What Is A Pension Adjustment?

(And What Is A Pension Adjustment Reversal?)

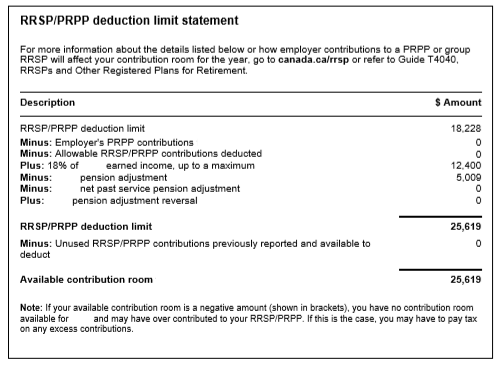

What is a pension adjustment? What is a pension adjusted reversal? If you’ve recently done your taxes or received your notice of assessment you may be wondering what these terms mean. You may have noticed large amounts of money being attributed to these items. You also may have noticed that they affect your available RRSP contribution room.

Anyone with a registered pension plan (RPP) or deferred profit sharing plan (DPSP) will notice that they’re receiving a pension adjustment.

The purpose of the pension adjustment is simple, it’s meant to equalize registered assets between those with employer sponsored pensions and those without. It reduces RRSP contribution room for those who receive (or will receive) benefits from a pension plan or deferred profit sharing plan.

The maximum anyone can put into their RRSP is 18% of previous years earned income up to the annual max. The pension adjustment reduces this new RRSP contribution room, sometimes to nearly nothing, in an attempt to make things more fair. The idea is that the maximum that can be put into registered savings (either pension, DPSP or RRSP) should be fair for everyone.

To do this effectively we need the pension adjustment (PA) and when people leave a pension or deferred profit sharing plan we need a pension adjustment reversal (PAR) (more on that later).

What is a Pension Adjustment (PA)?

A pension adjustment (PA) occurs whenever someone has a pension, either defined benefit (DBPP) or defined contribution (DCPP), or has a deferred profit sharing plan (DPSP).

The pension adjustment can be found in box 52 of your T4.

The purpose of PA is to equalize tax sheltered benefits for all Canadians. To do this the pension adjustment will decrease new RRSP contribution room dollar for dollar.

A $18,000 pension adjustment will reduce new RRSP contribution room by $18,000.

As an example, imagine we had two taxpayers, both earning $75,000/year, but one has a pension with their company and the other does not. Without the pension adjustment they would both earn $13,500 in new RRSP contribution room ($75,000 x 18%) but the person with the pension would also get the tax sheltered growth in the pension too. Not quite fair. With no pension adjustment the person with the pension plan would have access to more tax sheltered dollars than the other taxpayer (because the pension are also sheltered).

To eliminate this problem the pension adjustment reduces new RRSP contribution room. A $10,000 pension adjustment would reduce new RRSP contribution room to $3,500.

In our example, once the pension adjustment is taken into account, the employee with the pension has $10,000 of value in their pension and $3,500 in RRSP contribution room, $13,500 total. The employee without a pension has $13,500 in RRSP contribution room. Now it’s fair.

By including the pension adjustment in their tax return the taxpayer discloses the amount of tax-sheltered income which they are “receiving” through their employer pension plan, this allows the CRA to properly adjust new RRSP contribution room. This is why you may have noticed the pension adjustment on your notice of assessment where new RRSP contribution room is calculated.

Example of Pension Adjustment on Notice of Assessment

Calculating Your Pension Adjustment

If you have a pension plan through your employer, it’s important to understand how your Pension Adjustment is calculated.

Under a Defined Contribution Pension Plan (DCPP) your pension adjustment is the amount contributed for the year by employer and employee. A $5,000 employee contribution plus a $5,000 employee match equals a $10,000 pension adjustment. Pretty simple.

Under a Deferred Profit Sharing Plan (DPSP) your pension adjustment is the amount contributed for the year by your employer (there are no employee contributions to a DPSP). Again, pretty straightforward.

Under a Defined Benefit Pension Plan (DBPP) things get a little more complicated. In this case the pension adjustment is 9 times the benefit accumulated during year minus $600.Using our example from above, someone earning $75,000 per year and who receives a pension benefit of 2% per year of service will accumulate a pension benefit of $13,500 that year ($75,000 x 2% x 9 factor). The pension adjustment is then $12,900 ($13,500 minus $600).

Interesting fact, the maximum pension benefit is 2% per year of service. When we multiply by the factor of 9 this is 18%, the same rate at which we earn new RRSP contribution room. Because of the $600 subtraction when calculating the pension adjustment, this means even those who have a very generous defined benefit pension will still receive $600 in new RRSP contribution room each year.

Another interesting fact, although the pension adjustment is meant to make things fair, it’s actually too basic of a rule to truly be fair. For example, two different pension plans could both accumulate pension benefit at 2% per year of service, but one plan is indexed to inflation and the other is not. The indexed pension is technically worth much more, indexing is a huge benefit over time, but both these pensions would receive the same pension adjustment and the same reduction in new RRSP contribution room.

What is a Pension Adjustment Reversal (PAR)?

A Pension Adjustment Reversal (PAR) is used when someone leaves their pension plan or deferred profit sharing plan. It can restore contribution room to their RRSP.

This happens when the benefit received after leaving the plan is less than then pension adjustments over the years.

This is easiest to understand with a DCPP or DPSP. If there is an amount that is withheld because it hasn’t vested yet, this becomes a pension adjustment reversal.

Let’s say there were three years of pension adjustments of $13,500 ($40,500 total), but the amount received when leaving the plan is only $35,000 because $5,500 hadn’t vested yet. In this case a pension adjustment reversal is issued for $5,500 and this amount is added to next years RRSP contribution room. With a pension adjustment reversal RRSP contribution room goes up.

A pension adjustment reversal is a bit harder to understand with a defined benefit plan because the amount received when leaving the plan is calculated by the plan actuaries based on current interest rates, longevity etc. If the amount received is less than the pension adjustments then this amount becomes a pension adjustment reversal. This PAR is then added to new RRSP contribution room and they can contribute more to their RRSP the following year.

Let’s say a younger employee leaves their defined benefit pension and receives a commuted value of $30,000. If they’ve received pension adjustments of $13,500 per year for the last three years ($40,500 total), then they would receive a $10,500 pension adjustment reversal. This reversal represents the difference between the benefit they’ve received ($30,000) and the pension adjustments ($40,500).

It is important to note that a PAR can occur when someone leaves their plan, but they don’t necessarily have to leave their employer.

Pension Adjustments And Reversals

Pension adjustments are an important consideration for anyone with a registered pension plan (RPP) or deferred profit sharing plan (DPSP). Anyone who participates in one of these plans will notice that they’re receiving a pension adjustment on their T4 and on their notice of assessment.

These pension adjustments will directly affect how much can be contributed to RRSPs in the future. It’s important to anticipate this reduction when doing long-term planning. It may require that extra savings/investments be placed in a TFSA or non-registered account.

It’s also important to understand what could happen when leaving a defined benefit pension. For certain employees (especially younger ones or those without extra benefits like indexing) there could be a large pension adjustment reversal when leaving a defined benefit pension. This could be an advantage if this extra contribution room could be used in the near future (either by shifting over existing non-registered assets or with new contributions).

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Thank you Owen for this explanation. I’ve been reading numerous financial blogs for about five years, and you’re the only blogger to explain the PAR.

Glad you found it useful Bob!

One topic I wanted to touch on but didn’t have a chance is Past Service Pension Adjustments (PSPA). Perhaps I’ll cover PSPAs in the future.