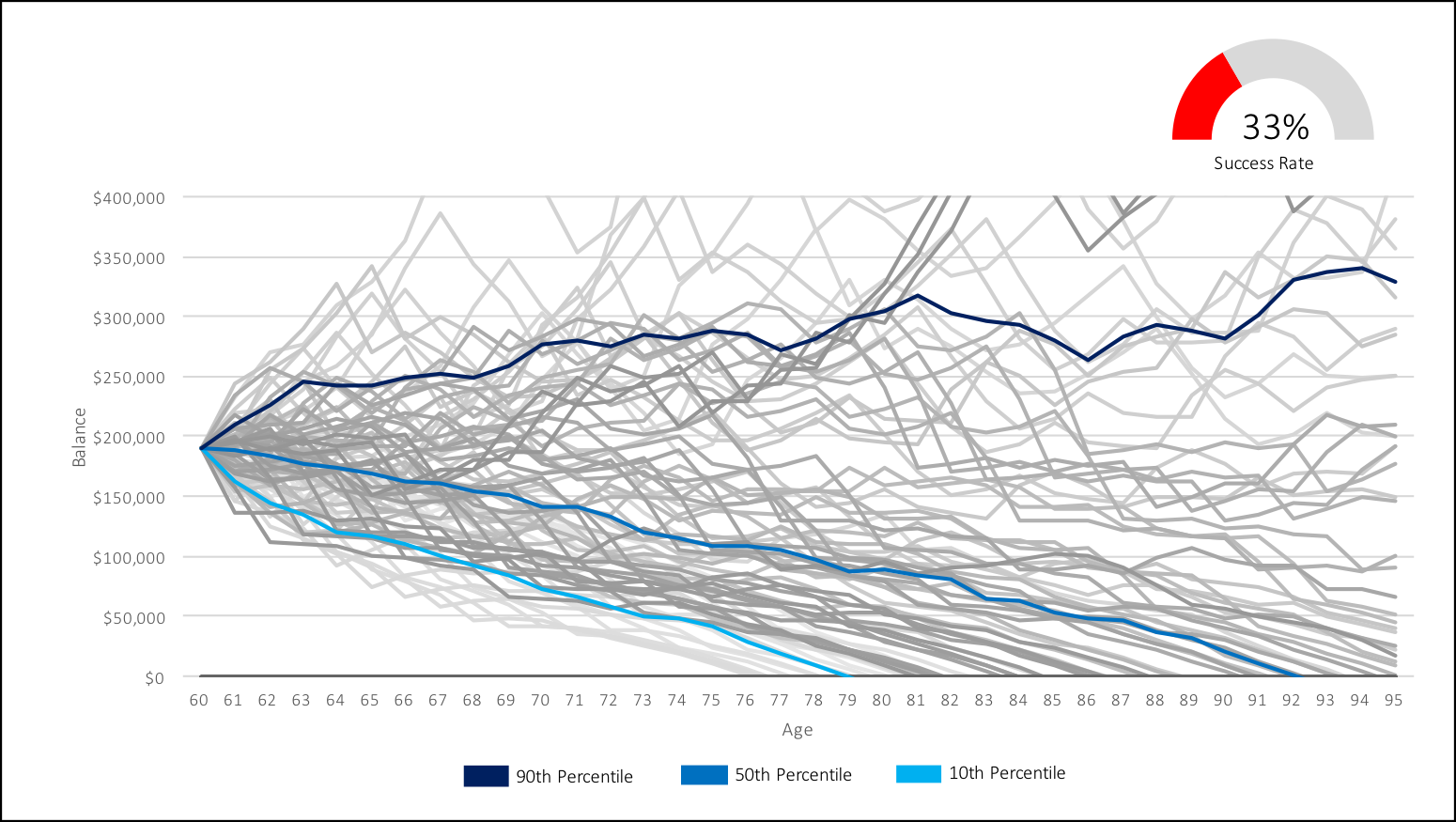

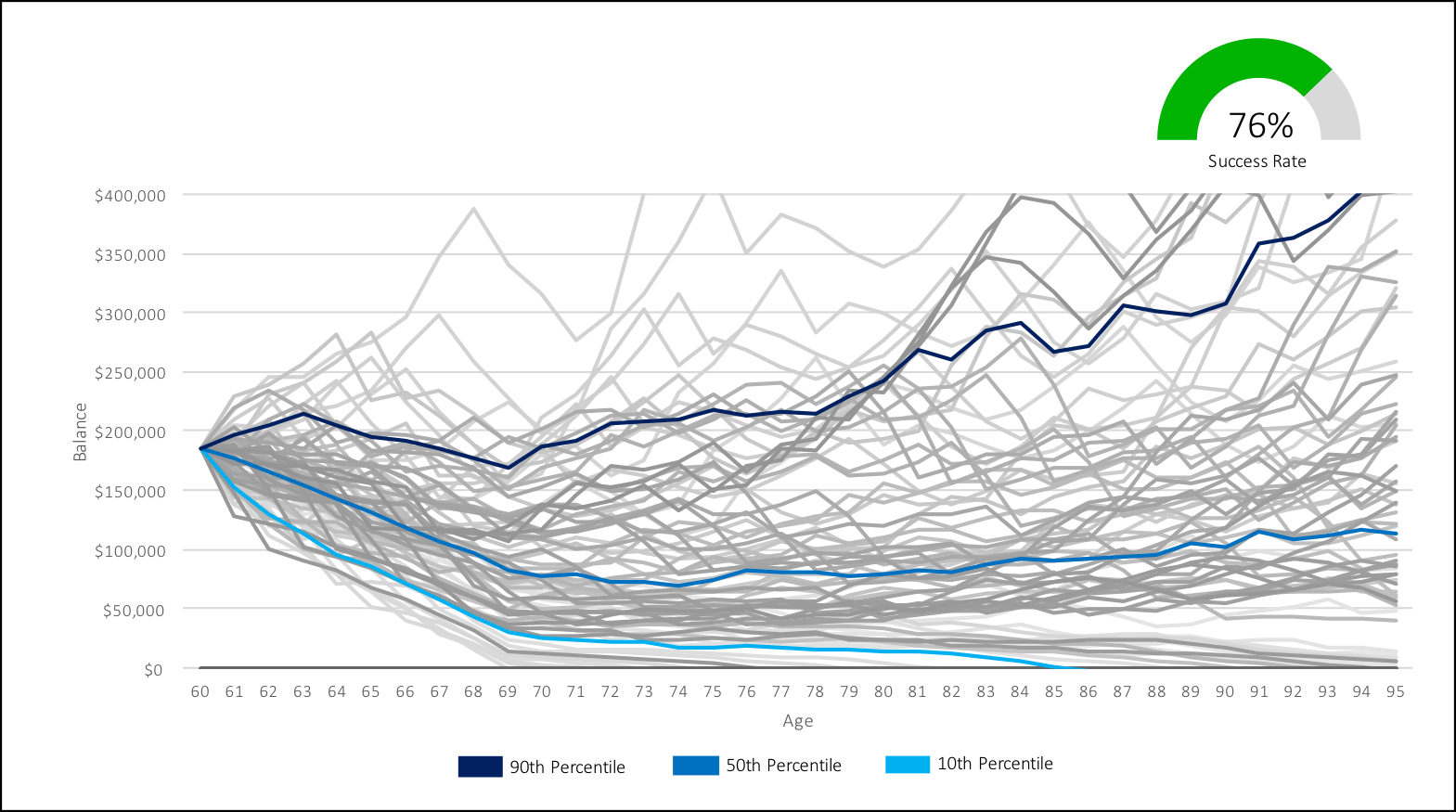

When we look at retirement planning, we measure “success rate” by taking a plan and running it through historical periods of stock, bond and inflation rates. Success rate is a good way to understand how a retirement plan will perform with real world returns. We look at the same investment balance, and same annual withdrawals, but over different historical periods.

It’s like we take a plan and send it back in time to 1901, or 1921, or 1930, or 1945, or 1972 etc etc

A historical period is considered a “success” when the plan reaches the end of the plan with an investment balance of at least $1.

While this type of analysis not fool proof, it does provide us with a good sense of how successful a plan could be during different periods of returns and inflation rates.

As we already mentioned in the section above, delaying CPP can reduce a number of different risks. Two of those risks are “market risk” and “inflation rate risk”. We can measure the impact of reducing these risks.

To see the effect on success rate let’s use the same example we used in the last post. We’ll assume that we already have some form of retirement income like LIRA/LIF withdrawals, a defined benefit pensions, or other RRSP/TFSA assets. The decision we’re trying to make is how to create that LAST $15,000 of retirement income.

We’re going to assume $200,000 of RRSP assets, the average CPP of $8,687/year at age 65, and a 60/40 asset allocation.

Let’s see how the success rate changes as we delay CPP.

We can see that the success rate of this particular plan significantly increases as CPP is delayed. This is because we’re drawing down investment assets and transferring some risk to the Canada Pension Plan.

This may not work the same for every plan. For example, it requires a certain amount of investment assets to absorb variations in stock and bond returns. In the second success rate chart below, where we delay CPP to age 70, you’ll notice that a lot of scenario’s decline dramatically from age 60 to 70 before they start to level out or increase. This might be considered a “success”, but will still be difficult to stomach as a new retiree. So make sure you review YOUR plan’s success rate with an advice-only planner to understand all the considerations when delaying CPP.

Success Rate Analysis

Taking CPP at 60 For Our Example Scenario

Success Rate Analysis

Taking CPP at 70 For Our Example Scenario

Improved Liquidity

Liquidity is essentially how much money we have available for spending at any given point. CPP is only available on a monthly basis and therefore doesn’t provide a large amount of liquidity for retirees. On the flip side, a large investment balance could be spent all at once if necessary, and therefore provides a HUGE amount of liquidity.

Taking CPP early means we don’t draw down on investment assets as quickly in our 60’s. This actually improves our liquidity in early retirement because we have more investment assets to draw from if the need were to arise.

This might be beneficial if you foresee a large purchase or expense in the near future. These expenses may not be 100% planned for, but may happen if the opportunity presents itself (Perhaps buying out a sibling from a family property? Or seeking alternative medical treatment?)

On the flip side, if you choose to delay CPP then you will have more liquidity in late retirement, this only happens after you reach the breakeven point for delaying CPP. This extra liquidity late in retirement can be useful too. For example, a higher investment balance in late retirement could be used for more expensive long-term care or retrofitting your home to be more accessible.

Depending on if you need extra liquidity (maybe you have enough investment assets that it’s not a concern), or when you would like to have access to extra liquidity in the future (early retirement or late retirement), this may impact your decision to take CPP early or late.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

“Get What You Deserve”

By the time we’ve hit retirement age we’ve typically been contributing to CPP for 40+ years. All these contributions can create a huge desire to “get what you deserve” from your CPP contributions. This isn’t exactly a rational feeling, but it’s a strong feeling none the less.

If you FEEL like you need to start drawing on CPP because of the many, many, many years that you’ve contributed, then by all means consider those feelings as you weigh the pro’s and con’s.

Making the financially optimal choice may not be the best thing to do if you don’t FEEL strongly about it. You don’t want to live with that nagging doubt. But it’s important to understand how much you value these feelings vs the cost of taking CPP early or late and make an informed decision rather than just acting on feelings alone.

Survivor CPP Benefits Can Drop By 40% to 100%

Survivor benefits for CPP can be a complex topic, but one consideration when deciding to delay CPP or take it early is what were to happen if one partner were to pass away unexpectedly. We all hope to live a long and healthy life, and we may feel like reaching breakeven is a reasonable assumption when delaying CPP, but what if that doesn’t happen?

CPP benefits for the survivor are at most 60% of the deceased partners benefit. This is the maximum; it can often be quite a bit less. CPP is maxed at the individual persons maximum benefit, you can’t go over this amount.

If the surviving partner was already receiving the maximum CPP benefit, then their additional survivor benefit would be 0%! Coupled with the full loss of OAS this can come as quite a shock!

This isn’t as large an impact for those with CPP below the maximum (which is most of us) because we will likely receive anywhere from 0% to 60% of our partners CPP. The exact impact will vary from person to person, but there will be an impact in the case of an unexpected death, and this is an important consideration when delaying CPP.

For those who choose to take CPP early rather than late the impact of survivor benefits will be smaller because there is less to be reduced. Plus, thanks to spousal rollover rules we can pass investment assets to the surviving spouse with no tax implications.

Disclaimer: As always, this post is for educational purposes only. We presented a couple of examples that were based on some specific assumptions. These assumptions may not match your situation. Even if they do match your exact situation you may choose to make a different decision based on your personal values. Make sure to review these decisions with your financial planner to determine what is the best decision based on your specific values and goals.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Nice job on presenting the case for delaying CPP to age 70. It is what my wife and I are planning to do. In addition to the reduced risks that you nicely explained, we believe that perhaps the best reason to defer is that it allows us to “safely” spend more annually starting right now.

Presently, less than 1 or 2% of retirees defer to age 70. It is a tough sell…

Anyhow, good job and good luck!

Hi Garth, thanks for your comment! We’re also planning to delay to age 70 but I like the flexibility of starting CPP/OAS earlier if we need to (especially if we’re in one of those scenarios that declines rapidly).

Question about that 1% – 2% stat, I’ve never actually come across stats on how many people take CPP at certain ages and would love to read more, would you happen to have more info/links?

Not sure if you are familiar of the writing of Fred Vettese? He is IMHO, one of the best retirement writers in Canada. He mentions the 1% figure in this article:

https://business.financialpost.com/personal-finance/retirement/why-you-should-wait-until-you-are-70-to-collect-cpp-benefits

And definitely read his latest book:

https://www.amazon.ca/Retirement-Income-Life-Getting-Without/dp/1988344050/ref=sr_1_1?keywords=fred+vettese&qid=1560814275&s=books&sr=1-1

Cheers

Garth

Yes, I’m very familiar with Fred Vettese, thanks for the links Garth!