A New Way To Share Your Financial Plan: The PlanEasy Public Dashboard

Talking about personal finances has always been somewhat taboo. It’s difficult to discuss personal finances with friends and family. Everyone has different values and goals. We all have different financial circumstances. And sometimes… talking about personal finances can lead to hurt feelings and personal strife.

This has led to many people avoiding personal finance discussions or discussing personal finances anonymously in online forums and communities.

But discussing personal finances in an online community can be difficult. Personal finances are personal. A financial plan can differ dramatically from one person to the next. To have a good discussion requires a lot of information, something difficult to do in an online community.

At PlanEasy we want to make financial planning easy. We want to make it easier to share and discuss personal finances online.

That’s why we’re introducing the PlanEasy Public Dashboard, a completely anonymous way for PlanEasy users to share their financial plan… let’s take a look at the Public Dashboard…

Personal Finance Communities

There are many, many personal finance communities online. There are communities for specific topics like FIRE. There are communities for specific countries like Canada. There are online groups dedicated to specific circumstances like low-income.

These online communities all have one thing in common, they allow like minded people to share and discuss personal finances, and most do this completely anonymously.

These communities can be HUGE too! Communities like Reddit’s r/PersonalFinanceCanada have over 800,000 members. It’s easy to create an anonymous username and join the discussion. And because it’s anonymous, it’s easy to ask very personal questions.

People are sharing very detailed personal finance information in these communities and getting fast and timely feedback regarding their situation (sometimes good… sometimes not so good). There can be hundreds or even thousands of new discussions started every single day!

Making Personal Finance Discussions Easier

But it’s difficult to have a very detailed personal finance discussion in an online forum because it’s hard to share all those details quickly.

As a result, questions in these online forums are typically focused on a single topic, but this creates a risk that feedback/discussion will not include all the relevant details. This isn’t very personal.

To make this type of detailed personal finance discussion easier we wanted to provide a way to share the incredible detail of a PlanEasy financial plan but in a completely anonymous way. We wanted to make sharing and discussing a financial plan very easy, enabling more personal finance discussion.

The PlanEasy Public Dashboard

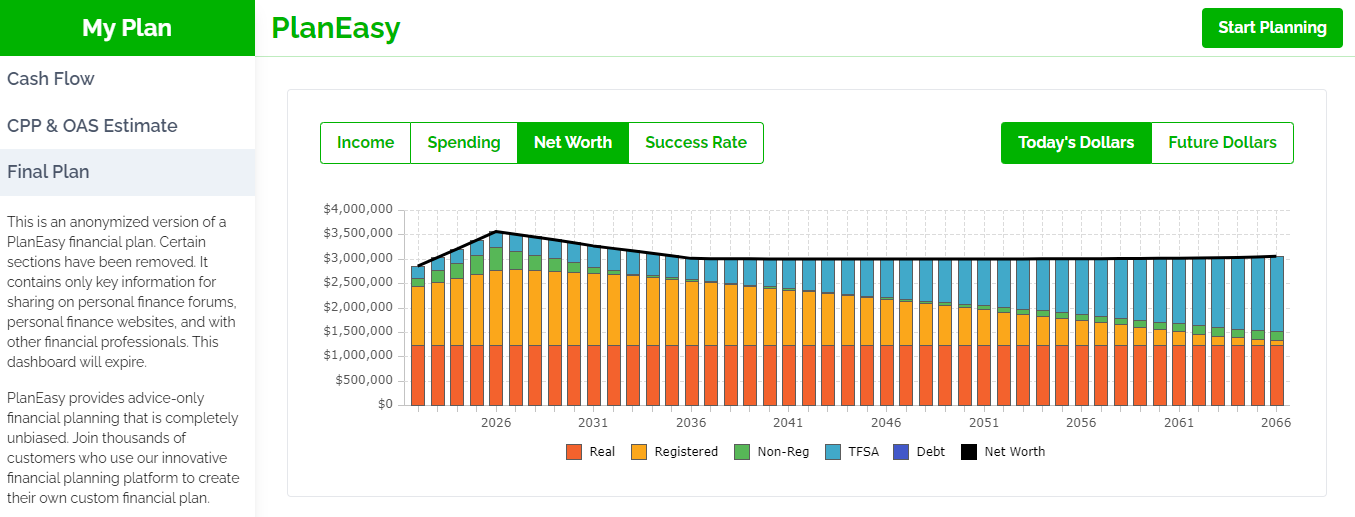

The PlanEasy Public Dashboard is a completely anonymized version of a PlanEasy financial plan. It’s been completely stripped of personal information like names, date of birth, debt names etc. This anonymized information is then copied to a separate encrypted database and gets deleted after a specific period of time of your choice (between 24hrs and 1-year).

What is left is purely the facts and numbers. This dashboard can be easily shared with other personal finance professionals or in online forums and communities.

The Public Dashboard contains only key pieces from a user’s financial plan…

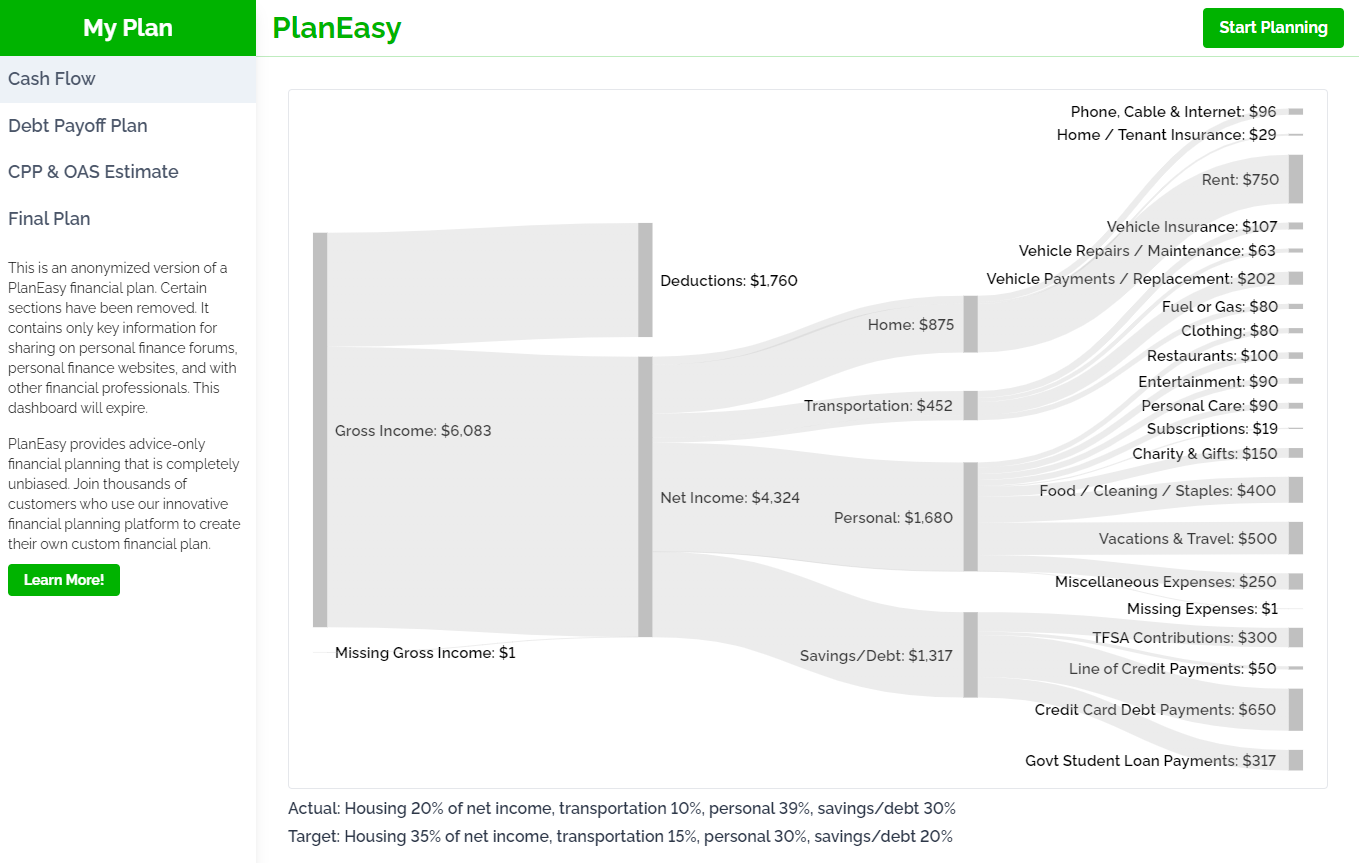

Cash Flow Diagram

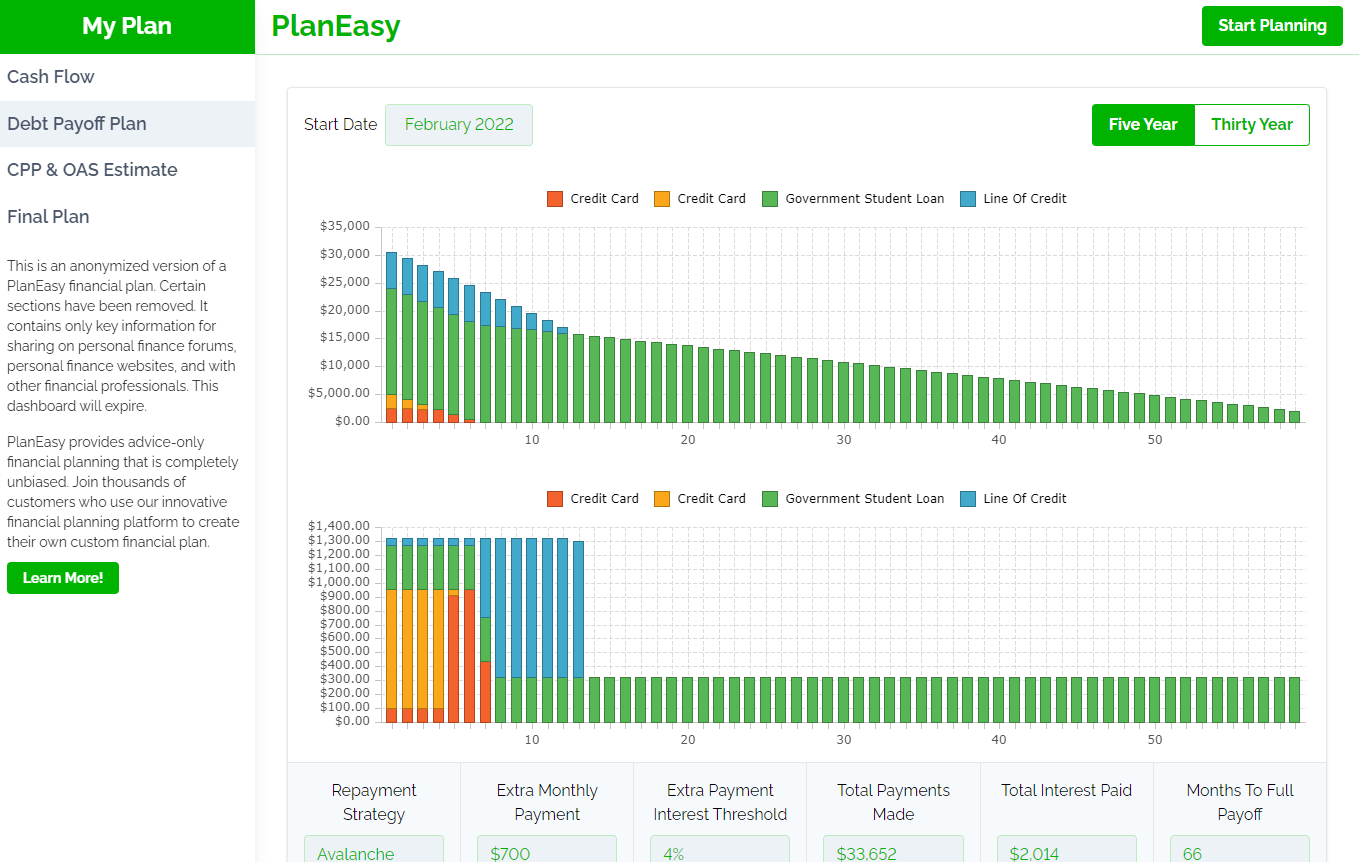

Debt Payoff Plan

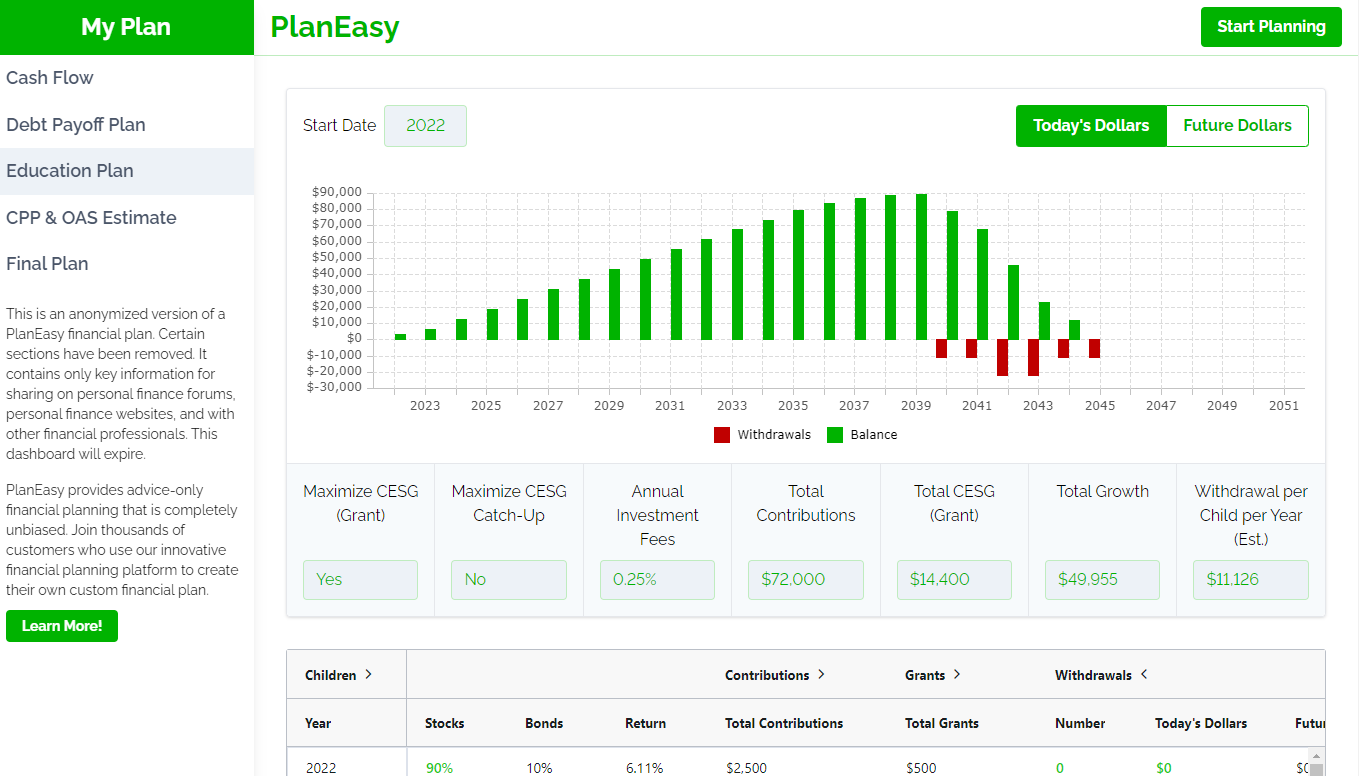

Education Plan

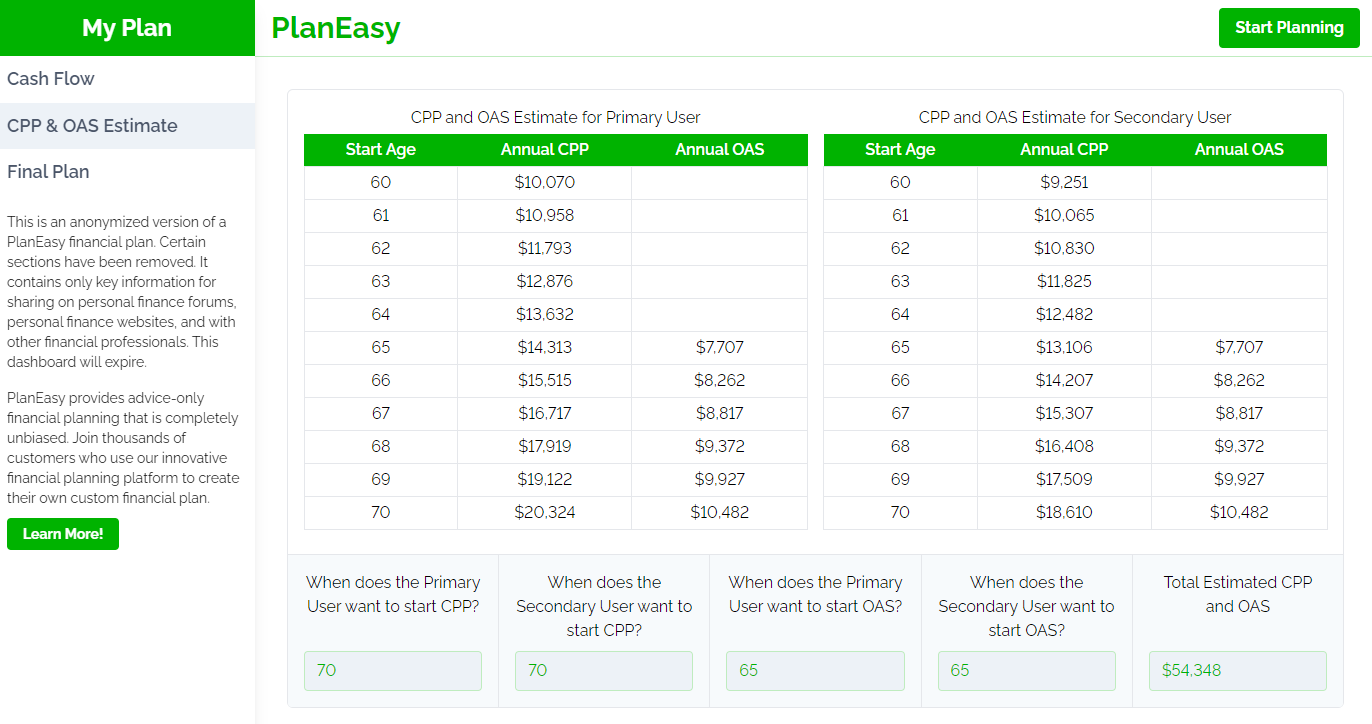

CPP & OAS Estimate

Final Plan Projections

Examples Of A PlanEasy Public Dashboard

Interested in exploring a PlanEasy Public Dashboard? Below are four examples of Public Dashboards. These public dashboards are set with an expiry if 1-year and will automatically be deleted in March 2023. They contain a lot of detail but no personal information.

Here are four different public dashboards to explore…

- Retirement Plan

- Low-Income Retirement Plan

- Recent Grad Financial Plan

- New Parents Aiming For FIRE Financial Plan

Want to create your own financial plan and your own public dashboard? Let’s see if we’re a good fit, start your financial plan right now…

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen,

I earn about 45K per year. I am a good saver. I don’t think my income will be much higher than 50K.

I maximize my TFSA.

Do you think an RRSP is still preferable over a taxable account?

I wonder if I invest in VGRO in my taxable over decades if I would do better just using my taxable account instead.

Hi Kam, it’s very much going to depend on the circumstances. A taxable account could be better if there are Canadian dividends, especially in a province like BC or Ontario where in a lower tax bracket this type of income has a negative tax rate. A taxable account could also be better if its right before age 65 and GIS benefits are expected in the near future. But over a longer period of time, and when RRSP withdrawals can be planned before age 65, then an RRSP is very attractive due to the tax free compounding over a long period.