Why We Choose To Spend Our Money On Freedom

What do you prefer to spend your money on? Cars, houses, vacations? Everyone spends their money differently. Some people enjoy nice cars, large houses, the latest clothes or gadgets, luxurious vacations, food, wine, restaurants, the list is endless.

But for some of us, we like to spend our money a different way. Some of us like to slowly buy more and more freedom, flexibility, and time.

Like other ways to spend money, buying freedom is a personal choice, but it’s the right trade-off for us. We don’t value expensive cars, or large houses, or expensive clothes, but what we do value is freedom, flexibility, and time.

Buying More Freedom, Flexibility, and Time

Freedom is bought in small increments. Someone who is debt free and has money in the bank has a certain amount of freedom. While another person with a large investment portfolio that supports their living expenses has a different amount of freedom.

There are different types of financial freedom and each type is a step towards full financial independence.

Different Types Of Financial Freedom:

- Net worth greater than zero

- Becoming debt free

- Fully funded emergency fund

- One year of salary invested

- Five years of salary invested

- Becoming mortgage free

- Investment growth that exceeds annual contributions

- Freedom to temporarily decrease work hours or take a leave of absence if necessary

- Fifty percent of household expenses covered by investment income

- Seventy five percent of household expenses covered by investment income

- Financial independence, one hundred percent of household expenses covered by investment income

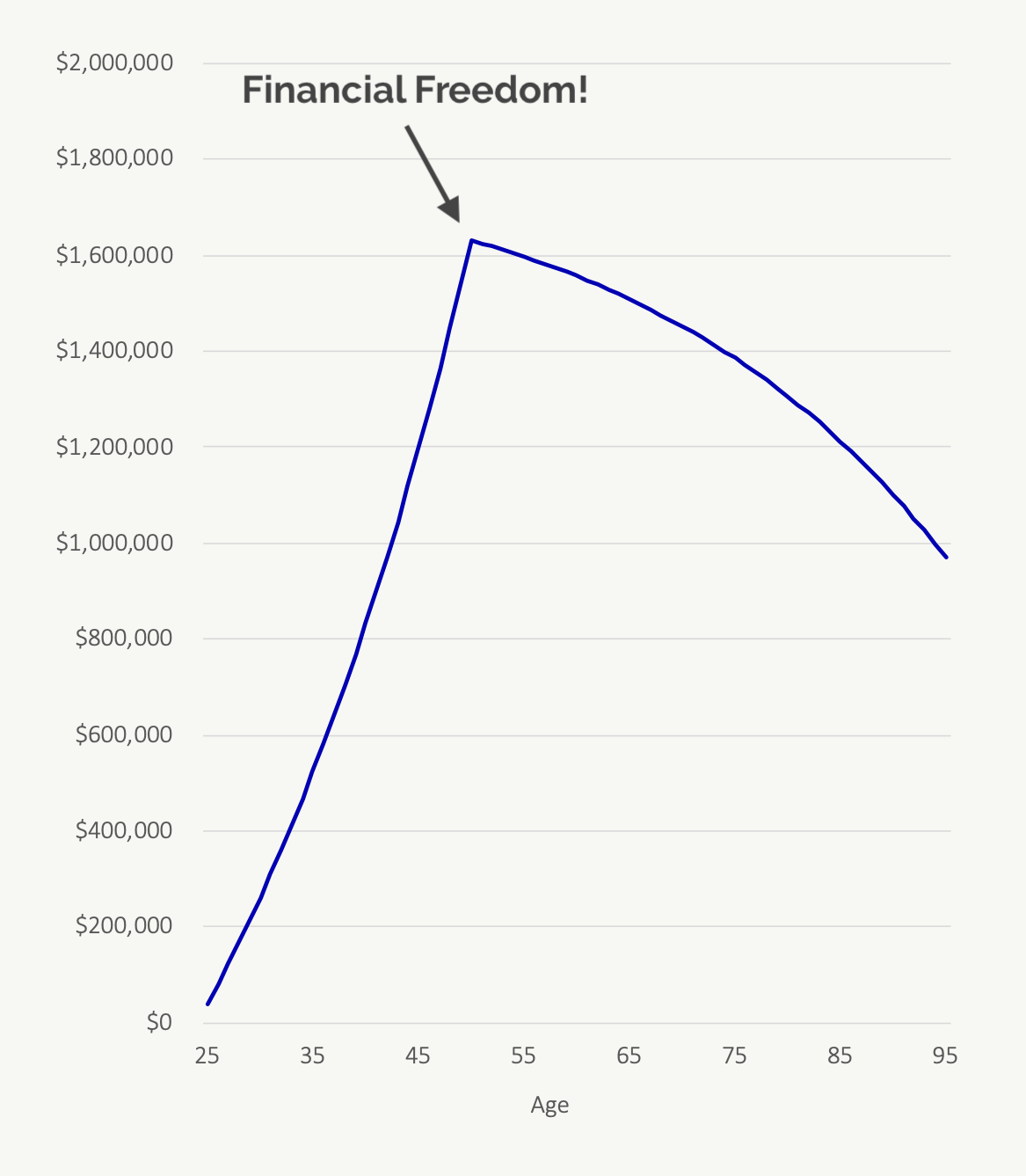

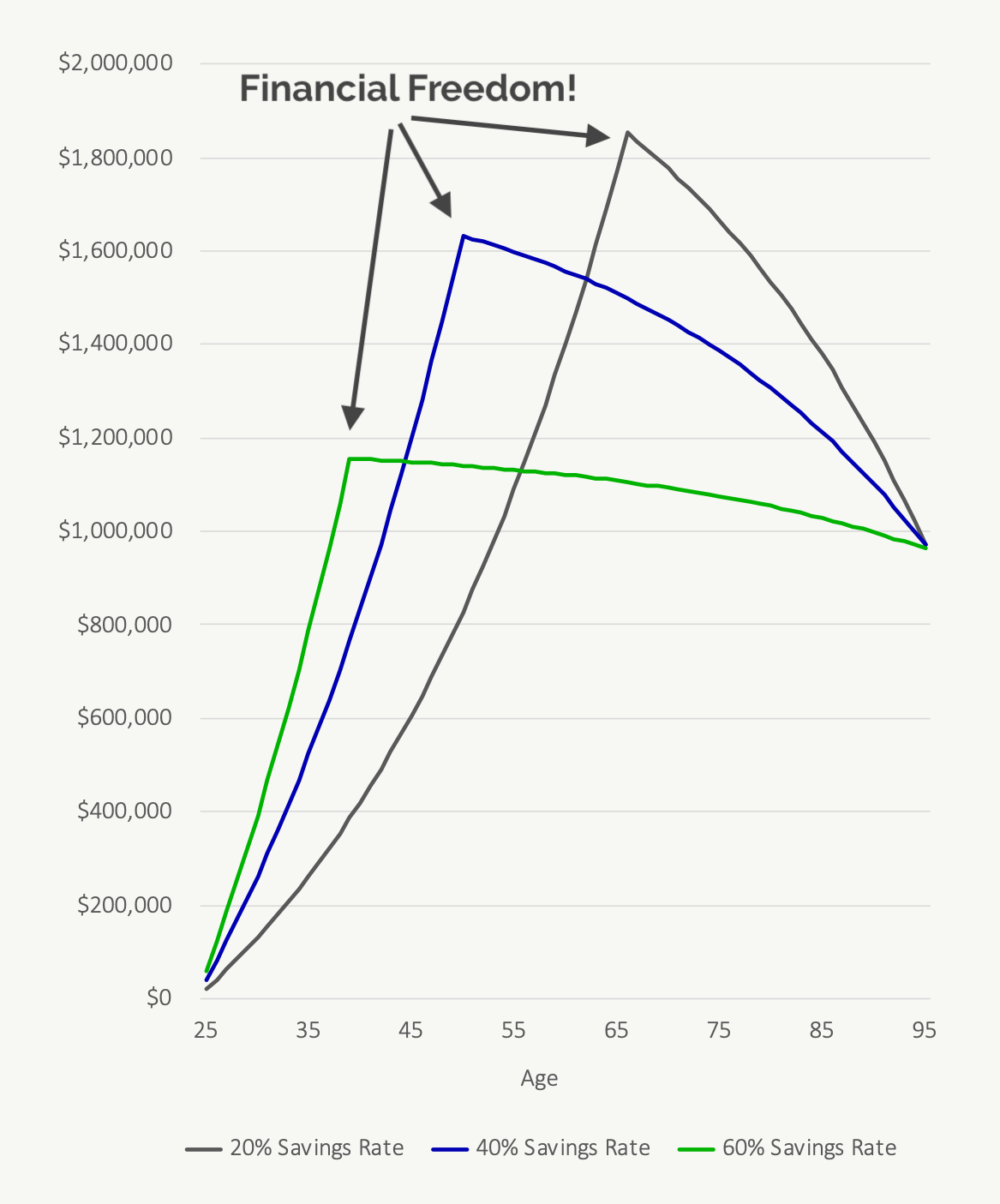

The more you save and the more you invest the more freedom you have. At some point you’ll have a large enough nest egg that you’re free to do anything. This is the ultimate in financial freedom.

Financial independence is when your savings and investments have grown to the point where they can sustain your lifestyle going forward, without the need for additional income.

Buying Freedom Is Worth Double

One of the interesting things about buying freedom, versus buying other things, is that each dollar saved is worth two (or more!). The more you save means the less you spend. The less you spend means the less you need in the future. This dual effect makes buying freedom very worthwhile.

For example, by spending $100 less per month that means that you need to save up $30,000 less to be fully free. So, not only does spending $100 less help you save faster, but it also means that you need less savings in the future. A double benefit.

Someone who spends $70,000 per year needs a nest egg of $1,750,000 to be financially independent but someone who spends $50,000 only needs a nest egg of $1,250,000 and someone who spends just $30,000 only needs a nest egg of $750,000. This assumes a 4% safe withdrawal rate.

Spending less means…

- Saving more

- Needing less in the future

- Reaching financial freedom faster

We Spend Our Money On Freedom

Everyone spends their money differently, and there is no right answer, but for us buying more freedom, flexibility, and time is an important goal.

It also doesn’t have to happen all at once. Unlike buying a car, or a house, buying more financial freedom happens in small increments. Every $100 invested buys a little more freedom and flexibility.

Where do you spend your money? How much is allocated to buying freedom, flexibility, and time? Does that balance between spending for today and saving for the future reflect your values and goals?

Every person is different and the right balance for one person may not be the right balance for another. To feel good about your personal finances it’s important to find the right balance for you.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments