Two (Less Obvious) Financial Benefits Of Owning A Home

There are a number of personal and financial benefits when owning a home. There is the stability, the forced savings of mortgage payments, the potential for appreciation etc. etc. But there are two somewhat less obvious benefits of owning a home.

These benefits will help homeowners financially, both before retirement in the accumulation phase and also after retirement in the decumulation phase. These benefits will make it easier for homeowners to achieve their financial goals, decrease taxes, and minimize government benefit clawbacks.

In this post we’re going to explore two, perhaps hidden, benefits of owning a home.

Benefit #1: Locked-In Housing Costs And Less Inflation Rate Risk

When it comes to financial planning it’s important to think about risk, one of those risks is inflation rate risk. A period of high inflation can be very challenging time for personal finances. During a period of high inflation, the price of goods and services will rise rapidly, this includes rental costs.

Homeowners however have a benefit versus renters when it comes to inflation. Homeowners “lock-in” a large portion of their housing costs when they purchase their home. This helps them avoid the impact of inflation in the future, especially if there was a period of high inflation but even during periods of modest inflation.

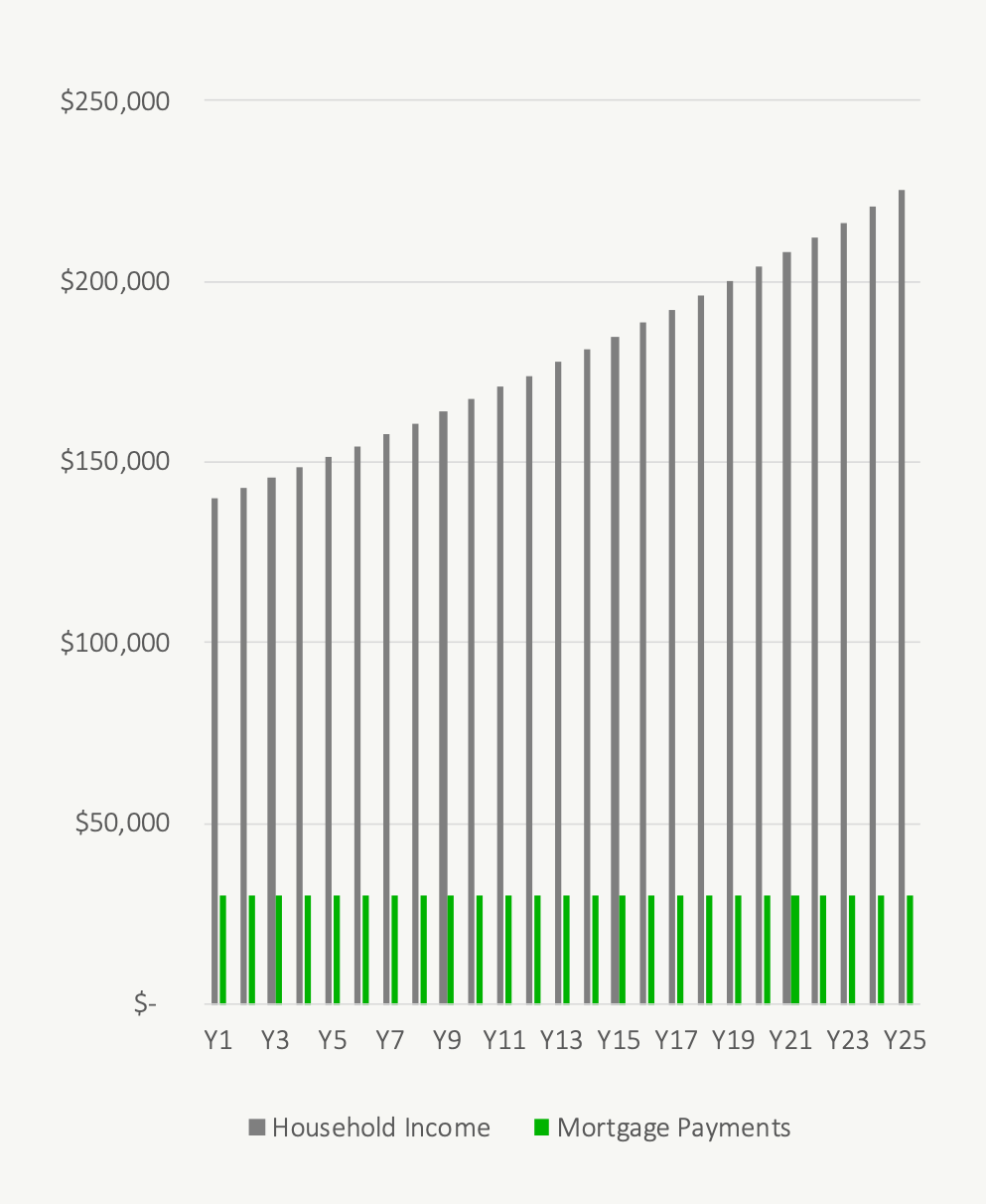

An easy way to understand this is to consider a couple of first-time home buyers. This couple earns a combined $140,000 per year and just recently purchased a home with mortgage of $2,500/month. Each year they put $30,000 towards the mortgage, 21.4% of their income.

What’s interesting is that over time their income will likely increase with inflation, but their mortgage payments will not. In we assume 2.0% inflation, and similar cost of living adjustments to salary/income (no merit increases, no promotions etc), over 5-years their income will have increased to $151,541 but their mortgage payments will still be $30,000 per year. Their mortgage now only represents 19.8% of their income.

Unlike a renter, who’s rent will likely keep pace with inflation over time, the homeowners can now save/spend an additional 1.6% of their income. That’s a nice financial benefit of owning a home. Even before the mortgage is fully paid off, the homeowner has the ability to save/spend more in the future.

This becomes even more dramatic over the course of the full 25-year mortgage. If interest rates are similar, the mortgage payments will remain $2,500/month or $30,000/year until the mortgage is paid off. Their household income however will continue to increase. By year 25 their income has risen to $225,181 (again, purely cost of living adjustments of 2.0% per year, no merit increases or promotions), and their mortgage payments are still the same at $30,000/year. Mortgage payments now only represents 13.3% of their income versus 21.4% in the beginning!

Just as fixed-income investors perform poorly during periods of high inflation, homeowners with a mortgage experience the opposite. Owning a home can help “lock-in” some housing costs and make it easier for homeowners save/spend in the future.

Mortgage Payments vs Inflation

(Assumes 2.0% cost of living adjustment per year)

Benefit #2: Less Income Tax And Gov. Benefit Clawbacks In The Future

One of the challenging things about being a renter, especially in retirement, is that those rent payments must be supported by extra savings and investments. Everything else being equal, a renter in retirement must have a significantly larger nest egg to support their retirement lifestyle. This causes a large amount of additional income tax and/or government benefit clawbacks in retirement.

Homeowners on the other hand have a significant portion of their assets tied up in the property (and with the capital gains exemption on your principal residence, there is no income tax to be paid on your home in the future). With more assets tied up in the property and not producing investment income each year, there is much less tax to pay in retirement for a homeowner.

For example, imagine a renter with a $2,500 monthly rent payment. To support that monthly rent payment in retirement will require $750,000 in financial assets to support these rent payments if we use the 4% rule. But this ignores the impact of income tax.

If we assume they’re in the 20% tax bracket, and that they have these assets invested in a non-registered account in a diversified investment with an asset allocation of 60% equities and 40% fixed-income, earning an average 4.97% after fees, then they would have an average tax rate around 11.7% on this income. Instead of just $30,000 per year for rent, their portfolio would need to generate $33,966 per year, $30,000 per year for rent, and $3,966 per year for income tax. To generate $33,966 per year would require a portfolio around $849,000 using the 4% rule.

This is even worse if these assets are inside a registered account like an RRSP. In this case the average tax rate is 20% because RRSP withdrawals are fully taxable. They would need to generate $37,523 per year from the RRSP, $30,000 per year for rent, and $7,523 per year for income tax. To generate $37,523 per year would require a portfolio around $938,000 using the 4% rule.

Financial Assets Required to Support $2,500/month Rent

(Based on 4% rule)

This becomes even more dramatic is if they’re in a higher tax bracket. In the 30% tax bracket this increases again. In a non-registered account, the average tax rate would be around 18.9%. Their portfolio would need to generate $37,011 per year, $30,000 per year for rent, and $7,011 per year for income tax. To generate $37,011 per year would require a portfolio around $925,000 using the 4% rule.

And lastly, if they were in the 30% tax bracket and the assets are inside a registered account like an RRSP, their portfolio would need to generate $42,644 per year, $30,000 per year for rent, and $12,644 per year for income tax. To generate $42,644 per year would require a portfolio around $1,066,000 using the 4% rule.

To make matters worse, this doesn’t even factor in the effect of Guaranteed Income Supplement (GIS) clawbacks or Old Age Security (OAS) clawbacks, two important retirement benefits with steep “clawbacks” (find out more about government benefit clawbacks and how they work).

Because renters need to generate a substantially larger amount of income in retirement to support rent payments it becomes much harder to qualify for GIS in retirement and/or they are more at risk of crossing into OAS clawbacks in retirement.

Homeowners have an advantage in retirement because they’re outgoing cash flow is relatively low versus a renter. This helps them avoid higher tax rates in retirement and even avoid GIS & OAS clawbacks. Everything else being equal, a renter will require a significantly higher nest egg approaching retirement.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments