How The Age Amount Tax Credit Can Increase Your Marginal Tax Rate In Retirement

Marginal tax rates are important. The represent the income tax you pay on the next dollar of income. Knowing your marginal tax rate both now and in the future can be extremely helpful when doing tax planning.

One tax planning opportunity is to make an RRSP contribution in a high tax bracket and withdraw later in a lower tax bracket. This opportunity can help defer tax until retirement when RRSP withdrawals are made at a lower tax rate. Ideally, an RRSP contribution allows you to contribute at a high marginal tax rate and withdraw at a lower marginal tax rate in the future.

This difference in tax rates can lead to a lot of tax savings. Contribute at a 40% tax rate now and withdraw at a 20% or 30% tax rate in the future and for every $1,000 that goes into an RRSP there is $100 to $200 in tax savings over a lifetime. Expand that to tens or hundreds of thousands of dollars of contribution and you can begin to see the incredible opportunity that a bit of tax planning can create.

But what if your marginal tax rate in retirement isn’t quite what you think it will be? What if its higher than you think? What if the typical marginal tax rate tables are missing something? You might be underestimating your future marginal tax rate in retirement.

In this post we’re going to explore a tax credit called the Age Amount and in particular the way that the Age Amount is reduced (or clawed back) based on income in retirement.

We’re also going to explore how this may affect your marginal tax rate in retirement. As we’ll see, the marginal tax rate you’re planning for may not be the marginal tax rate you actually experience in retirement.

What Is The Age Amount? Who Is Eligible?

The Age Amount is a non-refundable tax credit that is available to those over the age of 65. It is “non-refundable” because it cannot make your income tax go below zero, it will not create a refund.

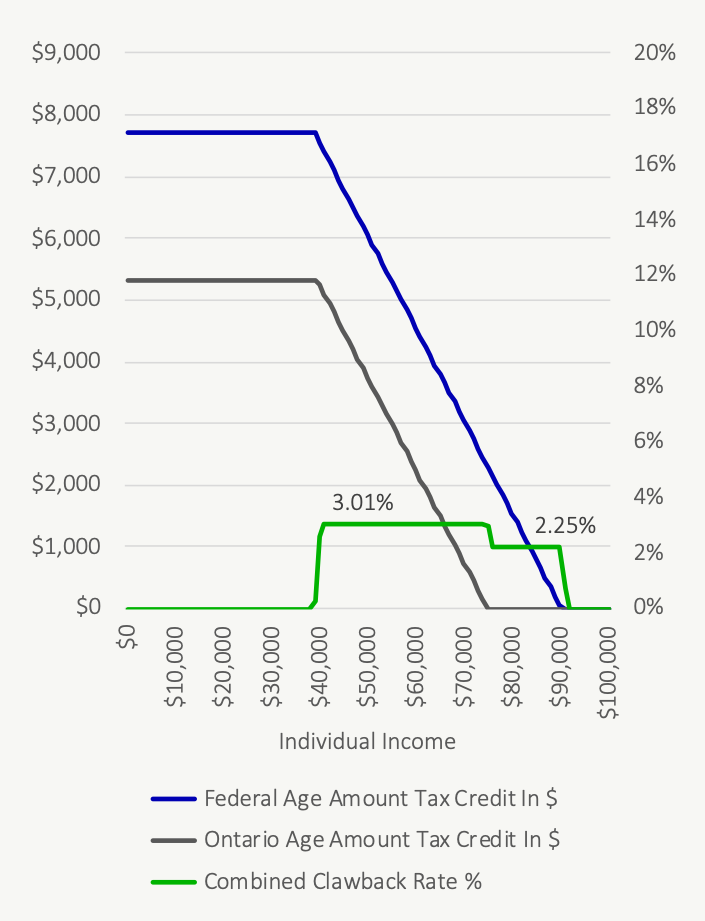

The Federal Age Amount tax credit is $7,713 in 2021 and the provincial Age Amount tax credit in Ontario is $5,312. These tax credits help reduce both Federal and Provincial tax each year for those over 65.

Just a reminder on how tax credits work. These tax credit amounts get multiplied by the lowest tax rate and it’s this amount that then reduces your income tax owing.

As an example, the Federal Age Amount tax credit is $7,713 but when multiplied by the 15% Federal tax rate it is worth $1,157 in tax reduction to the taxpayer ($7,713 x 15% = $1,157).

Similarly, the Ontario Age Amount tax credit is $5,312 but when multiplied by the 5.05% Ontario tax rate it is worth $268 in tax reduction to the taxpayer ($5,312 x 5.05% = $268).

Combined, the Age Amount is worth $1,425 in tax reduction to someone over the age of 65 living in Ontario. For a couple that is $2,850. Not too bad!

How Is The Age Amount Clawed Back?

The tax credit amounts mentioned above are the maximum Age Amount tax credit, but many people over 65 may not receive the full benefit of this tax credit. This is because the Age Amount tax credit is reduced when income crosses a certain level. The tax credit is reduced by 15% for every dollar above this income level.

For the Federal Age Amount tax credit, the clawback begins at when taxable net income (line 23600) crosses $38,893 and is entirely reduced to zero when income reaches $90,313.

Similarly, for the Ontario Age Amount tax credit, the clawback begins at when taxable net income (line 23600) crosses $39,546 and is entirely reduced to zero when income reaches $74,959.

How The Clawback On The Age Amount Increases Your Marginal Tax Rate

Because the Age Amount tax credit is reduced as income increases, it effectively acts like a tax rate. The more income you earn the lower the tax credit and the higher your income tax payable. This effective tax rate needs to be added to traditional tax rates when making tax planning decisions.

The result is that as your income crosses $38,893 ($39,546 in Ontario) in retirement the reduction in the tax credit has the same effect as a marginal tax rate of 2.25% (0.76% in Ontario).

In total, the Federal and Ontario clawback on the Age Amount effectively adds 3.01% to any marginal tax rate above the clawback threshold.

As soon as retirement income crosses $39,546 in Ontario, those over the age of 65 will experience an additional 3.01% effective tax rate as they earn more income, make additional withdrawals from RRSPs/RRIFs/LIFs, or generate additional investment income in non-registered accounts.

Notice how the tax credits get smaller as income crosses the clawback threshold around $40,000? This reduction acts like a marginal tax rate of 3.01% when we combine the Federal and Ontario clawbacks.

This might come as a surprise to some because this effective tax rate never shows up in typical marginal tax rate tables. This effective tax rate increases marginal tax rates in retirement. In retirement, after age 65, making an extra $10,000 RRSP withdrawal could trigger an additional $301 in income tax that may not have been planned for.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

The Age Amount And Its Clawback Rate

Although not extremely large, the Age Amount tax credit and its associated clawback rate adds to the marginal effective tax rate for those who are over the age of 65 and who are earning more than $39,546 per year in retirement income.

It’s another factor when planning drawdown in retirement. It may not change a drawdown strategy dramatically but it’s important to include this extra tax rate when planning retirement income because typical marginal tax rate tables will not include this effective tax rate.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Hi Owen, thank you for another great article!

There seem to be many clawbacks for retirees and I also believe careful planning can really help (such as make use of TFSA?).

Thank you again.

Hi June, you’re right, for many people in retirement a little bit of tax and benefit planning can be very helpful. TFSAs are great but depending on the situation there are other strategies as well. You may enjoy these articles about the Guaranteed Income Supplement, one of the most generous benefits in Canada but also one of the highest “clawback” rates at 50% to 75%.

https://www.planeasy.ca/what-is-the-guaranteed-income-supplement/

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/

Thank you very much for the reply and sharing the helpful articles Owen!