Rebalancing Your Investment Portfolio

Buy-low and Sell-high

Rebalancing is one of those simple things that investors should do at least once per year. Rebalancing your investment portfolio can have a really positive impact on your long-term returns. Not rebalancing your portfolio can lead to some nasty consequences that we definitely want to avoid.

Rebalancing regularly will keep your portfolio’s risk level on target. Rebalancing can also help you avoid a lot of behavioural biases that can impact investor returns. And good rebalancing rules will help you buy-low and sell-high (which is exactly what we want right?!)

For small, medium, or large portfolio’s rebalancing should happen at least once per year. We rebalance three times per year in January, May and September. We do this as part of our tri-annual financial check-in. It’s easy to do and very beneficial. Rebalancing your portfolio can help increase your long-term investment returns and at the same time decrease your risk.

We’ve had two major rebalances in the last 5 years. During the last large decrease in Canadian equities we had to sell bonds to buy Canadian stocks. And more recently, after a big increase in stock market values, we had to sell equities to buy more bonds. Now after the recent changes in the market we will probably need to rebalance our portfolio again.

Rebalancing is something we look forward to, we know that rebalancing is a good thing for the reasons listed below. When we rebalance it means our investment plan is working the way it should and it’s a good indication that we’re on track for our long-term plan.

What is rebalancing?

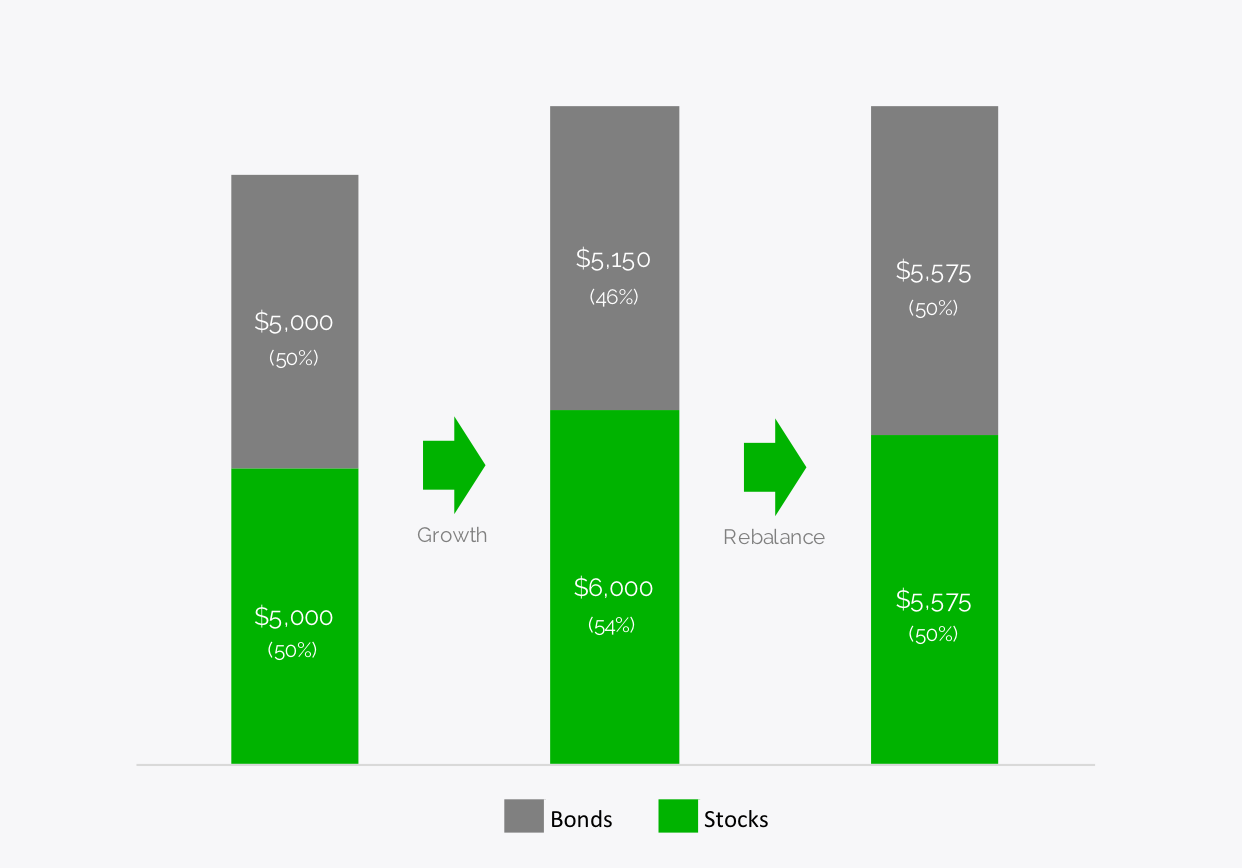

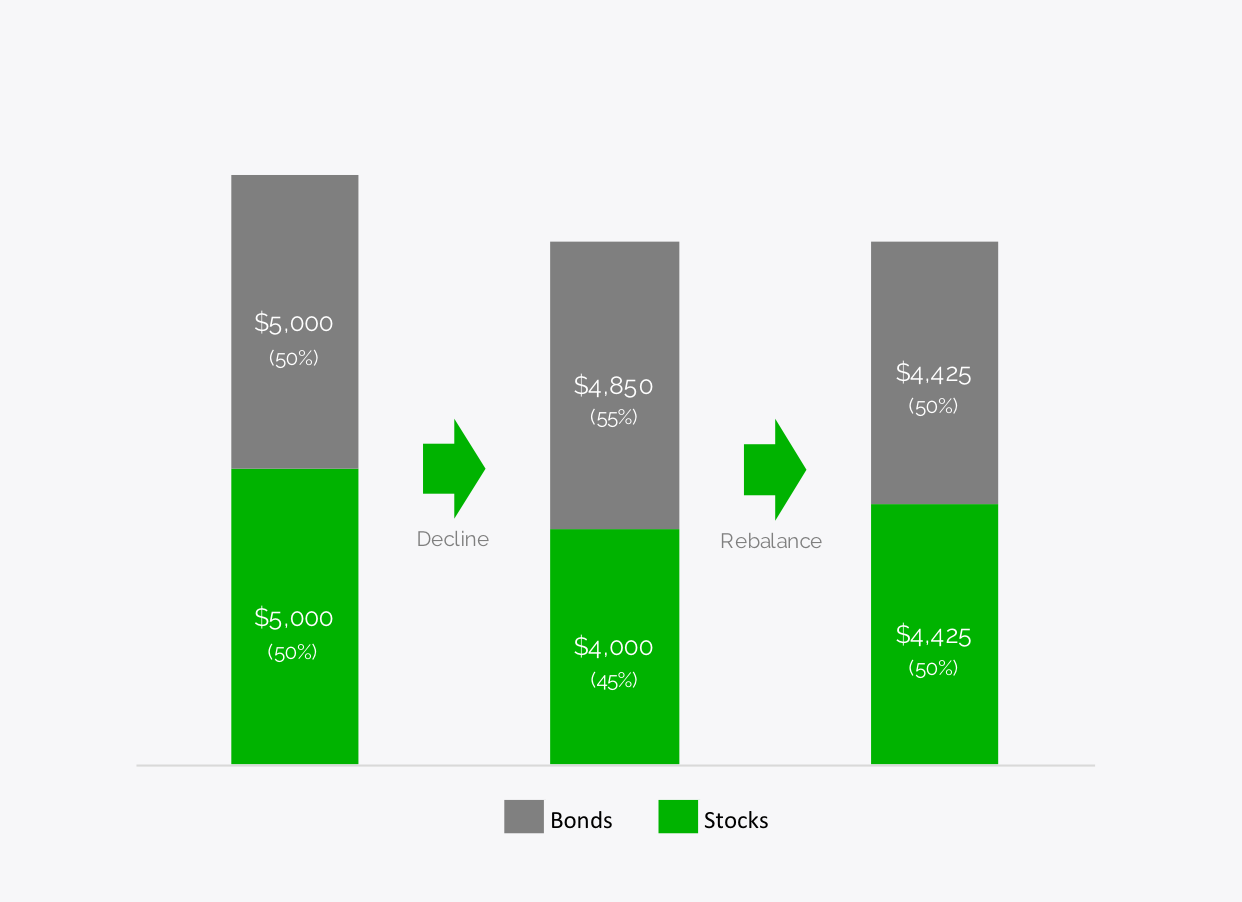

Rebalancing is easy to understand. Let’s use a simple example of a portfolio with 50% in stocks and 50% in fixed income (bonds or GICs etc).

If stocks increase by 20% one year and bonds only increase by 3% then our portfolio will be out of alignment versus our target asset allocation. We need to rebalance by selling some stocks and buying bonds.

The opposite can also happen. If stocks decrease by 20% one year and bonds only decrease by 3% then our portfolio will again be out of alignment versus our target asset allocation. In this case we need to rebalance by selling some bonds and buying stocks.

Benefits of Rebalancing

Rebalancing is a fantastic way to counteract a lot of behavioural biases that investors face. There is a lot of research regarding investor behaviour and how it can impact long-term returns. The average investor loses between 1-2% due to these behavioural biases. One of the reasons is that investors like to time the market (even though timing the market is impossible for the average investor).

Rebalancing helps to counter act this behavioural bias by giving you clear rules to help guide your buying and selling. Rebalancing between stocks and bonds actually helps you buy low and sell high. Rebalancing rules kick in when one asset class has increased or decreased in value relative to other asset classes.

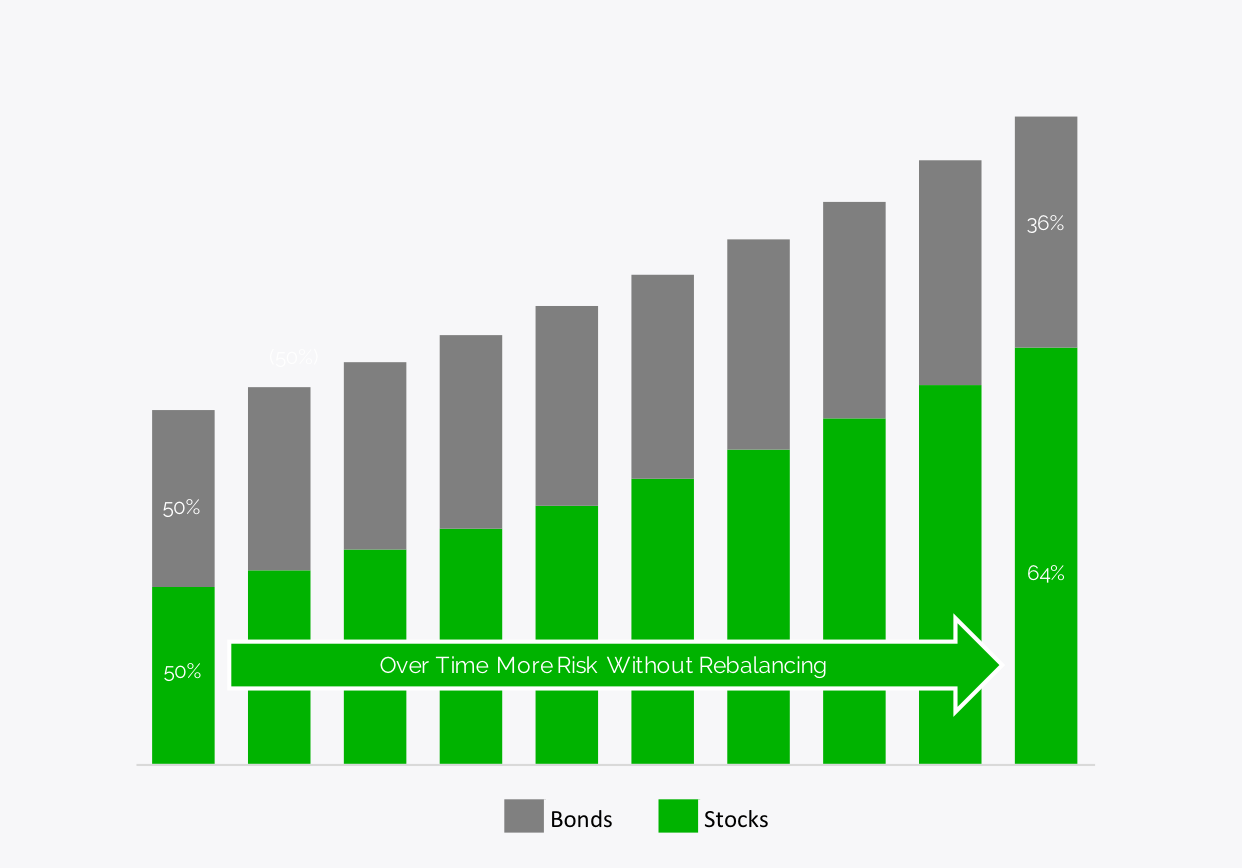

Rebalancing also helps keep your portfolio risk on target. If you don’t rebalance then stocks will increase in value over time. If you start with a balanced 50/50 portfolio within a few years it’s easy to end up with a more aggressive portfolio. This is because stocks typically increase in value faster than bonds. Without rebalancing your stock investments end up “taking over” your portfolio. If you don’t rebalance you end up taking on more risk because a larger portion of your portfolio ends up in higher risk investments.

What do you need to rebalance?

To rebalance your portfolio one thing you need clearly defined is your target asset allocation. You can split your allocation lots of different ways. One common way to split your allocation is between stocks and fixed income (bonds or GICs). You can even get more specific with your allocation and specify how much Canadian, US and International stocks you want to hold. You can even specify if you want to hold smaller companies (small cap) or very large companies (large cap).

Your target asset allocation should be based on your risk tolerance. The more stocks you hold the riskier your portfolio. Your risk tolerance and asset allocation will likely change over time. This might trigger the need to rebalance your portfolio.

You asset allocation, risk tolerance, investment strategy should all be clearly laid out in your investment plan. If you don’t have a clear investment plan then rebalancing becomes very nebulous.

Different Ways to Rebalance

There are two different ways to rebalance your investment portfolio. The first is selling to rebalance. This is when you sell any asset that are above your target asset allocation and then use that cash to purchase assets that are below your target asset allocation. The problem with selling to rebalance is that it can trigger taxes and trading fees that you might not want to pay.

The second way to rebalance your portfolio is to use new contributions. This is the best way to rebalance for investors will small/medium size portfolios. Every time you make a contribution you only buy assets that are below your target asset allocation. This will slowly bring your investment portfolio back in-line. The nice thing about using new contributions to rebalance is that there are no additional trading fees. The downside is that for larger portfolios your contributions might not be enough to get your portfolio back on target. If this is the case then you may need to sell to rebalance.

Rules For Rebalancing

It’s important to set clear rules for rebalancing. You want rebalancing to be purely mechanical, you want to leave emotion out of it. Often you’ll be rebalancing your portfolio after big increases or decreases in the stock market. These bull/bear markets come with lots of media attention, anxiety, fear, and/or irrational exuberance. Clear rebalancing rules will help you cut through the emotion.

1. Set timing: Annually, semi-annually, quarterly… we rebalance three times per year but once per year is fine. The key is to set a specific time to rebalance and stick to it.

2. Thresholds: Rebalancing doesn’t have to happen all the time, setting a threshold for rebalancing can help avoid a lot of work. Sometimes slight variances from your target allocation work themselves out over time. We use a 5% threshold, but you can set whatever threshold you like, the lower the threshold the more often you’ll need to rebalance.

Make Rebalancing Even Easier

Rebalance Using Dividends and New Contributions:Young investors who are still growing their investment portfolio can usually rebalance using new contributions and dividends. New investment purchases can be directed toward asset classes which are below the target allocation.

Rebalance Only In Tax Advantaged Accounts:Rebalancing in tax-advantaged accounts (like the TFSA or RRSP) make rebalancing even easier. When you buy and sell investments in these accounts there are no concerns for capital gains tax being triggered. If you rebalance using your non-registered account you need to be aware of capital gains, capital losses, and superficial loss rules.

Use A Robo-Advisor:Robo-advisors take care of rebalancing for you so this makes rebalance a non-issue for investors. A robo-advisor will help you create a target portfolio and then rebalance your portfolio periodically to make sure you stay on target. They take care of all the rebalancing work so you don’t have to lift a finger. One negative is that you pay for this extra service with higher annual fees.

All-in-one Funds:All-in-one funds are a portfolio of funds held in one basket fund. This “fund of funds” makes it very easy to create a highly-diversified portfolio because you only have to purchase one ETF or mutual fund. It also makes rebalancing easy because the fund provider does this for you. The negative side of all-in-one funds is that you’re stuck with one of three asset allocations, growth, balanced, or conservative, which might limit your flexibility.

Do It Once Per Year:No one says you have to rebalance every month, every quarter, or semi-annually. Rebalancing once per year is perfect. Taking more time between rebalancing can make it easier because slight differences in asset classes can work themselves out over the next few months but one year isn’t enough time for your portfolio to get really out of whack.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments