What Is Your Risk Profile?

What is your risk profile? This is a key question for every investor, yet I suspect it doesn’t get the attention it deserves.

Everyone sees risk differently. Some people don’t worry about risk at all, it doesn’t keep them up at night, it doesn’t cause them any stress. To them, not taking risks seems like a waste of time and resources. They’re risk seekers.

On the other hand, some people are deeply affected by risk. It causes them to worry, to always focus on the negatives, to think about all the things that could go wrong. For them, risk causes stress and sleepless nights. They’re risk averse.

Then there is everyone in-between. People who aren’t risk seekers, but who aren’t risk averse either. They see the benefit of risk, but it makes them a bit uneasy.

Choosing the right risk profile isn’t easy. There are a lot of factors to consider. Going too far one way or their other can cause issues over the long-term. But sometimes it takes some real-world experience before you can safely say what you’re risk profile truly is.

Why Is Your Risk Profile Important?

Your risk profile will help determine how much risk to take with your investment portfolio (but its not the only consideration!)

Risk is a big driver of return, so in general more risk means more return. In a perfect world a higher investment return is meant to compensate the investor for taking on more risk.

For example, in general, corporate bonds provide a higher return than GICs. There is a chance for a business to declare bankruptcy which creates risk, but GICs are essentially risk free and can be CDIC insured. Because there is more chance for bond holders to lose money they are compensated with a higher investment return.

Another example, in general, stocks provide a higher investment return than bonds, even for the same company. This is because bond holders have more rights than stock holders do. So even if a company declares bankruptcy it’s more likely that the bond holders will fair better than the stock holders. For this reason the stock holders are compensated with a higher investment return.

Personal risk profiles help determine how much of each type of asset you should hold. How much in stocks vs bonds vs cash equivalents like GICs. Personal risk profile is a big driver of asset allocation.

Choosing The Right Risk Profile

Understanding your risk profile is tricky. It can be easy to be lured into a more aggressive risk profile by the promise of higher returns. We can trick ourselves into thinking we have a higher risk profile than we actually do.

There are online tools that can help determine your personal risk profile. They’ll ask a series of questions to help you understand how much risk you might be comfortable with.

But… online risk profiles aren’t an exact science and its easy to sway the result. Like personality tests, these risk profiles can easily be influenced if you’re answer in a biased way. So… try to answer as honestly as you can.

When choosing the right risk profile don’t be fooled by recent experiences. This “recency bias” is hard to avoid and when we’ve had a long bull market this “recency bias” can cause us to assume we’re more risk tolerant than we really are.

When it’s been 10+ years since the last major recession/correction, its easy to trick ourselves into thinking that we have a higher risk tolerance. But this can lead to taking on too much risk and could lead to some disastrous consequences.

Taking On Too Much Risk

Take on too much risk and you might be in for a gut-wrenching ride that could last for years. When you take on too much risk you’ll be more likely to feel the emotional toll during a recession.

Because of this emotional rollercoaster you’ll be more likely to make a behavioral error, especially as a DIY investor. With all these crazy emotions there’s a higher chance of making a behavioural mistake, deviating from your investment plan, and selling at the market bottom in an effort to reduce risk and avoid any more pain (often too late and at the worst possible time).

When an investor is invested above their risk tolerance a large drop in the market can be devastating, not just financially but emotionally as well. Even if you don’t make a mistake and deviate from your investment plan it can still be a draining experience that lasts for years.

Take On Too Little Risk

Take on too little risk and you need to work harder, save more, delay your financial goals, spend less in retirement and possibly run out of money in the future.

Being too conservative generally means lower investment returns over the long run and they only way to make this up is by adding more to your investments or eventually drawing less in retirement.

As crazy as it sounds, taking on too little risk can also be risky as well. There is more than one type of risk. Reducing stock market risk by choosing a more conservative portfolio may mean you increase the risk in other areas of your financial plan. A conservative portfolio would have a harder time keeping pace with rapid inflation (like in the 70’s).

Tested By Experience

Choosing your personal risk profile is tough. It’s a fine balance. Sometimes the best way to choose your risk profile is through experience. That’s why investing on a regular basis, even if it’s a small amount, can provide some great experience that will benefit you when you’re able to invest more in the future.

Living through a large stock market correction or a full-blown recession can be a great test for your risk profile. It’s one thing to say you’re comfortable with a 40-50% decline in your portfolio, and it’s another thing entirely to see your hard-earned savings drop in half!

Investing each month, even if just a little bit, will provide you with some great experience and help you test your risk profile. That way once you’re investing more in the future, you’ll be confident that you have the right portfolio for you.

Determine Your Risk Profile

One way to determine your risk profile is to take an online questionnaire like this one from Vanguard. Its not perfect, and like previously mentioned, its easily tricked/biased if you don’t answer honestly.

Another way to determine your risk profile is to work with a financial planner to create a holistic financial plan. Its easier to nail down a risk profile when it’s in the context of all your other financial goals. Its easier to feel comfortable with your risk profile when you can see the impact this decision can have.

What You Could Expect To Lose

One great way to confirm your risk profile is to understand how much you might expect to lose during a recession. Canada Couch Potato has a number of model portfolios and what I love about their summaries is that they include the largest loss over 12M and standard deviation. These are both great ways to get a feel for how much risk you’re really taking.

Another great way to understand how much you might expect to lose is to run your financial plan through historical scenarios. We often do this for retirement plans, because we want to ensure we don’t run out of money in retirement. But we can do this for the build up phase as well.

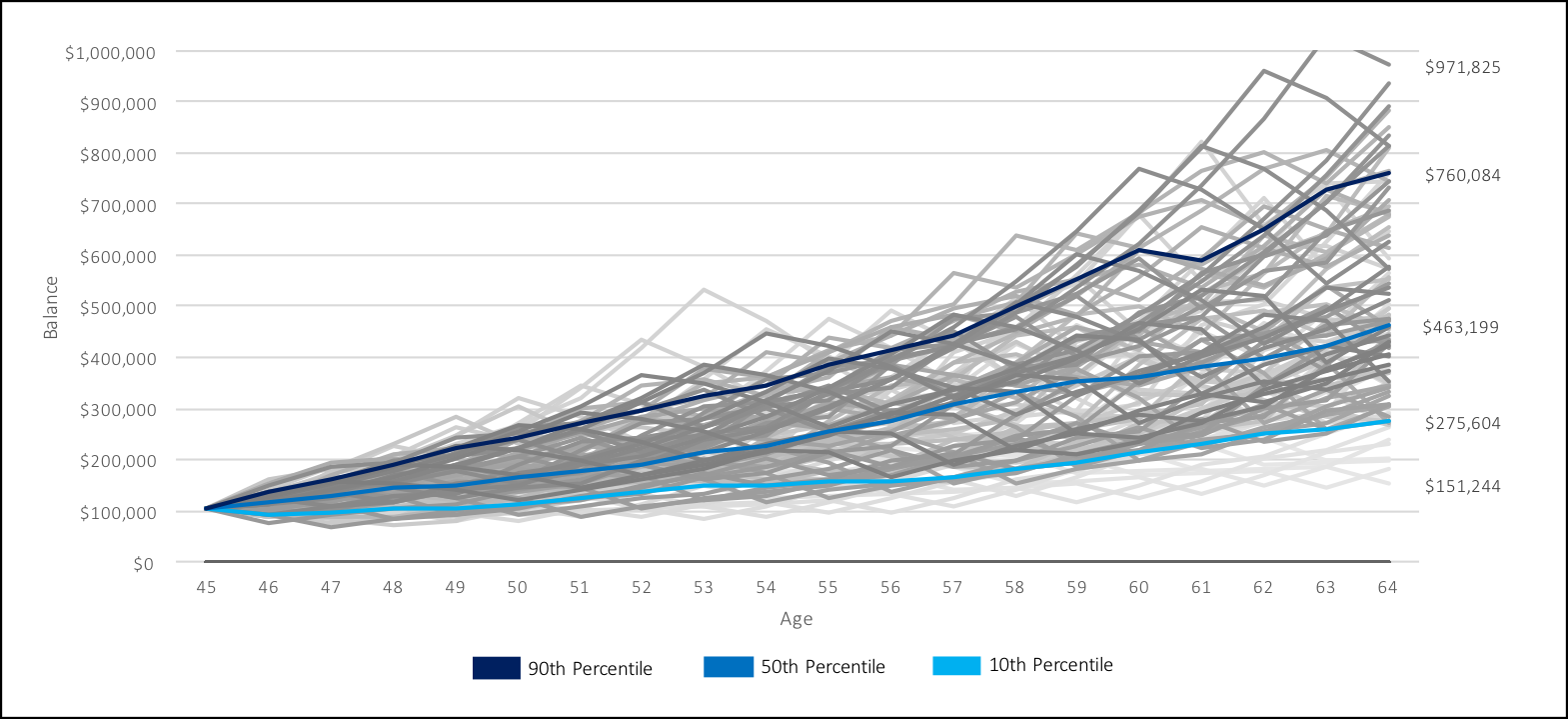

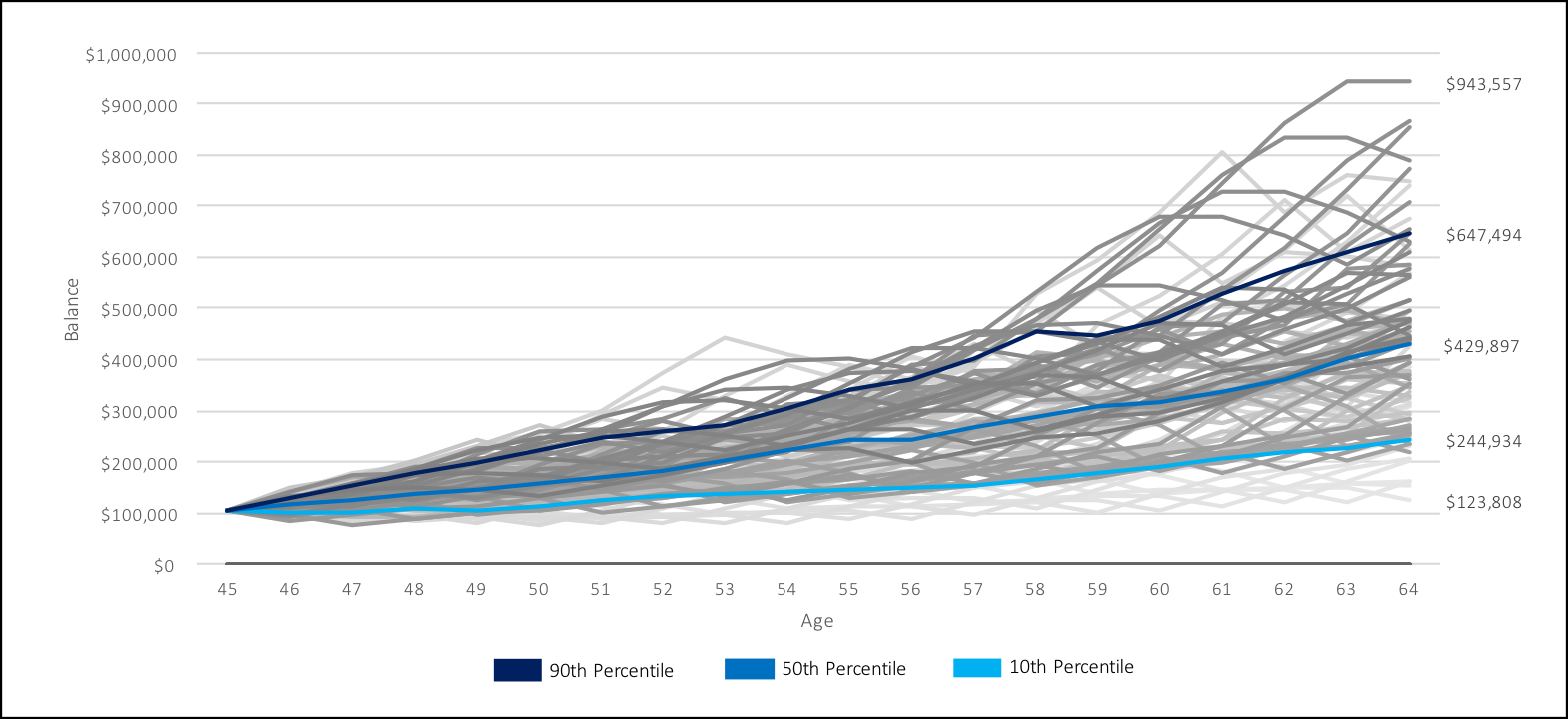

Below you’ll see what the real (today’s dollars) investment balance looks like, using historical results, when we start with $100,000 and invest $5,000 per year over 20 years with two different risk profiles.

Each line is one historical period. This gives us a sense of what our build up plan might do in the future based on past results. For example, the low lines represent historical periods that go through the great depression. The high lines represent historical periods that go through the bull market of the 90’s.

We have no idea what will happen in the future, but if you’re comfortable with the low lines based on historical results then hopefully you’ll be comfortable if we experience them again in the future and perhaps you’ve chosen the right risk profile.

Example Of Regular Contributions For An Aggressive Portfolio

Example Of Regular Contributions For A Balanced Portfolio

PS. Notice how the ending balance isn’t too drastically different between the Aggressive 90/10 portfolio and the Balanced 60/40 portfolio? This is because the “shorter” time frame of 20 years means that investment returns have less of an impact. This, combined with regular annual contributions, means that even in the 50th percentile, nearly half of the ending balance is made up of contributions.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments