Can You Retire When The Stock Market Is At An All Time High?

Can you retire when the stock market is at an all time high? For many soon-to-be retirees this is an important question. It can be extremely nerve-racking to “pull the plug” and leave a stable income when investment values are at their peak.

But is this really a concern? Is it bad to retire when markets are at an all time high?

For many soon-to-be retirees, their investment portfolio will make up an important part of their future retirement income. Even retirees with a pension or full CPP/OAS will often have a small investment portfolio to support additional spending in retirement.

Many retirees worry about retiring at an all time high. They worry about a large decline in investment values soon after retirement. They believe this will dramatically impact their retirement plan. But is this concern justified? Or is this one of those biases that we’re all susceptible to?

Working for a few additional years would certainly help solidify a soon-to-be retirees financial plan, but at what cost? That lost time can never be recovered and could represent some “prime retirement years”. That income may also never be needed if everything goes to plan.

As it turns out, we’re actually at an all time high quite often, and the impact of retiring at an all time high isn’t even close to what we’d assume…

What Is An “All Time High”?

An “all time high” or “ATH” is when the stock market reaches a new all time high in terms of total value. This could be any stock market, but often it’s the US S&P 500 that gets a lot of attention. (The S&P 500 is a large stock market index made up of 500 of the largest companies in the US)

Typically this does not include dividends, just the total value of the index/companies themselves.

When the S&P 500 reaches a new all time high this is a big deal, there are often media articles, news stories, blog posts etc to highlight this new milestone. But how often are we at an all time high? And is it really that noteworthy?

How Often Are We At An All Time High?

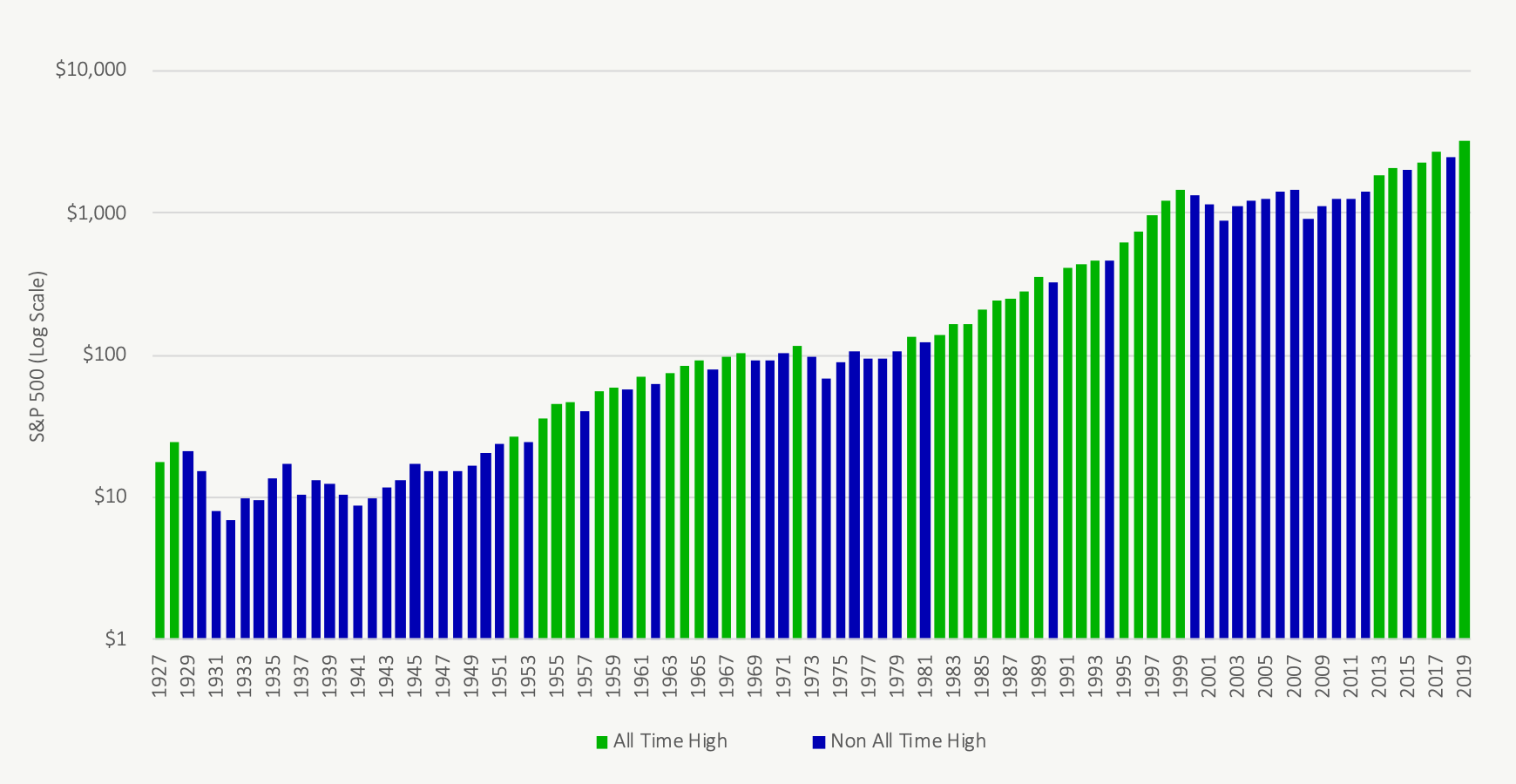

To determine how often we’re at a new all time high we’ll use the S&P 500 and we’ll only look once per year.

Because of the way the stock market works, we’re actually at an all time high quite often. With historical average returns of over 10% per year, the constant year over year growth quickly causes the S&P 500 to reach new highs. Even after a large drop or correction, the constant pace of growth means that new all time highs are inevitable, it’s just a matter of time.

In fact, since the early 1900’s until now we’ve actually been at an all time high nearly 40% of the time! Four out ten years will end with a new all time high and often these all time highs will be reached year after year during a “bull run”. This can clearly be seen in the chart below, where new all time highs (in green) are clustered in groups.

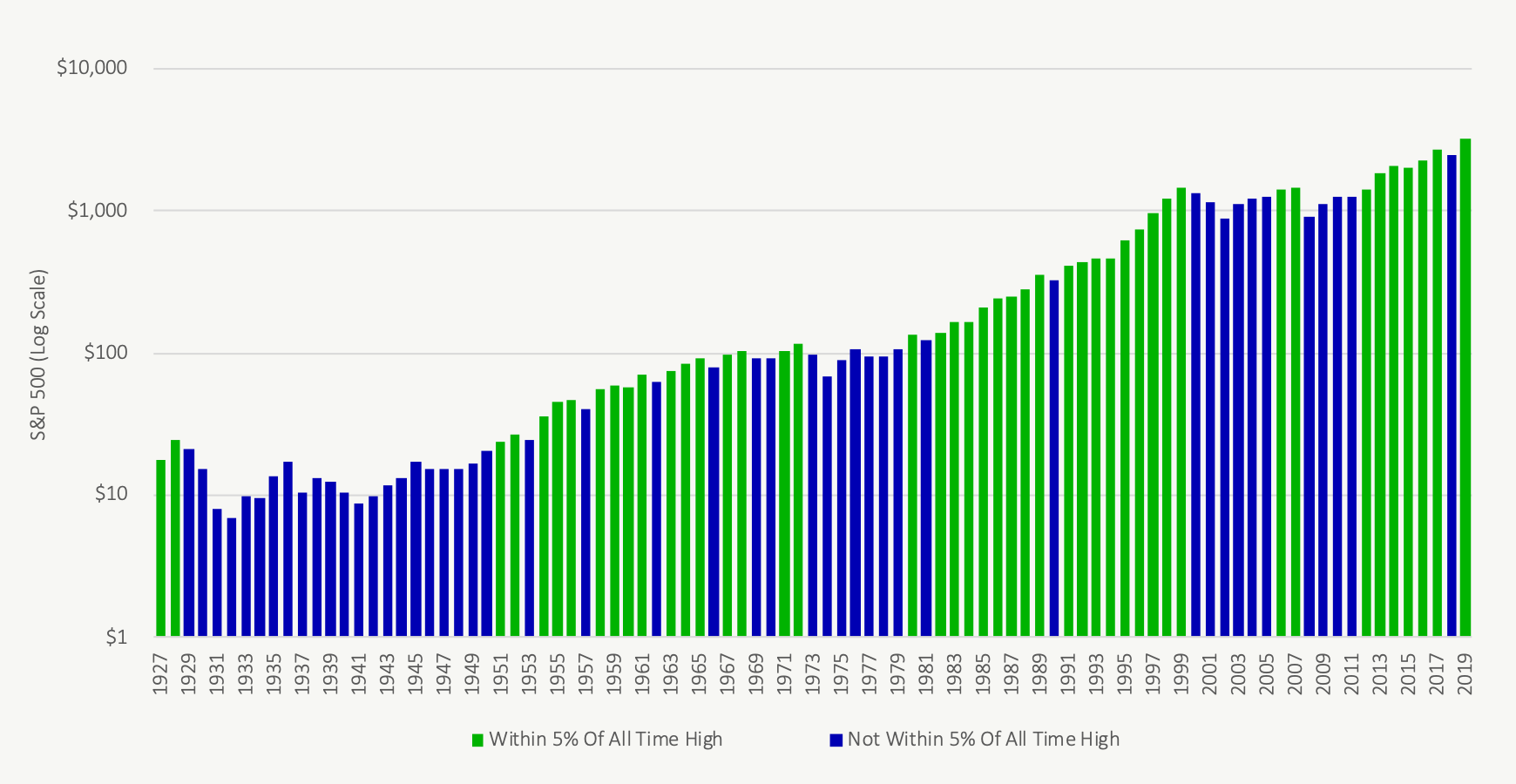

Plus, if we expand the criteria slightly and look at years where we’re within 5% of a previous all time high, this percentage increases to nearly 50%!

What Is The Success Rate If Retiring At An All Time High?

Even though it’s quite common to be at an all time high, it can still be nerve-racking to retire when markets are at their peak. We know that investment returns matter in retirement. Specifically, we know that a bad ‘sequence of returns‘ in early retirement can be very detrimental to long-term success.

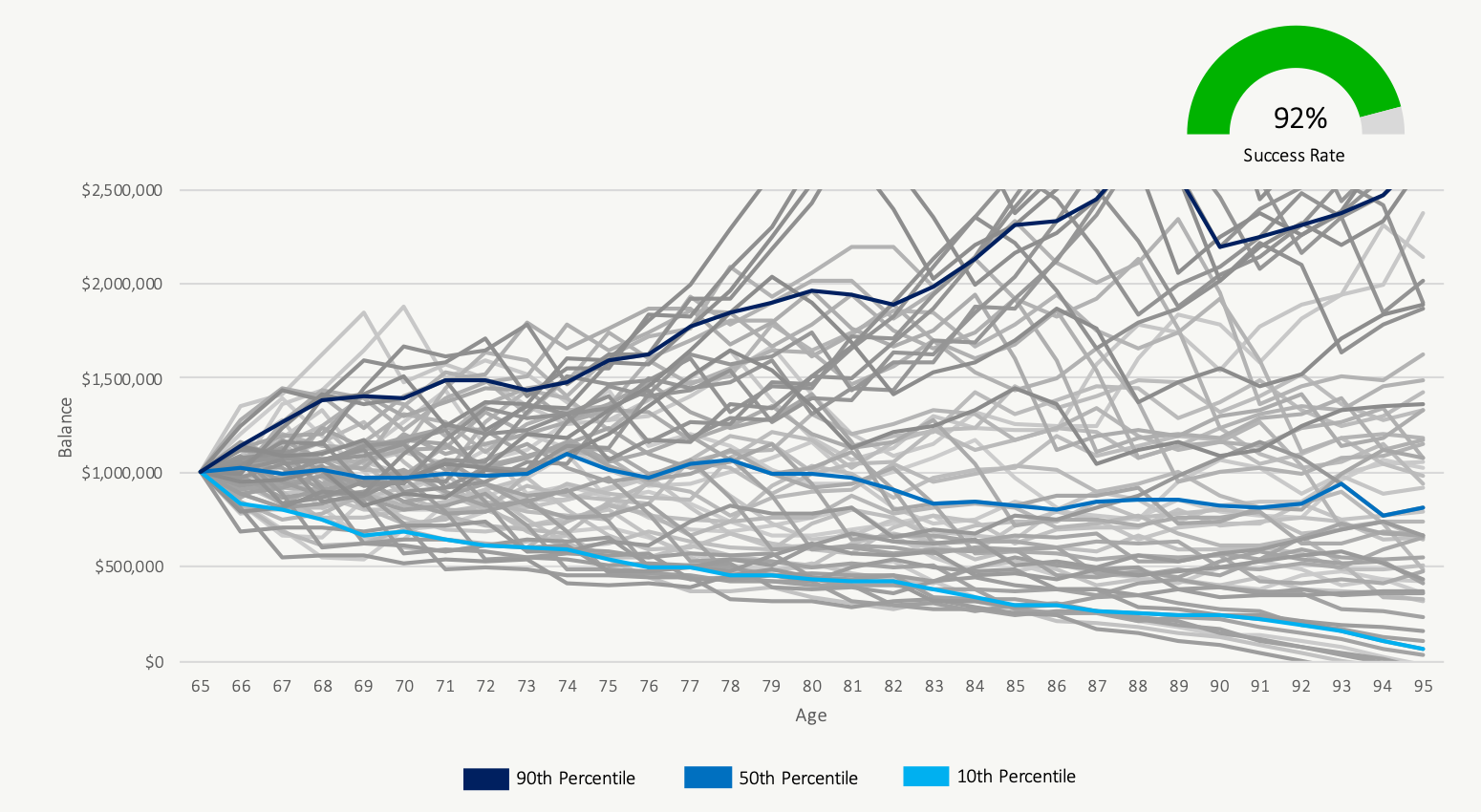

To test how successful a retirement plan can be when retiring at an all time high we’ll use the often quoted 4% rule but then we’ll only look at periods that start at an all time high.

Quick refresher on the 4% rule. The 4% rule suggests that a retiree can draw 4% from their portfolio each year, adjusted for inflation, and have a reasonably high chance of success. Success is when a retiree reaches the end of a 30-year retirement period with money left over (even if it’s just $1).

These are the different “paths” a retirement plan could take based on historical stock market returns when using the 4% rule. Based on historical results the success rate of withdrawing 4% per year is quite high over 30-years (although some paths get very close to zero).

Now, to test how successful this plan would be when retiring at an all time high we’ll only include the periods that start when the S&P 500 is at an all time high. This removes 60% of historical periods. This reduces the sample size significantly, so take this analysis with a grain of salt, but the success rate when retiring at an all time high is essentially the same! Why is this?!?

Reasons For Success

So why is retiring at an all time high so successful? There are a few important reasons…

1. Highly Diversified Portfolio

In the examples above we assume a highly diversified portfolio of Canadian, US and Global equities. We also assume a portion of the portfolio is in bonds/fixed income. So, although we use the S&P 500 to mark when an all time high occurs, the fact is that a diversified portfolio may not be at an all time high, or may have already reached an all time high thanks to the high level of diversification. For example, during the early 2000’s the S&P 500 underperformed the TSX, so a diversified portfolio would have benefited from this diversification.

2. Currency Conversion

The S&P 500 is obviously a US index and listed in US dollars. So even though the S&P 500 is at an all time high in USD, the conversion to Canadian dollars for Canadian investors means that it may not be at an all time high in CAD. This can both help and hurt an investor. For example, in 2008 the S&P 500 lost over 36% in one year, but in CAD the decline was only 22% due to the change in exchange rates happening over the same period. This currency conversion helped soften the blow in 2008 for Canadian investors who retired close to an all time high in 2007.

3. All Time Highs Are Quite Common

Probably the largest factor that improves the success rate when retiring at an all time high is that all time highs are quite common. Although someone could have retired at an all time high in 2014 they quickly saw their portfolio reach new all time highs in 2016, 2017, 2019 and beyond.

4. We’re Ignoring Some Long Periods In History

The last reason is that unfortunately the analysis above ignores some long periods in history. Because we’re only looking at periods that begin with an all time high we ignore a large period between 1929 and 1950 and another large period between 2000 and 2012. Retirees during this time may experience just as much trouble as a retiree who retired just prior.

Some Caveats…

There are some important caveats to highlight in the analysis above.

The first and most important is that past returns do not guarantee future results. This standard phrase from every mutual fund advertisement also applies to the analysis above. We use historical returns to test a retirement plan and there is no guarantee that future returns will look anything like what we’ve seen in the past.

The second is that we’re using the S&P 500 in USD to “mark” when we’re at an all time high. Using a different index to mark an all time high could drastically change the analysis.

The last caveat is that we’re not looking at many historical periods. By looking at only periods that start at an all time high we are forced to drop over 60% of historical periods. In addition, the analysis above doesn’t include retirements that started in the late 1990’s, 2000’s and 2010’s. This is because we haven’t yet seen 30+ years of investment results. It’s quite possible that retirees who retired at all time highs in 1999 or 2007 may yet run out of money. This will depend on future returns over the next 10 to 20+ years.

Still Nervous? Here’s What Can You Do To Improve The Success Rate

Still nervous about retiring when markets are at an all time high? There are a few things you can do to improve the success rate of your retirement plan.

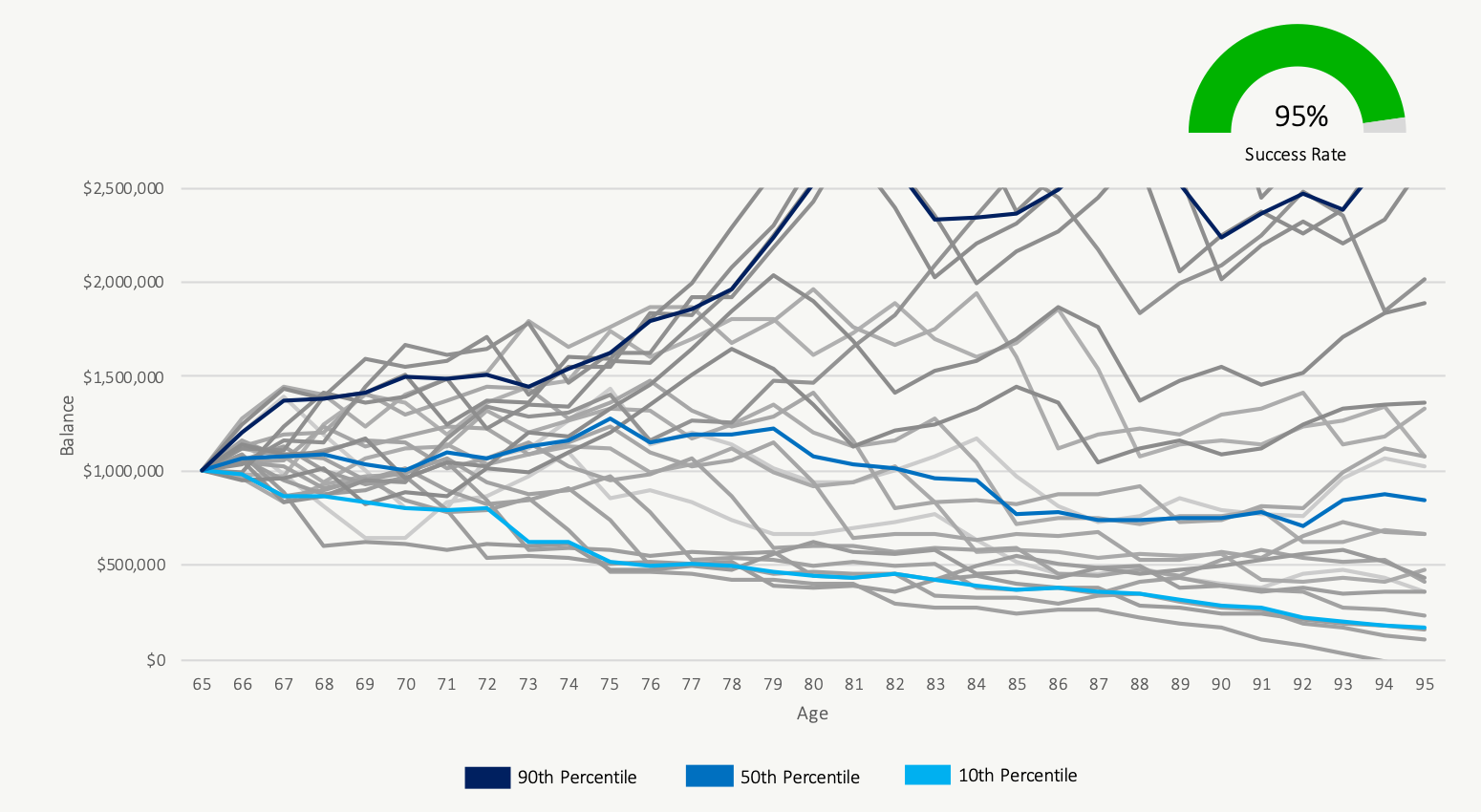

First is to plan for a reduced withdrawal rate in retirement. This essentially means spending less each year. Reducing the withdrawal rate from something like 4.0% to 3.5% or 3.0% will significantly improve the success rate of a retirement plan if starting from a market peak.

Second is to have lots of “discretionary” or “variable” spending that can be reduced if markets drop dramatically. This is another way to improve the success rate if starting from a market peak. This reduction in spending would only be necessary if investment returns turn negative shortly after retirement and do not recover quickly. This type of variable spending could be in the form of a healthy vacation or hobby fund.

Third is to ensure that investments are highly diversified and have low fees. Less diversification and higher fees will directly impact the future success of a retirement plan.

Fourth is to consider real estate assets as a “fall back asset” in case investment returns have a large impact on the plan. In these cases, a home can be sold in late retirement to free up capital and fund the final years of retirement or long-term care.

The last thing you can do is create a custom plan. There are often additional opportunities that can help improve the success rate of a retirement plan. This could be income splitting, tax/benefit optimization, delaying CPP/OAS and more. These options could work for or against a retiree depending on their situation. It can help to have a few retirement scenarios created to test a retirement plan in different situations and with different spending/retirement goals. This can help create comfort knowing that even in the worst-case scenario you have a solid plan in place.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments