How Do Tax Returns Work When There Is An RRSP Contribution or Withdrawal

The RRSP is a great financial planning tool. Investments grow tax-free within the account. Contributions to an RRSP reduce taxable income. And in some unique circumstances, it may even be advantageous to make contributions in one year and then deduct them in future years.

RRSP contributions and withdrawals will decrease and increase taxable income respectively. This effect can be seen on the tax return.

So, how do tax returns work when there is an RRSP contribution? What effect does an RRSP contribution have on the tax return?

And what about in the future? What happens when RRSP withdrawals are made? What effect does an RRSP withdrawal have on the tax return?

These are important questions. The benefit of strategic RRSP contributions and withdrawals can be $10,000’s or more.

Understanding how RRSP contributions and withdrawals affects your tax return is very important for Canadian retirement planning. We’ll go through the basics of how RRSPs work, as well as a few examples to show how an RRSP contribution or withdrawal shows up on the tax return.

How RRSPs Work

Here is a quick summary of how an RRSP works. When you earn income, you increase your RRSP contribution limit; put another way, you create contribution room in your RRSP. The amount of room you create is 18% of your earned income up to a maximum.

For example, for income earned in 2021, the maximum amount of additional RRSP contribution room you could have created was $27,830. It also depends what type of income you earn. Not all income counts as earned income and not all income will create additional RRSP contribution room.

The RRSP contribution room you create in a tax year can be used in the following tax year or any year after that.

Say you earned income in 2021 and created new RRSP contribution room, you would be allowed to use that new contribution room in 2022 and beyond. If you don’t contribute to your RRSP in 2022 the unused contribution room is carried forward until it is used in the future (and it’s not always the best idea to contribute to an RRSP, so carrying forward contribution can be a smart decision).

How RRSP Contributions and Withdrawals Effect Taxable Income

When you contribute to an RRSP you’ll use up some of your available contribution room. This RRSP contribution can then be used as a deduction when you file your tax return, or it can be carried forward and deducted in future years. An RRSP deduction lowers your taxable income.

On the opposite side, if you’ve already contributed to an RRSP and start to withdraw from it in the future, this amount will be added to your taxable income. An RRSP withdrawal increases your taxable income.

Let’s consider two examples, Clara and Wilbur who both reside in Ontario.

Clara earned $65,000 in income in 2020 and filed her taxes in 2021. On her Notice of Assessment, she saw that she now has $11,700 in additional contribution room. She earns $67,000 in 2021. She’s maximized her TFSA, and she starts contributing regularly to her RRSP. By the end of 2021 she was able to contribute a total of $10,000 to her RRSP.

Wilbur is about to retire. He earned $67,000 in employment income in 2021. Wilbur has a sizable RRSP and decided to start making withdrawals before OAS clawbacks begin. He withdraws $10,000 from his RRSP in 2021.

How will Clara and Wilbur’s income change?

In these simple scenarios, when Clara and Wilbur file their respective 2021 tax returns, Clara’s taxable income will be reduced to $57,000 while Wilbur’s taxable income will be increased to $77,000. Clara’s tax bill will be decreased, and Wilbur’s will increase – let’s look at what’s happening on the T1 return form for a clearer picture.

Where Does An RRSP Contribution Or Withdrawal Show Up On The Tax Return

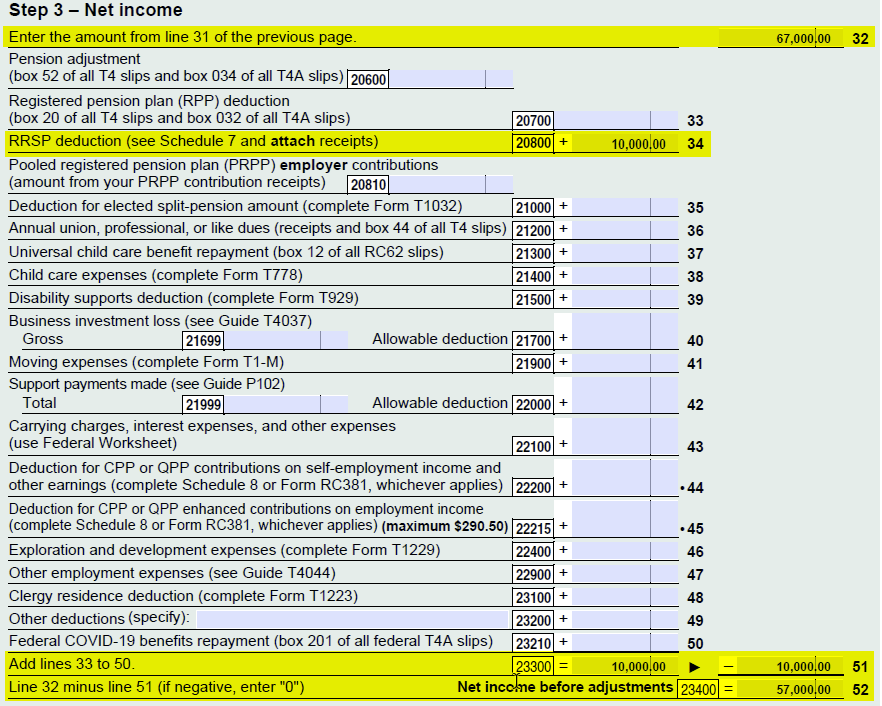

When Clara completes her tax return, in the Net Income section on line 20800 is where Clara would enter her $10,000 RRSP contribution. All the details have to be entered in an accompanying RRSP tax form (Schedule 7), which we know Clara filled out diligently!

Assuming Clara had no other income her Total Income would be $67,000 and her Net Income would now be $57,000:

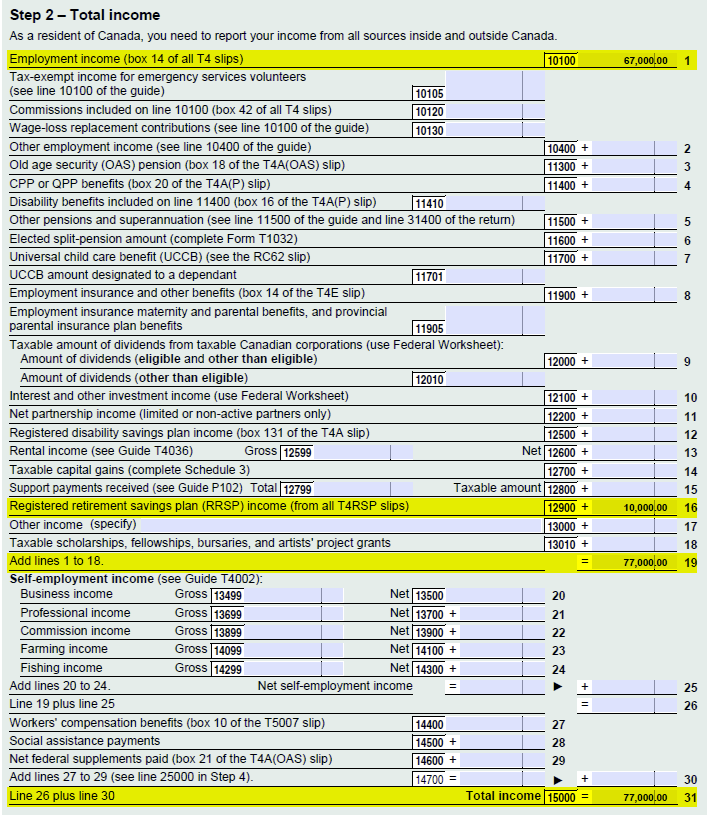

When Wilbur completes his tax return his RRSP withdrawal would show as an increase in Total Income. On line 12900, Wilbur would have to enter $10,000, which will be added to his employment income, resulting in an increase in Net Income to $77,000:

Let’s have a look at what happens to their income tax payable when there is an RRSP contribution and an RRSP withdrawal.

Benefit Of An RRSP Contribution On The Tax Return

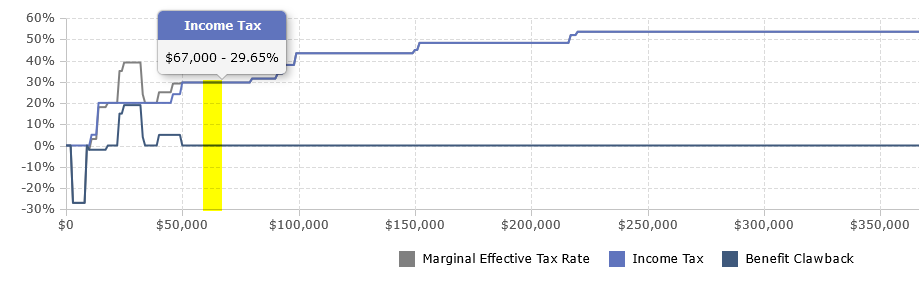

In the chart below we’re showing Clara’s marginal tax rate. This is the tax rate on the next dollar of income.

From our example above, Clara’s income before and RRSP deduction is $67,000. The highlighted area represents her RRSP contribution of $10,000 being deducted. Taxable income goes from $67,000 to $57,000.

Her tax bill would be reduced by the tax rate of the yellow area. The rate throughout the highlighted area (for a resident of Ontario) would be 29.65%, so income tax owing would be reduced by $2,965 ($10,000 times 29.65%). If income tax was deducted at source, then Clara’s RRSP contribution would create a tax refund. That’s a nice cheque/direct deposit she could expect from the CRA!

Impact Of An RRSP Withdrawal On The Tax Return

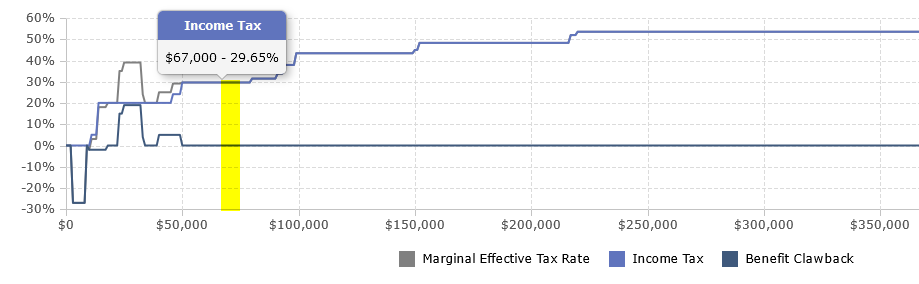

In the chart below we’re showing Wilbur’s marginal tax rate. This is the tax rate on the next dollar of income.

Wilbur’s employment income was exactly the same as Clara’s, but the highlighted area in his case shows additional taxes to be paid due to the RRSP withdrawal. Wilbur’s income tax owing would increase by the income in highlighted region. Opposite to Clara, Wilbur’s tax bill would increase by $2,965.

However, the story is a little more complicated for Wilbur. When Wilbur made the RRSP withdrawal his financial institution would have withheld a portion of the withdrawal to cover the eventual tax bill. The amount varies with the size of the withdrawal:

- 10% (5% in Quebec) on amounts up to $5,000

- 20% (10% in Quebec) on amounts over $5,000 up to and including $15,000

- 30% (15% in Quebec) on amounts over $15,000

(Quebecers aren’t benefiting here from lower rates – residents of Quebec will have an additional 15% withheld by Revenu Québec, regardless of the size of withdrawal.)

Wilbur’s withdrawal falls under the 20% category, so $2,000 (20% times $10,000) was withheld from that withdrawal and paid to the CRA. The $10,000 withdrawal was immediately reduced to $8,000.

Although $2,000 was withheld for income tax we know that the actual income tax owing will be $2,965. The amount withheld would reduce the future income tax owing from $2,965 to $965. Wilbur will still owe $965 when he files his income tax return.

In addition to the income tax withheld, the financial institution likely would have charged between $25 to $100+ for this withdrawal. Withdrawals from an RRSP are called a “partial deregistration” and typically incur fees of $25 to $100+.

It’s possible to avoid withholding tax and partial deregistration fees if the RRSP is converted to a RRIF. Minimum RRIF withdrawals will not incur withholding tax and most financial institutions either waive or reduce the deregistration fee for RRIFs.

RRSP Contributions or Withdrawals

Understanding how a contribution or a withdrawal from an RRSP impacts your tax return is an important part of creating a financial plan.

Contributing to an RRSP will lower your taxable income and consequently your tax bill. Depending on what your income is, and the size of your contribution, this could even drop you to a lower tax bracket, and perhaps help you qualify for more income-tested benefits like the Canada Child Benefit (CCB) or Guaranteed Income Supplement (GIS).

Withdrawing from an RRSP will increase your taxable income. Whenever you choose to withdraw from an RRSP there are several consequences. The amount withdrawn will be added to your taxable income, a portion of the withdrawal will be withheld by your bank, and you will likely face partial deregistration fees of $25 to $100+. The increase in taxable income will mean higher income tax payable and could mean lower government benefits the following year.

RRSP contributions and withdrawals are an important financial planning tool. An RRSP can both help and hurt your financial plan depending on the circumstances. If used strategically, RRSPs can help reduce income tax by $10,000’s or more and can increase government benefits by $10,000’s or more too. Understanding how RRSPs impact your tax return can make it easier to reach your financial goals.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments