It’s Not Just How Much You Spend, It’s How Many Transactions You Make

Lots of us track our spending. Tracking your spending is one of those foundational personal finance habits. It’s not something that comes naturally. This is a habit that requires work. Sure… you can reach your financial goals without tracking your spending, but it makes it harder, and why would you make things harder?

Tracking your spending doesn’t have to be difficult. At PlanEasy.ca all of our clients, including myself, use a simple online form to track our spending. Make a purchase, pull up the form, enter the amount and the category and hit submit. Easy.

All that data gets put in a neat little summary. It shows you the typical things like spending month-to-date, spend vs budget, total spend, etc.

But one of the neat things we included in our summary is how many transactions you make. How many transactions you’ve made over the last 30 days. The average number of transactions per day. How many “no spend” days you’ve had and your longest “no spend” streak.

I’m a firm believer that a lot of our spending is driven out of habit. You walk by a certain store, coffee shop, restaurant and out of habit you go in and you buy something.

![]()

Spending habits are easy to form. There is a clear “cue, routine, reward” cycle. The cues are everywhere in the form of advertising, marketing, sales, promotions, etc. The routine is simple, pull out your credit card and buy something. The reward is that immediate satisfaction you get from your purchase. It’s addictive.

Spending habits are hard to break. The way to break them is not by tracking how much money you spend, it’s by tracking how many times you spend money. It’s by tracking how many transactions you make each month, week, or day.

The more transactions you make, the more you reinforce your spending habits, and the harder they are to break.

Instead of focusing on how much you spend, try focusing on the number of transactions you make. Try to go for “no spend” streaks of 2, 3, 4, 5+ days in a row, or try going cold turkey and do a no spend month!

As you start to reduce the number of transactions you’ll also start to break those spending habits and you’re definitely going to be spending less each month.

How Many Transactions Do We Make Each Month?

So how many transactions do we actually make every month? This is surprisingly hard data to find. Based on one source we make approximately 20.9 billion transactions annually. That’s the total for every person in Canada each year.

If we divide that by the adult population we get an average number of 59.5 transactions per person per month.

From my experience this feels quite low. My guess would have been closer to 100+ or 150+ transactions per month.

If we make an average of 59.5 transactions per month that means we’re pulling out our wallet close to 2 times per day. Twice per day we’re enjoying that “cue, routine, reward” cycle that reinforces our spending habits.

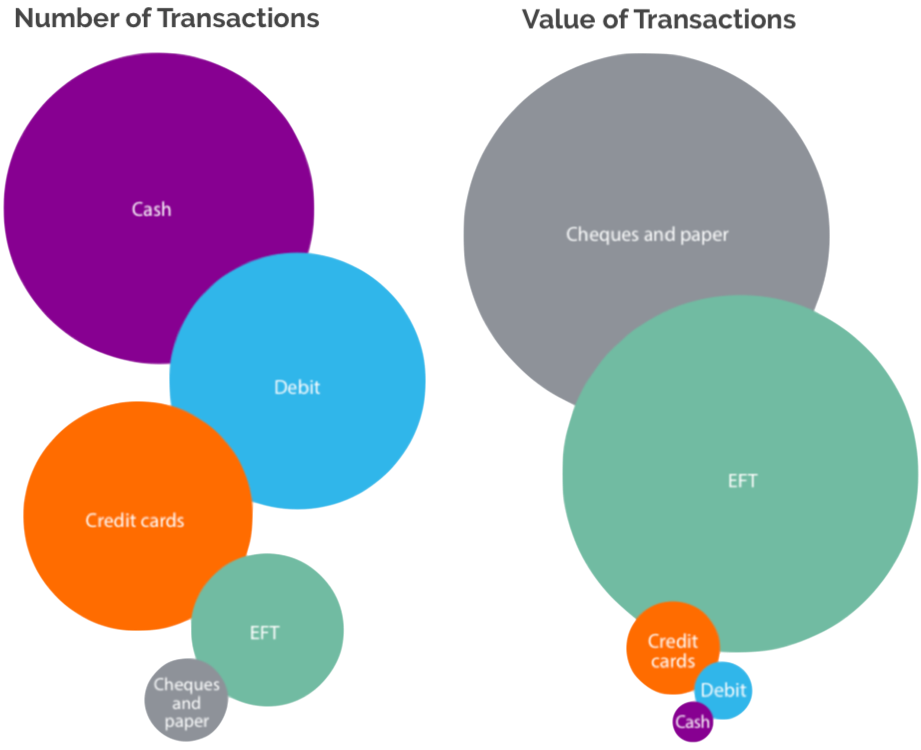

If you look at how we’re spending our money it seems to be mainly through cash, credit and debit transactions (although cash is rapidly declining each year and credit is growing). Cash, credit and debit are the highest number of transactions by volume.

How Many Transactions Do I Make Per Month?

Based on my own personal spend tracker I’ve averaged 1.1 transactions per day since the beginning of the year. I’m averaging 34 transactions per month (although the last month this has crept up a bit).

Although I don’t track how I spend money (ie cash, credit, debit) I do track the category. The largest categories by number of transactions are Groceries, with a whopping 40% of my monthly transactions, followed by Entertainment with 24% of my monthly transactions. The next largest category is Gas with 6% of my monthly transactions.

Interestingly, although Entertainment represents 24% of my monthly transactions it only represents 6% of my overall spend.

“The more transactions you make, the more you reinforce your spending habits, and the harder they are to break”

How Many Transactions Do You Make?

How many transactions do you make every day, week, month? Tracking how many transactions you make is an easy way to start tracking your spending. You don’t need to keep track of the amount, just the transactions. You can do this in a simple notepad on your phone, or with pen and paper.

Try making it into a game. See how many days you can go without spending money. Or try making fewer transactions this week than last week. Or try limiting yourself to just one transaction per day (half the average).

Remember, every transaction you make reinforces your spending habit. That “cue, routine, reward” cycle is super addictive and the best way to break the cycle is to stop making so many transactions.

Want to try our spend tracker? Complete the fit, values and goals assessment and book a free discovery call. Mention this post in your fit assessment we’ll give you a 30 day trial of our spend tracker.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments