6 Reasons To Start CPP At Age 60

When is the best time to start CPP benefits? In some cases, delaying CPP until age 70 is a wise choice. But in other cases, it might be best to start CPP at age 60.

In this blog post we’re going to look at six good reasons to start CPP at age 60.

Starting CPP at age 60 will mean a smaller monthly benefit but it also means getting CPP income earlier. Starting CPP at age 60 will decrease the size of the benefit by 36% versus the calculated amount at age 65, but even this reduced amount can be $10,000 per year or more!

This reduction in CPP benefits is called the actuarial adjustment and it’s 0.6% for each month that CPP starts before age 65. The maximum reduction is 36% if CPP starts at age 60 but this same rule applies to any start age in between. Start CPP 2-years early at age 63? That’s a 14.4% reduction (24-months x 0.6% per month). Start CPP 3.5-years early at age 61.5? That’s a 25.2% reduction (42-months x 0.6% per month).

Despite the reduction in monthly benefits there are a few very good reasons to start CPP at age 60.

Need Extra Retirement Income

The first and most obvious reason to start CPP at age 60 is when you need the extra income to support retirement spending. CPP at age 60 can be over $10,000 per year. That’s a lot of retirement income! (And with CPP Enhancement this is only going to get larger, read more about CPP Enhancement)

If you’ve just started retirement, or if you expect to start retirement soon, and you need extra retirement income, then consider starting CPP at age 60.

Shortened Life Expectancy

Another important reason to start CPP at age 60 is if you expect a shortened life expectancy. It could be that you’ve received a bad health diagnosis, or it could be that longevity does not run in your family.

If you have a good reason to believe that your life expectancy could be average or less, then definitely consider starting CPP right away at age 60.

Consider starting those payments as soon as possible because the breakeven point for delaying CPP can be in your late 80’s to early 90’s depending on factors like asset allocation, investment fees, and investment returns.

8+ Low Earning Years In The Past

Consider starting CPP early if you’ve had gaps in employment in the past, either for school, disability, job loss etc.

The amount you receive from the Canada Pension Plan is based on a credit system. You need to have a certain number of full credits to earn the maximum CPP benefit. A full credit is earned when your employment income for a given year was higher than the years maximum pensionable earnings (YMPE). If you look at your CPP statement of contributions (which you can get by logging into My Service Canada) you’ll see a small “M” next to each year you earned a full credit.

But you don’t M’s throughout your entire life to get max CPP. You can actually drop between 7-8 low or zero earning years from the CPP calculation. This is an important factor to consider if you plan on delaying CPP past age 60.

For example, if you attended university from age 18-22 then you would likely drop these 4 low earning years from your CPP calculation. But if you retire at age 60 then you’ll also have 5 more zero earning years between age 60-65. This would bring your total to 9, that’s more than the drop out amount, and those extra low/zero earning years will impact your CPP calculation if you start CPP after age 60.

If you retire at or before age 60, and expect low/zero employment income between 60-65, this provides an incentive to start CPP at age 60 rather than delay to age 65. Delaying to age 65 will add 5 zero earning years to your CPP calculation. If you already had 7-8 low or zero earning years in the past, then the addition of these zero earning years between age 60-65 acts as a large drag on your CPP benefit if you start CPP later.

Starting CPP at age 60 will eliminate this drag and it’s a good reason to start CPP early. This might be one of the reasons that most people prefer to start CPP at age 60 versus age 65 or age 70.

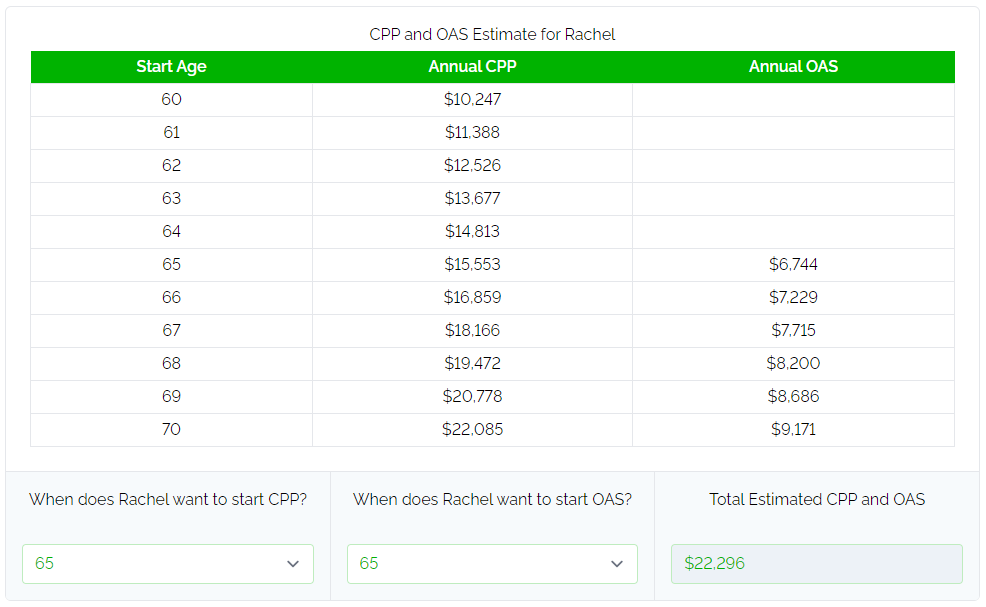

For example, Rachel wants to retire at age 60 but is considering delaying her CPP benefit to age 65 or 70. If Rachel didn’t have any large gaps in her past employment, then her CPP calculation on the PlanEasy platform would look like this…

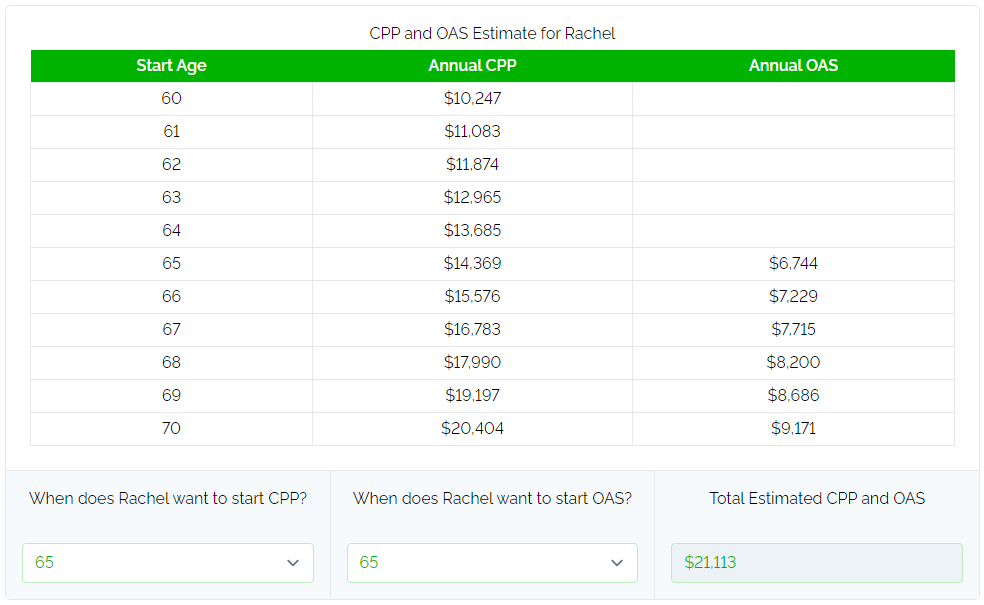

But if Rachel had a few extra zero earning years in the past, then her CPP benefit at age 60 would be the same, but delaying CPP to age 65 would add additional zero earning years that would act as a “drag” on her future CPP benefit. Notice how in this case Rachel’s benefit at age 60 is the same but at age 65 is lower because of this drag? This drag will decrease Rachel’s CPP benefit by over $1,000 per year if she’s had some gaps in employment and delays CPP to age 65!

Expect To Qualify For GIS

Another important reason to start CPP at age 60, even if still fully employed, is when you expect to qualify for GIS in the future.

The Guaranteed Income Supplement (GIS) is a generous government benefit that provides income support to low and moderate income seniors. It’s a generous benefit but comes with very high “clawback” rates.

Your future GIS benefit will be reduced by 50% to 75% of every extra dollar in taxable income.

Take $100 out of your RRSP/RRIF? GIS goes down by $50 to $75.

Earn an extra $100 in CPP benefits by delaying CPP? GIS goes down by $50 to $75.

This large clawback on GIS benefits makes it less attractive to delay CPP past age 60, even if fully employed. Sure, delaying CPP will make those payments larger in the future but 50% to 75% of that increase will be lost to GIS clawbacks.

In general, if you expect to qualify for GIS in the future then consider starting CPP as soon as possible at age 60 and use the extra income to top up TFSA investments instead.

There’s Been A Large Drop In Investment Values

Buy low, sell high. That’s the basic advice when investing.

When delaying CPP benefits past age 60 it typically means that withdrawals from investment assets must increase to fill that gap, after all, this retirement income must come from somewhere, right?

But during a large drop in investment values, perhaps during a recession or stock market correction, you would rather not be selling investments at reduced prices to help fund retirement spending.

Rather than selling investments when the stock market is down, one strategic option is to start CPP at age 60 (there are also other strategic options when deciding when to start CPP benefits)

Even if this wasn’t in your original plan, by starting CPP at age 60 you can decrease the withdrawals you need to make from your investment portfolio which can be a big advantage if investment values have declined.

It Just Feels Right

Finally, consider starting CPP at age 60 if it just feels right. Personal finance is “personal” after all. There is no one size fits all answer and the “math” is only part of decision.

After reviewing all the options, and comparing starting CPP at age 60 versus starting CPP at age 65 or starting CPP at age 70, if starting CPP at age 60 still feels right then that’s all that really matters.

Testing CPP Start Age In Your Financial Plan

If you’re a PlanEasy client, you can quickly see the difference between starting CPP at age 60, versus age 65, versus age 70 by changing the CPP start age in the CPP & OAS Estimate section and then recalculating your Final Plan Projections. The platform will automatically recalculate CPP benefits and adjust other income sources like RRSP, TFSA, and non-registered.

Here are three example projections for the exact same couple but with CPP starting at age 60, versus 65, versus 70.

Starting CPP At Age 60… https://public.planeasy.ca/dashboard/365d-FwFb3iWJh4jY

Starting CPP At Age 65… https://public.planeasy.ca/dashboard/365d-M6tmiJJT4R1K

Starting CPP At Age 70… https://public.planeasy.ca/dashboard/365d-o1Y6XKfPEf9x

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I don,t buy into your reasoning with one exception…. A worsening health condition would be it.

People who want their cake and eat it too…. Are not fwd planning. They listen to people who are negative and possible resentful of gov and other certain issues and do not encourage such friends to do the arithmetic. It’s a contagious argument amongst certain people that I want it now and more because I earned it and deserve it.

I accept free will… but I don’t buy into the reasoning.

Hi Bob, definitely lots disinformation about CPP out there, especially its funding status. It’s always a good idea to evaluate the different retirement income options before starting CPP benefits, especially because the decision to start CPP can only be reversed for a short period of time.

I’m sold on waiting until 70. Even with some extra dropout years I will still end up way, way ahead by waiting for 70.

To me the only two good reasons to take CPP early are

1) I absolutely have a serious health prognosis and there is minimal chance I will live beyond 70

2) I have not saved enough to fund my own retirement. In which case, I’ll probably still be working, and therefore adding more “M” years so I would still defer.

That’s a good plan James! Our plan is also to wait until age 70, but if we experience a large recession in our 60’s then I’ll put some serious thought into starting CPP earlier, especially after age 65 when we can ask for up to 12-months in retroactive payments. If faced with a large recession, the plan would be to use the emergency fund and dividends for retirement spending first, then request 12-months of retroactive CPP if the markets haven’t recovered yet. That should give us at least a year to wait out a large drop in the market before needing to make another withdrawal.