What Is “Adjusted Cost Base”? And Why Every Investor Should Know

For many investors adjusted cost based is something they may never need to worry about (but should still be aware of!) For most investors who are only using tax-sheltered accounts like the TFSA or RRSP, they never need to worry about adjusted cost base (or ACB for short).

This is because ACB is only required to calculate capital gains tax, and because most investors are investing inside a tax-sheltered account like a TFSA or RRSP, this is a non-issue.

But for anyone with investments outside of a tax-sheltered account, adjusted cost base is extremely important! And your ACB is something that you need to stay on top of.

Adjusted cost based is something every individual investor needs to track on their own. Yes, some mutual funds, robo-advisors, or even brokerage accounts might track adjusted cost based for you, but in the fine print they typically tell investors to track it themselves too. Why? Because they don’t want to be held accountable for a tax issue in the future.

Here’s why we need to worry about ACB and some tips on how to track it…

Why Worry About ACB?

Before we get into what adjusted cost base is, let’s first touch on why it’s important.

Any investment outside of a tax-sheltered account like an RRSP or a TFSA is going to be taxed on any investment growth. As an investor this is something we need to be aware of for many reasons. One important reason is that we want to understand the after-tax rate of return of our investments, and different types of investments create different types of taxable income.

For investments that increase in value, we need to be worried about capital gains tax. This is a tax that gets applied to the increase in value. This gets applied to any type of investment, from a rental property, to a stock, to a bond etc.

To calculate the increase in value we, in a very simple sense, subtract the sale price minus the purchase price. This is the capital gain. If you purchase a share for $20 and it increases in value to $30 then this means there is a $10 capital gain.

The only way we can calculate our capital gain is if we know what our original cost was. But for some types of investments the original cost isn’t enough…

What Is ACB Exactly?

When we purchase an investment the original purchase price is called the “cost basis”.

For many types of investments, there are things that affect the cost basis. These are things we need to keep track of because they can increase or decrease the cost basis. This could mean we need to pay more tax, but typically it means that we get to pay less tax because these things typically increase the cost basis and decrease the capital gains. Less tax is good and that’s one reason why we should track ACB!

When it comes it investments, the cost basis of an investment is the original purchase price adjusted for commissions and transaction fees, new purchases, stock splits, reinvested dividends, return of capital, reinvested capital gains distributions etc.

This is especially important for investment products like ETFs because they are a bit more complex and can have different forms of adjustments.

For individual stocks the tracking of adjusted cost based is a little bit easier, but it can still be a bit overwhelming.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

How Do You Track Adjusted Cost Base?

Tracking ACB can be a bit tricky depending on the type of investment you’re tracking. For ETFs there can be many different types of distributions and tracking all these different types of distributions can be confusing without some help.

You can use a spreadsheet to track your adjusted cost base but using an online tool such as adjustedcostbase.ca can help a lot.

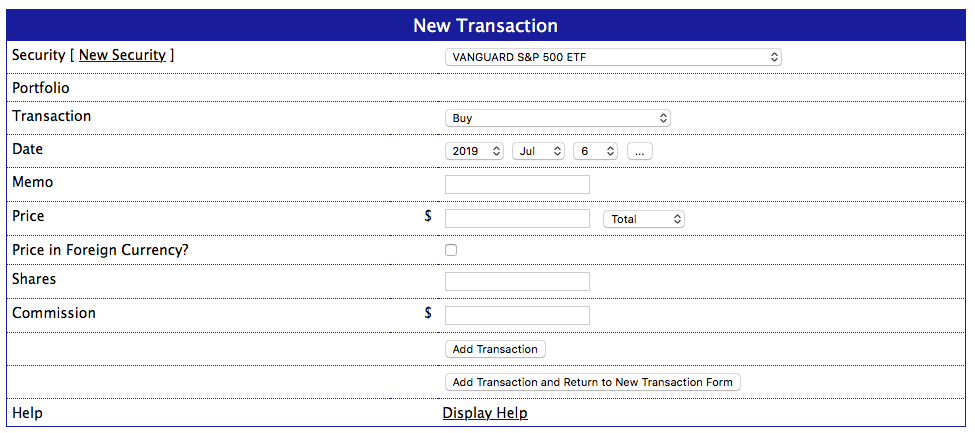

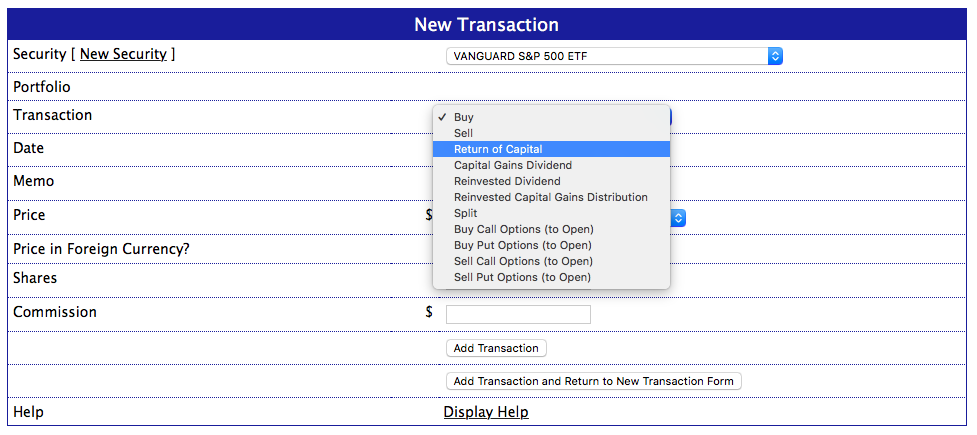

Adjustedcostbase.ca will prompt you to enter the different types of distributions and do the math for you to calculate the ACB for each individual stock/ETF/mutual fund.

You can even enter different types of distributions like capital gains distributions, return of capital, and reinvested capital gains distributions…

Not All Investments Are Equal

Last thing to consider when it comes to adjusted cost base is that not all investments are created equal. Some investments require more work to track ACB than others. For example, stocks can be a bit easier to track ACB for because there is a bit less happening and you can control if/when dividends are reinvested.

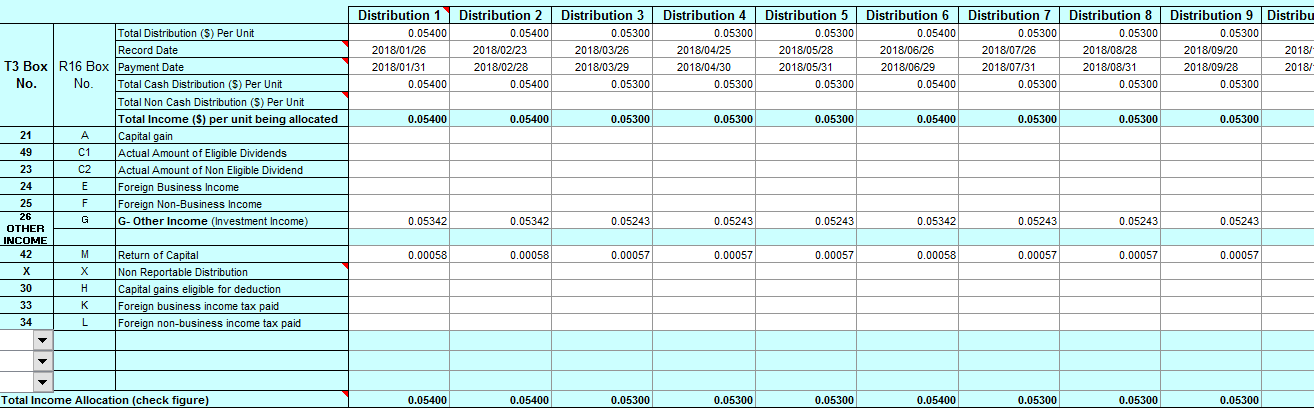

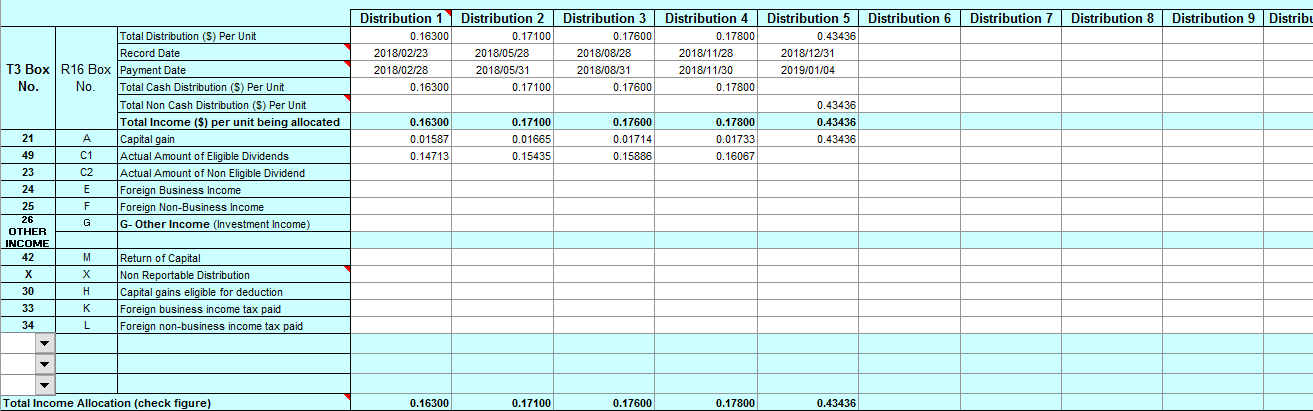

ETFs on the other hand can create a bit more complexity when tracking adjusted cost base, especially when they make monthly distributions (like a typical bond ETF). Check out the two examples below.

The first ETF is a bond ETF with monthly distributions. Not only is this more complex to track because there are 12 transactions per year, but there are also different types of distributions that need to be tracked. Notice how for this bond ETF there is a tiny “return of capital” distribution each month? That means 24 transactions to enter each year to track the adjusted cost base for this investment.

The second ETF below is an equity ETF with quarterly distributions. As you can see there are fewer transactions to track but there are still different types of distributions, so still pretty complex. If you were holding a few different equity ETFs in your non-registered account this would still take a bit of time each year to update your ACB.

This distribution information is provided by your broker on your T3 each year but you can also get this information from CDS Innovations “Mutual Fund and Limited Partnership Tax Breakdown Service”

The screen shots above are an example of the distribution information that every fund provider uploads to CDS each year during tax season. This is a good way to update your ACB if you’ve been putting it off for a few years and have misplaced your T3s from prior tax years.

Tracking ACB is important, so don’t put it off too long, its best to keep on top of it and tax time is the best time to update you ACB each year.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Also important to remember that in inflationary times such as the present, the “real” value of your ACB is decreasing. The result may be that the nominal “gain” due only to inflation becoming taxable income some day as well.

What a fantastic point Garth, thanks for adding that. You’re right that part of that capital gain is simply due to inflation and not actual investment growth in real terms.