What Is The Pension Income Tax Credit? Both The Amount And The Eligibility?

After reaching age 65 there are a couple of tax credits that we become eligible for. These tax credits vary in the amount of tax they save, but in general they help decrease income tax payable for those over the age of 65, and they can be very helpful to lower taxes in retirement.

But with some of these tax credits, they only apply if you have certain types of retirement income, and the pension income tax credit is one of those tax credits.

The pension income tax credit is one of a couple of tax credits that become available to everyone after age 65 (there is also the Age Amount Credit) but some people can access the pension income tax credit earlier than age 65 if they have certain types of retirement income.

All of these tax credits add up to provide a significant amount of tax savings in retirement, so it pays to understand the various credits and how to qualify for them.

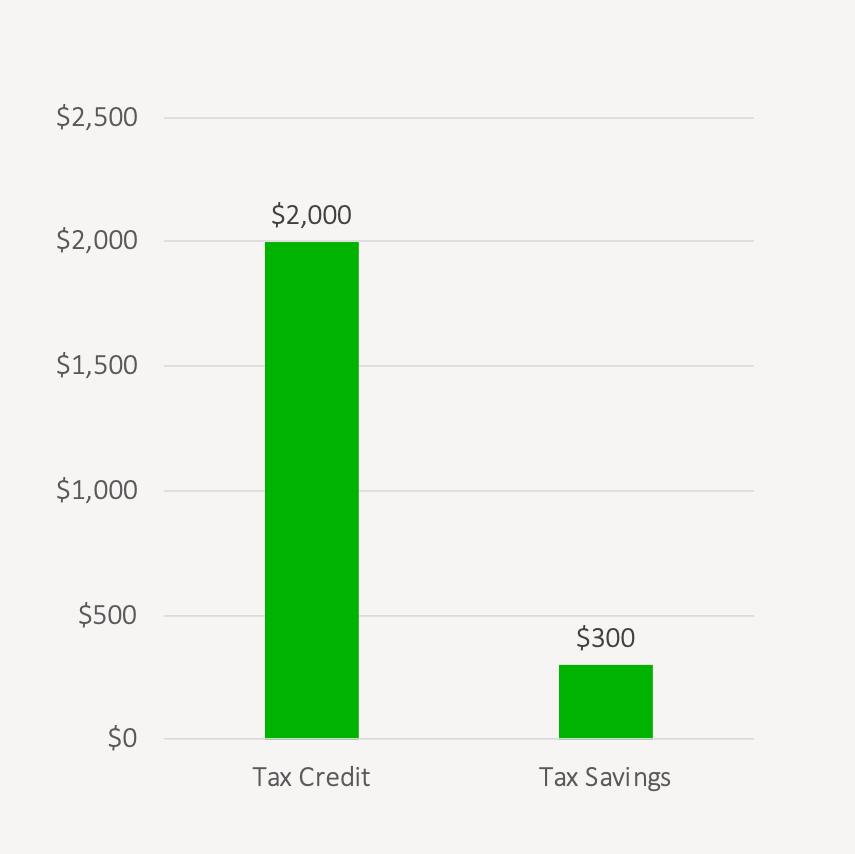

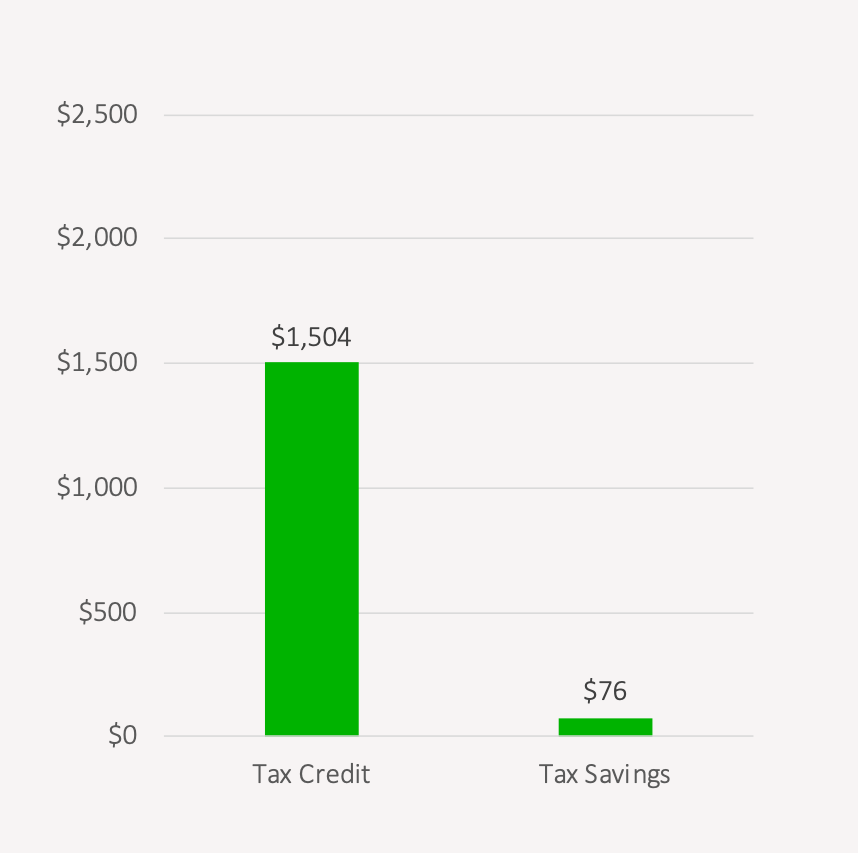

The pension income tax credit provides a tax credit of $2,000 federally and between $1,000 to $2,000 depending on the province.

What Is The Pension Income Tax Credit?

The pension income tax credit is a non-refundable tax credit that applies specifically to pension income (lines 11500, 11600, and 12900 on your tax return). Having pension income is an important part of the pension income credit eligibility. It’s considered a non-refundable tax credit because it cannot make tax go below $0.

As a result, when planning retirement drawdown, there can be an opportunity to purposely trigger a certain amount of income each year to use up these non-refundable tax credits.

When trying to use up the pension income tax credit it’s important to have a certain amount of pension income as part of the retirement drawdown plan.

Pension income includes…

- Defined benefit pension income

- RRIF income after age 65

- LIF income after age 65

- Annuity payments after age 65*

*but only if the annuity was purchased using funds inside an RRSP.

Notice that the list does not include RRSP income. Withdrawals from an RRSP will not qualify for the pension income tax credit at any age.

The pension income amount is $2,000 federally but the actual tax savings are much lower. To get the actual tax savings the tax credit is multiplied by the lowest Federal tax rate of 15%. This provides a tax savings of $300 per year. Not a lot, but it adds up over time.

There are also similar tax credits available by province. For example, the tax credit is worth $1,504 in Ontario multiplied by the lowest tax rate of 5.05% to get the actual tax savings of $76 per year.

Defined Benefit Pensions Have An Advantage

When it comes to the pension income tax credit those who receive a defined benefit pension have a large advantage. When a someone receives income from a defined benefit pension, they can immediately qualify for the tax credit, unlike other forms of pension income which only qualify after age 65.

For example, if the defined benefit pension starts at age 55 then there are 10 additional years of tax credit available. The tax credit is $2,000 per year at the federal 15% tax rate and so this provides tax savings of $300 per year. Over 10-years a person receiving a defined benefit pension will enjoy an extra $3,000 in tax savings (plus the provincial portion as well).

Couples Have And Advantage

Similarly, couples also have an advantage. Couples can split pension income and effectively share their pension income tax credit. So even if only one partner is receiving qualifying pension income, they can both enjoy the benefit of the pension income tax credit.

For couples, this increases the Federal tax savings from $300 per year to $600 per year and in Ontario it increases the provincial tax savings from $76 per year to $152 per year. In total, a couple can reduce their annual tax bill by up to $752 with the pension income tax credit.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Creating Pension Income After Age 65 And Before Age 72

For those without a defined benefit pension one very simple way to create pension income is to start RRIF withdrawals after age 65. Withdrawals from a RRIF will qualify for the pension income tax credit after age 65.

By the end of the year someone turns age 71 all of their RRSPs must be converted to RRIFs, so there is an opportunity to create RRIF income and qualify for the pension income tax credit for 6-years between age 65 and 71.

Over those 6-years, annual RRIF withdrawals of $2,000 per year will maximize the pension income tax credit. Even if RRIF withdrawals between age 65-71 aren’t part of the income strategy, it can make sense to transfer $12,000 to a RRIF and withdrawal $2,000 per year to maximize the credit each year. This provides tax savings of $1,800 federally, and $456 in Ontario, for a total tax savings of $2,256 over 6-years.

For couples this amount can be doubled with each partner putting $12,000 in a RRIF and each withdrawing $2,000 per year. Over 6-years this would provide tax savings of $4,512 in Ontario, not too bad!

This strategy can have downsides, however. One downside is that many financial institutions charge “deregistration fees” for RRSP and RRIF withdrawals. Depending on the financial institution these deregistration fees can be as high as $100, $120, and even $150+ per withdrawal! This can dramatically cut into the tax benefit of making small $2,000 RRIF withdrawals each year. If you’re going to employ this strategy, set up your RRIF with a low-cost brokerage account that has low deregistration fees of $25 or less (ideally $0!).

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments