The Financial Benefits Of Marriage

Getting married is a big step in a relationship. It often means changes to personal finances. Some of these changes can be quite positive. These changes can actually make it much, much easier to achieve financial goals.

In this post we’ll explore the financial benefits of marriage (or entering a common-law relationship).

There are obviously a lot of considerations when combining finances, but there are certain financial advantages that couples have versus individuals. These advantages can make it easier to achieve financial goals. There are tax advantages, saving advantages, spending advantages, debt advantages, and risk reduction advantages.

If you’ve recently entered into a common-law relationship, or if you’ve recently gotten married, then you might be interested to know the financial benefits of marriage.

Income Splitting

One of the most obvious financial advantages of marriage is income splitting. The goal of income splitting is to shift income from a higher income partner to a lower income partner. For couples with different income levels and different marginal tax rates, income splitting can create a sizable tax advantage.

Income splitting strategies differ depending on age, financial situation, before or after retirement etc.

For retirees over the age of 65 splitting income from a RRIF is easy to do. As long as RRSPs are converted to RRIFs, those withdrawals can be split on the tax return and can provide a great income splitting tool for retirees over 65.

For retirees below the age of 65, spousal RRSP withdrawals, strategically planned personal RRSP withdrawals, and defined benefit pension income can provide income splitting opportunities.

For those under age 65, who have not reached retirement yet, there are other income splitting opportunities like gifting money to maximize TFSAs or using spousal loans. These income splitting opportunities need to be carefully structured to ensure there is no income attribution back to the higher income earner in the future.

Learn more about the different ways to split income.

Sharing Tax Credits

Most tax credits are non-refundable tax credits. This means that if a tax credit brings tax below zero there is no refund given, tax simply goes to zero.

For individuals this creates a lost opportunity when tax credits aren’t fully used each year.

But for married and common-law couples, there is an advantage because most tax credits can be shared with a partner. If a tax credit isn’t fully used by one partner, then it can typically be transferred to the other partner.

This is another big financial benefit of marriage. When compared with the taxes they would pay if they were considered two individuals, this sharing of tax credits helps couples reduce their income tax.

Lower Expenses

Another clear financial advantage for couples is that they benefit from lower expenses. Household spending for a couple is not 2x that of an individual, its much less. This creates a financial advantage for couples.

Lower spending could be due to…

- Shared housing expenses

- Shared transportation expenses

- Shared employer health care coverage

- Etc.

If everything else is equal (income, lifestyle etc), couples are able to save more each year. When we add the benefit of investment compounding, this can create quite a difference over time.

If a couple is able to reduce their combined spending by even just 10% of their gross income that difference, over-time, can be staggering.

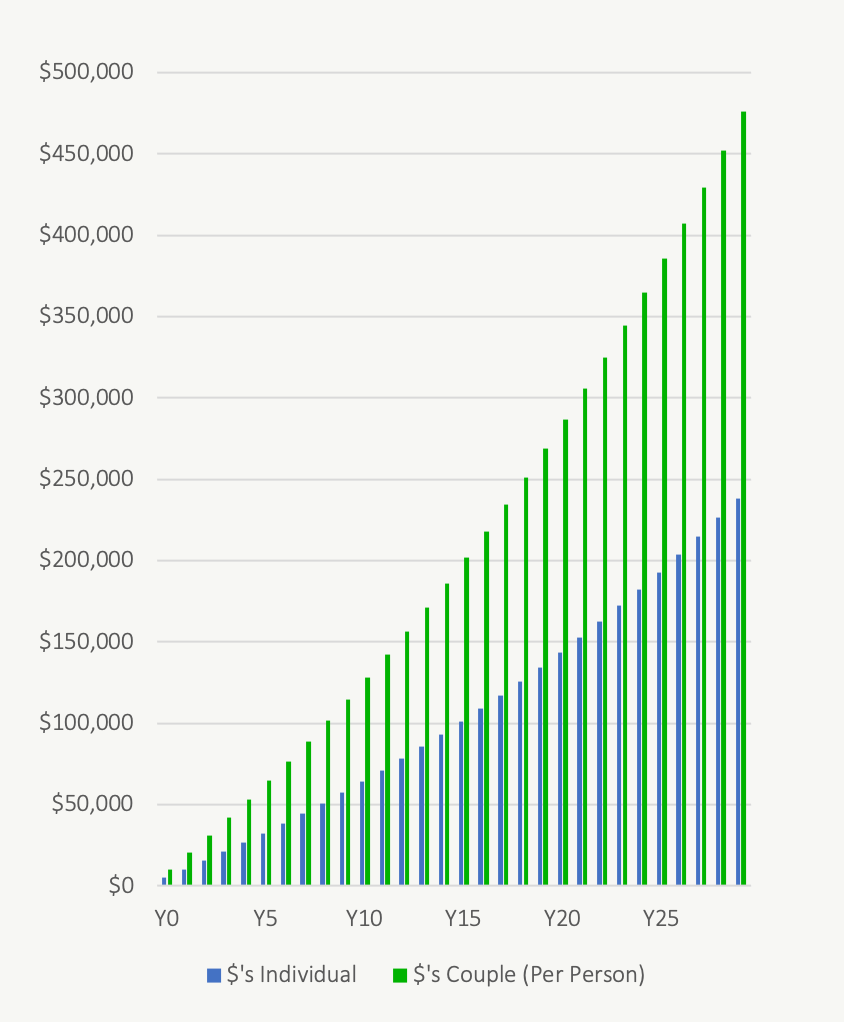

Couple Saving 20% vs Individual Saving 10%

(Adjusted to Show Wealth per Person)

Avoiding Government Benefit Clawbacks

Similar to income splitting, another financial benefit of marriage is that it can create opportunities to avoid government benefit clawbacks.

Couples can more strategically plan TFSA and RRSP contributions. They can plan to maximize both their tax advantaged contribution room. This can help tax shelter more of their investments and avoid government benefit clawbacks both now and in the future.

That being said, many government benefits are adjusted for individuals versus couples, which can level the field substantially. For example, individuals are eligible for an extra GST/HST credit. Depending on their income level, this extra GST/HST credit can provide them with a similar benefit as a couple. Likewise, Guaranteed Income Supplement or GIS (a generous low-income retirement benefit) is only 20% higher for couples versus individuals.

Still, with two maximized TFSAs and RRSPs, a couple can theoretically hold double the financial assets in tax sheltered accounts and more easily qualify for income tested government benefits.

Paying Off Debt Faster (Especially High Interest Debt)

Couples have an advantage when it comes to debt, especially high interest debt. High interest debt can create a serious drag on personal finances. It can be difficult to overcome the force of compounding interest when it’s working against you.

Couples have an advantage because they can throw more cash flow at high interest debt and pay it off faster. Rather than starting to invest right away, a couple can choose to attack their combined high interest debt first. This can help clear off debt faster and stop the drag of monthly interest.

There may even be an opportunity to use their combined credit rating and income to refinance high interest debt and decrease annual interest expenses.

With their combined resources, and a long-term outlook, couples working together can move past debt much faster than individuals working separately.

Reduced Risk

The last financial benefit of marriage is reduced risk. Couples are able to absorb larger financial risks, especially dual income couples.

Dual income couples are able to better manage changes to income like a job loss or disability. Not only do they have multiple income sources, but they typically have a higher savings rate and lower spending. This combination makes it easier to absorb these risks.

Couples are also able to manage with a smaller emergency fund. With two incomes and reduced risk there is less need to have a huge emergency fund. A couple doesn’t necessarily need 2x the emergency fund of two individuals.

This reduced risk also allows couples to take on more risk if they choose. This could be going back to school, making a risky change in jobs, or perhaps taking on additional investment risk. This can help couples accelerate income or increase investment returns.

The Financial Benefits Of Marriage

There can be some significant financial benefits for married or common-law couples. There are tax advantages, saving advantages, spending advantages, debt advantages, and risk reduction advantages. These advantages can make it easier to achieve financial goals.

Couples working together on a combined financial plan have the ability to accelerate their financial plan and achieve goals much faster.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments