TFSA or RRSP? Which One Is Best For You?

Both the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP) are tax-sheltered accounts offered to Canadians by the government as a way to help save and invest without the drag of income tax on annual returns.

Although both are great ways to help grow your money, it can be difficult to decide which one is best for you.

Often one type of account is better for an individual than the other. In most cases we would prefer to maximize one of these accounts before moving on to the next.

Which account we choose, TFSA or RRSP, will depend on a number of factors. These factors may change over time. It’s reasonable to assume that a new grad entering the work force would be better suited to maximizing their TFSA first but as their income grows they may prefer to start focusing on their RRSP instead.

This decision between TFSA or RRSP often involves looking at your marginal effective tax rate today and your marginal effective tax rate in the future. You marginal effective tax rate is your income tax rate PLUS the claw back rate you experience from government benefits.

Making the right decision between TFSA or RRSP can help save $100,000’s over time.

It can mean paying thousands LESS in income tax and it can mean qualifying for thousands MORE in government benefits (like the Canada Child Benefit (CCB) or the Guaranteed Income Supplement (GIS) or one of dozens of other government benefits that are available).

How TFSAs And RRSPs Differ With Taxes

Looking into the difference in tax benefits between TFSAs and RRSPs can be a good deciding factor when choosing between the two. The biggest tax differences are:

RRSPs let you defer taxes, meaning you contribute pre-tax dollars to the account then later pay them when you withdraw. This is an advantage if your marginal effective tax rate in retirement is lower than during your contribution years, because you will end up paying less tax on the money withdrawn

The money you contribute to your TFSA has already been taxed, so when you choose to withdraw it you do not pay any more. This is an advantage if your marginal effective tax rate in retirement is higher than during your contribution years. This can easily happen for low and moderate-income retirees who qualify for GIS in retirement which has a 50% to 75% claw back rate.

If you’re interested in a more detailed tax comparison of the TFSA versus the RRSP we suggest reading this post which puts both accounts head to head.

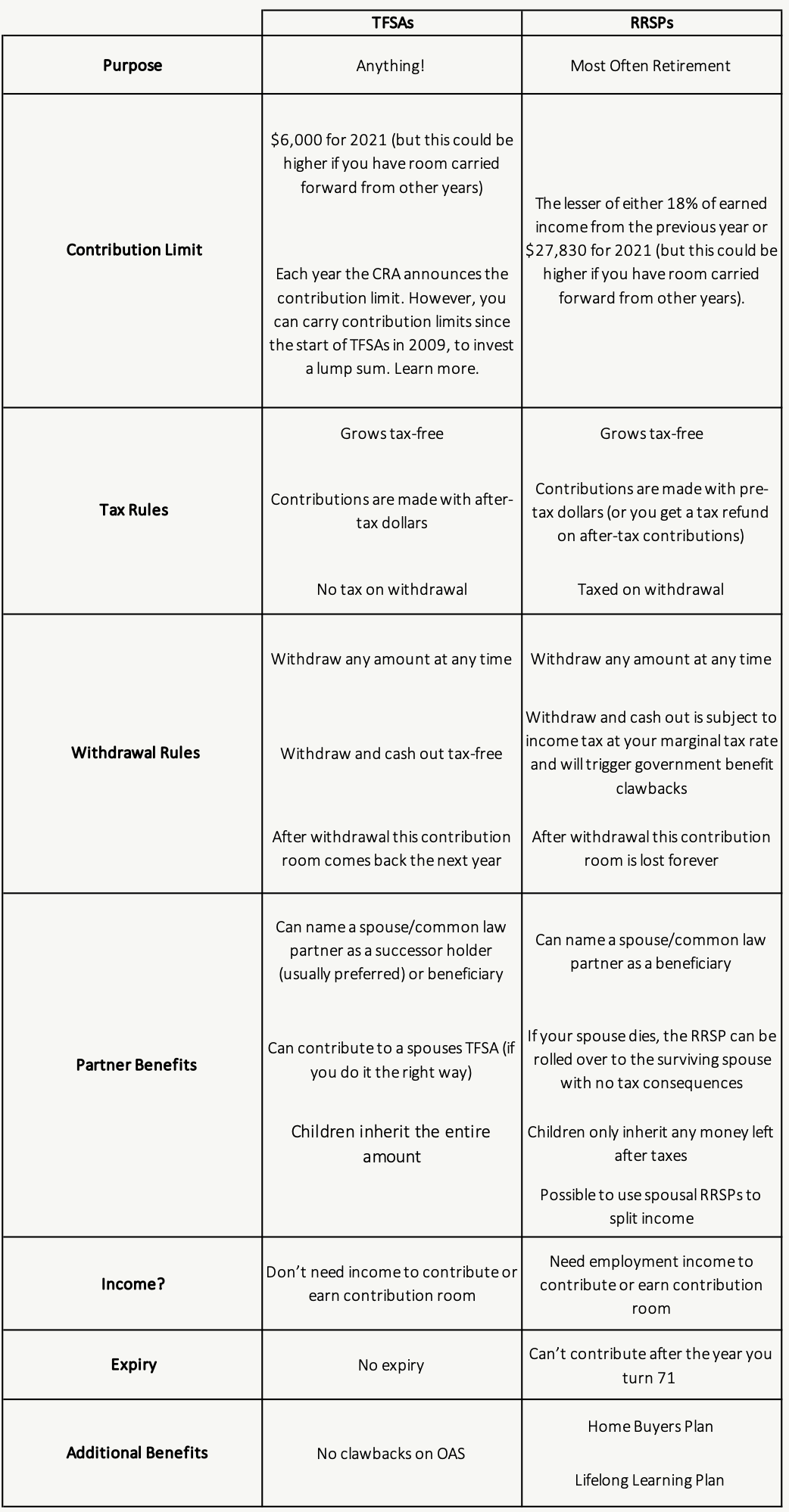

Comparing and Contrasting TFSAs and RRSPs

Here is an overall outline of the main differences between TFSAa and RRSPs.

TFSA or RRSP: Things to Consider

There are many considerations when deciding between the TFSA or the RRSP but here are a few of the main things to consider. To find out more about WHY these factors are important we suggest reading this post.

- Marginal effective tax rate today?

- Marginal effective tax rate in retirement?

- What is your government benefit claw back rate, how will it evolve over time?

- Would income splitting help decrease tax?

- Would you benefit from creditor protection?

- Do you typically spend your tax refund?

- What is the goal/timing for money in the TFSA or RRSP?

- Will mandatory RRIF withdrawals be a problem in the future?

Make Things Easier By Choosing The Right Account

One of the benefits of choosing the right account is that it can help make things easier for your personal finances. Using the right account can help you save $10,000’s or even $100,000’s more over time.

This tax and benefit efficiency can make a huge difference in your financial plan, helping you to retire earlier or retire with more financial security.

This TFSA or RRSP decision may also change over time. Just because the TFSA is the right choice now doesn’t mean it will always be the right choice in the future.

Or, just because the RRSP is the right choice now doesn’t mean it will remain that way in the future.

And, in some cases, it might be beneficial to mix contributions to both RRSP and TFSA depending on your specific tax situation (although these situations are less common and would require some detailed planning).

It’s a good idea to revisit the TFSA or RRSP decision each year to make sure that you’re still making the right choice given your situation at the time. With thousands of dollars on the table this is a little bit of effort for a very big reward!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen, we have a popular, simple tool on our website that might be helpful with the calculations.

https://www.financialcalculators.net/steadyhand/tfsa-rrsp/

Best wishes, David.

That’s great David, thanks for adding that!

There’s a detailed comparison here where deferring CPP/OAS while maxing out you tax credit room for that 5 years always beats a TFSA even in the lowest tax bracket while contributing

https://youtu.be/ZyJlxgyQraQ?si=awohyKlTmEakrH5v&t=1590