How Are Dividends Taxed? How Can They Lower Taxes In Retirement?

Dividends from Canadian corporations receive some special tax treatment that can make them an attractive investment in non-registered accounts. This special treatment means that they can help lower your average tax rate, especially in retirement.

But this special tax treatment makes it a bit confusing to understand how dividends are taxed. To calculate tax on Canadian dividends there are things like “gross ups” and dividend tax credits to consider.

Despite the extra confusion caused by this special tax treatment it can be very attractive to invest in Canadian companies. For most people there is a significant tax advantage when receiving Canadian dividends. For example, in Ontario, a retiree in the lowest tax bracket will experience a negative tax rate on eligible dividends!

The way these eligible dividends are taxed can help offset other income from CPP, OAS, pensions and RRSP withdrawals. With a bit of tax planning this advantage could add thousands in after-tax income for a retiree.

In this post we’ll look at how dividends are taxed, the difference between eligible and non-eligible dividends, and we’ll look at an example of how eligible dividends can help lower taxes in retirement (all the way to zero!).

Lastly, we’ll also look at how the dividend gross up can also trigger OAS clawbacks for high income retirees. A surprising negative of the way dividends are taxed (although it’s still an attractive form of income).

What Are Dividends?

Before we get into how dividends are taxed, it’s important to understand what dividends are in the first place. Dividends are payments from a corporation to its shareholders. Typically dividends represent a portion of the profits that a corporation has earned.

A corporation could be a private corporation or a public corporation. It could be a Canadian corporation or a US/Global corporation.

Dividends are also paid by mutual funds and ETFs. Mutual funds and ETFs can hold many different companies and accrue dividends from all of the different investments they own. An index ETF would own a small portion of hundreds or even thousands of companies. As those companies pay dividends the ETF adds them up and then pays them to ETF owners. The idea is the same as owning a company directly, but there is a middleman in between.

The way dividends are taxed will depend on where the dividend came from, what type of corporation it is, how that corporation is taxed, and if that corporation is based in Canada.

Typically dividends being paid by a mutual fund or ETF retain their form. The dividends just “flow through” the mutual fund or ETF. This is important for tax treatment later, especially when an ETF owns multiple types of investments that pay different forms of income. This could result in a dividend from an ETF that has many different parts.

Watch The Video

Eligible vs Non-Eligible Dividends

When it comes to Canadian dividends, the difference between eligible and non-eligible dividends is very important because they are each taxed differently. When a Canadian corporation issues a dividend they have to say whether it is an eligible dividend or a non-eligible dividend.

For the most part, dividends issued from a Canadian controlled private corporation will issue non-eligible dividends, as long as their income was taxed at the small business tax rate. This could be your typical small or medium sized business in Canada.

Large public corporations in Canada on the other hand will typically issue eligible dividends. These are companies like Bell, Royal Bank etc. (Private Canadian corporations may also pay eligible dividends when they pay tax at the general corporate tax rate)

We care about eligible vs non-eligible dividends because they receive different tax treatment. They each have different “gross-up” rates and different dividend tax credit rates (more on this in the next section). These gross-ups and dividend tax credits are important when doing long-term tax planning.

DIY investors who are invested in Canadian equities will likely be receiving eligible dividends (although it is possible in some circumstances to receive non-eligible dividends from a public company in Canada).

How Are Dividends Taxed?

The interesting thing about Canadian dividends is how they are taxed. They receive a special tax treatment that could be both helpful or harmful in retirement. But before we get into tax planning opportunities let’s first look at how dividends are taxed.

Eligible Canadian dividends experience what is called a “gross up”. The actual dividend amount is increased by 38% and its this grossed up amount that gets included in an individual’s income. So if you receive $100 in eligible dividends then the actual amount reported in your net income for tax purposes is actually $138. Even though you only received $100 in cash, your net income increases by $138 (this is important for government benefit calculations, more on this later).

To offset this gross up there is a special non-refundable dividend tax credit. For eligible dividends the Federal tax credit is 15.0198% of the grossed up amount (there is also a provincial tax credit too, for example its 10% in Ontario). This tax credit reduces the tax owing on the grossed up dividend.

This is how it works for the lowest tax bracket in Ontario…

Cash Dividend: $100

Grossed Up Amount: $138 ($100 x 138%)

Tax Rate: 20.05% (Combined Federal and Ontario)

Tax Before Credit: $27.67 ($138 x 20.05%)

Dividend Tax Credit Rate: 25.0198% (Combined Federal and Ontario)

Dividend Tax Credit: $34.53 ($138 x 25.0198%)

Tax After Credit: -$6.86 ($27.67 – $34.53)

That’s right, negative tax. In Ontario, in the two lowest tax brackets, the tax rate on eligible dividends is actually negative.

As good as this sounds however, this negative tax rate is only beneficial when there is other income. Because the Dividend Tax Credit is a non-refundable tax credit, there can’t be negative tax, if tax is negative then you just lose some or all of the Dividend Tax Credit. If there is no other income then the final tax would be zero.

However, there is an opportunity to trigger extra income to use up these non-refundable tax credits if they’re not being used. This can help lower income tax in retirement.

Note: Non-eligible dividends are taxed similarly but the gross-up is only 15%, the Federal dividend tax credit is only 9.0301%, and the dividend tax credit is only 3.2863% in Ontario.

How Eligible Dividends Can Help Lower Income Tax In Retirement

Because eligible dividends in certain provinces have a negative tax rate at lower income levels this can be very beneficial for retirees who want to lower their taxes in retirement. Depending on the province, this negative tax rate could apply to many retirees who have non-registered investments.

In Ontario as an example, a couple could earn up to $106,718 in taxable net income before their dividends experience a positive tax rate.

To demonstrate the benefit of eligible dividends in retirement we’ll use an example. We’ll assume a retiree is earning marginal dividend income of $10,000 each year. We’ll assume that their other tax credits, like the basic personal exemption and the age amount, are being used up by CPP and OAS income. Using our example from above…

Cash Dividend: $10,000

Grossed Up Amount: $13,800 ($100 x 138%)

Tax Rate: 20.05% (Combined Federal and Ontario)

Tax Before Credit: $2,766.90 ($13,800 x 20.05%)

Dividend Tax Credit Rate: 25.0198% (Combined Federal and Ontario)

Dividend Tax Credit: $3,452.73 ($13,800 x 25.0198%)

Tax After Credit: -$685.83 ($2,766.90 – $3,452.73)

Because of the negative tax rate we can actually trigger some extra income to use up these non-refundable tax credits and still pay zero tax. If we don’t use them they’ll just disappear because these are non-refundable tax credits and they cannot bring tax below zero.

The easiest way to use up these non-refundable tax credits in retirement is to make a strategic RRSP withdrawal, even if it’s not necessary to help with annual living expenses.

A strategic RRSP withdrawal would be taxed at the marginal tax rate of 20.05%. So with a negative tax of -$685.83 this retiree can actually withdraw $3,420.60 from their RRSP without paying any extra tax.

Strategic RRSP Withdrawal: -$3,420.60 (-$685.83 / 20.05%)

By making a strategic RRSP withdrawal they’ll trigger just enough tax at the marginal tax rate to use up all of the non-refundable tax credits. This retiree will be able to withdraw $3,420.60 from their RRSP tax free!

Blog post continues below...

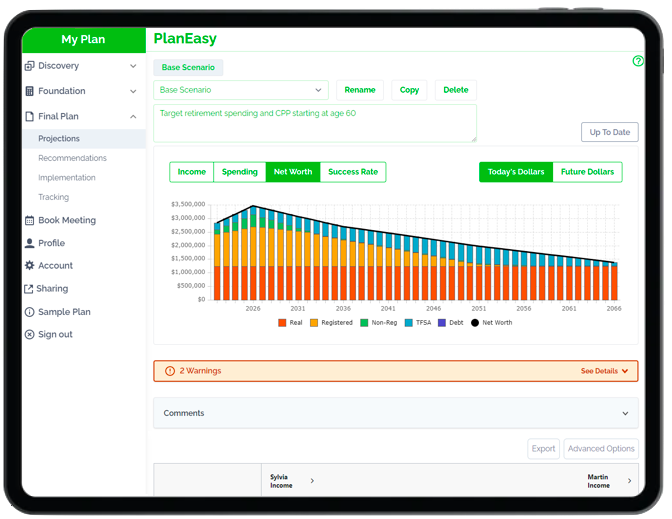

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

How Eligible Dividends Can Hurt High Income Retirees

On the flip side, eligible dividends can hurt higher income retirees who may experience the OAS clawback (officially the OAS Recovery Tax).

This tax is levied when net taxable income is above a certain income threshold for an individual. For 2022 the threshold is $81,761. Once net taxable income crosses this threshold the extra income is subject to the 15% OAS clawback.

For someone earning income just below the OAS clawback threshold the dividend gross up can push them over the threshold and cause extra clawbacks. This income could be from pension, CPP, OAS, minimum RRIF/LIF withdrawals etc.

For example, for a retiree earning $81,000 per year plus an extra $10,000 in eligible dividends, the gross up will add $3,800 to their net taxable income due to the gross up. Even though the $3,800 is just the grossed up amount, and isn’t actually cash received by the retiree, it will still be subject to the OAS clawback of 15%.

Ideally these eligible dividend producing investments would be held in a tax advantaged account like a TFSA. Inside the TFSA the dividends would not trigger the gross up. The $10,000 in dividends could be withdrawn from the TFSA and there would be no OAS clawback.

The Advantage Of How Dividends Are Taxed

For most people there is a significant tax advantage when investing in Canadian companies producing eligible dividends.

The way these eligible dividends are taxed can help offset other income from CPP, OAS, pensions and RRSP withdrawals. With a bit of tax planning this advantage could add thousands in after-tax income for a retiree.

This won’t apply to every person. This is only an advantage for those who have already maximized their tax advantaged accounts like TFSA and RRSP. Taking advantage of the dividend tax credit will require a portfolio of non-registered investments. It will also require a more complex asset allocation, with certain assets being held in certain accounts (non-reg versus TFSA versus RRSP).

This type of complex asset allocation isn’t possible when investing with a robo-advisor or an ‘all-in-one’ ETF. Plus, this extra complexity can make it less attractive for anyone who isn’t comfortable doing the extra work for their own individual investments.

Still, the way dividends are taxed can make them very attractive for retirees who want to maximize their after-tax income and minimize taxes in retirement. This type of tax planning should definitely be a consideration for any retiree (or future retiree) with a sizable non-registered portfolio.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Love this article and examples provided. It allowed me to understand how combined tax credit for dividend stock can make my tax negative, and how eligible dividends are actually preferable.

thank you!

Glad you found it helpful Gregor! The dividend tax credit is a great opportunity if its used to its full potential.

This is a great article. I really don’t understand why this strategy isn’t used more. As an advisor when I mention this to clients they don’t believe it exists. Great strategy to use paired with whole life insurance leverage income and a TFSA draw.

This is good planning

Agreed, when done right this type of tax planning can be very helpful.

A somewhat complex subject explained extremely well. Thank you Owen.

Thanks Bob, I appreciate the comment. If done well, Canadian eligible dividends can be a great tax planning tool in retirement.

Thanks for the insightful article Owen. For those with a negative tax rate due to an eligible dividend, would withdrawing from an RRSP (and say depositing it into a TFSA) be a good option to utilize the negative tax rate? I assume the only downside is losing both the TFSA and RRSP contribution room.

Hi Matt, you are 100% right, it would be a fantastic option to strategically withdraw from an RRSP in early retirement to “use up” tax credits and lower tax rates. Most of these tax credits are “non-refundable” so if they aren’t used then they are lost. The dividend tax credit allows a retiree to draw more from their RRSP at lower income levels because of the negative tax rate in some provinces.

You’ll probably really enjoy this blog post where we look at different withdrawal orders in retirement. The best withdrawal plan in the example is actually a mixture of RRSP and non-registered first to ensure that all tax credits and lower-tax rates are “used up”. Now, this is different for everyone depending on the relative size of their RRSPs, TFSAs, and non-reg accounts, but its a great example of how some strategic decumulation planning can save $10,000’s in retirement…

https://www.planeasy.ca/retirement-income-start-drawdown-with-rrsp-non-registered-or-tfsa/

Very good article, you have skills to explain complicated tax terminology using every day English, thank you!

Can you help to write one regarding small business tax planning? like RDTOH account, Capital Dividend Account. I have read some article, but still confused.

Hi Dean, appreciate the comment! Unfortunately our focus at PlanEasy is only on personal finances and not corporate finances. If I come across some good resources on corporate tax planning I’ll send it over.