Can A Financial Plan Predict The Future?

In a world filled with uncertainty a financial plan has this amazing ability to predict the future.

It can help predict future income, expenses, assets, and debts. It can help predict if you’ll be financially secure in the future or if you’ll be eating cat food. It can help predict if you need to save more to achieve your goals or if you can spend more now and enjoy today. In can help predict if you’ll run out of money in retirement or if you’ll end up with millions.

A financial plan isn’t a perfect prediction of course. It’s based on certain assumptions. But good assumptions can create a good prediction. There will still be some chance of the future working out differently than planned, but with a path mapped out the future becomes very real and very achievable.

They say that “failing to plan is planning to fail”. A financial plan will help you know where you’re going. It will help you create a clear roadmap to follow. If you can hit the milestones on the roadmap then success is all but guaranteed.

Here are just a few ways that a financial plan can help you predict the future and make it a reality.

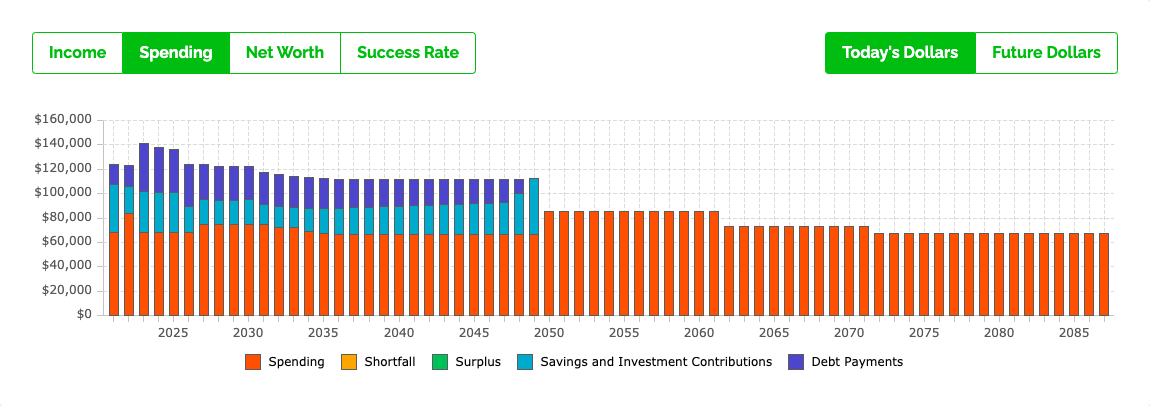

Predict Future Spending, Saving, and Debt Payments

One of the most important aspects in a financial plan is spending. Spend too much and there isn’t enough capacity to save and pay down debt. Spend too little and there is a missed opportunity to perhaps find a better balance between spending and saving during your prime.

A good financial plan will map out spending, saving, and debt payments year-by-year for the next 40-80+ years. It will help predict these important factors well into the future.

A good financial plan will include these factors, but a great financial plan will help predict how these will change over time. A great financial plan will predict changes in spending when buying a house, starting a family, taking time off from work, entering retirement etc. It will help predict when debt is paid off and when savings can increase.

A great financial plan will highlight exactly what needs to be done year by year.

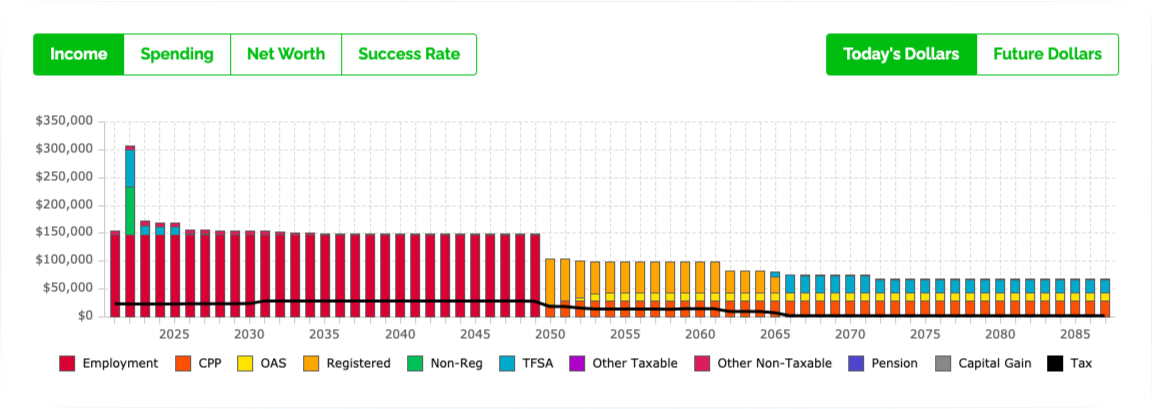

Predict Future Income

Without income there can be no savings, no debt payments, and no spending. So, it’s important to make the right assumptions for future income.

We may assume something conservative like an annual cost of living adjustment. Or for younger people we may also assume additional increases in the form of promotions and merit increases.

Making the right assumptions for income will help improve the accuracy of the financial plan.

It’s also important to estimate future income from government benefits like Canada Pension Plan (CPP), Old Age Security (OAS), Guaranteed Income Supplement (GIS) and Canada Child Benefit (CCB). These are important factors in most financial plans.

Between CPP and OAS a significant amount of retirement income is covered by these two benefits, so it’s important to predict their future value. A great financial plan will help estimate future income from CPP and OAS using past contributions (called your CPP Statement of Contributions) and future income assumptions.

In retirement, we also want to estimate future income from defined benefit pensions, RRSP/RRIF withdrawals, non-registered withdrawals, and TFSA withdrawals.

Last, but certainly not least, it’s extremely important to predict the future tax liability along with future income. Different types of income will be taxed differently. Depending on the mix of income, tax could be low or high. The sale of a rental property, vacation property, or non-registered investments could trigger a sizable capital gain. A large RRSP/RRIF withdrawal could push you into higher marginal tax rates. Predicting and planning for future tax liability will help minimize tax where possible.

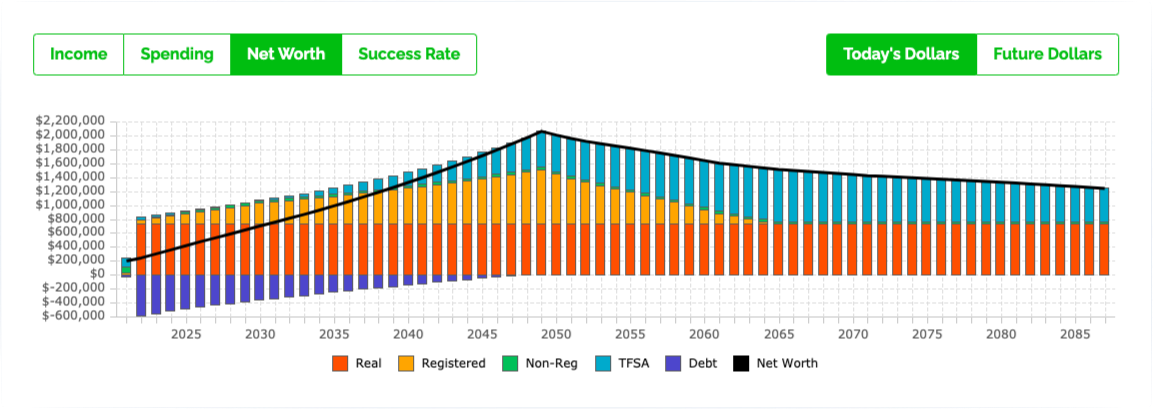

Predict Future Net Worth

One of the most exciting parts of a financial plan is seeing how net worth evolves over time. With annual contributions, annual investment returns, and annual debt payments, net worth can grow very quickly. It can be exciting to see how daily/weekly/monthly savings can snowball into an impressive net worth over time.

Seeing how net worth increases in the future can be extremely motivating. Seeing future net worth reach $1 million, $2 million, $3 million+ will make it easier to make those small sacrifices today. It will provide daily motivation to keep savings and investment contributions on track.

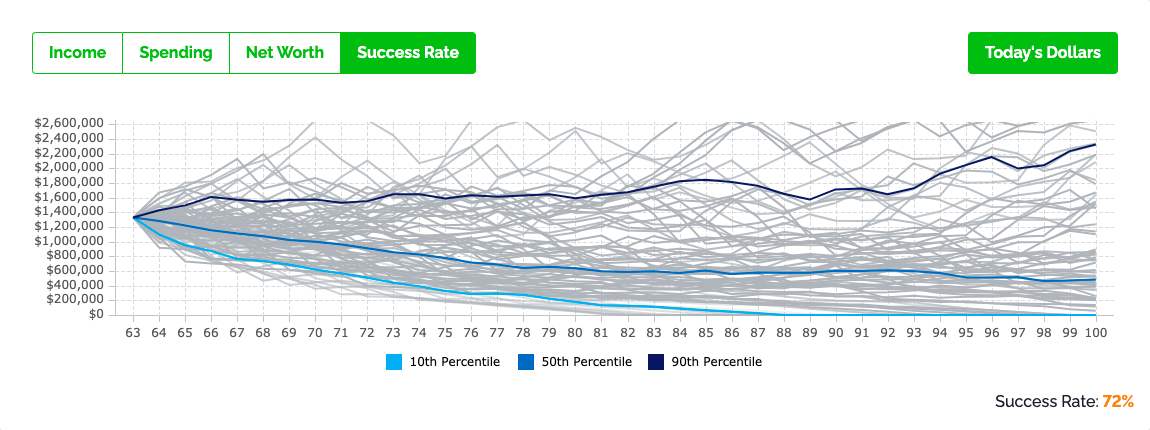

Predict Success Rate and Investment Variability

A financial plan cannot predict everything of course. It cannot predict year-to-year investment returns. But over time, a financial plan does a good job at predicting future financial success by using historical benchmarks for long-term investment returns and general investment variability (year-to-year ups and downs).

Using historical investment returns will help a financial plan predict how the future may look with different rates of investment returns and inflation rates. Every line in the chart below represents one possible path that a financial plan could take. It’s helps predict a reasonable range of expected returns based on past historical results.

Anything within this range is considered normal based on historical results, and although we cannot predict year-to-year investment returns, we can use historical results to see how many future paths may run out of money. Every line that goes to zero represents one historical period of investment returns that would cause the current plan to run out of money if those investment returns were to be repeated in the future. Too many failures and the success rate will drop too low and signal a possible issue within the plan.

So, while we cannot predict year-to-year investment returns, by using historical results we can get a good sense of the investment risk and inflation rate risk a plan may face in the future and how much flexibility in spending might be necessary to avoid failure.

What Does Your Financial Future Look Like?

So, what does your financial future look like? Does it look good? Are you happy with your financial future or are you actively making changes today to improve it?

If you don’t know what your financial future looks like, but you’d like to find out, it might be time for a financial plan.

And the best thing about predicting the future? If you don’t like what you see you can change it.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen,

Wonderful Article.!!!

You are never too old, too young, too wealthy or too poor to engage in financial planning. The goals may be different but at each life stage, it is important to have a road map to assist you in achieving them.

Thanks

Aleem

Thank you Aleem, couldn’t agree more! It’s also important to understand what a financial plan should look like. There are too many “financial plans” out there that are just too basic/simple to be called a true financial plan.