Debt Snowball Or Debt Avalanche Or Both?

When it comes to paying off debt there are two popular strategies. These strategies are known as “the debt snowball” and “the debt avalanche”.

These are the two most popular strategies to pay off debt and they either take advantage of human psychology OR mathematics to help pay off debt faster.

Which debt payoff strategy you should choose depends on your situation. Choosing one method vs the other may mean paying off your debt off faster or…. it could mean taking longer to pay off your debt and making more interest payments.

The problem is that everyone is different and there isn’t a one-size-fits-all strategy. We have different amounts of debt, we have different types of debt, and those debts carry different interest rates (and to make it even more complicated, some kinds of debt are tax deductible or let you reduce payments in difficult times, like some student loans, which can be a very valuable benefit!).

On top of this we all value things differently. Some of us prefer that immediate feedback of paying off the first debt the fastest (even if it means paying a bit more in the long run). Whereas some of us prefer to delay gratification a little bit, as long as it’s worthwhile and we pay less interest in the end.

Choosing the right debt paydown strategy will depend on your personal situation and who you are as a person. In this post, we’ll summarize the two different methods and propose a third method that combines the best of both worlds.

We’ll also show you a cool little debt calculator that will help you decide which debt to pay off first.

Option 1: Debt Snowball

The term ‘debt snowball’ is quite descriptive. To use this debt payoff strategy you would order your debts from the smallest dollar amount to the largest dollar amount and you pay the minimum amount on all debts and put any extra cash towards the smallest debt first. As you pay off your smaller debts you slowly work up to the largest debt. Hence the ‘debt snowball’.

One of the main benefits of the debt snowball is that you get to the first debt payoff the fastest. By started with the smallest debt you can wipe out that first loan faster than with other debt payoff methods. This is a huge psychological boost. It feels great to knock off those debts and this helps to solidify/reinforce your debt payment routine.

Another small benefit of the debt snowball is that you have more flexibility. By paying off debts faster your minimum payment decreases and you free up more cash flow in case of emergencies.

The downside of using the debt snowball is that in the long run you’re paying more interest on your debt. This is an undeniable, mathematical fact. How much extra interest you pay depends on your loans and your interest rates. In some cases, the extra interest can be thousands or tens of thousands of dollars. Think of all the extra days you’ll need to work to pay that extra interest. It might not be worth it.

This extra interest also extends your debt freedom date by weeks, months or even years. Ouch.

Option 2: Debt Avalanche

The ‘debt avalanche’ takes a different approach. To use this approach, you order your debts from the highest interest rate to the lowest interest rate and you pay the minimum amount on all debts and put any extra cash towards the debt with the highest interest rate first. As you pay off your high interest rate debt you slowly work down to the lowest interest rate debt. You start way at the top and work down to the bottom. Hence the debt avalanche.

The main benefit of the debt avalanche is that you pay the least interest. By starting with your highest interest rate debt you pay the least amount of interest over the course of all your loans. Depending on your debt and interest rates, this could be a lot.

With the debt avalanche strategy you also pay off your final debt sooner. By paying less interest you get to reach your debt freedom date much faster. Maybe weeks, months or years earlier.

The downside of the debt avalanche is that it takes longer to get to your first debt payoff. Your first debt payoff is that magical moment when you start to see all your hard work pay off. With the debt avalanche you sometimes delay this psychological boost of paying off your first debt. Depending on your personality, the lack of positive feedback can be very detrimental.

Between the two strategies, the difference in the timing of your first loan payoff could be months or even years. Imagine waiting another few months or a even a few extra years to pay off your first loan. It means waiting another few months before you can see all that scrimping and saving pay off. That could be too long for many people.

Option 3: Debt Snowball/Avalanche Hybrid

There is a hybrid version of the debt snowball and debt avalanche, this method is built our debt calculator (which you can access here for FREE!). The hybrid method looks at the interest paid and prioritizes the fastest first debt payoff but also reduces the amount of interest you pay. This means that if two loans will be paid off within a similar time frame, the hybrid method will prioritize the one that has a higher interest rate. You still pay off your first debt around the same time, but you pay less interest by focusing on the higher interest rate debt first.

For example, if you had one debt that is $1,100 and 5.5% interest, a second debt that is $1,300 and 19.99% interest, and a third debt that is $4,500 and 6.5% interest, the hybrid method would take the best of both worlds and start with the $1,300 debt at 19.99%, then focus on the $1,100 debt at 5.5% for a quick payoff, and then finally focus on the $4,500 debt at 6.5%.

The benefit of the hybrid method is that you get to experience some of the psychological benefit of the debt snowball, but you also get to reduce your total interest paid like the debt avalanche.

The debt calculator helps you prioritize your different debts by looking at both time and interest paid. Then it gives you a nice payment plan to follow. This can be updated periodically as your situation changes.

Debt Calculator

Choosing the right method can be hard, especially when you have a few different debts with various interest rates. Our debt calculator can help you evaluate the three different methods and choose the best one for you.

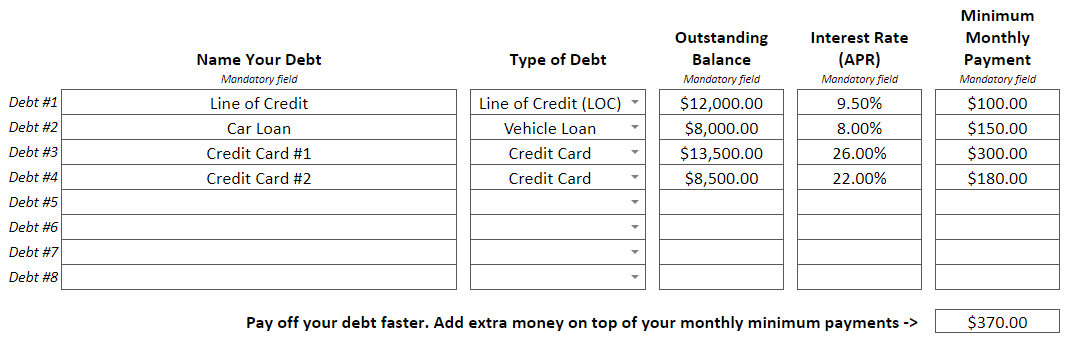

Start by entering all your debt information…

Then choose the different payment methods using the drop down. The calculations and charts will update automatically for each method. Choose the right method for you by looking at how much interest you pay overall, how fast you reach your first debt payoff (Wooohooo!), and how fast you can pay off all your debt (YESSSS!).

You can also add extra payments to see how that decreases your interest paid and time to full payoff.

You can add an extra payment each month, this is great if you have a bit of room in your monthly budget, or…. you can add a one-off payment in a specific month, this is great if you get a quarterly or annual bonus that you want to put against your debt.

By playing with the calculator you can not only choose the right debt payoff strategy for you, but you can also see how small changes in your monthly budget can help you pay off your debt way faster!

Download a copy of the debt calculator for free and start planning your debt freedom!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments