Cash Flow Changes When Starting A Family

Starting a family is probably one of the most complex periods in a person’s financial life. There are changes to income, expenses, insurance, investments (RESPs) etc.

Anticipating and managing all these changes can be overwhelming. It’s good to have a framework to help understand what changes you can expect and how large they may be.

It’s also a good idea to prepare yourself financially for all these big changes. There are a few things you can do to prepare your finances for a decrease in income and an increase in expenses.

Generally you can separate the financial changes when starting a family into six different areas.

There are changes to…

- Income

- One-time expenses

- On-going expenses

- Insurance

- Investments

- Taxes and Gov. Benefits

In each of these areas there are different financial impacts that come with starting a family. Some of these impacts are positive and some are negative.

For example when it comes to Income, most new parents can expect to receive the Canada Child Benefit, one of the most generous benefits in Canada. This government benefit could add thousands to a new parents annual income (plus its non-taxable!) But at the same time a new parent may take 12-18 months off work which has a very negative impact on Income.

There are also many new expenses a new parent will face. There are one-time expenses, on-going expenses and then short lived but high cost expenses like daycare.

To help a new parent plan all these changes we need to look at each area separately to understand what changes we might expect.

Changes To Income

There are a few changes to income that happen when stating a family, the most obvious one being a decrease in family income if taking time off work. An income disruption is often the largest “cost” of starting a family.

To help offset part of this decrease in income there are a few new income sources you may be eligible for. The main one is parental benefits from Employment Insurance. The second, less common one, is an income top up from an employer.

Employment insurance benefits aim to replace 55% of your earnings up to a maximum of $573 per week. If your annual income is $54,200 or higher, then you’ll receive the maximum from EI. These benefits are reduced if you take an extended leave of 18-months. Over 18-months the income replacement rate is only 33% up to a maximum of $344 per week.

Employer top-up is another income source new parents may be eligible for. This isn’t exactly a new income source, as it’s paid by the employer, but it is an employee benefit. Few employers offer this benefit. Typically it’s for a set a period of time, like 6 weeks, 8 weeks, 15 weeks, 34 weeks etc. It also has a specific income replacement percentage, so in addition to EI, the employer will provide additional income until you reach 75%, 85%, 90% etc of your income before going on leave.

The other new income source when starting a family is the Canada Child Benefit. This is probably one of the most generous government benefits in Canada. This benefit provides monthly non-taxable payments to families with children 17 and under. The maximum is $6,639 per child per year for children under age 6 and $5,602 per year per child for children age 6-17. This benefit then gets reduced based on family net income, so the actual amount you receive will likely be lower.

Depending on family income there are also other government benefits you may be eligible for like the GST/HST credit and/or provincial benefits like the Trillium benefit in Ontario.

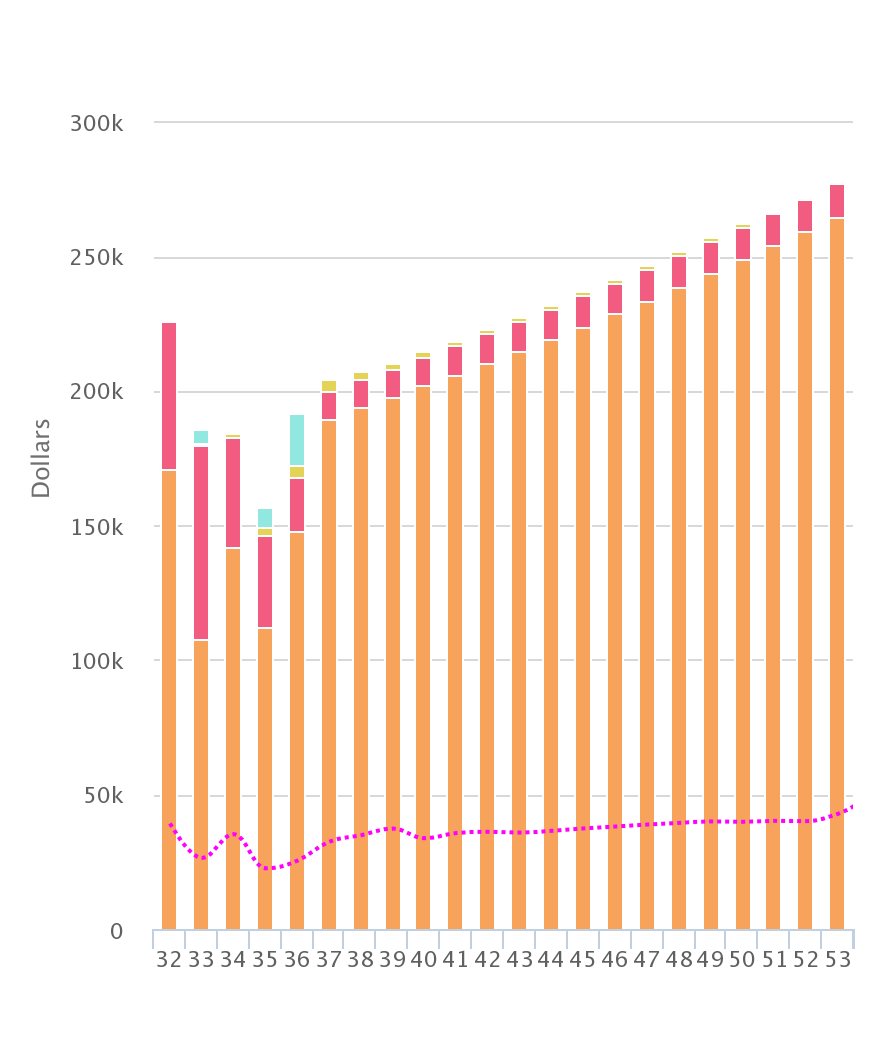

Example of Income Changes Year to Year

(Employment income drops with each new baby but Employment Insurance and Employer Top-Ups can help fill this gap)

New One-Time Expenses

There are many new expenses when starting a family but a few only happen once or maybe twice, these are one-time expenses like buying a crib. But even though they may only happen once, these one-time expenses can start to add up if you don’t plan ahead. Good examples of possible one-time expenses include a stroller, a high chair, a car seat, a crib, a dresser, change table etc.

How much you spend on these one-time expenses will vary greatly based on your taste, if you buy new or used, or if you get gifts or hand-me-downs from friends and family.

Buying slightly used baby equipment is probably one of the best ways to save money when starting a family. Baby furniture is typically gently used and almost new.

One-time expenses can also increase if you choose to use cloth diapers. Although they can save money over time, especially if you plan on having 2-3 children, the upfront cost of cloth diapers can be high so it’s best to plan ahead.

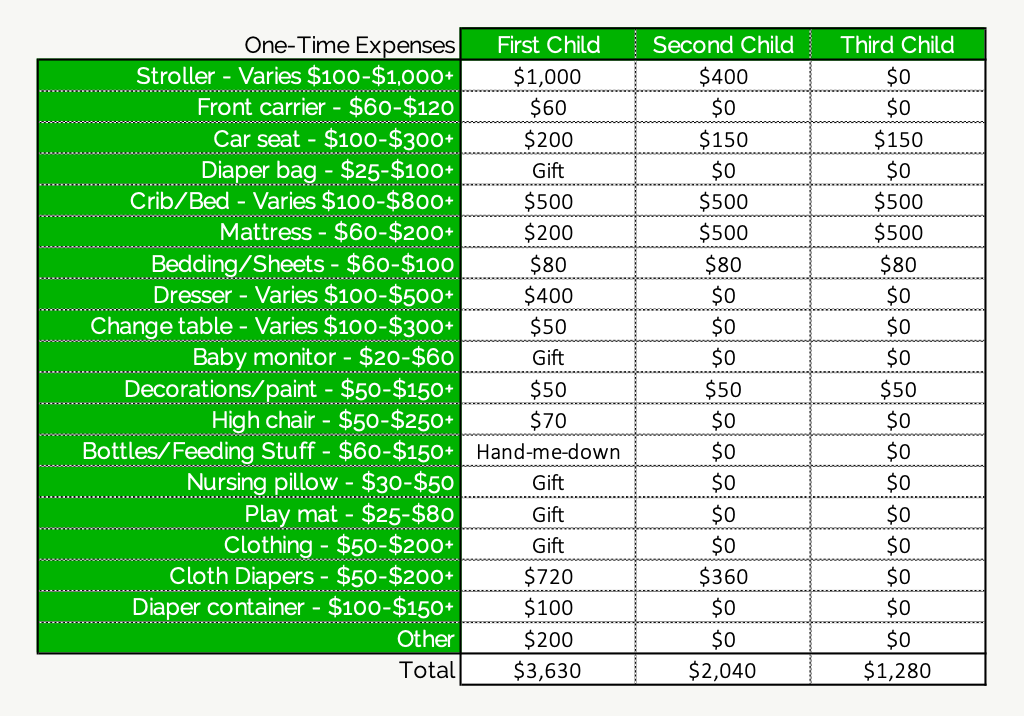

Here is an example of how one couple might plan their one-time expenses. They’re planning for three children about 2-years apart. They’ll need to add car seats and beds with each new baby but many expenses are one-time and can be reused with each new baby. This means the one-time cost associated with each new baby decreases.

Example of One-Time Expenses

(These can vary greatly from person to person)

New On-Going Expenses

In addition to one-time expenses there are many on-going expenses when starting a family as well. Some expenses will phase in and then phase out, like daycare expenses. While other expenses may start low and build over time, like additional food and clothing costs.

On-going expenses can also be low or high depending on your taste and lifestyle. It can also depend greatly on activities and programs you enroll your future children in. High level competitive sports like hockey may require a much higher “Activities” budget in the future.

It’s not important to perfectly predict future family expenses but instead create a reasonable estimate and then adjust over time. No budget is perfect. Most budgets need to be updated regularly, possibly making trade-offs between different categories.

Creating an estimate for on-going family expenses lets us understand possible cash-flow issues in the future and make adjustments accordingly.

Because these are on-going expenses they increase with each new child. They may increase as the children get older as well.

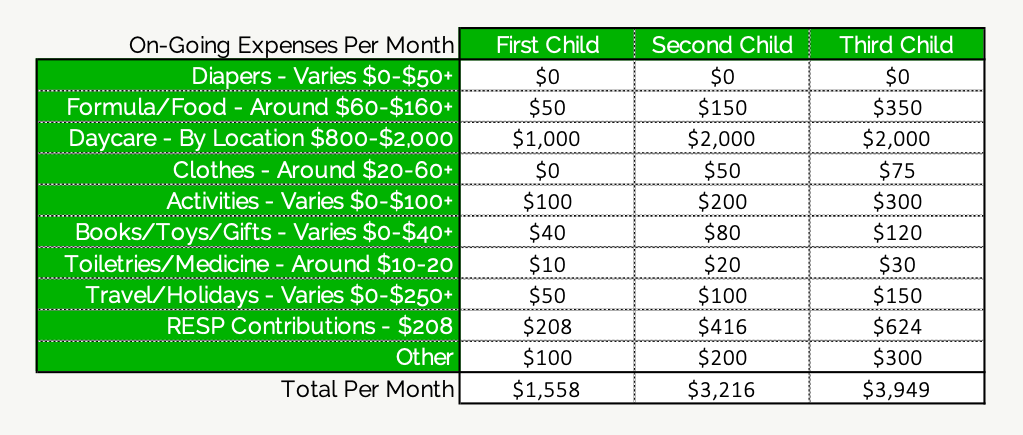

Example of On-Going Expenses

(These can vary greatly from person to person)

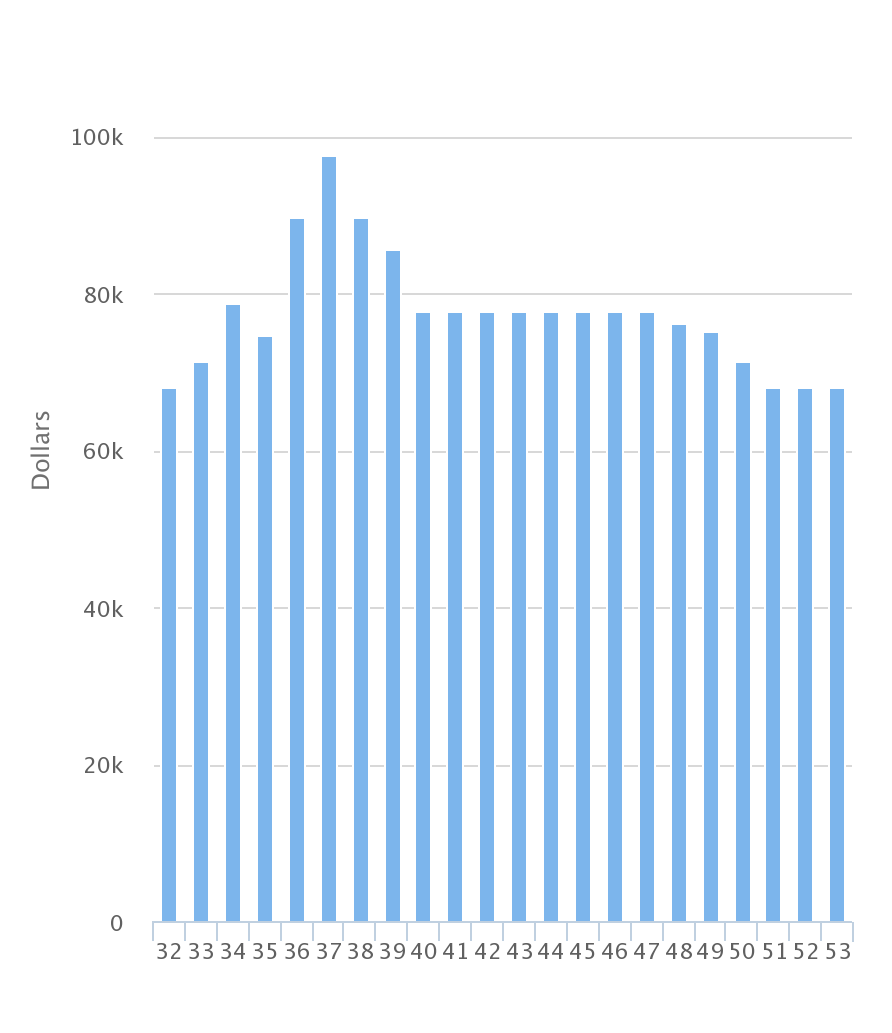

Example of Spending Changes Year to Year

(See how quickly spending ramps up as children are born)

More Insurance Coverage

It might not be the highest on the list but it probably should be. Once you start a family your dependents are now relying on your income. Once you have dependents it becomes extremely important to check that you’re well insured against an unexpected loss of income.

Insurance coverage like life insurance and long-term disability insurance become very important once you start a family.

Many employers already offer group insurance coverage as an employee benefit. Life insurance may be 1x or 2x annual income. Long-term disability insurance may be 50%, 60% or 66.7% of your gross income.

It’s important to understand how much insurance coverage you already qualify for through your employer because it may be necessary to purchase additional insurance coverage.

Often group employer coverage has an option to increase coverage at a very reasonable cost. But if this isn’t an option then it may be necessary to purchase additional private coverage through an insurance broker.

New Investment Account: The RESP

RESP stands for registered education savings plan, it’s a special account that can be used to help fund your children’s future education. The account is funded with after-tax contributions and unlike an RRSP, there is no tax refund.

Contributions to an RESP are attractive for two reasons. One reason is that there is a grant, called the Canada Education Savings Grant (CESG). This grant matches your contribution up to 20% or up to $500 per year, whichever is lower. This grant has a lifetime maximum of $7,200 per child. To reach the maximum grant requires contributions of $208 per month per child for 14.4 years.

The second reason RESPs are attractive is because investments grow tax free inside the account. This investment growth is taxed only when withdrawn. When withdrawals are done in the hands of a child this usually results in a very low tax rate upon withdrawal.

Learn more about how the RESP works…

Tax Planning: New Tax Deductions And Credits

When starting a family there are a number of new tax planning opportunities to be aware of. Some of these opportunities are pretty straight forward and some are a bit more complex.

Simple tax planning opportunities include taking advantage of childcare deductions and childcare credits on your annual tax return. Although childcare is very expensive, these deductions and credits can help offset some of the cost.

More complex tax planning opportunities could include using lifetime maximum RESP contributions if TFSA and RRSP is already full, or possibly prioritizing RRSP contributions over TFSA contributions to maximize the Canada Child Benefit. These opportunities are on a case by case basis but could provide $1,000’s in tax reductions and benefit increases.

One example is a past client with three children. They were a dual income family but one partner earns significantly more than the other. The higher income partner was already in a 40% tax bracket but when we added the 8.0% clawback on Canada Child Benefit their marginal effective tax rate was approaching 50%.

This couple were good savers but were prioritizing TFSA over RRSP. By switching their focus to the RRSP for the higher income earner we were able to essentially double their savings. A $30,000 pre-tax RRSP contribution was only worth $15,000 in their TFSA after-tax and benefit clawbacks. Even better, by using a spousal-RRSP they would contribute at a ~50% tax rate and in the future the spouse could withdraw at a 20% tax rate, leading to even more tax savings!

Cash Flow Changes When Starting A Family

Starting a family can be a financial challenge. There are many changes to income and expenses. There are new accounts like the RESP, new needs for insurance coverage, and new tax planning opportunities to understand.

This is probably one of the most complex periods in a person’s financial life and this can feel a bit overwhelming at times. Planning ahead can help ensure you spend time with your new family rather than worrying about reduced income and upcoming expenses.

Starting a family is an exciting time and money should be the last concern. Plan ahead to help understand where financial issues may arise and how to avoid them.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments