Creating A Budget? Focus On The Big Stuff

When creating a budget, it can be very tempting to get into the nitty gritty right off the bat. Don’t fall into this trap!

The majority of our spending is driven by just a couple of things, accidentally focusing on the small stuff can be a real time waster. Even worse, spending too much time on the small stuff can be very frustrating, it could cause you to abandon your budget all together.

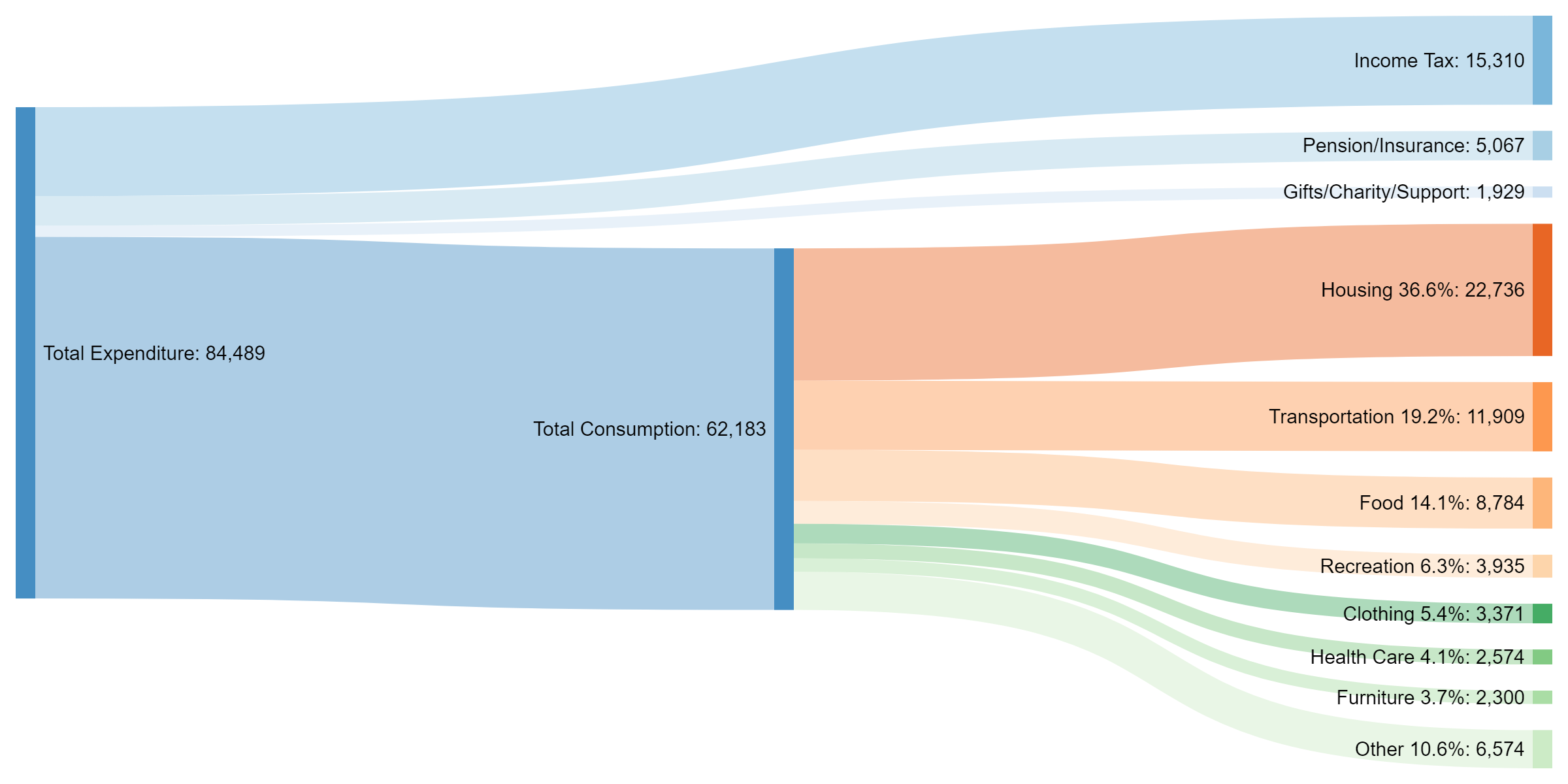

When you look at average household spending are certain patterns that emerge. Some budget categories are very small and some are very large. This obviously varies from person to person but in on average the trend is very clear. There are just three budget categories that make up almost 70% of annual spending.

Those three categories are housing, transportation and food.

When you’re trying to balance your budget, it helps to focus on these three categories first.

Why?

Improvements in these three categories will give you the biggest savings for your effort.

These three categories represent the “big stuff”. They make up the majority of your spending. Even a small improvement here can make a big difference to your overall budget.

As a bonus, improvements made in these three categories are easier to maintain. After making a change its typically easier to sustain spending reductions when it’s in housing, transportation and food.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

How To Budget Your Money:

When you create a budget you probably use different budget categories to “bucket” your monthly expenses. This can help when you’re tracking you spending too. This can also help when you’re looking to make changes and balance your budget.

The trick to creating an effective budget is to stop making “buckets” once they start to get too small. You wouldn’t budget separately for milk vs eggs, you would just lump it all together into a category called groceries. Do the same with your other budget categories. Just lump a few expenses all together.

Typical Budget Categories:

A large % of the spend is in just three categories, housing at 36.6%, transportation at 19.2% and food at 14.1%. Focusing on these three categories can give you a big improvement for not a lot of effort.

Improvements in these areas are also easier to maintain. Usually there is one large decision to make but no decisions after that. This makes it easier to maintain these improvements in your budget.

According to statistics Canada this is what the average household spending looks like, 69.9% of average household spending is in housing, transportation and food.

Typical Household Spending

Ways To Save Money on Housing:

- Rent/mortgage – Find cheaper rent, move to a smaller home, house hack your way to zero housing costs.

- Utilities – Find ways to run your home more efficiently. Use less water, less electricity, less heat.

- Insurance – Negotiate your home insurance every year before renewal. (Try to avoid negotiating right after renewal because there are often penalties for breaking your insurance contract mid-year)

- Communications – Negotiate your cable/cell phone bills. Better yet, cut cable all together and get an internet only package.

- Home maintenance – Find ways to DIY. Do preventative maintenance to avoid bigger issues down the road.

“Housing, transportation and food make up almost 70% of household spending”

“Housing, transportation and food make up the majority of your spending. Even a small improvement in these three categories can make a big difference to your overall budget.”

Ways To Save Money on Transportation:

- Lease/financing costs – Switch to a less expensive vehicle. Start saving now to buy a used vehicle outright. Sell your car and go completely carless or go from a two-car household to a one-car household.

- Gas/Fuel – Switch to a vehicle that is more fuel efficient. Start biking/walking instead of using the car.

- Insurance – Negotiate your car insurance every year before renewal (Try to avoid negotiating right after renewal because there are often penalties for breaking your insurance contract mid-year)

- Maintenance – Find ways to DIY routine maintenance like oil changes, air filter replacement and tire rotations. Extend the time between vehicle maintenance by walking/biking instead of using the car.

Ways To Save Money on Food:

- Groceries – Cook more at home. Make a meal plan. Avoid food waste. Meal prep. There are many ways to decrease your grocery bill.

- Restaurants – Avoid take-out by having a few prepared meals in the freezer. Save restaurant meals for special occasions and social outings. Set a restaurant budget for the month and plan accordingly.

Making A Budget Can Have BIG Results:

Don’t underestimate the impact these three budget categories can have. Making a budget for these three areas can have big results. If the average family can reduce their spending in these categories by even 10% it would more than DOUBLE their average household savings rate.

By focusing on these big spending categories, you may not even need to focus on your other expenses. You might be able to achieve your financial goals just by making a few small tweaks to these big budget categories.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments