Blow Your Mind

Track Your Spending For 30 Days

The average person makes anywhere from 100 to 200+ transactions per month. It’s unlikely that the average person can recall each and every transaction they’ve made over the last month (heck, sometimes I can’t even remember what I DID yesterday let alone what I spent money on).

Having a short memory makes us terrible at understanding our spending habits. Some people are natural budgeters, they can recall perfectly what they spend their money on. But for the majority of us, we need to track our spending to understand where our money is going.

Tracking your spending doesn’t have to be difficult. With the help of technology it can be super easy. Even going old school with pen & paper isn’t that difficult.

Tracking your spending is the only real way to understand your spending habits and make changes.

The Benefits Of Tracking Your Spending:

Tracking your spending can be very beneficial. Tracking your spending is the only way to really understand where your money goes. You’ll probably be very surprised when you see a full picture of your monthly spending.

The first time I started to track my spending I was amazed at how much I spent on coffee and treats. Even when it wasn’t a social occasion I was spending the equivalent of $500+ per year. By making a couple of quick changes I was able to save $500+ per year just from that one change alone.

Tracking your spending is the only way to build a good budget. Many new budgeters find it difficult to stick to a budget simply because their first budget is so out of whack from reality it has no chance to take hold.

Tracking your spending lets you make trade-offs. When you rank your spending from most important to least important there is always something at the bottom of the list that you care the least about. These are the easiest things to cut from your budget if you want to save more money.

Lastly, tracking your spending is kinda cool. It’s neat to see your spending habits over 30-90 days. It gets even cooler when you track your spending over an even longer period and start to see new habits take hold.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

How Long Do You Need To Track Your Spending?

This is a very personal decision.

At a minimum you should track your spending as long as it takes to reach your goals and get into a new routine.

When I track my spending I do it for short bursts, maybe 30-90 days in a row. During this time I work on building better spending habits. Once those new habits are formed I stop tracking my spending as closely.

The only reason I’ll start to track my spending again is when I find myself overspending my monthly budget. If I find myself going over budget I’ll track my spending for another 30-90 days to get myself back on track.

(I use the digital envelope method to manage my budget each month. So while I don’t track my spending in detail I do have a few digital envelopes to help manage my monthly spending).

“Tracking your spending doesn’t have to be hard. It can be as simple as a pen and paper.”

High Tech Ways To Track Your Spending:

There are lots of cool new ways to track your spending.

Data aggregators like Mint can help you track your spending in extreme detail. Mint makes it very easy to see every transaction and get a sense of where you’re spending your money.

Budgeting apps like You Need A Budget (YNAB) also make it easy to track your spending but they also help you make a budget for the future. With YNAB there is an option to manually input transactions or you can link YNAB to your bank accounts to bring in transactions automatically.

There are pro’s and con’s to using these services. Mint is free to use but obviously they want to sell you products. You share your spending data with Mint and they work with advertisers to sell you products that fit your profile. YNAB has a (low) monthly fee.

If you want to try a free solution but one that takes a bit of technical knowledge to set up, you can use a Google form to enter transactions and have it aggregate in a Google sheet automatically. This is what we do with new clients. We have two Google forms for each client to enter both expenses and income. By putting these links on your phone it’s super easy to enter transactions as you make them. Email us if you’d like to give it a try for free, support@planeasy.ca.

“Tracking your spending is the only way to understand your spending habits and make changes.”

Low Tech Ways To Track Your Spending:

There are also low tech ways to track your spending. Tracking your spending doesn’t have to be hard. It can be as simple as a pen and paper or using the notepad on your phone.

Just jot down transactions as you make them. Then review your transactions every few weeks to look for patterns or categories that are higher than you’d like.

Visualize Your Spending:

One of the cools things about tracking your spending is that you can visualize it in different ways. This can help identify areas of opportunity or it can just help to keep you on track.

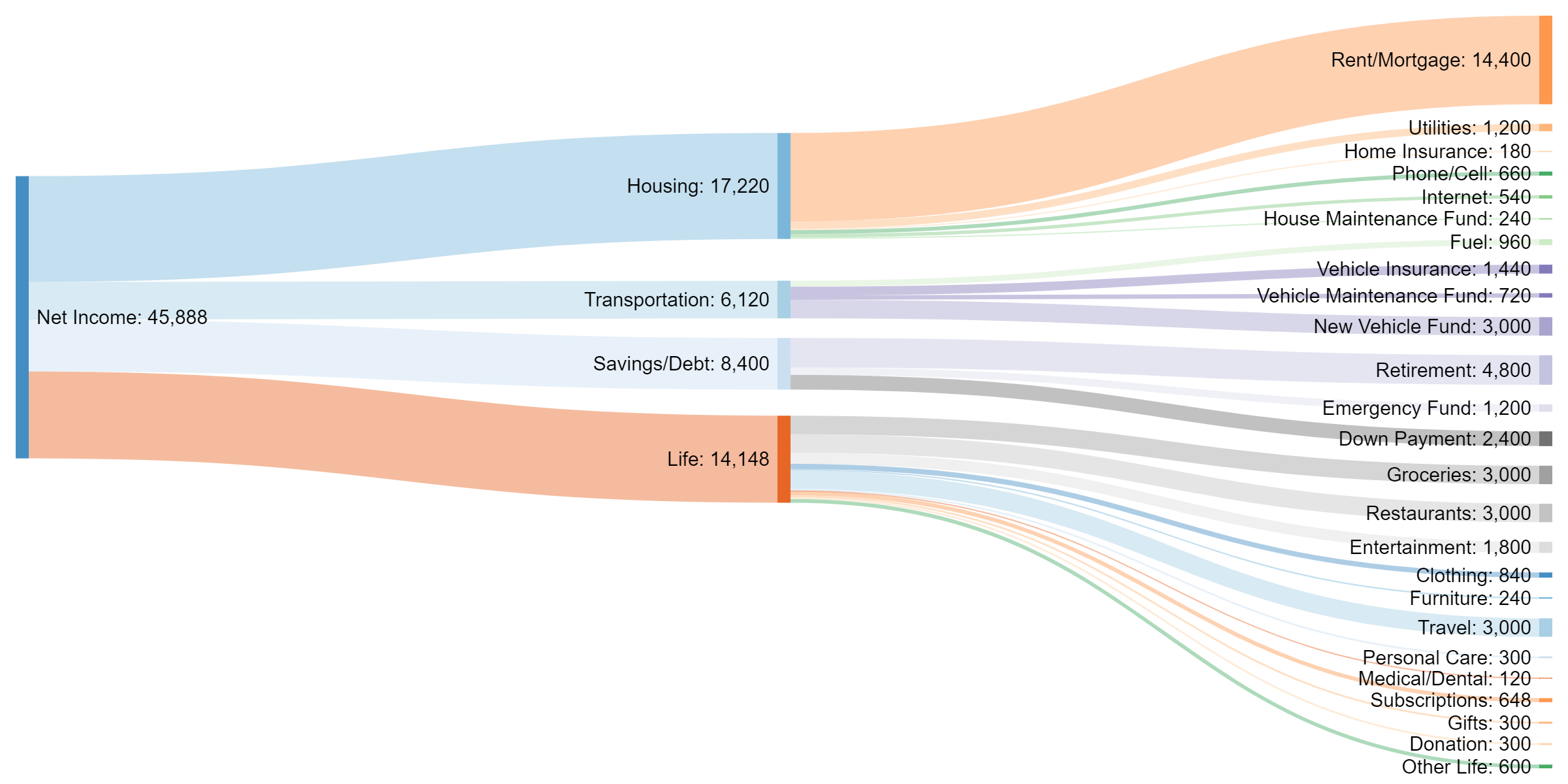

You can do a Sankey diagram to help visualize cash flow (check out my personal Sankey diagram where I share my families 2018 budget)

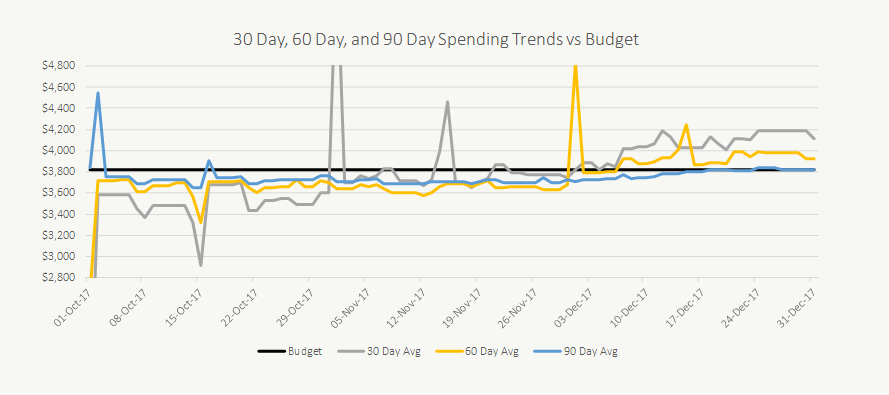

You can do a line graph with 30, 60 and 90 day averages to see how your spending is trending (if your 30 day average is above your 90 day average then you’re in a bad spending trend, clearly there was some holiday spending in this 30 day trend).

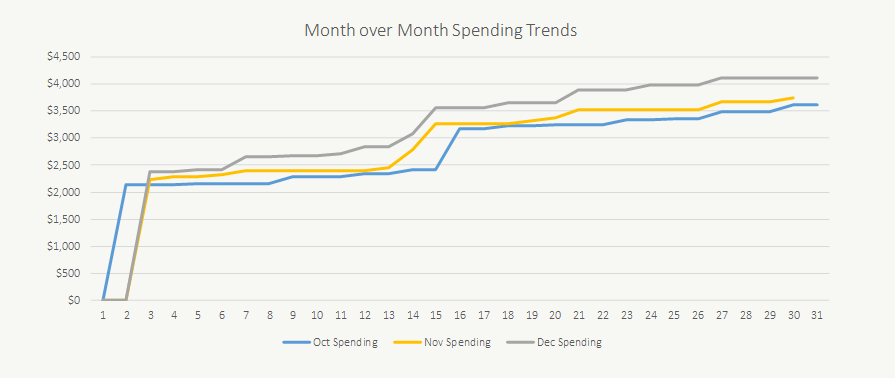

Or if you find that a bit confusing you can also view your spending month over month. This shows you how your month-to-date expenses compare to prior months (Again, you can clearly see there was some extra spending in November and December compared with October).

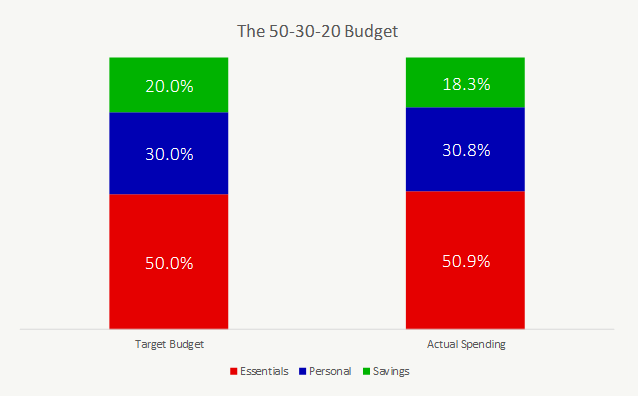

You can also visualize your spending against general rules like the 50/30/20 budget (In this case we’re doing pretty well. Saving is a bit below the target 20% but it’s pretty close).

Tracking your spending can be a bit tedious but once you get into the routine it can be fun too. Email us if you want some help setting up your budget tracking, support@planeasy.ca.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments