Case Study: Retirement Plan

Sylvia and Martin

The Situation

Sylvia (age 55) and Martin (age 55) are planning for retirement in 5-years at age 60. They just paid off their mortgage and are wondering what to do with the extra cash flow. They have a bit of room in the RRSPs and TFSAs but after that they aren’t sure how taxable investing works.

Their two children are grown and independent, but they would like to plan for gifts worth $50,000 for each child in a few years. This could be for a home purchase or wedding in the future.

Their goal is to travel extensively in early retirement while they’re still healthy. They plan on spending significantly more in early retirement from age 60-70 and then less from age 70+.

They don’t have defined benefit pensions, so they like the idea of delaying Canada Pension Plan (CPP) until age 70 to create a large amount of secure income later in retirement. But they are also worried that delaying CPP for 10-years will impact their cashflow and curtail their travel plans.

They’ve been investing with an investment advisor for many years, and feel the returns have been ok, but their original investment advisor has retired, and they were transferred to another advisor a few years ago. They aren’t happy with the level of service relative to the investment fees they pay and would like to understand the different low-cost investment options that now exist. They’ve had their two TFSAs with a robo-advisor for a few years now and are thinking about switching over their entire portfolio.

Sylvia and Martin want to confirm they’re on the right track for a comfortable and worry-free retirement and that they can meet their spending goals in early retirement without running out of money late in retirement.

The Goal

With a detailed retirement plan Sylvia and Martin can have a comfortable and worry-free retirement knowing that they’re able to meet their spending goals without running out of money late in retirement. They have a detailed decumulation plan for retirement and can take advantage of income splitting opportunities before age 65 as well as after age 65. They feel secure knowing their plan is successful even in the worst-case scenario.

The Approach

Sylvia and Martin engaged in a Custom Financial Plan with three separate scenarios. We helped Sylvia and Martin do the following…

- Reviewed current income and expenses and created a cash flow plan for retirement

- Mapped out retirement spending year-by-year including extra for travel in early retirement

- Estimated CPP and OAS benefits based on past contributions

- Analyzed the cost/benefit of when to start CPP benefits

- Structured their drawdown plan for income splitting and lowest lifetime tax liability

- Put together an estate plan that efficiently transfers wealth in the future

- Analyzed how their high fee investment portfolio could impact their spending plans in retirement

- Tested the need for spending flexibility to help reduce the chance of running out of money in the future

The Plan

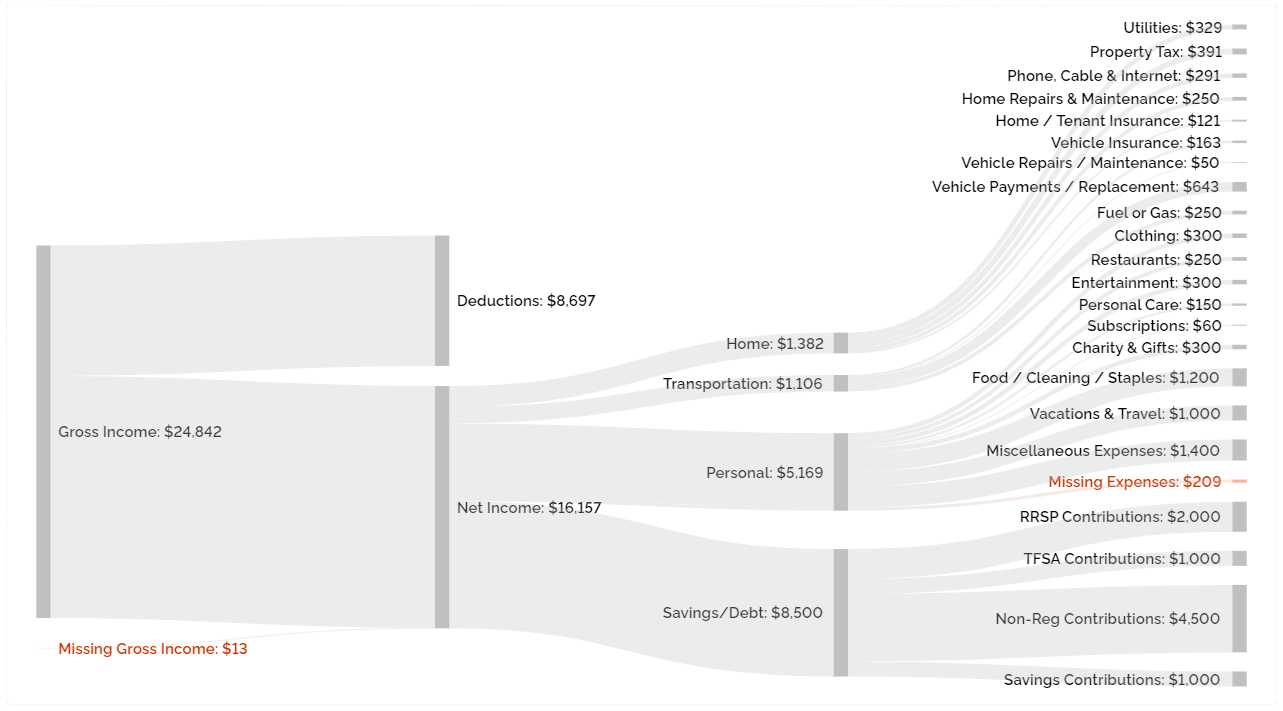

Now that the mortgage on Sylvia and Martin’s $1,200,000 home is paid off, they have a very high savings rate. Their high savings rate will help them accelerate their investment portfolio just before they retire. By mapping their income and expenses we can see that just over 50% of their current net income will be going towards savings and investments, an impressive amount. We can also see that despite their high income, they’ll need less than half of it in the future to cover their “core retirement spending”.

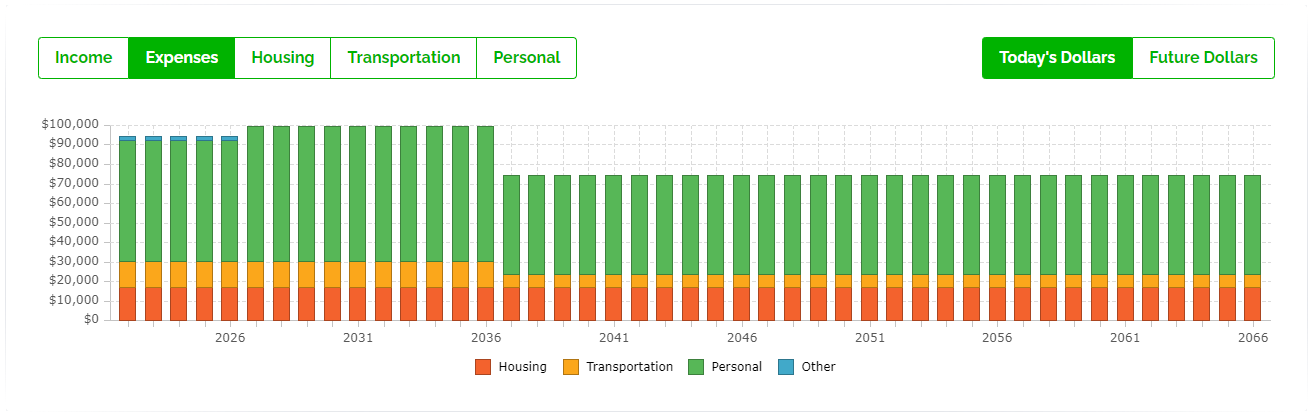

Looking forward, we helped them map out future expenses year by year. They plan for much higher spending in early retirement between age 60 and age 70. They plan to spend approximately $24,000 per year on travel in early retirement. This spending is entirely discretionary, and Sylvia and Martin are willing to reduce this amount if investment returns are below average. This flexibility could be important in their plan. They have three spending phases in their plan, pre-retirement, early retirement, and mid/late retirement.

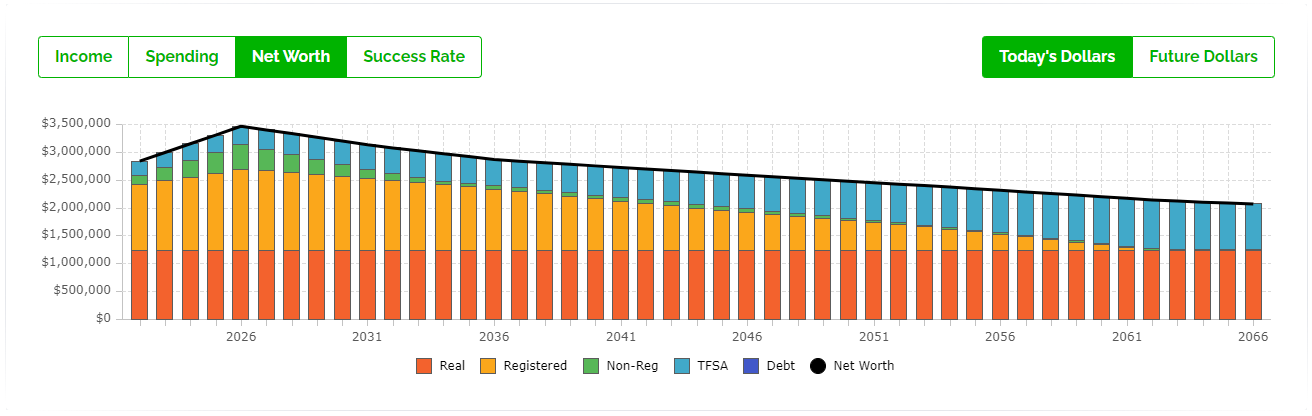

Thanks to their high savings rate their net worth is expected to accelerate over the next few years with fewer child expenses, no mortgage payments, and peak earning years. If investment returns remain on track their net worth will grow to $3.4M by the time they retire. This acceleration of net worth in the final years before retirement is an important part of their plan.

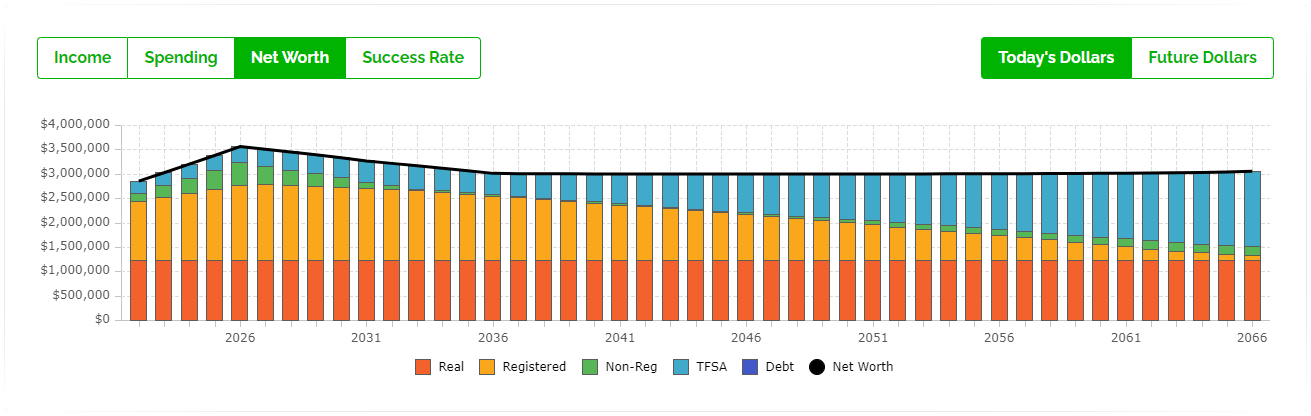

One potential issue is that their investment fees of 2.49% create a significant drag on their retirement plan. At retirement, nearly $2M will be invested with their investment advisor. This creates an annual investment fee of nearly $50,000 per year. That’s more than half of their target retirement spending! They already have their TFSAs with a robo-advisor and have been happy with the returns. They decide to shift all their investment assets to the robo-advisor. They’ve been happy with the returns on their TFSAs and the reduced investment fees will help them keep more of their retirement savings. This dramatically improves their net worth later in retirement.

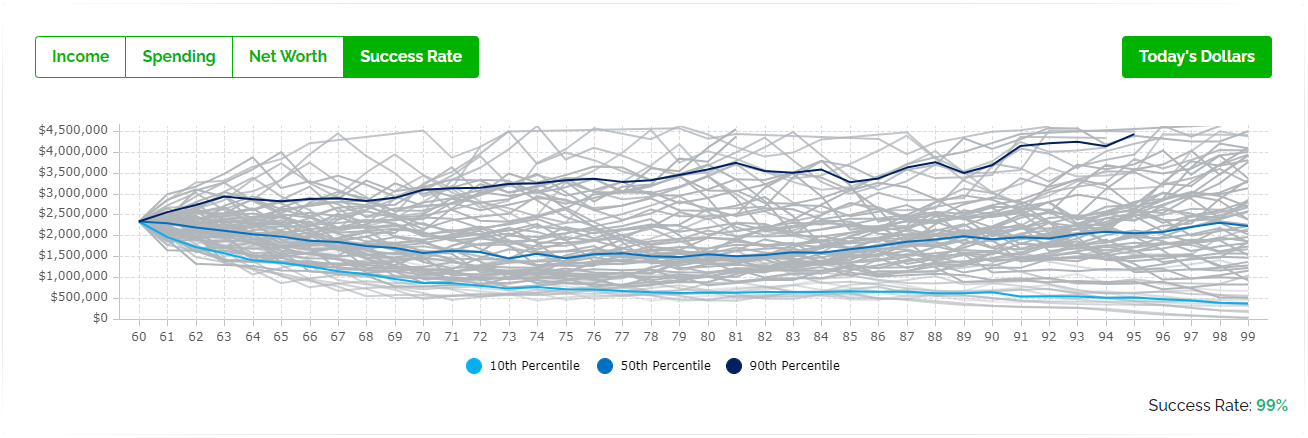

Reducing their investment fees helps increase their future net worth but it also helps improve their success rate. The chance of running out of money drops significantly without the drag of high investment fees. This means a much lower chance of running out of money in the future and more room to increase retirement spending if investment returns are average or above average. Even in the bottom 10th percentile of historical investment returns, they’ll still have investment assets to draw from in late retirement. And if investment returns are in the 50th or 90th percentiles they’ll be able to spend significantly more in the future.

Next Steps

Sylvia and Martin have a good retirement plan and with a few small changes it will now be excellent. They know when to start CPP, OAS, and convert RRSPs to RRIFs. They have a clear decumulation plan with specific withdrawals year-by-year. They’ll also be able to split income effectively in early retirement before age 65 and in mid/late retirement after age 65.

Their decision to reduce their investment fees will help improve net worth and reduce the risk of running out of money in the future. They have a great retirement plan with a lot of room to spend more on travel in the future.

They plan to meet with their advice-only financial planner every 6-months to keep the plan up to date and review their action items for the next 6-months. They want to stay focused on their plan because retirement is just a few years away.

Want to see Sylvia and Martin’s plan in more detail? Click the link below to see their “PlanEasy Public Dashboard” that includes all their income and spending information, detailed projections, and success rate.