Are Actively Managed Portfolios Guaranteed To Underperform Passively Managed Portfolios?

Are actively managed portfolios guaranteed to underperform passively managed portfolios? That’s what William F. Sharpe argued when he wrote The Arithmetic Of Active Management.

The idea is quite simple, and the paper is quite short if you’d like to read it.

It presents a very simple argument for low-cost passive investing versus high-cost active investing.

Through simple arithmetic, Sharpe argues that it’s easy to see that passive portfolios will outperform active portfolios. The argument is built on a few simple concepts so let’s take a look…

First: We Need To Define The Market

The first step in understanding the argument is to define what “the market” is. This could be the S&P 500, or it could be the entire US stock market, or it could be the entire global stock market.

Given the ease at which index funds have made global investing we’ll consider “the market” to represent the entire global stock market.

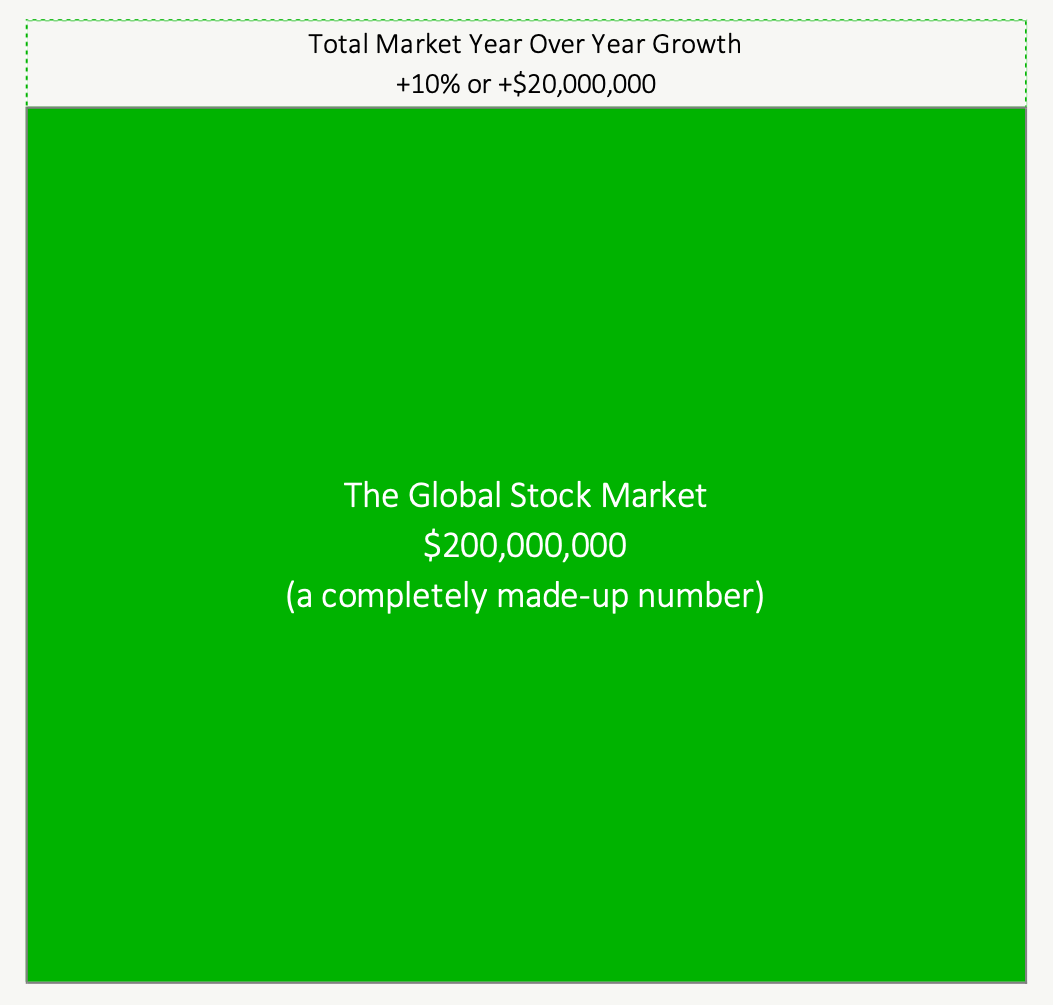

In our example, we’ll assume the global stock market had a great year and is up 10% year over year.

To make the example even easier to follow let’s assume the entire global stock market is worth $200,000,000 (a completely made-up number) and therefore with a 10% gain it’s up $20,000,000 versus last year.

Second: We Need To Split The Market Into Active Investors And Passive Investors

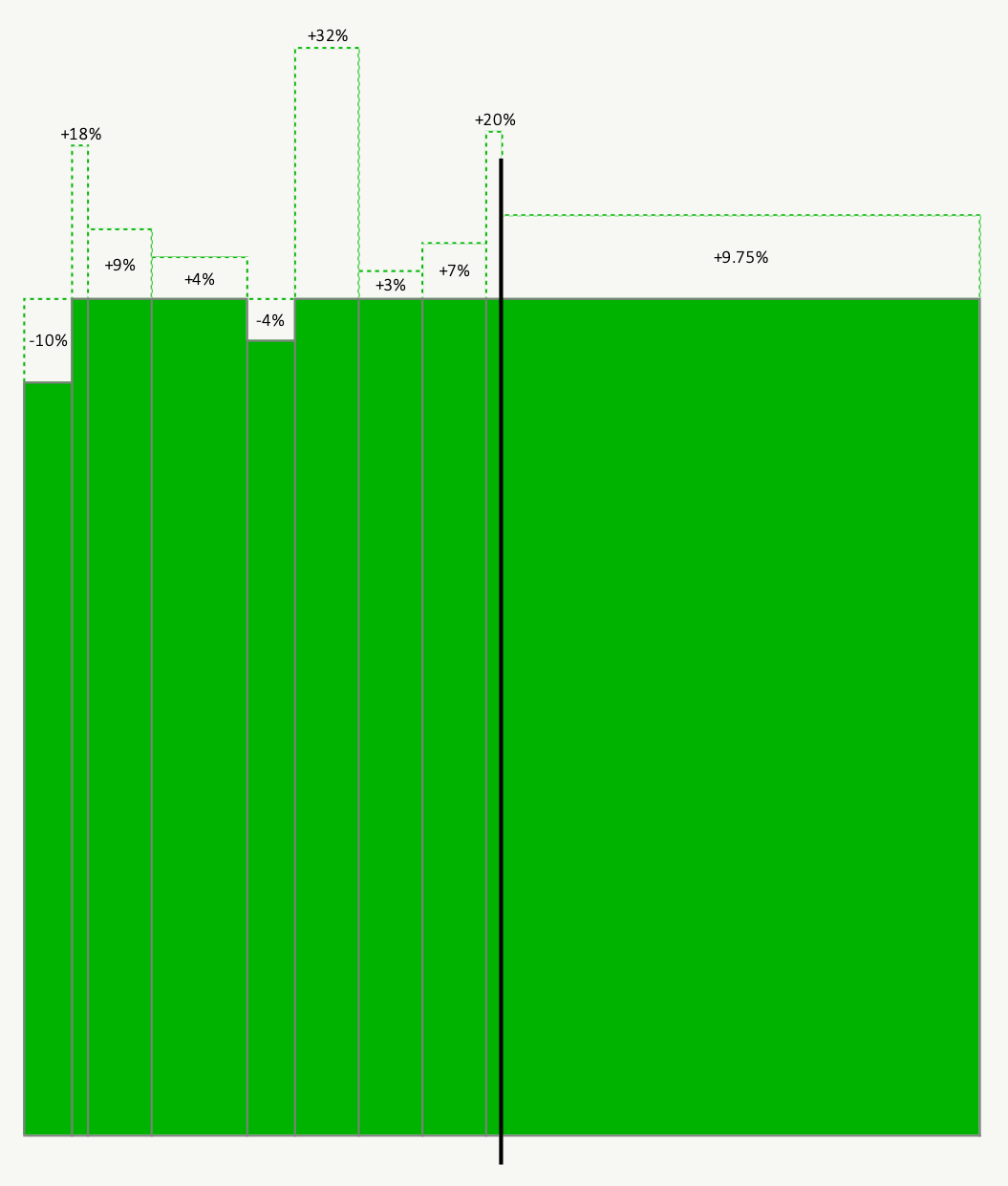

The second step in the argument is to split the market into active investors and passive investors. Because there are only two types of investors this needs to be a mirror of each other, it could be 60/40, 30/70, 47.5/52.5 but to make things simple we’ll assume the market is split 50/50 between passive investors and active investors.

Now it’s easy to see that the passive investors are all up 10% or $10,000,000. They passively invest in the entire market and therefore match the market returns. It’s now also easy to see that the active investors are also all up 10% or $10,000,000. As a whole the active investors can’t be doing better than the passive investors, 2 minus 1 does not equal 1.5 (as the active investors might like you to believe), 2 minus 1 equals 1.

So, if the entire market is up $20,000,000, and the passive investors represent half the market then they are up $10,000,000, then that leaves just the active investors who also must also be up $10,000,000, the same as the passive investors.

Already we can see that active investors cannot possibly beat passive investors, but we still need to account for investment fees, which are going to impact the active investors more than the passive investors.

Third: We Need To Calculate Returns After Fees

To really understand how actively managed portfolios are guaranteed to underperform passively managed portfolios the last step is to calculate the investment returns after fees.

Investment fees are an important consideration for any investor. Annual investment fees represent a drag on annual returns. The larger the fees the higher the drag.

Now, because passive investing typically has lower trading costs and razor thin profit margins, we’ll assume an average investment fee of 0.25% for a passively managed portfolio.

Active management on the other hand is more expensive. Not only are there additional fees for trading, but there are portfolio managers, business analysts, marketing teams, salespeople etc. etc., plus there is also the need to generate a large profit margin for the parent company. This increases the fees for an activity managed portfolio. A typical actively managed mutual fund portfolio could have fees of 2.5%, 10x that of a passively managed portfolio.

Now that we subtract investment fees, we can really see how actively managed portfolios are all but guaranteed to underperform passively managed portfolios on the whole.

But What About Individual Active Portfolios? Can Some Individual Portfolio Managers Beat The Market?

One argument that most active investment managers like to make is that they’re better than the average. While there will certainly be a number of winners in the active portion of the market… there must also be losers.

The stock market is a zero-sum game. For every transaction there are two parties, the buyer and the seller. If the buyer “wins” the seller must “lose” and vice versa.

Overall, the sum of the winners and the losers in the active side of the market must equal the market return minus fees. So, while some active managers might beat the market one year, there is no guarantee they’ll continue to beat the market the following year, and after fees it becomes harder and harder to beat the market repeatedly.

The other argument that active portfolio managers could make is that they have access to investment options that the passive investors do not. The active investors could argue that their “market” is much larger and includes infrastructure projects, private markets, startups/IPOs, private lending etc. While this might be true, it may not be enough to beat the passive investors on a consistent basis, especially when adjusted for risk, and especially after fees.

Are Actively Managed Portfolios Guaranteed To Underperform Passively Managed Portfolios?

Are actively managed portfolios guaranteed to underperform passively managed portfolios? William F. Sharpe certainly makes a convincing argument when he wrote The Arithmetic Of Active Management.

The argument is that on average, active portfolio managers must have returns before fees that equal their passive counterparts. Then, after deducting investment fees, which are higher for active management, it makes it much harder for active portfolio managers to beat the market on a regular basis and impossible for all active portfolios to beat the market as a whole.

Disclaimer: Nothing is guaranteed. The stock market is not quite as perfect as we’d like to believe, and many passive investors are only participating in part of the market (eg. they’re only investing in the S&P 500, or they’re under indexed in global investments, or they’re over indexed in Canadian investments etc. etc.). This post is for educational purposes only and should not be considered investment advice.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments