Don’t Get Surprised By OAS and CPP Survivor Benefits

For many people, CPP and OAS will make up a significant portion of their retirement income. A reduction in CPP and OAS income due to CPP survivor benefits or OAS survivor benefits can be very stressful. Even more so because this reduction will follow the unexpected death of a partner or spouse.

Many people may not realize, but OAS and CPP survivor benefits are reduced by anywhere from 40% to a full 100%!

For higher income households, who may have significant assets in either RRSPs or TFSAs, it’s not uncommon for CPP and OAS to make up 25%-30% of their retirement income.

For lower and moderate-income households, government pensions like CPP and OAS can provide 50%-75% of their retirement income.

For very low-income households, CPP and OAS, when combined with other low-income benefits like GIS, can easily make up 100% of retirement income for some couples.

In all of these situations, losing even some of these benefits can result in a big change to retirement plans, and what many people may not realize is the extent to which some of these benefits can be reduced when a partner passes away.

Although difficult and unpleasant to even think about, the impact of a partner’s death is an important consideration for many retirement plans. It’s important to understand what changes there might be to both retirement income and retirement spending if the unfortunate were to happen.

For some plans, those which have a large amount of investment assets, the risk is much smaller. Investment assets inside RRSPs and TFSAs can be transferred through spousal rollovers with no tax consequences. So, the disruption to these plans may be smaller.

But for some plans, the change in CPP and OAS income due to an unexpected death can be quite large, especially in certain circumstances. In the worst-case scenario, the loss of CPP and OAS combined can easily represent more than $20,000 per year in lost retirement income!

Here’s what to watch out for when it comes to CPP survivor benefits…

Related Posts:

CPP Survivor Benefits When A Partner Dies

When a partner passes away, CPP is reduced based on a complex formula. The CPP survivor pension is then combined with the widow/widowers CPP pension, but this combined CPP pension is also subject to a maximum amount.

The result of these rules can often be surprising for survivors.

In the best-case scenario, the deceased’s CPP benefit will be reduced by 40%.

In the worst-case scenario, the deceased’s CPP benefit will be reduced by up to 100% and could disappear entirely!

It’s important to understand which scenario you might face if the worst were to happen.

There are many factors that can influence the survivor benefit. A survivor who is over the age of 65 could receive “60% of the contributor’s retirement pension if the surviving spouse or common-law partner is not receiving other CPP benefits”. If the survivor is under the age of 65 they could receive “a flat rate portion plus 37.5% of the contributor’s retirement pension, if the surviving spouse or common-law partner is not receiving other CPP benefits”.

Confusing, right?

And there’s more…

Notice how in the above quotes they say, “if the surviving spouse or common-law partner is not receiving other CPP benefits”? This is because a survivor who is receiving CPP will get a “combined payment” that is subject to its own rules. For example, the most a retiree can receive from CPP is the maximum retirement pension for an individual. This means that the survivor pension might be reduced even further if the survivor is already close to the maximum CPP themselves.

Here are a few examples where both partners are over the age of 65…

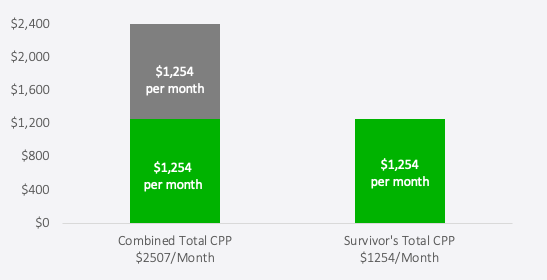

Both Partners At The Max CPP

In this case, the maximum combined CPP payment means that the survivor benefit is reduced by 100%!

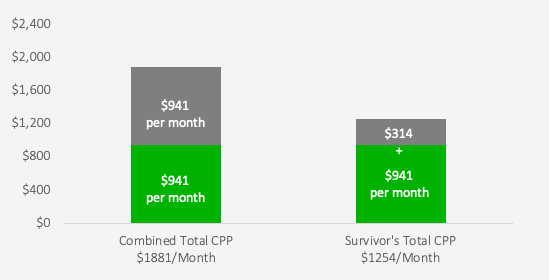

Both Partners Receiving A High CPP Amount

In this case, the maximum combined CPP payment means that the survivor benefit is reduced by 66%!

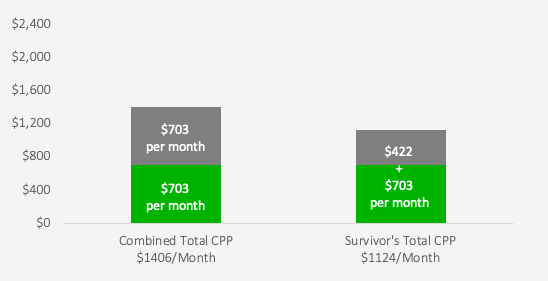

Both Partners Receiving The Average CPP Amount

In this case, because both partners are well below the maximum combined CPP payment, that the survivor benefit is reduced by 40%.

Does It Matter When CPP Benefits Start?

Delaying CPP to age 70 can be very attractive in certain situations. It can provide a higher CPP payment for the rest of your life and can significantly reduce longevity risk, inflation rate risk, and investment risk.

(Read more about the pros and cons of delaying CPP and how the breakeven point for delaying CPP can be in your mid to late 80’s)

Given delaying CPP is so attractive, you might be wondering if delaying CPP will impact the survivor benefit? Does delaying CPP to age 70 mean that there is a higher survivor benefit in the future?

Similarly, does starting CPP at age 60 mean a smaller survivor benefit in the future?

Unfortunately, the CPP survivor benefit is based on the “calculated amount” that would have been received at age 65. This means that even if the deceased delayed CPP to age 70, or started CPP at age 60, there no impact on the survivor benefit that the widow/widower will receive.

What Happens To OAS When A Partner Dies?

Unfortunately, the impact to OAS for the survivor is even more severe. When a partner passes away the deceased’s OAS benefits are lost entirely. There currently is no survivor benefit for OAS.

OAS is based on residency in Canada. Someone who has lived in Canada for 40+ years prior to age 65 would be receiving an annual benefit of $7,707 (based on the latest 2022 rates). Losing that benefit will result in a $7,707 reduction in annual income for the surviving spouse, a significant reduction in retirement income.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Create A Survivor Scenario For Your Retirement Plan

The best way to understand the impact of a partner passing is to create a survivor scenario for your retirement plan. An advice-only financial planner can help you understand the financial implications of these scenarios.

Along with reductions in OAS and CPP, there are other impacts we might want to be aware of as well.

For example, a survivor would benefit from the spousal rollover of RRSP assets, but this could trigger larger minimum RRIF withdrawals in the future. This might mean higher tax payments for the survivor to create the same after-tax spending.

In addition to higher taxes, these increased registered withdrawals may trigger OAS clawbacks for the survivor. So not only have we lost the partners OAS but the survivor may also lose their OAS due to the claw back.

Understanding these implications can be tricky. If you’re wondering how your plan would change in a survivor scenario then please reach out to an advice-only financial planner for help. Don’t get surprised by OAS and CPP survivor benefits.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Another solid piece! Keep up the good work!

Thank you Garth! Always appreciate your comments!

Hi Owen, great post! I have a couple of questions?

Is oas calculated on years before 65 and (18 and over)?

What is the (flat rate) for a younger spouse who’s not receiving cpp when a spouse who is passes away?

Thanks

Hi Phil, thanks for your comment!

1. Yes. OAS is based on residency between age 18 and 65 (47 years) and to receive the maximum OAS requires at least 40 years.

2. The current flat rate is $193.66 for 2019. You can find the latest CPP and OAS figures on the rate card here…

https://www.canada.ca/en/employment-social-development/programs/pensions/pension.html

Owen, I assume that another impact on the survivor’s income would be the loss of their partner’s Federal and Provincial pension income and age amount credits.

Lots to think about on this matter.

Hi Bob! Yes you’re absolutely right, there are a number of tax implications to consider in addition to changes in CPP/OAS. Just the loss of income splitting alone can be a big impact, not to mention the various credits that disappear, and the fact its harder to qualify for certain government benefits like GIS and GST/HST credits.

Definitely a lot to consider. Thanks for adding your comment!

My Husband died 8 years ago is my survivors benefit in with my cpp.

Did not know if this was how it worked, or if I was intitled to get it.

Hi Carolyn, CPP survivor benefits should start the month after a partners death BUT it requires an application to CPP. This should be done as soon as possible. CPP will only pay 12-months of survivor benefits retroactively. Here is the link to see if you qualify and how to apply…

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-survivor-pension.html

From this comment: “Unfortunately, the CPP survivor benefit is based on the “calculated amount” that would have been received at age 65”, it appears that the age the deceased took cpp has no impact on the survivor benefit.

Question: Does the age that the survivor took cpp have an impact on their survivor benefit?

Example: The survivor’s age 65 cpp was $1000/month, but they decide to wait until age 70 to take cpp of $1420/month. If their spouse who was earning the full cpp amount dies, how does the survivor benefit change for the cases of taking cpp at age 65 vs 70?

Thanks

Hi Simon, good question, when the survivor started their CPP can impact the combined benefit. There is an adjustment if the survivor started their CPP benefit before age 65 and there is also a different survivor benefit calculation if the survivor is under the age of 65.

My spouse passed away several years ago and get my CPP and a portion of his. I will turn 65 next year. I also get a portion of his DND pension. When I turn 65 next year, will I lose any off his DND pensions?

Hi Heather, it is possible that there could be a reduction with your pension at age 65. Often pensions have a “bridge” benefit that goes away at age 65. But this can be different with survivor benefits. My recommendation is to call then pension provider and they can walk you through the specific changes with your pension plan.

Hi there Owen.

I live in Canada and I collect a CPP survivors benefit. At the age of 55 I got a terminal illness while still collecting CPP Survivors benefit. I will be turning 60. My question is. Is there another CPP survivor pension that I need to apply for to compensate for my illness durning my illness years.

Hi Colleen, there is the CPP Disability Pension that you may qualify for. I would recommend speaking with your doctor and Service Canada.

I have a pension of $3400/month (after tax). My survivor’s pension is $450/month. I own my own home but I don’t have any other sources of income nor do I have dependents. $3850/month total. My CPP is currently estimated to be $1000/month when I retire- not including the survivors pension which I know will be reduced. Would it make sense to delay getting Cpp until I’m 70. I’m presently 64 years young.

Hi Cherry, I would strongly recommend getting a CPP estimate from Doug Runchey (a retired Service Canada employee) who is an expert on CPP and can accurately calculate your combined CPP + Survivor pension at various ages. It may be that delaying your CPP to age 70 is the most financially beneficial option in the long run but Doug can help confirm this hypothosis.