Can An RRSP Be Too Big?

Can an RRSP be too big? That would be a nice problem to have, wouldn’t it?

Having an oversized RRSP means one of two things, either RRSP contributions have been on track for many, many years, or investment returns have been above average for a long time, or some combination of the two.

Having a large RRSP is a good problem to have, but it’s still a problem. With a large RRSP the problem becomes how to get that money out without losing a large percentage to income tax or government clawbacks.

At a certain level, withdrawals from an RRSP could trigger higher marginal tax rates and/or government benefit clawbacks. In these situations, it’s pretty easy to hit marginal effective tax rates of 50%+ in retirement. Losing half of an RRSP withdrawal to tax and benefit clawbacks is not ideal.

With an RRSP that is “too big” it’s possible to have a tax rate in retirement that is higher than when employed.

If you have a large RRSP, or if you have a modest RRSP but are still contributing, then there are a few issues that should be on your radar.

When It Comes To RRSPs, How Big Is Too Big?

First of all, how big is an RRSP that is “too big”? Unfortunately, there’s no exact answer, it will depend on the type and amount of other retirement income.

Even a modest RRSP can become “too big” when combined with large amounts of CPP and OAS income, especially when both benefits are delayed until age 70.

Even a smaller RRSP can also become “too big” when combined with a lot of pension income or non-registered investment income.

But in general, when an individual’s RRSP assets are $500,000 or greater, or a couple’s combined RRSP assets are $1,000,000 or greater, this is when they start to become too big.

It’s at this point, when combined with typical CPP and OAS income, that those future RRSP/RRIF withdrawals start to maximize the lower tax brackets. With RRSP assets that are over $500,000 per person, retirement withdrawals start to creep into the higher marginal tax brackets.

Minimum RRIF Withdrawals

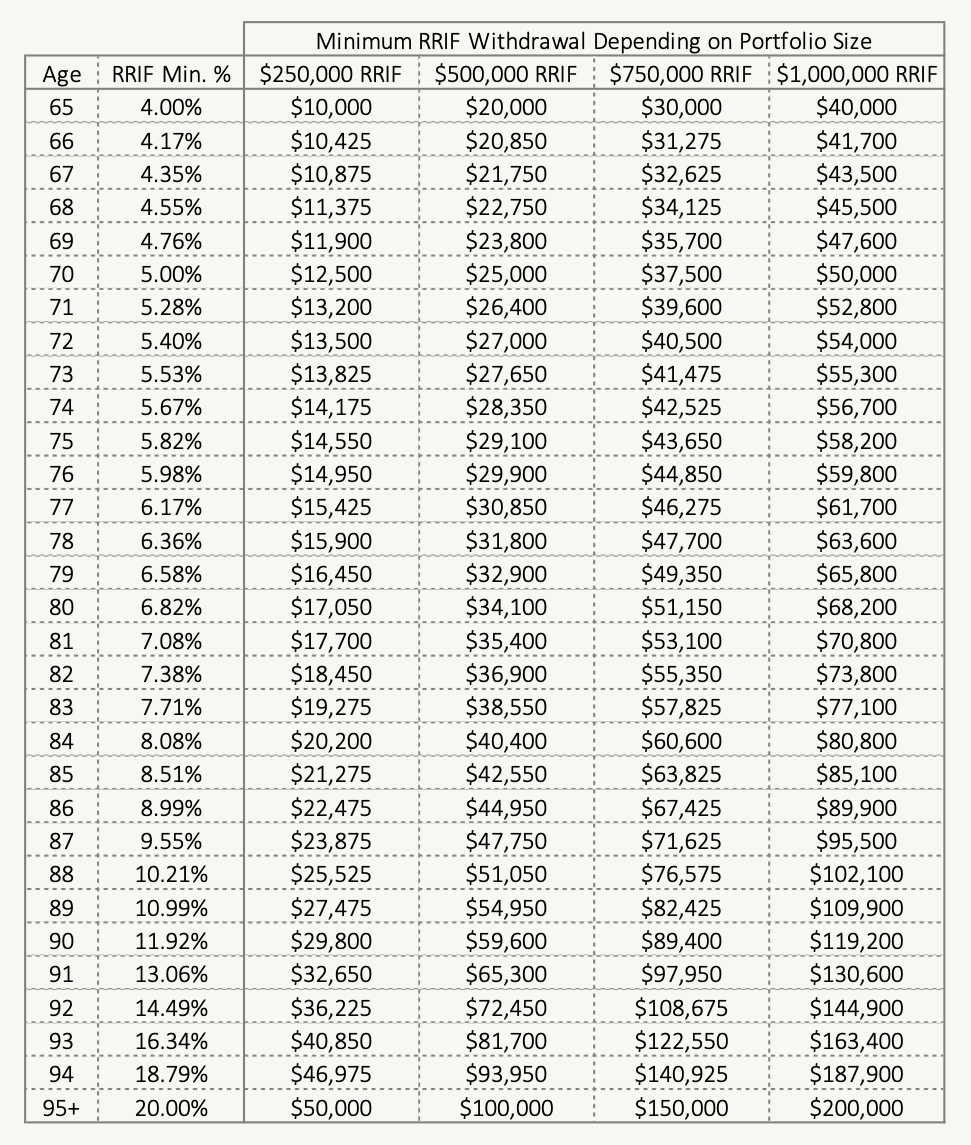

Another important consideration when RRSPs become “too big” is that they will trigger some equally large RRIF withdrawals after being converted to a RRIF.

The minimum RRIF withdrawal are based on the RRIF balance at the end of the previous year and the age of the account holder. Based on the age of the account holder there is a certain percentage of the account that must be withdrawn each year.

This percentage increases with age and when an RRSP is “too big” those percentages cause some very large annual withdrawals.

OAS Clawbacks

When an RRSP/RRIF is very large there is also a good chance that withdrawals cause retirement income to cross into OAS clawback territory.

These clawbacks start when individual taxable income is $79,845 or more (in 2021). Any income above this threshold will incur a 15% clawback on OAS benefits. These clawbacks will continue until OAS benefits are reduced to zero.

For large RRSP/RRIFs these clawbacks can push marginal tax rates from the 30-40% range into the 50%+ range.

Learn more about OAS clawbacks.

Doing A Spousal Rollover

When RRSPs become “too big” they also become an issue when there is a spousal rollover.

For couples, when one partner passes away, the survivor can “rollover” the deceased’s RRSP/RRIF into their own without triggering any income tax. That spousal rollover can create a monster RRSP/RRIF.

When two large RRSPs or RRIFs are combined they can easily create a RRSP/RRIF that is “too big”.

For the survivor, this combined RRSP/RRIF will cause some very large minimum RRIF withdrawals, and because income splitting is no longer an opportunity, all of that income will be taxed at the individuals marginal tax rate.

A Large Tax Bill For The Estate

Lastly, when an RRSP becomes “too big” it also becomes an issue for the future estate. When RRSP/RRIF assets aren’t drawdown fast enough in retirement it can result in a large RRSP/RRIF being taxed in the estate.

In this situation the entire contents of the RRSP/RRIF will be taxed all at once. Depending on the size of the RRSP/RRIF this can trigger a lot of income tax on the final return.

If we assume Ontario, and if we assume a small amount of other income from CPP and OAS, then…

… a $250,000 RRSP/RRIF, if taxed all at once in the estate, would trigger income tax of $104,015, an average of 42%.

… a $500,000 RRSP/RRIF, if taxed all at once in the estate, would trigger income tax of $237,839, an average of 48%.

… a $750,000 RRSP/RRIF, if taxed all at once in the estate, would trigger income tax of $371,663, an average of 50%.

… a $1,000,000 RRSP/RRIF, if taxed all at once in the estate, would trigger income tax of $505,487, an average of 51%.

To avoid losing 50%+ of your RRSP to income tax and government benefit clawbacks it’s important to create a good drawdown plan for retirement assets. With a little bit of planning it can be possible to avoid all the issues above, even with an RRSP that is “too big”.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments